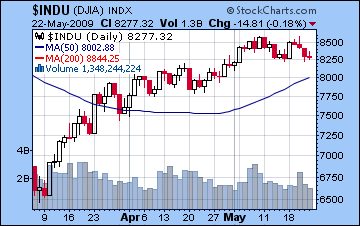

- Possible early midweek weakness followed by late week rally

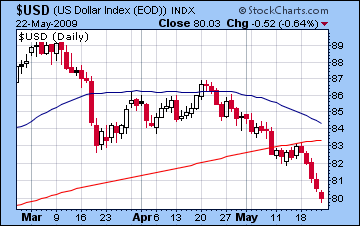

- Dollar likely to stabilize with bounce possible

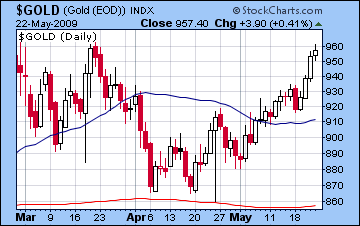

- Gold weaker, perhaps substantially

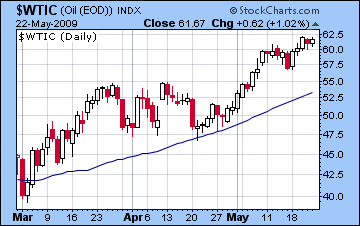

- Crude unlikely to move higher

- Possible early midweek weakness followed by late week rally

- Dollar likely to stabilize with bounce possible

- Gold weaker, perhaps substantially

- Crude unlikely to move higher

This week features a couple of potentially offsetting influences so we could once again be looking at two countervailing moves this week. First and foremost, Jupiter finally conjoins Neptune exactly on Wednesday. While this is a very bullish influence and we can isolate it as the key engine behind this two month "hope" rally, I’m less certain that we can expect a lot of upside this week from its conjunction. Slow moving planets like Jupiter and Neptune require faster moving planets to release their energy (like last Monday’s Sun-Mercury!) and we have two possible candidates this week. First, the Moon forms a trine aspect with Jupiter-Neptune very early in the week. With US markets closed Monday, there is a chance that Wall St may miss out on some of this available bullish energy. Second, Mars (2 Aries) forms a sextile aspect to Jupiter-Neptune but the difficulty here is that Mars is unreliable as a positive trigger. Mars contains a lot of energy, so there is a chance for a bigger than average move here (>2%), but it’s not clear which direction it will be in. Mars could act as a negative influence on stocks during the midweek since Mercury will join Mars in Aries. I am acknowledging a very real ambiguity here about the role of Mars here, although I would lean towards a midweek pullback, probably concentrated on Tuesday and Wednesday. Thursday and especially Friday seem more clearly bullish to me, however, as Mercury will move into a positive harmonic aspect with Venus. If we do see the markets sell off midweek, then a good portion of the decline may be erased by Friday, although I think the overall bias this week will be somewhat negative. If, by chance, however, Tuesday ends up positive, then we will probably be looking at a positive week overall with a possibility of matching the May 8 highs. As an added complicating factor, Neptune will turn retrograde on Friday. Given Neptune’s association with image, illusion, and confusion, we should watch out for media distortions or deliberate misinformation that come to light around that time. By itself, this is likely a slightly negative factor for stocks.

This week features a couple of potentially offsetting influences so we could once again be looking at two countervailing moves this week. First and foremost, Jupiter finally conjoins Neptune exactly on Wednesday. While this is a very bullish influence and we can isolate it as the key engine behind this two month "hope" rally, I’m less certain that we can expect a lot of upside this week from its conjunction. Slow moving planets like Jupiter and Neptune require faster moving planets to release their energy (like last Monday’s Sun-Mercury!) and we have two possible candidates this week. First, the Moon forms a trine aspect with Jupiter-Neptune very early in the week. With US markets closed Monday, there is a chance that Wall St may miss out on some of this available bullish energy. Second, Mars (2 Aries) forms a sextile aspect to Jupiter-Neptune but the difficulty here is that Mars is unreliable as a positive trigger. Mars contains a lot of energy, so there is a chance for a bigger than average move here (>2%), but it’s not clear which direction it will be in. Mars could act as a negative influence on stocks during the midweek since Mercury will join Mars in Aries. I am acknowledging a very real ambiguity here about the role of Mars here, although I would lean towards a midweek pullback, probably concentrated on Tuesday and Wednesday. Thursday and especially Friday seem more clearly bullish to me, however, as Mercury will move into a positive harmonic aspect with Venus. If we do see the markets sell off midweek, then a good portion of the decline may be erased by Friday, although I think the overall bias this week will be somewhat negative. If, by chance, however, Tuesday ends up positive, then we will probably be looking at a positive week overall with a possibility of matching the May 8 highs. As an added complicating factor, Neptune will turn retrograde on Friday. Given Neptune’s association with image, illusion, and confusion, we should watch out for media distortions or deliberate misinformation that come to light around that time. By itself, this is likely a slightly negative factor for stocks.

Next week (June 1-5) seems more clearly negative given the Mars-Rahu square June 2 and Sun-Saturn square on June 5. However, even there, it is important that there will be some major up days since Venus (2 Aries) will trigger the Jupiter-Neptune earlier in the week. Overall, I think there is a chance that the first week of June may be the interim low here, after which stocks will rise through June and July. If this week ends up negative, then there is a good chance that we will see the Dow trade towards 7800 by early June. The default setting in this market is still up, however, so the downside seems fairly limited. An important acid test for resuming the rally will occur June 8-10 when Mercury is in aspect with Jupiter, Uranus and Neptune. If the rally is going to extend towards Dow 10,000/SPX 1050, then this configuration should produce a big up move (>3%). Similarly, June 15-17 coincides with a very nice Sun aspect to Jupiter, Uranus and Neptune and this should take markets substantially higher.

5-day outlook — bearish-neutral

30-day outlook — neutral-bullish

90-day outlook — bullish

1-year outlook — bearish

Stocks in Mumbai went into orbit Monday rising more than 17% after the bigger than expected margin of victory of the Congress-led UPA in the Lok Sabha elections. After some minor profit taking through the rest of the week the Nifty closed at 4238 while the Sensex finished at 13,887. Regrettably, I did not foresee this kind of explosive up move at this time as I mistook the forest for the trees. While I had been generally bullish on Indian stocks for the spring period, I did not isolate May 18 as a date of critical importance, although in retrospect, there were clues. Essentially, the Sun-Mercury conjunction (3 Taurus) on Monday acted as a trigger for the bullish Jupiter-Neptune (2 Aquarius) conjunction which was in turn sitting on a sensitive spot in the Sensex and NSE natal charts. What made this move harder to predict was that Jupiter is moving very slowly now ahead of its retrograde station (on June 15 at 3 Aquarius), so it will be in a favourable place in the key natal charts for the next two months. This is one reason why I had expected the rally to continue into summer. Just when the Jupiter would be activated and all that bullish energy would be released was a trickier matter, and unfortunately one that eluded me. Readers seeking further explanation may refer to the "Mumbai’s Magnificent Monday" page on my website. And while we did smash through Nifty 4000 on Monday defying my forecast, it was interesting to see the market start to give back a bit of the gains the rest of the week, perhaps coinciding with the Mars aspect to the Mercury-Jupiter in the NSE chart as I had mentioned last week.

This week looks mixed with more bearishness in the earlier part of the week. On the positive side, Jupiter makes its exact conjunction with Neptune on Wednesday, although I believe the upside of this aspect may manifest earlier, perhaps on Monday as the Moon is in exalted in Taurus whilst transiting Rohini. The picture becomes more complex on Tuesday and Wednesday as Mars (2 Aries) will form a sextile aspect with the Jupiter-Neptune conjunction. Mars is a malefic planet but the sextile is often a bringer of positive energy, so we have something of an ambiguous situation here. Given that the Sun will form tense aspects with Sauturn in the NSE and Sensex charts, I think that tilts the weight of evidence towards more declines midweek. It’s by no means certain, but it is the scenario that appears to best fit the available evidence. Later in the week on Thursday and Friday, the bulls may find their legs again as Mercury moves into aspect with Venus (especially Friday). In addition, Venus (28 Pisces) will form a potentially favourable aspect with the Mercury-Jupiter pattern in the NSE chart. If the early week correction appears on time, then there’s still a good chance we will be down overall, although probably not by much, say around 4100-4200 on the Nifty by Friday. If, on the other hand, the bullish scenario prevails and the midweek Mars-Jupiter aspect ends up taking the market higher, then Friday’s action may well see the Nifty trade above 4400. As I said, however, I don’t think that is a likely outcome.

This week looks mixed with more bearishness in the earlier part of the week. On the positive side, Jupiter makes its exact conjunction with Neptune on Wednesday, although I believe the upside of this aspect may manifest earlier, perhaps on Monday as the Moon is in exalted in Taurus whilst transiting Rohini. The picture becomes more complex on Tuesday and Wednesday as Mars (2 Aries) will form a sextile aspect with the Jupiter-Neptune conjunction. Mars is a malefic planet but the sextile is often a bringer of positive energy, so we have something of an ambiguous situation here. Given that the Sun will form tense aspects with Sauturn in the NSE and Sensex charts, I think that tilts the weight of evidence towards more declines midweek. It’s by no means certain, but it is the scenario that appears to best fit the available evidence. Later in the week on Thursday and Friday, the bulls may find their legs again as Mercury moves into aspect with Venus (especially Friday). In addition, Venus (28 Pisces) will form a potentially favourable aspect with the Mercury-Jupiter pattern in the NSE chart. If the early week correction appears on time, then there’s still a good chance we will be down overall, although probably not by much, say around 4100-4200 on the Nifty by Friday. If, on the other hand, the bullish scenario prevails and the midweek Mars-Jupiter aspect ends up taking the market higher, then Friday’s action may well see the Nifty trade above 4400. As I said, however, I don’t think that is a likely outcome.

The following week (June 1-5) appears to start bullish as Venus will aspect Jupiter but there are two decidedly malefic aspects the market will have to deal with. Mars will square Rahu on June 2 and Sun will square Saturn on Friday June 5. Overall, this is likely to push the market lower. Given the suddenness of Monday’s move and the absence of any meaningful technical indicators that might address levels and targets, it is difficult to know how much profit taking might be possible here. Certainly, a close below 4000 on the Nifty is well within reach, but how much below is hard to say. At this point, I am expecting the rally to resume during the week of June 8-12 when Mercury forms an aspect with Jupiter, Uranus, and Neptune. Some possible levels of resistance on the way up include 4500 and 5200 so we will see how much strength this rally has.

5-day outlook — bearish

30-day outlook — neutral

90-day outlook — bullish

1 year outlook — bearish-neutral

The dollar got hammered last week as treasury yields rose on fears that the government-issued debt might be so excessive as to warrant a ratings downgrade. The USDX fell five days in a row and barely managed to finish above 80. While I foresaw some of this negativity especially later in the week, my call for an up day on the Venus-Ascendant trine aspect did not come to pass. As it happened the Sun-Mercury conjunction at 3 Taurus in opposition to the natal Saturn set the tone for the week, and the declines kept coming as the Sun transited exactly opposite the Saturn on Thursday and even into Friday. This week seems mixed with the chance of some rebound earlier in the week as the Sun trines the MC in the natal DX chart. Admittedly this isn’t much to go on, but I am triangulating with the Euro chart here which features a more problematic pattern. The late week may see dollar weakness again as transiting Mars will aspect the natal Sun. So if Tuesday is positive for the dollar, it should manage to stay above 80 this week, perhaps moving towards 81. Next week (June 1-5) seems more bullish for the dollar, so we may see it move towards its resistance level of 83 and its 200-day moving average. With the rally in stocks likely to extend further this summer, we may see the dollar fall to 74-77 before it rallies strongly in the fall. Even if that rally is strong, it is unlikely to get back to 90.

The dollar got hammered last week as treasury yields rose on fears that the government-issued debt might be so excessive as to warrant a ratings downgrade. The USDX fell five days in a row and barely managed to finish above 80. While I foresaw some of this negativity especially later in the week, my call for an up day on the Venus-Ascendant trine aspect did not come to pass. As it happened the Sun-Mercury conjunction at 3 Taurus in opposition to the natal Saturn set the tone for the week, and the declines kept coming as the Sun transited exactly opposite the Saturn on Thursday and even into Friday. This week seems mixed with the chance of some rebound earlier in the week as the Sun trines the MC in the natal DX chart. Admittedly this isn’t much to go on, but I am triangulating with the Euro chart here which features a more problematic pattern. The late week may see dollar weakness again as transiting Mars will aspect the natal Sun. So if Tuesday is positive for the dollar, it should manage to stay above 80 this week, perhaps moving towards 81. Next week (June 1-5) seems more bullish for the dollar, so we may see it move towards its resistance level of 83 and its 200-day moving average. With the rally in stocks likely to extend further this summer, we may see the dollar fall to 74-77 before it rallies strongly in the fall. Even if that rally is strong, it is unlikely to get back to 90.

As the greenback plunged on US treasury worries, the Euro took flight and closed just below 1.40. I mistakenly thought Monday’s Sun-Mercury conjunction would be Euro bearish but instead it pushed it higher. While it did form a negative aspect with the natal Saturn, the source of the optimism may have derived from the fact that the conjunction took place near the benefic 9th house cusp. This week there is a chance for a sharp sell off in the Euro as transiting Mars will conjoin the natal Saturn in the malefic 8th house. Normally, this conjunction would essentially guarantee a significant one- to two-day decline but we have to be careful here since the Jupiter-Neptune conjunction will be softening the blow somewhat since it forms a sextile to Saturn. So while I am bearish on the Euro this week, its a very conditional forecast. The late week may see a bounce as Venus comes under the supportive aspect of natal Rahu. Overall, we might see 1.35 over the next two weeks, although the summer rally in the Euro may well push it back up to 1.50. Buoyed by the pro-market election results, the Indian Rupee surged to 47 to the dollar this week. Some profit taking is inevitable here over the next two weeks, and 48-49 seems quite possible.

US Dollar

5-day outlook — neutral-bullish

30-day outlook — neutral

90-day outlook — bearish

1-year outlook — bearish

The rally in crude oil assumed a new level of confidence last week as it shook off the previous week’s sell off and made its highest close yet, above $61. I grossly misinterpreted Monday’s Mars-Sun aspect in the ETF chart and as the Jupiter-Neptune aspect continued to work its bullish magic in the key natal charts.

The rally in crude oil assumed a new level of confidence last week as it shook off the previous week’s sell off and made its highest close yet, above $61. I grossly misinterpreted Monday’s Mars-Sun aspect in the ETF chart and as the Jupiter-Neptune aspect continued to work its bullish magic in the key natal charts.

This week offers two contradictory indications, at least for the early week period. On the bullish side, Venus conjoins the natal Sun in the ETF chart on Tuesday, an apparently auspicious signature, but Mars aspects the natal Mars in the Futures chart, a very bearish indication. I am tempted to think the Mars-to-Mars contact will carry the day and usher in some profit taking for Tuesday and Wednesday, but I can’t be sure of that. The Jupiter sextile to the natal Mars has the potential to mitigate a lot of the negative effects of the Mars-Mars contact. Nonetheless, a negative outcome appears to be the most likely scenario here, and with next week shaping up to be more clearly negative, we will likely see crude move back towards $55, and perhaps even to $50. Given the speculative nature of the crude oil market and the big daily moves, predicting price levels has been very difficult.

5-day outlook — bearish-neutral

30-day outlook — neutral-bullish

90-day outlook — bullish

1-year outlook — bullish

After some early week declines, gold extended its recent rally as it closed Friday at $957. This was essentially in keeping with the forecast which highlighted a very favourable alignment of Mercury and Jupiter to the natal Venus in the ETF chart towards the end of the week. Wednesday’s Moon-Jupiter transit also pushed prices higher as predicted. More disappointing was Monday’s decline, which coincided with the Sun-Mercury conjunction. This opposed the natal ETF Sun but was otherwise lacking in stressful aspects.

After some early week declines, gold extended its recent rally as it closed Friday at $957. This was essentially in keeping with the forecast which highlighted a very favourable alignment of Mercury and Jupiter to the natal Venus in the ETF chart towards the end of the week. Wednesday’s Moon-Jupiter transit also pushed prices higher as predicted. More disappointing was Monday’s decline, which coincided with the Sun-Mercury conjunction. This opposed the natal ETF Sun but was otherwise lacking in stressful aspects.

This week may be a turning point for gold as we will see a couple of potentially bearish aspects in the ETF chart. Tuesday and Wednesday will see Mars make its 8th house quincunx aspect, arguably its most malefic aspect, to the natal Sun. Thursday seems harder to fathom, while Friday may well be the best chance for a gain this week as Venus and Mercury will form an alignment with the natal Mercury. Overall, we should be lower this week perhaps approaching $930, although early next week may see buyers return as Venus will aspect its natal position on Monday and Tuesday. Later next week, I am expecting more weakness on the Mars-Rahu aspect.

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — bearish