Fed intervention boosts stocks; EU summit on Friday before lunar eclipse

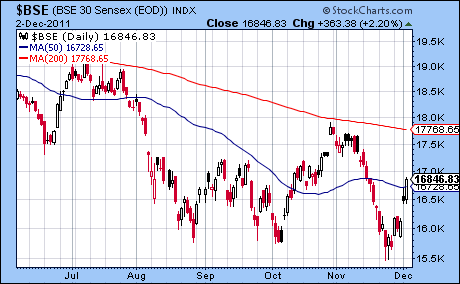

How do you solve a debt crisis? With more debt, of course! Europe’s financial endgame was put on hold last week as a coordinated central bank intervention flooded its crippled banking sector with cheap US dollars. The Fed’s injection of fresh liquidity was widely applauded as global stocks markets soared and bond yields fell back to earth. In New York, the Dow zoomed higher by 7% closing at 12,019 while the S&P 500 finished at 1244. While the size of the rally was unexpected, I did suggest that the first half of the week was somewhat harder to call and that upside surprises were more likely to occur then. Such sudden developments are not uncommon during eclipse periods such as we are in now. As expected, the late week was weaker on the Mars influence, although its negative effects were quite muted. Indian markets also moved sharply higher throughout the week as the Sensex rose 7% closing at 16,846 while the Nifty ended the week at 5050.

How do you solve a debt crisis? With more debt, of course! Europe’s financial endgame was put on hold last week as a coordinated central bank intervention flooded its crippled banking sector with cheap US dollars. The Fed’s injection of fresh liquidity was widely applauded as global stocks markets soared and bond yields fell back to earth. In New York, the Dow zoomed higher by 7% closing at 12,019 while the S&P 500 finished at 1244. While the size of the rally was unexpected, I did suggest that the first half of the week was somewhat harder to call and that upside surprises were more likely to occur then. Such sudden developments are not uncommon during eclipse periods such as we are in now. As expected, the late week was weaker on the Mars influence, although its negative effects were quite muted. Indian markets also moved sharply higher throughout the week as the Sensex rose 7% closing at 16,846 while the Nifty ended the week at 5050.

Now we are one step closer to some kind of resolution — for good or ill — to the European debt crisis. An EU summit is scheduled for this Friday where the latest bailout package will be unveiled for all to see. What will the markets think? In previous posts, I have noted the approach of the Jupiter-Saturn opposition aspect in December and January and how this is likely to create a mood of caution and skepticism towards any new Eurozone bailout plans. Last week’s free spending intervention was suggested that we might have to wait a little longer for the the true spirit of Saturn to settle in. The complicating factor in the upcoming Jupiter-Saturn aspect is that these two planets will have company. As I have discussed in more detail in my newsletter, Uranus and Neptune will also figure prominently in a much larger four-planet alignment that will be in its tightest configuration in January. At the moment, risk-taking Uranus (6 Pisces) may well be resonating more closely with expansionary Jupiter (6 Aries). This is usually a bullish pairing that often coincides with rallies. Their unusually long conjunction in 2009 and 2010 was a key factor in a huge QE1 and QE2 recovery rally after the meltdown. So this latest example of inflationary Fed largesse is more likely the result of this Jupiter-Uranus aspect. It is worth noting that both planets are moving very slowly this month since Uranus stations this Saturday and Jupiter is due to station in late December. Slow planets are more powerful, and powerful bullish planets can translate into optimism and significantly higher prices for assets.

Transits for Tuesday December 6, 2011 9.30 a.m. New York

But Saturn is gradually edging its way into this equation as it moves closer. Just when we might see more fear and caution enter the markets is harder to say. It could be next week, or it could be next month. But what we can say is that the presence of Saturn in this larger alignment undermines the likelihood of a quick resolution to the Eurozone crisis. If Jupiter and Uranus like to solve debt problems through by issuing more debt and stoking inflation, Saturn prefers the tougher road of austerity and constraint. Germany’s PM Angela Merkel appears to be holding fast onto this more Saturnian approach to the crisis as she has categorically refused the possibility of issuing Eurobonds which would weaken Germany’s credit rating and fan the flames of inflation. As Saturn is likely to strengthen over the coming weeks, there is little reason to expect Merkel’s view will change. The markets may want a full-blown money printing QE-type solution, but they are unlikely to get what they want with Saturn sitting on the doorstep. It will be recalled that the first brush with Greece’s insolvency appeared in mid-2010. Markets fell sharply in May (the flash crash) as the vulnerability of the Eurozone became apparent. It was no coincidence that Saturn played a key role in that event as it formed a close alignment with Jupiter, Uranus and Neptune from May to August 2010. The same planets are involved this time around, although the angular arrangement is different. History may not exactly repeat itself, but it may well rhyme.

This week could see some weakness in the early going due to the Sun-Rahu conjunction on Tuesday and the approach of the Mars-Rahu aspect. Both of these are short term influences however, so it is unclear if they will be enough to crowd out the otherwise bullish influence of Jupiter and Uranus. Perhaps gains are more likely as we get closer to Friday. Uranus will be super strong on Saturday for its direct station as it concludes its four month retrograde cycle and returns to direct motion. Uranus stations can be turning points in the market that deserve close watching. What makes this particular station particularly interesting is that a lunar eclipse occurs on the same day. Since this will be just one day after the EU summit, there is a greater chance for major new developments.

On paper, this eclipse + Uranus combination should not be positive for finding a durable solution for Europe. Eclipses are destabilizing influences which shake the status quo. More conservatively, it is possible this energy will simply reflect proposals for a new fiscal union in the Eurozone. This would chart a course that would fundamentally change the EU from a simple currency union between countries into something that resembles a "United States of Europe" that is more closely integrated. Whether or not it will be favourably received is harder to say. Saturn’s fairly close proximity here makes me think the reaction won’t be good, although it may not happen immediately.

Market Forecast for week of September 12

Market Forecast for week of September 5

Click here for previous weekly market forecasts

Please note that this is a much abbreviated version of my investor newsletter which can be subscribed to here.

Please read my Disclaimer