Welcome to the inaugural issue of the MVA Investor Newsletter!

Welcome to the inaugural issue of the MVA Investor Newsletter!

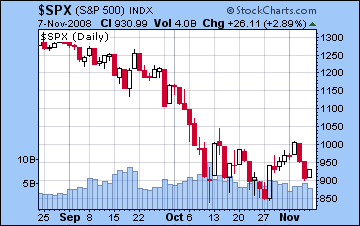

This week stocks will likely move higher as Jupiter (expansion, optimism) and Uranus (change, suddenness) are in a positive aspect. Uranus’ role here may give rallies a surprising element to them, so some quick rises are possible this week and perhaps into next. There is actually some significant change in the prevailing planetary forces this week as both Venus and Mars changed signs on Friday. Venus’ move into Sagittarius may provide support to Jupiter and boost confidence and thus create a floor for the market. Similarly, Mars’ entrance into its own sign of Scorpio may be seen as potentially helpful for sentiment since it is channelling the otherwise malefic energies of Mars into more constructive ways. It is possible we may see greater strength in consumer and entertainment sectors (Venus), mining and metal-related shares (Mars) and construction.

This week stocks will likely move higher as Jupiter (expansion, optimism) and Uranus (change, suddenness) are in a positive aspect. Uranus’ role here may give rallies a surprising element to them, so some quick rises are possible this week and perhaps into next. There is actually some significant change in the prevailing planetary forces this week as both Venus and Mars changed signs on Friday. Venus’ move into Sagittarius may provide support to Jupiter and boost confidence and thus create a floor for the market. Similarly, Mars’ entrance into its own sign of Scorpio may be seen as potentially helpful for sentiment since it is channelling the otherwise malefic energies of Mars into more constructive ways. It is possible we may see greater strength in consumer and entertainment sectors (Venus), mining and metal-related shares (Mars) and construction.

Midweek looks strongest, as Venus (money) conjoins Pluto (power). While daily predictions are more speculative, we may see the biggest gains Tuesday and Wednesday as the Moon enters Aries. By the end of the week, some pullback is possible and may continue into the following week. Thursday midday may push the market lower, as the Moon opposes Mars. This may mark Thursday morning as a possible exit point for a short term trade.

Overall, I believe this will be significant bear market rally that has the potential to boost the market by 15% in the coming weeks. It seems very likely that we will see the SPX at 1000 and 9600 on the Dow, perhaps as soon as this week. 1060 (Dow 10,000) is also very possible by the last week of November. There is an outside chance that this week’s rally could even get to 1060. As I see it now, the market will likely begin to head lower in that last week of November and form a significant low in early to mid-December. This will likely be a retest of the October 10 low of 840 on the SPX and 7773 on the Dow. Next week seems mixed with some significant down days, so I would be cautious about holding onto long positions. I will refine this forecast next weekend.

Possible Trading Strategies: Investors may short rallies with the intention of closing positions by the second week of December. Modest short positions could be taken if the market rises above SPX 1000, with the intention of additional shorting if it goes to 1060 or higher. More conservative investors may consider shorting only if the market approaches 1060 or waiting until the December bottom before going long.

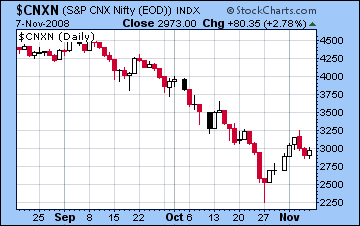

Markets in Mumbai rose modestly last week as the Sensex ended Friday’s session at 9964 while the Nifty closed at 2973. While the conjunction of the transiting Sun to the natal Rahu in the NSE chart did bring about an expected decline midweek, trading was less negative than expected due to Venus’ offsetting benefic influence. On Friday, the downward momentum was reversed as Venus conjoined the ascendant. We can expect the market to rise further this week as Sun approaches natal Jupiter thus increasing optimism. Wednesday and Thursday look particularly favourable as the coming Full Moon will activate the natal Jupiter in this chart. The Full Moon occurs at midday IST on Thursday. Investors should be wary of late Thursday and particularly Friday as transiting Mercury will conjoin the natal Rahu. This may create some confusion and increase the urgency of sellers. I think Nifty 3200 and Sensex 11,000 is very possible in the near future, perhaps even this week. With a more generally favourable outlook here, investors need to keep in mind that the rally may ultimately extend to Nifty 3500 and Sensex 12,000.

Markets in Mumbai rose modestly last week as the Sensex ended Friday’s session at 9964 while the Nifty closed at 2973. While the conjunction of the transiting Sun to the natal Rahu in the NSE chart did bring about an expected decline midweek, trading was less negative than expected due to Venus’ offsetting benefic influence. On Friday, the downward momentum was reversed as Venus conjoined the ascendant. We can expect the market to rise further this week as Sun approaches natal Jupiter thus increasing optimism. Wednesday and Thursday look particularly favourable as the coming Full Moon will activate the natal Jupiter in this chart. The Full Moon occurs at midday IST on Thursday. Investors should be wary of late Thursday and particularly Friday as transiting Mercury will conjoin the natal Rahu. This may create some confusion and increase the urgency of sellers. I think Nifty 3200 and Sensex 11,000 is very possible in the near future, perhaps even this week. With a more generally favourable outlook here, investors need to keep in mind that the rally may ultimately extend to Nifty 3500 and Sensex 12,000.

Possible Trading Strategies: More adventurous investors may consider going long Monday in the hope of catching the move upward through the week. Otherwise, one might short any rallies with the intention of covering all positions by the second week of December. Since I am not certain of how much pullback there may be next week, new short positions at Nifty 3200 should perhaps be modest since the market may be running up to 3500 in the near term. A more prudent strategy might be to short the market near 3500, keeping in mind that it may climb further still by the last week of November before heading into the December low.

World currencies rose against the dollar last week on the ongoing recovery of the banking system. Daily volatility remains high, but the Euro has climbed back to 1.27 while the Rupee closed Friday’s session at 47.4. Look for further gains against the USD this week and into next. A sharp midweek decline in the US dollar is possible as Venus conjoins Pluto on the 4th house cusp of the Euro chart. 1.30 is within reach for the Euro. The Rupee will also likely appreciate significantly this week, perhaps breaking the 47 level and moving towards 46.5.

Crude was lower last week as it ended Friday’s session at $61. Our bearish forecast was largely correct, although I had thought it might have moved below $60. I think crude will move significantly higher this week, perhaps back to $70 as transiting Mars moves away from the malefic 6th house cusp in the Futures chart. The Venus-Pluto conjunction will approach the Ketu-Neptune conjunction and this will propel prices substantially higher.

Gold was 2% higher last week as it closed at $734. While I have generally been bearish on gold, I think it will go higher this week. Mercury is in good aspect to the natal Jupiter in the Futures chart. For added confidence, a favourable pattern can be seen in the GLD chart as Venus conjoins Pluto on the natal ascendant on Tuesday and Wednesday. We could see an explosive move up here, perhaps above $800. Look for a possible sharp pullback by Friday as transiting Mars conjoins the 12th house cusp symbolizing loss. Gold will once again weaken by December so any long positions taken should be seen as short term plays.