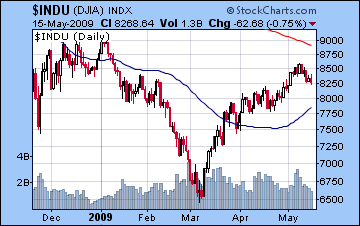

- NY mixed with midweek gains possible; Mumbai to be bullish until Wed or Thurs.

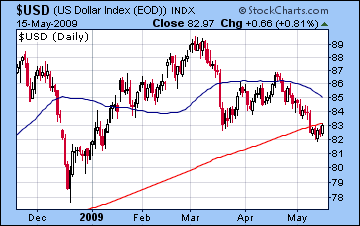

- Dollar may rise late week

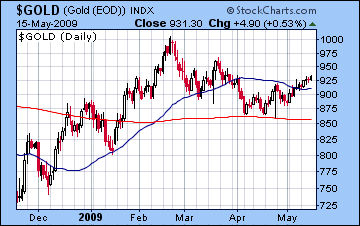

- Gold to continue rally

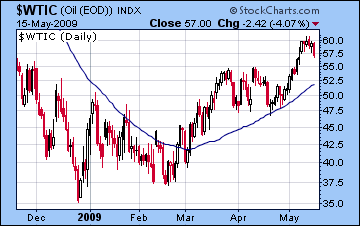

- Crude to weaken

- NY mixed with midweek gains possible; Mumbai to be bullish until Wed or Thurs.

- Dollar may rise late week

- Gold to continue rally

- Crude to weaken

This week features two interesting configurations, one positive and one negative. First, we have Venus in a tense partial aspect with Saturn early in the week. This angle is most exact Tuesday, but since both planets are moving more slowly than normal, we need to be flexible about when the effects might manifest. My best guess is that the bearishness may be expressed as early as Monday and will coincide with the Sun-Mercury conjunction and the Moon’s transit of Aquarius, opposite Saturn. Moon-Saturn aspects often produce caution and pessimism, particularly when they happen when a benefic planet like Venus is in aspect with bearish Saturn. Now the positive pattern occurs midweek when retrograde Mercury forms a partial but exact aspect with the Jupiter-Neptune conjunction. While this is exact on Thursday, it may begin to manifest as early as Tuesday. These two countervailing energies overlap in terms of time, so the intraweek dynamics are harder to predict. Certainly, there looks like some brief midday strength on Tuesday as the Moon conjoins Uranus in Pisces, but whether its enough to keep markets in the green into the afternoon is unclear. I think Tuesday very well could end up positive, especially if we see a big down day Monday. Wednesday also looks like it has some upside potential as the transiting Moon approaches the exalted Venus. Thursday and Friday seem more bearish, however, as the Moon conjoins Mars on Thursday and Mercury has slipped past the helpful influence of Jupiter. Friday has the additional feature of a Sun-Rahu aspect at 7 Taurus, the very same degree where Mercury went retrograde two weeks before. While I think the negatives will likely outweigh the positives this week, we need to be prepared for a significant bounce here. If for some reason Monday’s sell off does not occur or is comparatively mild (<1%), then we may well end up positive for the week.

This week features two interesting configurations, one positive and one negative. First, we have Venus in a tense partial aspect with Saturn early in the week. This angle is most exact Tuesday, but since both planets are moving more slowly than normal, we need to be flexible about when the effects might manifest. My best guess is that the bearishness may be expressed as early as Monday and will coincide with the Sun-Mercury conjunction and the Moon’s transit of Aquarius, opposite Saturn. Moon-Saturn aspects often produce caution and pessimism, particularly when they happen when a benefic planet like Venus is in aspect with bearish Saturn. Now the positive pattern occurs midweek when retrograde Mercury forms a partial but exact aspect with the Jupiter-Neptune conjunction. While this is exact on Thursday, it may begin to manifest as early as Tuesday. These two countervailing energies overlap in terms of time, so the intraweek dynamics are harder to predict. Certainly, there looks like some brief midday strength on Tuesday as the Moon conjoins Uranus in Pisces, but whether its enough to keep markets in the green into the afternoon is unclear. I think Tuesday very well could end up positive, especially if we see a big down day Monday. Wednesday also looks like it has some upside potential as the transiting Moon approaches the exalted Venus. Thursday and Friday seem more bearish, however, as the Moon conjoins Mars on Thursday and Mercury has slipped past the helpful influence of Jupiter. Friday has the additional feature of a Sun-Rahu aspect at 7 Taurus, the very same degree where Mercury went retrograde two weeks before. While I think the negatives will likely outweigh the positives this week, we need to be prepared for a significant bounce here. If for some reason Monday’s sell off does not occur or is comparatively mild (<1%), then we may well end up positive for the week.

The following week (May 25-29) will be shortened for the Monday Memorial Day holiday and so far looks fairly positive, so I would not rule out some rally attempts then. There are no clearly negative planetary patterns there that would force the market down significantly and the Moon-Mercury-Venus alignment on Friday, May 29 looks quite positive indeed. The week after that (June 1-5) looks like a better candidate for declines, as Mars squares the nodes and the Sun squares Saturn on Friday, June 5. This is likely to be the most negative week in any retracement move and June 5 could mark a possible interim low. In terms of levels, I am growing increasingly skeptical that we can reach even a 50% retracement which would be about SPX 800/Dow 7500. A negative week this week would be an important step towards that goal, but even then, it may be too tall an order. Perhaps a 38% retracement is more doable (SPX 830/Dow 7900), especially if we don’t fall much further this week and have another rally attempt next week. Since we are entering a choppy consolidation phase here, investors should be aware that the upward bias of the Jupiter-Neptune conjunction is still in play here so there is still some more room for this rally to go by July or August.

5-day outlook — bearish-neutral

30-day outlook — bearish-neutral

90-day outlook — bullish

1-year outlook — bearish

Dalal Street shook off global pessimism as more clues of a solid UPA election win pushed up markets 2% by Friday. The Sensex closed at 12,173 while the Nifty finished the week at 3671. This latest rise was not entirely unexpected, given the potential for Friday’s gains on the Sun-Jupiter aspect which were largely realized. The tense aspect involving Mercury-Mars-Saturn did produce some losses, although they did not arrive exactly on schedule, as Tuesday was a big up day. In retrospect, this likely resulted from the Moon activating the very bullish Jupiter-Uranus-Neptune pattern and temporarily shunted aside the pessimism until Wednesday and Thursday. From a technical perspective, the market seemed to be butting up against resistance at Nifty 3700 as it was unable to find enough buyers to push it over the top. And while it is still trading well above its 200-day moving average, that average is still falling, even after this powerful rally. Of course, the huge Congress win renders much of this technical discussion moot, as its pro-market policies will make stocks more attractive in the near term. I did not anticipate this kind of victory, so whatever consolidation we were expecting to see here is going to be both delayed and diminished given the probable post-election rally.

Astrologically, the week is shaping up to be fairly mixed but with some definite bullish energy. A Sun-Mercury conjunction on Monday is sometimes indicative of a bearish move, particularly given the Moon is opposite Saturn in Aquarius. But it seems impossible that Monday could be anything but a huge rally, so we’ll have to simply ignore the planetary energies on that one. The Indian market has been bucking the global trend lately and it seems that pattern may well continue here. A tense Venus-Saturn aspect on Tuesday has some negative potential to spark selling but that, too, may be overwhelmed by some activated Jupiter energy. Mercury’s aspect to Jupiter-Neptune midweek can be quite a bullish influence, especially since it occurs so close to the Sensex ascendant. In spite of some of these possible negative aspects, this rally is likely to move higher by virtue of the relevant activation points in the Indian natal charts. And no matter what the stars say, one cannot ignore the reality of the new political situation and its implications for domestic and foreign investors. So some significant gains are likely in the first part of the week, but it’s very possible they may not live up to the hopes of some bullish analysts. We can also expect some weakness by Thursday and Friday as Mars lines up against the NSE Mercury and Jupiter. I don’t quite see Nifty 4000 here, but it’s possible that 3900 may well be in play, although it may represent the intraweek high rather than the Friday close which should be somewhat lower.

Astrologically, the week is shaping up to be fairly mixed but with some definite bullish energy. A Sun-Mercury conjunction on Monday is sometimes indicative of a bearish move, particularly given the Moon is opposite Saturn in Aquarius. But it seems impossible that Monday could be anything but a huge rally, so we’ll have to simply ignore the planetary energies on that one. The Indian market has been bucking the global trend lately and it seems that pattern may well continue here. A tense Venus-Saturn aspect on Tuesday has some negative potential to spark selling but that, too, may be overwhelmed by some activated Jupiter energy. Mercury’s aspect to Jupiter-Neptune midweek can be quite a bullish influence, especially since it occurs so close to the Sensex ascendant. In spite of some of these possible negative aspects, this rally is likely to move higher by virtue of the relevant activation points in the Indian natal charts. And no matter what the stars say, one cannot ignore the reality of the new political situation and its implications for domestic and foreign investors. So some significant gains are likely in the first part of the week, but it’s very possible they may not live up to the hopes of some bullish analysts. We can also expect some weakness by Thursday and Friday as Mars lines up against the NSE Mercury and Jupiter. I don’t quite see Nifty 4000 here, but it’s possible that 3900 may well be in play, although it may represent the intraweek high rather than the Friday close which should be somewhat lower.

Next week (May 25 – 29) is still looking fairly bullish so there may be another run towards Nifty 3900-4000 especially at the end of that week. Mercury will make its direct station at the end of next week in a very close aspect to the natal Jupiter in the Sensex chart so this will give encouragement to the bulls. Early June looks more decidedly bearish as Mars squares Rahu on June 3 and Sun squares Saturn on June 5. Given the strength of this rally, we cannot expect much of a retracement here, perhaps just 10-15% off the highs we put in this week. The following week (June 8-12) will likely begin bearish but buyers will move in again by midweek and likely move the market higher. Overall, stocks in Mumbai will likely continue this rally into July and August. It is not unreasonable to think we could eventually see a 50% retracement between the 2008 highs and 2008 lows which would be about Nifty 4500. It may well surpass that level and move towards 5200 by August, but let’s first see what it can do this week on this bullish election news.

5-day outlook — bullish

30-day outlook — neutral-bullish

90-day outlook — bullish

1-year outlook — bearish

The US dollar staged a modest rally off recent lows last week and closed at 83, as it recovered to its 200-day moving average. This rise was largely in keeping with expectations as Wednesday’s bounce coincided with the Mars-Mars aspect, while Friday’s gain was also anticipated nicely by the Venus sextile to the natal Jupiter. While the Jupiter-Neptune conjunction isn’t doing the greenback any favours in the natal chart, it also is not suffering unduly. This week may see more choppiness with some big up days and down days coming very close together. Monday has a chance for gains as the Sun-Mercury conjunction occurs in close aspect to the natal Sun at 3 Scorpio. Tuesday may see some mild weakness, but a positive bias exists for Wednesday and after as Venus trines the Ascendant. This is really a nice enough aspect to counteract a lot of negativity that may exist in the chart and ought to produce at least one solid up day for the dollar. However, a sharp pullback is likely on either Wednesday or Thursday as the Sun opposes the natal Saturn. We should finish positive for the week, perhaps above 84, but next week will likely see some moments of weakness, particularly late week in advance of the Mercury direct station.

The US dollar staged a modest rally off recent lows last week and closed at 83, as it recovered to its 200-day moving average. This rise was largely in keeping with expectations as Wednesday’s bounce coincided with the Mars-Mars aspect, while Friday’s gain was also anticipated nicely by the Venus sextile to the natal Jupiter. While the Jupiter-Neptune conjunction isn’t doing the greenback any favours in the natal chart, it also is not suffering unduly. This week may see more choppiness with some big up days and down days coming very close together. Monday has a chance for gains as the Sun-Mercury conjunction occurs in close aspect to the natal Sun at 3 Scorpio. Tuesday may see some mild weakness, but a positive bias exists for Wednesday and after as Venus trines the Ascendant. This is really a nice enough aspect to counteract a lot of negativity that may exist in the chart and ought to produce at least one solid up day for the dollar. However, a sharp pullback is likely on either Wednesday or Thursday as the Sun opposes the natal Saturn. We should finish positive for the week, perhaps above 84, but next week will likely see some moments of weakness, particularly late week in advance of the Mercury direct station.

After trading above 1.36 in the early part of the week, the Euro closed below 1.35 as anxiety over the economic recovery send investors back into the dollar. I thought we might see a little more upside early on, but it barely managed a brief touch of 1.37. It was interesting to see how divergent energies played out late week as the Mars to Mars aspect overruled the Sun-Venus combination and sent the Euro lower on Friday. While I had been neutral to bearish bias overall, I thought we might see a little more support at the end of the week. Another example of how Mars is not a force to be taken lightly. This week the Sun-Mercury conjunction forms a weak but nonetheless notable semisextile aspect with the natal Saturn in the Euro chart so this may push it down on Monday and perhaps into Tuesday. Some gains are possible especially Wednesday as Moon transits Pisces but the Euro may slip back again later in the week as Mars is aspected by the natal Rahu. This is actually an ambiguous situation since the negative Mars-Rahu is somewhat countered by the favourable Mercury-Venus aspect. Overall, however, I think the Euro is likely to move lower here, although probably not by much. The Indian Rupee lost ground last week as it traded near 49.5. The stunning election win by Congress is likely to infuse it with much strength this week but it will probably return to these levels by early June.

After trading sporadically above $60 early in the week, crude oil fell back to $57 by Friday’s close. I thought crude might have more strength here to close above $60 if only for a day or two, but the bullishness from the Venus aspect in the Futures chart was nullified by the Mars influence in the ETF chart. Most disappointing was Friday’s drop, which did not correlate with any close aspect.

After trading sporadically above $60 early in the week, crude oil fell back to $57 by Friday’s close. I thought crude might have more strength here to close above $60 if only for a day or two, but the bullishness from the Venus aspect in the Futures chart was nullified by the Mars influence in the ETF chart. Most disappointing was Friday’s drop, which did not correlate with any close aspect.

This week looks fairly bearish for crude as it takes a pause from its recent run-up. Monday could well see more profit taking as the Aquarius Moon highlights the Saturn-Moon conjunction and transiting Mars conjoins the natal Sun in the ETF chart. This has the potential for a major pullback, perhaps down below $55. Wednesday and Thursday could see gains as the Moon joins Venus in Pisces and thereby activates the Futures Mercury. Friday looks negative as Mars forms a partial aspect with the natal Mercury in the ETF chart. Even if we see a midweek rally, it is very unlikely to take us back to $60 and with Friday’s weakness we will likely finish below current levels. Next week looks a little more bullish as Mars joins the Jupiter-Uranus-Neptune parade at 2 degrees of their respective signs. Watch for a possible interim low on June 5 below $50.

Gold added to its recent rally last week as it closed above $930, its highest level in six weeks. Tuesday proved to be the best day of the week, mostly coinciding with the Venus-Jupiter aspect in the ETF chart. I had thought Friday’s lift might be higher than it was (just $3) given the exactitude of the Venus aspect, but it seems it was offset by the unfortunate placement of Mercury on the malefic 6th house cusp.

Gold added to its recent rally last week as it closed above $930, its highest level in six weeks. Tuesday proved to be the best day of the week, mostly coinciding with the Venus-Jupiter aspect in the ETF chart. I had thought Friday’s lift might be higher than it was (just $3) given the exactitude of the Venus aspect, but it seems it was offset by the unfortunate placement of Mercury on the malefic 6th house cusp.

This week seems more mixed for gold, although some late week strength should be enough to keep the rally going. Monday and Tuesday may see some selling as there are no clearly favourable aspects. The Sun-Mercury conjunction on Monday could conceivably push bullion higher, but it’s less certain. If it does go higher in the early going, then gold is much more likely to make a bigger move higher. That’s because the Moon transits Pisces on Wednesday and will join Venus opposite Jupiter in the ETF chart. Then Thursday and Friday will feature Mercury forming a multi-planet alignment with Jupiter and the natal Venus. Thursday is perhaps more bullish of the two, but there is definitely a strong chance for gains here that may move gold to $950-960 which would equal the March highs. A significant pullback is most likely next week as Mars will aspect the natal Saturn in the ETF chart on May 27-28. As I mentioned last week, June is looking pretty bearish for gold, so there is a good chance that the high we see this week may be the high for the near and medium term.