- Early gains in stocks possible but danger of large declines

- Dollar to stay strong with break out possible

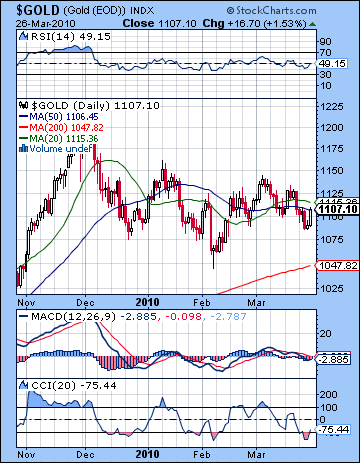

- Gold trending lower

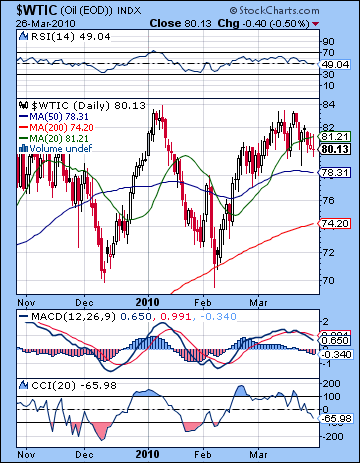

- Crude mixed; declines outweighing gains especially as week progresses

- Early gains in stocks possible but danger of large declines

- Dollar to stay strong with break out possible

- Gold trending lower

- Crude mixed; declines outweighing gains especially as week progresses

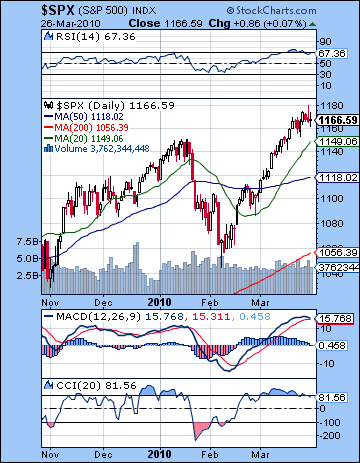

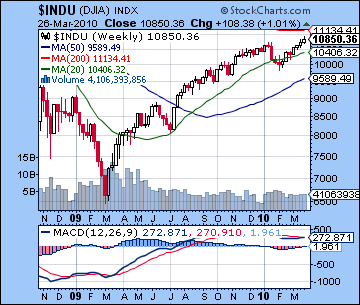

Stocks in New York added to their recent gains last week as investors stayed positive in the aftermath of the passage of Obama’s health reform bill. After trading as high as 1180, the S&P closed the week less than 1% higher at 1166 while the Dow finished at 10,850. This outcome was disappointing mostly because I had expected more downside from the Sun-Saturn opposition on Monday. While international markets were lower as the aspect became exact, US markets benefited from the separation of the Sun away from Saturn as the lower open was quickly reversed and stocks closer modestly higher. The bullish mood continued into Tuesday as Venus reached its highest degree of exaltation. I had been uncertain if Wednesday’s Moon-Venus square would be sufficient to produce an up day and it turned out it wasn’t as the market finally moved lower. Thursday was positive into midday on the Sun-Pluto aspect but as expected prices slumped near the close the market ended lower. Friday started higher on the Greece bailout plan but the sellers moved in after lunch as stocks ended mixed. This volatile session was perhaps a good reflection of the Mercury-Rahu aspect which suggested unexpected turns and choppy trading. Saturn has not been a reliable indicator of market action here as prices have continued to rise despite the trio of aspects we’ve seen over the past two weeks. This does not mean that Saturn has been neutralized; it shows that I have misinterpreted the relative importance of the triggering aspects needed to produce a significant downward move. Saturn’s next test comes in late April and the opposition aspect with Uranus. Given the recent tendency of Saturn-Uranus opposition aspects to coincide with market lows, it is worth keeping this aspect in mind. While the aspect cannot produce an exact date of a trend reversal, it has been implicated in the lows of November 2008 and March 2009. On both those occasions, the aspect formed about 3-4 weeks ahead of the low. Of course, it does not always translate into declines since its opposition in September 2009 saw prices rise without significant interruption. Nonetheless, its proximity here should give some concern to bulls.

Stocks in New York added to their recent gains last week as investors stayed positive in the aftermath of the passage of Obama’s health reform bill. After trading as high as 1180, the S&P closed the week less than 1% higher at 1166 while the Dow finished at 10,850. This outcome was disappointing mostly because I had expected more downside from the Sun-Saturn opposition on Monday. While international markets were lower as the aspect became exact, US markets benefited from the separation of the Sun away from Saturn as the lower open was quickly reversed and stocks closer modestly higher. The bullish mood continued into Tuesday as Venus reached its highest degree of exaltation. I had been uncertain if Wednesday’s Moon-Venus square would be sufficient to produce an up day and it turned out it wasn’t as the market finally moved lower. Thursday was positive into midday on the Sun-Pluto aspect but as expected prices slumped near the close the market ended lower. Friday started higher on the Greece bailout plan but the sellers moved in after lunch as stocks ended mixed. This volatile session was perhaps a good reflection of the Mercury-Rahu aspect which suggested unexpected turns and choppy trading. Saturn has not been a reliable indicator of market action here as prices have continued to rise despite the trio of aspects we’ve seen over the past two weeks. This does not mean that Saturn has been neutralized; it shows that I have misinterpreted the relative importance of the triggering aspects needed to produce a significant downward move. Saturn’s next test comes in late April and the opposition aspect with Uranus. Given the recent tendency of Saturn-Uranus opposition aspects to coincide with market lows, it is worth keeping this aspect in mind. While the aspect cannot produce an exact date of a trend reversal, it has been implicated in the lows of November 2008 and March 2009. On both those occasions, the aspect formed about 3-4 weeks ahead of the low. Of course, it does not always translate into declines since its opposition in September 2009 saw prices rise without significant interruption. Nonetheless, its proximity here should give some concern to bulls.

Another week, another high. Bernanke’s cheap money policy has pushed prices higher than most people expected as liquidity continues to overrule fundamentals, technicals or any other metric one can imagine. The dividend yield on stocks is now near historic lows of less than 2.5% while the $VIX has hit 16. This is as low as the VIX has ever gone and it is worth noting that the last time we saw it this low was at the highs made in May 2008 and, more tellingly, in October 2007 when the US market made its all-time high. From a contrarian perspective, this is a strong indication of excessive complacency that should accompany a market top. It’s still not an exact measurement so time correlations are going to be fairly loose, but it ought to give bullish investors pause. Meanwhile, the volume story is much the same: slackening volume generally with higher volume on down days. This pattern could conceivably go on indefinitely, but it makes the rally more fragile and more unable to withstand surprises. It is priced to perfection here and anything untoward could take it down sharply. The number of stocks making 52 week highs fell this week, marking a divergence with the higher prices and thus a possible sign that the rally is narrowing and make reverse soon. Daily MACD on the S&P is curling over here although it has not yet formed a bearish crossover. CCI (81) has fallen below the bullish line and seems to be deteriorating and points to lower prices ahead. RSI (67) is similarly weakening and suggests lower peaks so that even if we see another move higher it may not get very far. The MACD on the weekly Dow chart is finally showing a tiny bullish crossover but it may not be enough to be persuasive. In the S&P chart, we can see the market has moved closer to its resistance level in the upward rising channel around 1190. Support may be found near the 20 DMA at 1150, and then the 50 DMA around 1120. Below that, the 200 DMA coincides with recent lows so it should be seen as a somewhat firmer support level around 1030-1050.

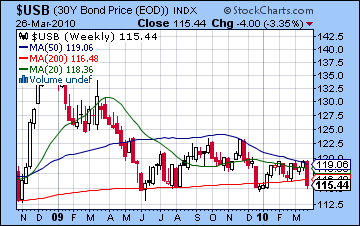

Despite the EU-IMF joint bailout of Greece, concerns remain about the high levels of government debt. US treasury yields rose again last week as the 30-year bond rose to 4.75%. We can see from the $USB weekly chart that the value of the long bond is very near some important technical support here. If it falls much below 115, it is likely to fall further, and perhaps sharply. We may have got a glimpse of a dark financial future this week when both stocks and bonds fell in tandem on Wednesday, a sign perhaps that the current levels of deficit financing are unsustainable and that interest rates may have to rise sooner than many people expect. The double tip scenario is still very much on the table as the rest of the bad commercial and housing debt has yet to work its way through the system. And yet even if treasuries continue to fall out of favor here, stocks could still rise as equities are seen as better risk in a world awash in debt. Bonds may well continue to be struggle for another week but I still expect some kind of a rally here, perhaps starting as late as mid-April. While we have seen that bonds may fall together with falling stocks, a bond rally is perhaps more likely to coincide with a sell-off in stocks as investors seek the relative safety of US treasuries.

With the Saturn aspects now behind us, we will be paying special attention to the effects of Venus and Mercury entering the sign of Aries this week. This may be seen as a problematic influence for the market since Aries is ruled by malefic Mars and Mars is currently in a debilitated state in Cancer. Nonetheless the ongoing aspect between Uranus and Neptune appears to be driving this market for the moment so it is unclear just now much of a drag this Aries influence may be. This week begins with an apparently positive alignment between Venus, Uranus and Neptune on Monday. This is likely to push up prices, especially in the morning. There is a chance that it all may be come unglued by the close but I would not say that is likely. Tuesday looks more bearish as the Full Moon is square Rahu and may reflect some sudden anxiety. Wednesday is especially difficult to call since there is a bearish Venus-Saturn aspect but a bullish aspect between Mercury, Uranus and Neptune. While this may simply produce a nothing day, I am inclined to think we could see a sizable move here, perhaps on the upside. The Moon is opposite Venus at the open suggesting positive energy early, but it is hard to say if the good vibes can continue through the day. Certainly a significant up day is likely Wednesday or Thursday (Friday is closed for Good Friday), but it is unclear which day it will be. I would lean towards a gain on Wednesday with a loss on Thursday. The most likely day for a loss looks like Tuesday with Monday looking most bullish, although my confidence is only moderate on both those calls. Unless the new Aries influence totally overtakes the markets and, for example, produces a loss on Monday, this week could conceivably finish higher. I would not rule out a test of resistance at 1190 here. On the other hand, a new sign influence can shake things up considerably so it is possible that losses may be larger than they have been recently. That means that one down day has the potential to outweigh three up days. So while the specific aspects lean towards a bullish outcome this week, the sign change into Aries looks more generally bearish although it is harder to know exactly when the down days will manifest. Overall, I would lean towards a bearish bias.

With the Saturn aspects now behind us, we will be paying special attention to the effects of Venus and Mercury entering the sign of Aries this week. This may be seen as a problematic influence for the market since Aries is ruled by malefic Mars and Mars is currently in a debilitated state in Cancer. Nonetheless the ongoing aspect between Uranus and Neptune appears to be driving this market for the moment so it is unclear just now much of a drag this Aries influence may be. This week begins with an apparently positive alignment between Venus, Uranus and Neptune on Monday. This is likely to push up prices, especially in the morning. There is a chance that it all may be come unglued by the close but I would not say that is likely. Tuesday looks more bearish as the Full Moon is square Rahu and may reflect some sudden anxiety. Wednesday is especially difficult to call since there is a bearish Venus-Saturn aspect but a bullish aspect between Mercury, Uranus and Neptune. While this may simply produce a nothing day, I am inclined to think we could see a sizable move here, perhaps on the upside. The Moon is opposite Venus at the open suggesting positive energy early, but it is hard to say if the good vibes can continue through the day. Certainly a significant up day is likely Wednesday or Thursday (Friday is closed for Good Friday), but it is unclear which day it will be. I would lean towards a gain on Wednesday with a loss on Thursday. The most likely day for a loss looks like Tuesday with Monday looking most bullish, although my confidence is only moderate on both those calls. Unless the new Aries influence totally overtakes the markets and, for example, produces a loss on Monday, this week could conceivably finish higher. I would not rule out a test of resistance at 1190 here. On the other hand, a new sign influence can shake things up considerably so it is possible that losses may be larger than they have been recently. That means that one down day has the potential to outweigh three up days. So while the specific aspects lean towards a bullish outcome this week, the sign change into Aries looks more generally bearish although it is harder to know exactly when the down days will manifest. Overall, I would lean towards a bearish bias.

Next week (April 5 – 9) begins negatively on a Mercury-Mars square but it is possible that its effects may be felt largely overseas before the US trading day. Look for an up day either Tuesday or Wednesday on the Sun-Jupiter aspect but overall this week looks bearish. The following week (Apr 12-16) also tilts towards the bears due to the Sun’s entry into Aries. After that, the market may move sideways or move a little lower for a week but then fall hard right at the end of the month and the first days of May on the minor Mars-Saturn-Ketu aspect. It is possible we might hit bottom around May 4 and the Sun-Mars square and then begin to move higher. Assuming we put in the top in the coming days, the correction would then last for the better part of four weeks and should take the market down at least 7-10%. There is still a very good chance the correction will be deeper than given the powerful Saturn-Uranus opposition so I would definitely not rule out SPX 1020 which would be a significant test of the 200 DMA. The month of May looks more bullish on the approaching Jupiter-Uranus conjunction. One complicating factor is that this very bullish combination will be aligned with bearish Saturn so it is possible that the gains may be tempered somewhat. A key date to watch will therefore be May 17-18 when Sun, Venus, Jupiter and Saturn all align in the same degree of their respective signs. This ought to produce a gain in the run-up but there is a chance for prices to slump afterwards. The rally should start to sputter by mid-June with a possible gentle slide into July that picks up downside momentum into August and September.

Next week (April 5 – 9) begins negatively on a Mercury-Mars square but it is possible that its effects may be felt largely overseas before the US trading day. Look for an up day either Tuesday or Wednesday on the Sun-Jupiter aspect but overall this week looks bearish. The following week (Apr 12-16) also tilts towards the bears due to the Sun’s entry into Aries. After that, the market may move sideways or move a little lower for a week but then fall hard right at the end of the month and the first days of May on the minor Mars-Saturn-Ketu aspect. It is possible we might hit bottom around May 4 and the Sun-Mars square and then begin to move higher. Assuming we put in the top in the coming days, the correction would then last for the better part of four weeks and should take the market down at least 7-10%. There is still a very good chance the correction will be deeper than given the powerful Saturn-Uranus opposition so I would definitely not rule out SPX 1020 which would be a significant test of the 200 DMA. The month of May looks more bullish on the approaching Jupiter-Uranus conjunction. One complicating factor is that this very bullish combination will be aligned with bearish Saturn so it is possible that the gains may be tempered somewhat. A key date to watch will therefore be May 17-18 when Sun, Venus, Jupiter and Saturn all align in the same degree of their respective signs. This ought to produce a gain in the run-up but there is a chance for prices to slump afterwards. The rally should start to sputter by mid-June with a possible gentle slide into July that picks up downside momentum into August and September.

5-day outlook — bearish-neutral SPX 1140-1170

30-day outlook — bearish SPX 1100-1150

90-day outlook — bearish-neutral SPX 1100-1200

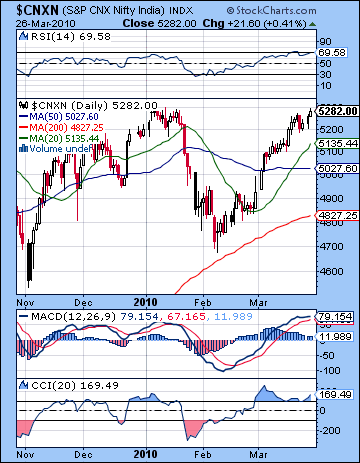

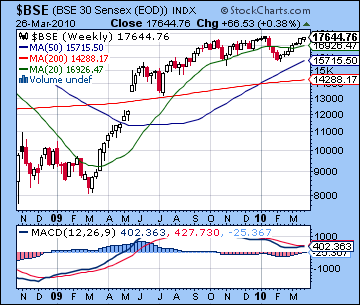

Stocks in Mumbai rose for the seventh straight week as financials and automakers led the way in the liquidity driven rally. In keeping with recent patterns, the gains were largely fractional over the previous week as the Sensex closed up less than half a percent at 17,644 while the Nifty finished at 5282. I had thought we would see more downside especially early in the week on Monday’s Sun-Saturn aspect. The market did drop but it was a very modest pullback. Tuesday was also more bullish than expected as stocks ended in the green. While I was correct in expecting a net negative outcome early, it was nonetheless a disappointing result. After Wednesday’s holiday closing, the rebound continued as forecast with gains on both Thursday and Friday. This was also in keeping with expectations although I did not anticipation gains on both days. As it turned out, Venus was very strong by transit in late Pisces and this provided more than enough activation for the NSE chart to lodge two consecutive winning sessions. Perhaps in keeping with the continued effect of Saturn, the rally off the February lows has been quite a guarded affair as gains have been quite small with many flat or down days mixed in. With the market still unable to make new highs for the year, it seems that Saturn is still worthy of some attention here, although it has similarly failed to drive prices down very far when the opportunity was presented. The inability of the Sun-Saturn aspect to take prices significantly lower, for example, is a reminder that we have yet to see the full effects of Saturn. I had expected more downside in March on the quick series of transits by Venus, Mercury and the Sun but it has not unfolded that way. So it seems we may have to await the effects of the slower and more powerful aspect between Saturn and Uranus that becomes exact on 26 April. That is not to say that the market will continue rising until then, but the time around that exact opposition is perhaps more likely to be very bearish. Before then, the market is unlikely to trend much higher as there are a number of offsetting influences to consider.

Stocks in Mumbai rose for the seventh straight week as financials and automakers led the way in the liquidity driven rally. In keeping with recent patterns, the gains were largely fractional over the previous week as the Sensex closed up less than half a percent at 17,644 while the Nifty finished at 5282. I had thought we would see more downside especially early in the week on Monday’s Sun-Saturn aspect. The market did drop but it was a very modest pullback. Tuesday was also more bullish than expected as stocks ended in the green. While I was correct in expecting a net negative outcome early, it was nonetheless a disappointing result. After Wednesday’s holiday closing, the rebound continued as forecast with gains on both Thursday and Friday. This was also in keeping with expectations although I did not anticipation gains on both days. As it turned out, Venus was very strong by transit in late Pisces and this provided more than enough activation for the NSE chart to lodge two consecutive winning sessions. Perhaps in keeping with the continued effect of Saturn, the rally off the February lows has been quite a guarded affair as gains have been quite small with many flat or down days mixed in. With the market still unable to make new highs for the year, it seems that Saturn is still worthy of some attention here, although it has similarly failed to drive prices down very far when the opportunity was presented. The inability of the Sun-Saturn aspect to take prices significantly lower, for example, is a reminder that we have yet to see the full effects of Saturn. I had expected more downside in March on the quick series of transits by Venus, Mercury and the Sun but it has not unfolded that way. So it seems we may have to await the effects of the slower and more powerful aspect between Saturn and Uranus that becomes exact on 26 April. That is not to say that the market will continue rising until then, but the time around that exact opposition is perhaps more likely to be very bearish. Before then, the market is unlikely to trend much higher as there are a number of offsetting influences to consider.

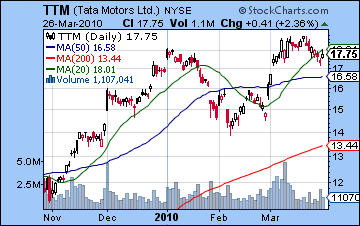

The Nifty did manage to break above 5250 and the rising trend line last week so that should be seen as a moderately bullish indication. Buyers swooped in at 5200 on Tuesday and prevented any further damage as bulls were itching to challenge the January high at 5300. It traded near that level briefly on Friday but that is really the crux of the matter at this stage of the game. A close above 5300 will likely bring more money into the market, although we should be careful about a "fake up" move for a day or two that does not last. The daily MACD is still in a bullish crossover with a diminishing gap suggesting a possible reversal in the near future. CCI (169) is still bullish although it has not equalled its levels from three weeks ago. RSI (69) is again pushing up against some recent resistance so it may be worthwhile to wait and see if it can climb above 70 and therefore take out the previous peak. The weekly Sensex chart shows a MACD that is still in a negative crossover despite the recent rally. It is coming very close, of course, but the current technical situation of the market does not encourage new positions. If it makes new highs here, then we would likely see the beginnings of a more bullish crossover. The NYSE chart for Tata Motors (TTM) is an interesting case study of the state of the Indian market, especially through the eyes of the foreign investor. It is very close to its March highs here and is probably more bullish than the market as a whole. Volume is also higher on up days than on down days so this is another sign that US investors see a promising situation in India. And it may well be that foreign institutional investors have been driving this rebound rally as India looks more promising than the US and many other jurisdictions at this point. As bullish as this chart is, however, it may be overly reliant on foreign liquidity and once that dries up due to rising interest rates or the end to the Fed’s quantitative easing, the Indian market may suffer. In any event, Nifty 5300 is the key resistance level to watch now with 5500 as a possible best case scenario either in early April or perhaps in June. Support may be found initially near the 20 DMA at 5150 which would also correspond with the bottom of the rising price channel from the February low. Below that, the 50 DMA around 5100-5150 should also bring in new buyers since it has served as fairly reliable support for smaller pullbacks in recent months. 4700-4800 may also serve as support here since it is close to the 200 DMA and also marks the previous low. This is the critical low to watch if we are going to see a major change in the trend in the near term. It is still quite possible we could get there by early May.

This week will sees a mixture of positive and negative influences. For the bulls, a couple of very nice planetary patterns offer the potential to take prices higher, especially on Monday and Wednesday. Venus will form a positive alignment with Uranus and Neptune on Monday that is likely to take prices higher at least in the early going. There is a risk that prices could slump by the close so I would not rule out a negative day overall. Nonetheless, this seems like a plausible recipe for an up day. Tuesday features a Full Moon in Hasta which could reflect a change in mood. Generally, this seems less conducive to gains since we will have both Venus and Mercury now in the sign of Aries. This is a potentially negative influence for the week that could offset some of particular bullish aspects. The reason why planets in Aries is a possible problem now is because Aries is ruled by Mars, and Mars is currently debilitated in Cancer. So there is a greater chance for the negative side of Aries to come through in the form of rash actions and sudden turns of events. Since this is a sign change rather than an aspect, this may not immediately impact the market and may only serve to deepen losses when they occur through aspecting. Venus enters Aries on Saturday and Mercury follows on Tuesday. This is, therefore, another reason why Tuesday looks potentially bearish. Wednesday is a tough call since Mercury will form a bullish pattern with Uranus and Neptune but Venus will make a tense minor aspect with Saturn. This day will be an important test of the effect of the Aries sign change. If the market drops here, it will increase the likelihood for a much longer correction. If the market manages another advance, it will mean we will have to wait a little longer for a meaningful retracement to occur. I would lean towards a gain here, but it’s far from certain. Thursday could be more negative with both Mercury and Venus now past the bullish influence of Uranus and Neptune. The Moon aspects Jupiter and Ketu in the morning so gains are more likely then but watch for weakness into the close. Overall, the market may end up close to current levels or lower although this does not rule out a break above 5300, if only for a day.

This week will sees a mixture of positive and negative influences. For the bulls, a couple of very nice planetary patterns offer the potential to take prices higher, especially on Monday and Wednesday. Venus will form a positive alignment with Uranus and Neptune on Monday that is likely to take prices higher at least in the early going. There is a risk that prices could slump by the close so I would not rule out a negative day overall. Nonetheless, this seems like a plausible recipe for an up day. Tuesday features a Full Moon in Hasta which could reflect a change in mood. Generally, this seems less conducive to gains since we will have both Venus and Mercury now in the sign of Aries. This is a potentially negative influence for the week that could offset some of particular bullish aspects. The reason why planets in Aries is a possible problem now is because Aries is ruled by Mars, and Mars is currently debilitated in Cancer. So there is a greater chance for the negative side of Aries to come through in the form of rash actions and sudden turns of events. Since this is a sign change rather than an aspect, this may not immediately impact the market and may only serve to deepen losses when they occur through aspecting. Venus enters Aries on Saturday and Mercury follows on Tuesday. This is, therefore, another reason why Tuesday looks potentially bearish. Wednesday is a tough call since Mercury will form a bullish pattern with Uranus and Neptune but Venus will make a tense minor aspect with Saturn. This day will be an important test of the effect of the Aries sign change. If the market drops here, it will increase the likelihood for a much longer correction. If the market manages another advance, it will mean we will have to wait a little longer for a meaningful retracement to occur. I would lean towards a gain here, but it’s far from certain. Thursday could be more negative with both Mercury and Venus now past the bullish influence of Uranus and Neptune. The Moon aspects Jupiter and Ketu in the morning so gains are more likely then but watch for weakness into the close. Overall, the market may end up close to current levels or lower although this does not rule out a break above 5300, if only for a day.

Next week (April 5 – 9) will likely begin quite negatively on the Mercury-Mars square aspect with some positive influence likely towards the end of the week on the Sun-Jupiter aspect. Generally, however, this week looks more bearish than the previous week with a testing of some support levels more likely. The following week (Apr 12-16) looks mixed to positive as the Sun enters Aries midweek. This may create more problems although perhaps not immediately. The Sun stays in Aries for a whole month, so this influence should be considered as a background bearish influence. After that, a significant weakening of the market is possible as Saturn moves closer to its aspect with Uranus and the Sun creates an alignment with them both on Monday, the 19th. The last week of April and first week of May look the most bearish here so it is possible we could actually see the largest percentage down moves occur then. May generally looks mixed to bullish so some kind of rebound rally is likely. With the approach of the Jupiter-Uranus conjunction in early June, the market will likely bounce of any lows made in early May. How high it goes is very hard to say, but I would not rule out 5300 again or perhaps even higher. If the correction on the Saturn-Uranus is deep and takes the Nifty below 4700, then the market will be very hard pressed to make 5300 again. The rally may run into trouble in June after Jupiter has passed Uranus and Mars aspects both Neptune and Jupiter. Gains will be increasing hard to come by in July and August so a larger downturn seems likely then.

Next week (April 5 – 9) will likely begin quite negatively on the Mercury-Mars square aspect with some positive influence likely towards the end of the week on the Sun-Jupiter aspect. Generally, however, this week looks more bearish than the previous week with a testing of some support levels more likely. The following week (Apr 12-16) looks mixed to positive as the Sun enters Aries midweek. This may create more problems although perhaps not immediately. The Sun stays in Aries for a whole month, so this influence should be considered as a background bearish influence. After that, a significant weakening of the market is possible as Saturn moves closer to its aspect with Uranus and the Sun creates an alignment with them both on Monday, the 19th. The last week of April and first week of May look the most bearish here so it is possible we could actually see the largest percentage down moves occur then. May generally looks mixed to bullish so some kind of rebound rally is likely. With the approach of the Jupiter-Uranus conjunction in early June, the market will likely bounce of any lows made in early May. How high it goes is very hard to say, but I would not rule out 5300 again or perhaps even higher. If the correction on the Saturn-Uranus is deep and takes the Nifty below 4700, then the market will be very hard pressed to make 5300 again. The rally may run into trouble in June after Jupiter has passed Uranus and Mars aspects both Neptune and Jupiter. Gains will be increasing hard to come by in July and August so a larger downturn seems likely then.

5-day outlook — bearish-neutral NIFTY 5150-5300

30-day outlook — bearish NIFTY 4800-5000

90-day outlook — bearish-neutral 4800-5200

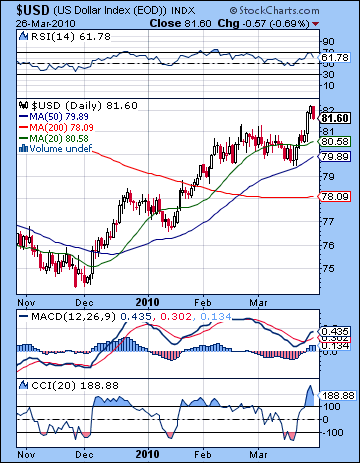

The Dollar got some of its mojo back last week as worries over the Portuguese downgrade and European sovereign debt made the US look more attractive. After closing above 82 Thursday, it ended the week at its resistance level of 81.60. This bullish outcome was very much in keeping with expectations although the big gain for the week came a little later than anticipated, on Wednesday, rather than Monday and the Sun-Saturn aspect. Transiting Jupiter moves more slowly, however, so this was certainly within range of its favorable aspects to the ascendant in the USDX chart. As predicted, we also got a late week pullback as the Mercury was in aspect to the natal Mars on Thursday which manifested in Friday’s substantial profit taking. The Dollar crossed above 82 temporarily last week so this was a significant first test of a key resistance level. The fact that it corrected the next day reveals perhaps that it may take another run (or two) before it can break out higher. The next resistance level is around 83.5 and 84 and is derived from the rising trend line of the recent rally. It seems likely that we will get there at some point in April. Daily MACD is once again in a bullish cross over and CCI (189) is also looking very bullish. RSI (61) is more ambiguous since it has come off a recent high near 70. Given that it is close to a common reversal level, this indicator is less bullish than the others. The weekly indicators are still looking much more positive, however, so that augurs well for continued strength going forward. Support is around 80 now, which corresponds to both the bottom of the current rising price channel and the 50 DMA. Any breaks below that level would likely signal a larger sell-off.

The Dollar got some of its mojo back last week as worries over the Portuguese downgrade and European sovereign debt made the US look more attractive. After closing above 82 Thursday, it ended the week at its resistance level of 81.60. This bullish outcome was very much in keeping with expectations although the big gain for the week came a little later than anticipated, on Wednesday, rather than Monday and the Sun-Saturn aspect. Transiting Jupiter moves more slowly, however, so this was certainly within range of its favorable aspects to the ascendant in the USDX chart. As predicted, we also got a late week pullback as the Mercury was in aspect to the natal Mars on Thursday which manifested in Friday’s substantial profit taking. The Dollar crossed above 82 temporarily last week so this was a significant first test of a key resistance level. The fact that it corrected the next day reveals perhaps that it may take another run (or two) before it can break out higher. The next resistance level is around 83.5 and 84 and is derived from the rising trend line of the recent rally. It seems likely that we will get there at some point in April. Daily MACD is once again in a bullish cross over and CCI (189) is also looking very bullish. RSI (61) is more ambiguous since it has come off a recent high near 70. Given that it is close to a common reversal level, this indicator is less bullish than the others. The weekly indicators are still looking much more positive, however, so that augurs well for continued strength going forward. Support is around 80 now, which corresponds to both the bottom of the current rising price channel and the 50 DMA. Any breaks below that level would likely signal a larger sell-off.

This week also leans towards the positive for the Dollar. Monday may be lower on the Venus-Uranus-Neptune pattern but Tuesday is likely to get most of that back and maybe more. Wednesday is difficult to call with possible aspects on both sides, although caution should be advised given the strength of Mercury. Thursday is perhaps a better looking day. There is the potential for another big move like we saw last Wednesday, so even if there are a couple of down days, the up day may be able to take the Dollar higher overall. Next week may begin positively on the Sun aspect to the natal ascendant but there may be some kind of pullback late in the week as Venus conjoins the natal Rahu. As we move into the middle of April we may expect more consolidation — presumably at higher levels — followed by another move higher in late April and early May. It is unclear how long this rally can continue without a significant pullback. Transiting Saturn will form a stressful aspect to the natal Sun in May but there is a real chance that much of its negative effects will be offset by favourable aspects from Neptune and Uranus. So I would not rule out an extension of the Dollar rally into May and June but it seems less obvious than the run-up we’ve seen in the past three months.

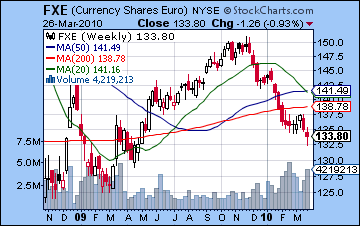

The Euro bounced back at the end last week on news that a bailout of Greece had been formulated between the EU and its new best friend, the IMF. Nonetheless, this was very much a down week as the Portugal downgrade reminded investors of the long term structural problems of the Euro. Many investors now think it may well dissolve completely. I tend to support that view, although it may take a while with 2015-2016 looking like the most difficult years. We correctly identified the Sun-Saturn opposition across the Euro’s ascendant as causing some problems, although they did not show up until Wednesday. As predicted, the Euro hit 1.33 and made new lows for the year as it broke through support levels. We also forecast the late week rebound which coincided with the Venus-Rahu aspect in the natal chart. The Euro seems primed for more downside here, even if contrarians like Jim Rogers have taken long positions on it. Resistance is likely near the falling trend line around 1.37 with support now closer to 1.30. If that doesn’t hold, we can expect a test of its 2009 lows of 1.25 fairly soon thereafter. The volume still supports the bearish view of the Euro since volume tends to be higher on down weeks. This week looks negative as Venus and then Mercury will set up in aspect with the Saturn and once again activate the ascendant. Monday will be interesting given that the Moon and Saturn will conjoin right atop the ascendant. Normally this could be negative, but it seems likely to flip the other way given the Venus alignment with Uranus and Neptune. Either way, it could well be a sizable percentage move. Tuesday and Thursday may be more likely to produce declines. The Rupee gained more ground last week closing at 45.16. A correction is more likely this week back to recent levels around 45.5.

The Euro bounced back at the end last week on news that a bailout of Greece had been formulated between the EU and its new best friend, the IMF. Nonetheless, this was very much a down week as the Portugal downgrade reminded investors of the long term structural problems of the Euro. Many investors now think it may well dissolve completely. I tend to support that view, although it may take a while with 2015-2016 looking like the most difficult years. We correctly identified the Sun-Saturn opposition across the Euro’s ascendant as causing some problems, although they did not show up until Wednesday. As predicted, the Euro hit 1.33 and made new lows for the year as it broke through support levels. We also forecast the late week rebound which coincided with the Venus-Rahu aspect in the natal chart. The Euro seems primed for more downside here, even if contrarians like Jim Rogers have taken long positions on it. Resistance is likely near the falling trend line around 1.37 with support now closer to 1.30. If that doesn’t hold, we can expect a test of its 2009 lows of 1.25 fairly soon thereafter. The volume still supports the bearish view of the Euro since volume tends to be higher on down weeks. This week looks negative as Venus and then Mercury will set up in aspect with the Saturn and once again activate the ascendant. Monday will be interesting given that the Moon and Saturn will conjoin right atop the ascendant. Normally this could be negative, but it seems likely to flip the other way given the Venus alignment with Uranus and Neptune. Either way, it could well be a sizable percentage move. Tuesday and Thursday may be more likely to produce declines. The Rupee gained more ground last week closing at 45.16. A correction is more likely this week back to recent levels around 45.5.

Dollar

5-day outlook — bullish

30-day outlook — bullish

90-day outlook — bullish

As the Dollar rose, crude slipped back last week closing near $80. The decline was fairly modest but was largely in keeping with last week’s forecast. However, the early week Sun-Saturn aspect did not produce immediate results as crude actually gained on Monday and Tuesday. The selling only arrived on Wednesday as the rest of the week was mostly bearish. This was at odds with expectations as I thought we might see more upward movement on the strong Venus placement in the natal chart. Overall, the failure to match or break above the previous high of $84 was sobering to commodity bulls. With the Dollar still very much on the rise, it will difficult for crude to make further headway here. Daily MACD is now is negative crossover and we can see evidence a bearish divergence with respect to the previous peak. CCI (-65) is weak and looking more and more like it is about to move lower towards the -100 line. A bearish divergence is also evident in the RSI chart where recent highs are at lower levels than those seen in January. At 49 the RSI has now moved into bearish territory so that may add to the general picture of technical weakness here. The weekly technicals are more equivocal perhaps with MACD flat and seeking a direction. Resistance is still the previous high of $84 with the outside possibility of a run towards $90 and the upper channel trend line. Support is probably around the 50 DMA which currently stands around $78. This is only an interim support level and would deflect only minor corrections. As a result of recent gains, the 200 DMA has now moved to $74 so this could be a source of stronger resistance, although I think recent lows around $70 are more definitive. I expect these lower levels to be tested through April.

As the Dollar rose, crude slipped back last week closing near $80. The decline was fairly modest but was largely in keeping with last week’s forecast. However, the early week Sun-Saturn aspect did not produce immediate results as crude actually gained on Monday and Tuesday. The selling only arrived on Wednesday as the rest of the week was mostly bearish. This was at odds with expectations as I thought we might see more upward movement on the strong Venus placement in the natal chart. Overall, the failure to match or break above the previous high of $84 was sobering to commodity bulls. With the Dollar still very much on the rise, it will difficult for crude to make further headway here. Daily MACD is now is negative crossover and we can see evidence a bearish divergence with respect to the previous peak. CCI (-65) is weak and looking more and more like it is about to move lower towards the -100 line. A bearish divergence is also evident in the RSI chart where recent highs are at lower levels than those seen in January. At 49 the RSI has now moved into bearish territory so that may add to the general picture of technical weakness here. The weekly technicals are more equivocal perhaps with MACD flat and seeking a direction. Resistance is still the previous high of $84 with the outside possibility of a run towards $90 and the upper channel trend line. Support is probably around the 50 DMA which currently stands around $78. This is only an interim support level and would deflect only minor corrections. As a result of recent gains, the 200 DMA has now moved to $74 so this could be a source of stronger resistance, although I think recent lows around $70 are more definitive. I expect these lower levels to be tested through April.

This week will likely see the pullback continue although some up days are still very possible. Monday’s Venus aspect may well take prices higher but Tuesday Mercury will conjoin the natal Mars in the Futures chart so this could spark more selling. Wednesday’s Full Moon offers a chance for gains on the Sun’s aspect to natal Jupiter. Thursday seems more negative again as transiting Mars (8 Cancer) will square the natal Moon-Saturn conjunction (9 Libra). This is not quite exact but given the slow speed of Mars, we cannot rule out a significant decline here. Transiting Venus (7 Aries) will moving into opposition to the Moon-Saturn, so that is an additional factor to consider. If the markets had been open on Friday, they would most likely fall further since these aspects tighten at that time. Look for bearish sentiment to continue through the holiday weekend. Next week will probably start off with more selling but that should reverse by the end of the week. We could see choppy trading in the middle of April with another round of declines slated for the last week of April and perhaps into the first week of May.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish-neutral

After what was looking like another down week, the tension over the sinking of a South Korean navy ship gave gold a boost on Friday. It finished the week unchanged at $1107. This outcome was in keeping with expectations as prices drifted lower early in the week on the Sun-Saturn aspect. We didn’t see a huge decline here perhaps because the aspect was past exact. But Friday’s gain was largely in keeping with the forecast since I had noted the possibility of such a move in last week’s newsletter on the Venus aspect to the 4th house cusp. The midweek retreat to $1085 wasn’t overly dramatic and did not properly test support at $1070. Gold appears to be in a pennant pattern here with a narrowing of highs and lows over the past weeks after the December high of $1220. Prices appear to drawn to the 20 and 50 DMA averages which have converged in recent weeks. The pennant is neither bullish or bearish since it relies on a breakout to determine market direction. However, the series of lower highs is not encouraging to gold bulls so one should expect a break out down as the most likely outcome here. Daily MACD is slipping and is in a bearish crossover. CCI (-75) is fairly bearish also and RSI (49) shows a series of falling peaks. In the event of another rally, we could see resistance near the previous high of $1130. Support is still around $1070, with another level of support around the 200 DMA at $1040. A firmer support level is likely right around the $1000 level which not only represents an important psychological marker but coincides with significant resistance from last year.

After what was looking like another down week, the tension over the sinking of a South Korean navy ship gave gold a boost on Friday. It finished the week unchanged at $1107. This outcome was in keeping with expectations as prices drifted lower early in the week on the Sun-Saturn aspect. We didn’t see a huge decline here perhaps because the aspect was past exact. But Friday’s gain was largely in keeping with the forecast since I had noted the possibility of such a move in last week’s newsletter on the Venus aspect to the 4th house cusp. The midweek retreat to $1085 wasn’t overly dramatic and did not properly test support at $1070. Gold appears to be in a pennant pattern here with a narrowing of highs and lows over the past weeks after the December high of $1220. Prices appear to drawn to the 20 and 50 DMA averages which have converged in recent weeks. The pennant is neither bullish or bearish since it relies on a breakout to determine market direction. However, the series of lower highs is not encouraging to gold bulls so one should expect a break out down as the most likely outcome here. Daily MACD is slipping and is in a bearish crossover. CCI (-75) is fairly bearish also and RSI (49) shows a series of falling peaks. In the event of another rally, we could see resistance near the previous high of $1130. Support is still around $1070, with another level of support around the 200 DMA at $1040. A firmer support level is likely right around the $1000 level which not only represents an important psychological marker but coincides with significant resistance from last year.

This week still looks difficult for gold. Monday could see a gain as gold’s secondary significator Venus is in good aspect with Uranus and Neptune. And I also would not rule out a gain for Tuesday since Venus will aspect the ascendant in the ETF chart. But at the same time, both Venus and Mercury will fall under the aspect of natal Saturn so that should act as a drag on any upward momentum. Worse still, transiting Mars will aspect natal Ketu which will increase the likelihood for sudden moves, most likely down. Wednesday is difficult to call, although the t-square involving Mars, Moon and Venus does not offer much encouragement for bulls. Thursday brings transiting Venus to natal Rahu which may bring gains. Overall, the trend seems lower until early next week, with a possible reversal higher on Wednesday. A short up trend is possible until April 12th or so, but the Mars-to-Mars square is a harsh aspect and may manifest on the previous Friday, the 9th. The rest of April seems choppy at best with a bearish bias. Declines are more likely in the last week of April and the first week of May. The next big move down in gold will take place in the last week of May. The Venus-Ketu conjunction on the 30th could be key in this regard.

5-day outlook — bearish

30-day outlook — bearish

90-day outlook — bearish