(16 November 2015) So far, so Virgo. Or more precisely, Venus in Virgo. Ever since Venus began its transit of sidereal Virgo on 3rd November, most global stock markets have fallen. In some cases, such as in the US and Europe, the entry date came very close to the interim high whereas other markets such as India’s has seen declines that began in October extended further.

(16 November 2015) So far, so Virgo. Or more precisely, Venus in Virgo. Ever since Venus began its transit of sidereal Virgo on 3rd November, most global stock markets have fallen. In some cases, such as in the US and Europe, the entry date came very close to the interim high whereas other markets such as India’s has seen declines that began in October extended further.

In any event, the bearish influence of the transit of Venus in Virgo appears to be confirmed yet again. As I have shown in a previous stock market analysis, recent incidents of this once-a-year transit have correlated with declines. The four-week-long transit of Venus in Virgo has correlated with declines in each of the last six years. The astrological reasoning is fairly simple: Venus is seen as the planet of money and value and traditionally it is said to do poorly in Virgo, which is considered its sign of debilitation. Amazingly, this very basic one-factor model of stock market movements has generally outweighed most other planetary factors.

As stocks rose today (Monday), we still have two weeks to go in this transit of Virgo so we cannot rule out a rebound in stocks towards the end of the month. But so far, it is looking like the overall 27-day bearish influence of Venus in Virgo will hold for another year.

But what happens when Venus leaves Virgo and enters Libra on 30th November? According to astrological tradition, Venus is said to "rule" the sign of Libra. There is a general affinity between the symbolism of the planet Venus and the sign of Libra: amity, sociality, optimism, diplomacy. From a purely deductive point of view, one would think that Venus would do well in Libra. Since financial astrology places a special importance on Venus through its rulership over notions of value, there is some reason to expect stocks would generally rise during its four-week transit of Libra. Let’s see what the recent data of this transit suggests.

Venus in Libra

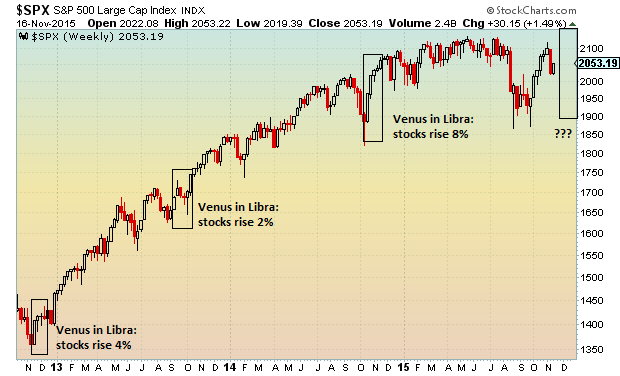

In the chart above and table below, we find good evidence that the transit of Venus in Libra is in fact bullish for US stocks. I would expect this relationship to generally hold for other national markets although the strength of the correlation may be somewhat different. Obviously, this is a very small dataset so I am not making any definitive truth claims here. But it is an interesting observation nonetheless. On several occasions, the actual day of the entry of Venus into sidereal Libra correlated with a very large gains in stocks. This happened most famously in 2010 on September 1st and the Ben Bernanke speech at Jackson Hole that argued for more quantitative easing (QE). It also occurred on 2011 on October 4th immediately after the market bottomed following the US debt default crisis that year.

Please note that I am referring to sidereal Libra as used in India and not tropical Libra as used more commonly in the West. There is now a 24 degree difference between zodiacs which complicates this question about the effects of sign transits of different planets.

| Year | Venus entry date | Venus exit date | Market outcome – DOW |

| 2007 | November 29 | December 24 | +2% |

| 2008 | September 19 | October 13 | -16% |

| 2009 | November 3 | November 26 | +6% |

| 2010 | September 1 | December 31* | +20%* |

| 2011 | October 4 | October 27 | +7% |

| 2012 | November 17 | December 10 | +4% |

| 2013 | September 6 | October 1 | +2% |

| 2014 | October 19 | November 11 | +8% |

| 2015 | November 30 | December 24 | ??? |

We should note a rather glaring anomaly, however. Stocks plunged 16% in 2008 during that year’s Venus transit of Libra. This was part of the larger financial meltdown brought about by the US mortgage crisis. How are we to make sense of this? I would say it is an obvious outlier, since there were several other strongly bearish alignments in play at that time. The alignments were so strongly bearish that I made mention of them several times on my blog and website back in 2008. The chances that stocks would rise during that period were very small despite the apparently bullish transit of Venus in Libra. Just as in economics, astrology has to contend with a multiplicity of factors which have to be assessed for their impact on the ultimate outcome. In 2008, I did not expect the transit of Venus in Libra to have much bullish effect at all in light of the overwhelmingly negative alignment of Saturn, Rahu and Neptune.

But if 2008 is an outlier, then what is the likelihood that the 2015 Venus transit of Libra will produce higher stock prices? Since the Saturn-Neptune square will be separating and hence, weakening through the course of the 2015 transit in December, I would think the chances are good that stocks will rise during the course of this transit. This is not a certainty, of course, but rather an educated guess based on the previous track record of this transit. I offer more details on this question in my weekly subscriber newsletter.

Weekly Market Forecast

Markets were mostly lower last week as investors pondered the implications of a possible Fed rate hike in December. Monday trading was higher across the board despite the Paris terror attacks. I had been fairly bearish in last week’s market forecast given the Mars-Rahu conjunction. Thursday in particular was bearish on the Moon-Saturn alignment, although the Sun-Jupiter failed to boost stocks much at all.

The clouds remain in place this week as both Mercury and the Sun align with Ketu (South Node) into midweek. Wednesday and Thursday look more bearish in this respect so any gains we might have seen in the early going this week could be vulnerable to these later moves.

You can be notified of new posts if you follow ModernVedAstro on Twitter.

Please note that this is a more general and much abbreviated free version of my

investor newsletter which can be subscribed to

Please read my Disclaimer

Market forecast for week of 9 November 2015

Market forecast for week of 2 November 2015

Market forecast for week of 26 October 2015

Market forecast for week of 19 October 2015

Market forecast for week of 5 October 2015

Market forecast for week of 28 September 2015

Market forecast for week of 21 September 2015

Market forecast for week of 14 September 2015

Market forecast for week of 7 September 2015

Market forecast for week of 31 August 2015

Market forecast for week of 24 August 2015

Market forecast for week of 17 August 2015

Market forecast for week of 10 August

Market forecast for week of 27 July 2015

Market forecast for week of 20 July 2015

Market forecast for week of 13 July 2015

Market forecast for week of 6 July 2015

Market forecast for week of 29 June 2015

Market forecast for week of 22 June 2015

Market forecast for week of 15 June 2015

Market forecast for week of 8 June 2015

Market forecast for week of 1 June 2015

Market forecast for week of 25 May 2015

Market forecast for week of 18 May 2015

Market forecast for week of 11 May 2015

Market forecast for week of 4 May 2015

Market forecast for week of 27 April 2015

Market forecast for week of 20 April 2015

Market forecast for week of 13 April 2015

Market forecast for week of 30 March 2015

Market forecast for week of 16 March 2015

Market forecast for week of 9 March 2015

Market forecast for week of 2 March 2015

Market forecast for week of 23 February 2015

Market forecast for week of 9 February 2015

Market forecast for week of 2 February 2015

Market forecast for week of 26 January 2015

Market forecast for week of 19 January 2015