- Prepare to shift orienation from bearish to bullish Dec 15-19

- Probable decline to Dow 8000/SPX 820 or below by Friday

- Probable decline to Sensex 8400/Nifty 2600 by Friday

- Possible early week rise to Dow 8800-9000

- Probable early week rise to Sensex 9500/Nifty 2800

- Gold continues to fall

We should see the market deteriorate further through the week as the Saturn-Neptune aspect becomes tighter and the Sun-Mars conjunction gradually moves into aspect to that malefic configuration. I am expecting a breach of Dow 8000 by Friday the 12th and that downward trend should continue into next week. That said, there is a real possibility for gains Monday or Tuesday that could push the market towards Dow 9000, however briefly. Mercury, the planet of trading, changes signs on Monday morning (EST) as it enters sidereal Sagittarius, the constellation ruled by benefic Jupiter. At the same time, Jupiter will also change signs as it enters Capricorn on Tuesday afternoon (EST). The combined effect of these benefic planets entering new sign may be enough to propel the market higher. However, I expect the bearish mood to intensify by Wednesday at the latest as the market heads lower and approaches its rendezvous with the stressful multi-planet configuration on the 12th and 15th.

We should see the market deteriorate further through the week as the Saturn-Neptune aspect becomes tighter and the Sun-Mars conjunction gradually moves into aspect to that malefic configuration. I am expecting a breach of Dow 8000 by Friday the 12th and that downward trend should continue into next week. That said, there is a real possibility for gains Monday or Tuesday that could push the market towards Dow 9000, however briefly. Mercury, the planet of trading, changes signs on Monday morning (EST) as it enters sidereal Sagittarius, the constellation ruled by benefic Jupiter. At the same time, Jupiter will also change signs as it enters Capricorn on Tuesday afternoon (EST). The combined effect of these benefic planets entering new sign may be enough to propel the market higher. However, I expect the bearish mood to intensify by Wednesday at the latest as the market heads lower and approaches its rendezvous with the stressful multi-planet configuration on the 12th and 15th.

Investors should prepare for a shift in their orientation soon, as the bottom that is formed from Dec 12-19 will probably be a fairly long term one. At this point, the most likely scenario is that the low will occur on Monday December 15 (EST), but that date may well be off by a few days either way. It’s also important to note the likelihood of another significant decline for Dec 25-29 that will coincide with the Sun-Mars-Pluto conjunction in Sagittarius. This may be related to a violent geopolitical event that will shake market confidence. While I don’t expect this late December low to be lower than the one we seen next week, it is conceivable that it will be fairly close. If anything, it may provide another opportunity for investors to go long on stocks in advance of the significant January rally that will push up prices by at least 30% over the December lows. While some major declines are probable for February and March, those late winter lows will likely be higher than the lows we set in December. The spring rally will likely take the market above the January high so it may be possible to hold onto long positions for several months as this rally matures through the first half of 2009, until June or July. I will update this long term outlook view as circumstances warrant or when new information becomes available.

Possible Trading Strategies: It will still be profitable to take new short positions early week, even if the rally is not extended to Dow 9000. I expect the market to bottom at 7400-8000, although there is a chance it could be closer to 7000. If trading on Friday the 12th moves below 8000, then investors may consider covering some short positions then. Although Monday the 15th is likely to be lower, I am not certain of that and a weekend is a long time to be holding already profitable positions while contemplating uncertain outcomes. As the market bottoms December 12-19, it will be important to establish long positions. These are perhaps best taken on the 15th and after, just in case there is a catastrophic capitulation during trading on the 15th. More cautious investors may wish to wait to go long during the Dec 25-29 period just in case its lows retest the ones set next week.

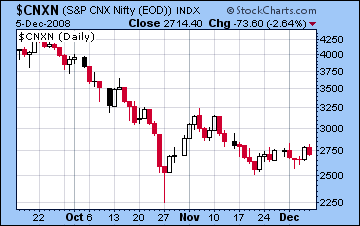

Markets in Mumbai continued to trade in a fairly narrow range as the major indices lost 1% for the week. The Nifty ended Friday’s session at 2714 while the Sensex closed at 8965. I had expected for a stronger push towards Nifty 3000 last week, but it encountered a lot of resistance just above the 2800 level. I mistakenly thought the positive energy from the Moon-Venus-Jupiter conjunction would extend deeper into last Monday’s trading but it was exhausted earlier in the day and the market declined through the afternoon. Thursday’s gain came as transiting Moon and Jupiter were in aspect to the natal Mercury in the NSE chart. This had sufficient positive energy to outweigh the negative influence of transiting Rahu (16 Capricorn) which is now in tense aspect to the very tight Sun-Venus (16 Libra) conjunction in the NSE chart.

This week looks more decidedly negative in advance of the Sun-Mars-Saturn-Neptune configuration that will become exact Friday the 12th and next Monday the 15th. A retest of Nifty 2525 is very likely and the markets may well fall below that level. Monday looks very positive as Mercury not only enters Jupiter-ruled Sagittarius but it also conjoins the ascendant in the NSE horoscope. I would not be surprised to see a gain of 5% that could take the Nifty well above 2800. Tuesday’s holiday closure means that Wednesday may see the sentiment shift. A rise in the morning is possible but things may well go into the red by the afternoon as the Moon conjoins the NSE Ketu. Thursday and Friday will probably both be negative and may push the market down closer to Nifty 2600.

This week looks more decidedly negative in advance of the Sun-Mars-Saturn-Neptune configuration that will become exact Friday the 12th and next Monday the 15th. A retest of Nifty 2525 is very likely and the markets may well fall below that level. Monday looks very positive as Mercury not only enters Jupiter-ruled Sagittarius but it also conjoins the ascendant in the NSE horoscope. I would not be surprised to see a gain of 5% that could take the Nifty well above 2800. Tuesday’s holiday closure means that Wednesday may see the sentiment shift. A rise in the morning is possible but things may well go into the red by the afternoon as the Moon conjoins the NSE Ketu. Thursday and Friday will probably both be negative and may push the market down closer to Nifty 2600.

Most of the decline from this planetary configuration will likely occur between Dec 15-19 so investors should expect to see a durable bottom formed at that time. As noted above, there is still a possibility (but not a probability) that the decline of Dec 25-29 may retest the lows of Dec 15-19. This may be an seen as another opportunity to add to long positions in advance of the January rally which should move prices higher by at least 25%. While some pullback in February and March is very likely, those lows will be higher than the December lows we see here. The market will then move higher through May and into June. At this point, the June-July highs look higher than January and will likely be the highs for 2009.

Possible Trading Strategies: Monday’s rally will be a good opportunity to take short positions in advance of the decline late in the week and next week. Investors seeking out long positions are best advised to wait until next week as the lows from the 15-19th will be lower than anything we see this week. Long positions taken next week may either be taken with the intention of covering them sometime in mid- to late-January or perhaps in June/July depending on the individual investor’s preferences.

The US dollar was largely unchanged on the week after some early week strength against most global currencies. The Euro ended the week close to its opening trade just above 1.27. We may see a little boost for the Euro above 1.28 early on this week, but it looks fairly weak here as transiting Mars is in aspect to its natal position in the Euro chart. Friday could see a very sharp decline that pushes it under 1.23. Next week looks like more bearishness that may take it once again under 1.20. The Rupee was largely unchanged last week as it closed Friday around 49.5. While some upward movement to 49 is probable early on, it is almost certain to move back above 50 by week’s end and may well touch 51. Next week looks even worse.

Crude plunged last week and barely ended trading above $40 on predictions for declining demand in this recessionary environment. I had expected a brief relief rally on the Sun-Mars transit to the natal Jupiter in the Futures chart but in the end, the Ketu aspect to the natal Jupiter won the day and the price continued downward. I had originally forecast a mid-December low of $40 for crude but that now seems too conservative. It’s going to be much lower still this week, with the largest declines Thursday and Friday as transiting Mercury conjoins the natal Ketu-Neptune conjunction. I would not be surprised to see it trade closer to $35 later this week and perhaps $30 next week.

The rally in gold ended last week as it fell significantly Monday and never recovered. It closed Friday at $752. While I had called the rally from the previous week, the optimism had run its course before the start of Monday’s trading. I think we’re in the midst of a major pullback in gold now, so $650 is well within reach in the next two or three weeks. The Sun is in tense aspect with Saturn towards the end of the week and that should be the primary influence on gold. Therefore, we should see it fall further, especially later in the week. $725 is very possible here, if not lower.