- Possible early week gain in stocks followed by declines; Fall correction still in the offing

- Dollar weakness early but recovery possible later; next phase of Dollar rally imminent

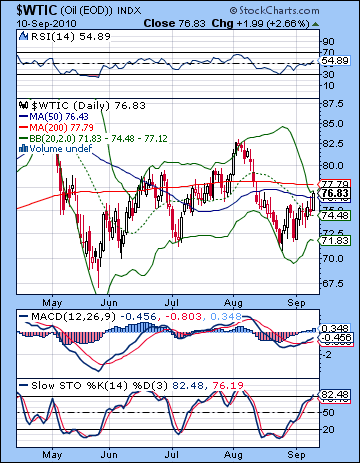

- Crude oil mixed with gains more likely early; larger decline set for October

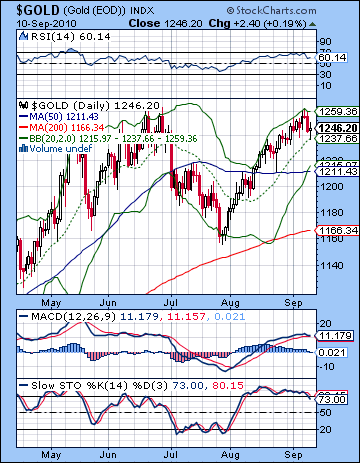

- Gold may retest highs Monday but then prone to profit taking; larger correction likely after Sun enters Virgo on Friday

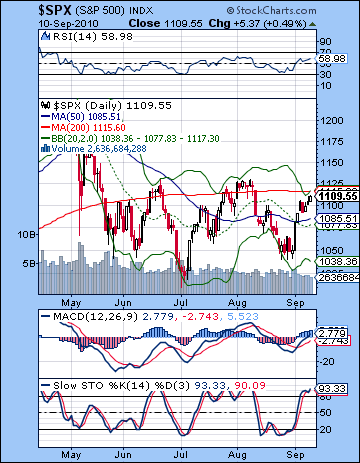

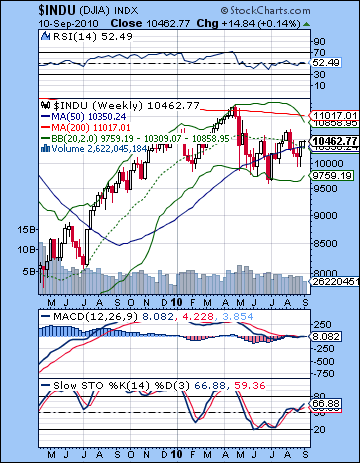

In a low-volume, holiday-shortened week, stocks edged slightly higher on diminishing worries over European sovereign debt . Prices bumped up repeatedly against some tough resistance as the Dow closed up 0.2% at 10,462 while the S&P500 finished at 1109. While Tuesday’s red candle was a little surprising, the overall weekly outcome was largely in keeping with expectations as sentiment did not change appreciably and the bulls retained control. I could see that the between the Venus-Jupiter aspect and the Jupiter-Uranus conjunction, there would likely be sufficient optimism to prevent much selling as well as the possibility of higher prices. This came to pass, although I had expected more early week upside. Tuesday’s down day may have been a hangover from Monday’s entry of Mars into Libra, although that is by no means clear. More puzzling was the absence of any kind of weakness later in the week, especially on Friday. I had expected the approaching Mercury-Saturn aspect to have put a more negative spin on the market that day. As it happened, prices rallied into the close and we ended near important resistance levels of 1110-1115 and the 200 DMA. It might make sense to once again explain away the gains at the feet of the Jupiter-Uranus conjunction, although since it is such a slow moving pairing, this is very much an unsatisfactory solution. The bottom line, however, is we’re still stuck in the upper end of a trading range between 1040 and 1130 and we may not yet be done with it until Jupiter is edged out of the picture by Saturn later in September. Retrograde Jupiter (5 Pisces) is fast approaching its conjunction with Uranus (4 Pisces) due to be exact on September 18. This is a bullish planetary pairing to usually increases risk appetite and can lead to flights of optimism, even in an uncertain context. The ability of the bulls to keep prices towards the top of the trading range is largely attributable to this Jupiter-Uranus combination. That we may not have broken above 1110 or even 1130 may be due to the bearish influence from the Mercury retrograde cycle (Aug 20-Sep 12) and the ongoing conjunction with Venus and Mars. With Mercury’s cycle ending this week, we should again reconsider the balance of cosmic forces. Normally, the end of a retrograde Mercury cycle should be an additional bullish influence. While this may be theoretically true, Mercury’s change in direction this week nonetheless could impact sentiment by "reversing" the prevailing direction of the market. Since the market has been rising of late, this reversal in Mercury may actually reverse the markets lower. More important, however, is that we can see the relative influence of Jupiter and Saturn changing places in the days ahead. Jupiter and Saturn are the planetary embodiment of bullish and bearish sentiment and prices will usually follow whichever planet is stronger. Jupiter has been very much in the spotlight of late through its Uranus contact, but this may well be coming to an end. Meanwhile, bearish Saturn will get a boost this week as Mercury and then Venus are in aspect to it. Admittedly, these are aspects involving only weaker, fast moving planets but we should see some fallout nonetheless. Later in the month, Saturn will form a tense square aspect with the Moon’s Nodes, better known as Rahu and Ketu. This aspect is exact on September 27 and may well begin to be felt well ahead of this date as the aspect approaches exactitude. So the handing off of the planetary baton could well be close at hand.

In a low-volume, holiday-shortened week, stocks edged slightly higher on diminishing worries over European sovereign debt . Prices bumped up repeatedly against some tough resistance as the Dow closed up 0.2% at 10,462 while the S&P500 finished at 1109. While Tuesday’s red candle was a little surprising, the overall weekly outcome was largely in keeping with expectations as sentiment did not change appreciably and the bulls retained control. I could see that the between the Venus-Jupiter aspect and the Jupiter-Uranus conjunction, there would likely be sufficient optimism to prevent much selling as well as the possibility of higher prices. This came to pass, although I had expected more early week upside. Tuesday’s down day may have been a hangover from Monday’s entry of Mars into Libra, although that is by no means clear. More puzzling was the absence of any kind of weakness later in the week, especially on Friday. I had expected the approaching Mercury-Saturn aspect to have put a more negative spin on the market that day. As it happened, prices rallied into the close and we ended near important resistance levels of 1110-1115 and the 200 DMA. It might make sense to once again explain away the gains at the feet of the Jupiter-Uranus conjunction, although since it is such a slow moving pairing, this is very much an unsatisfactory solution. The bottom line, however, is we’re still stuck in the upper end of a trading range between 1040 and 1130 and we may not yet be done with it until Jupiter is edged out of the picture by Saturn later in September. Retrograde Jupiter (5 Pisces) is fast approaching its conjunction with Uranus (4 Pisces) due to be exact on September 18. This is a bullish planetary pairing to usually increases risk appetite and can lead to flights of optimism, even in an uncertain context. The ability of the bulls to keep prices towards the top of the trading range is largely attributable to this Jupiter-Uranus combination. That we may not have broken above 1110 or even 1130 may be due to the bearish influence from the Mercury retrograde cycle (Aug 20-Sep 12) and the ongoing conjunction with Venus and Mars. With Mercury’s cycle ending this week, we should again reconsider the balance of cosmic forces. Normally, the end of a retrograde Mercury cycle should be an additional bullish influence. While this may be theoretically true, Mercury’s change in direction this week nonetheless could impact sentiment by "reversing" the prevailing direction of the market. Since the market has been rising of late, this reversal in Mercury may actually reverse the markets lower. More important, however, is that we can see the relative influence of Jupiter and Saturn changing places in the days ahead. Jupiter and Saturn are the planetary embodiment of bullish and bearish sentiment and prices will usually follow whichever planet is stronger. Jupiter has been very much in the spotlight of late through its Uranus contact, but this may well be coming to an end. Meanwhile, bearish Saturn will get a boost this week as Mercury and then Venus are in aspect to it. Admittedly, these are aspects involving only weaker, fast moving planets but we should see some fallout nonetheless. Later in the month, Saturn will form a tense square aspect with the Moon’s Nodes, better known as Rahu and Ketu. This aspect is exact on September 27 and may well begin to be felt well ahead of this date as the aspect approaches exactitude. So the handing off of the planetary baton could well be close at hand.

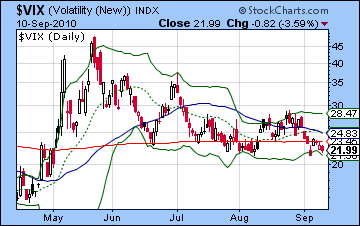

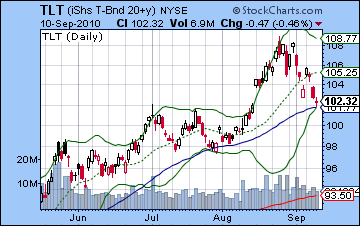

The technical picture stayed in the bulls favor, despite the marginal gains coming on low volume. The 200 DMA at 1115 remained intact as resistance and was not directly challenged at any point last week. In that sense, the bears can still claim that the rally is very much on a short leash here. However, the falling trendline on the S&P was slightly violated on the upside with Friday’s positive outcome. This is one piece of evidence that might suggest a push to the previous high of 1130 is in the offing. At the same time, it’s worth noting that the falling trendline has not yet been broken on either the DJIA or the small cap Russell 2000. So advantage bulls, although perhaps not substantially. It remains a battle of contradictory patterns as we can see a smaller head and shoulders pattern forming on several charts around the early August top while at the same time there is a bullish inverse head and shoulders around the July bottom. Prices are still at the top Bollinger band suggesting that some kind of pullback may be forthcoming, at least back to the 20 DMA at 1077. Interestingly, a more thoroughgoing correction would test support at the bottom band at 1038 — very close to the line in the sand at 1040. Technical indicators are telling much the same story as last week as they are looking bullish. Stochastics (93) are still overbought while RSI and MACD are on the rise. The next resistance level is likely 1115 but I doubt that will exercise much influence on prices and 1130 may prove to be a more important level. In terms of support, 1070-1080 may bring in new buyers so any pullback to that level may bounce quickly. The weekly Dow chart shows prices still in the neighborhood of the 20 WMA, although they have now risen slightly above it. MACD is near flat here and RSI (52) is leaning only slightly towards the bulls. Perhaps the most bullish indication here is the Stochastics (66) which has a little ways to go yet before reaching the overbought area. This is not to say that it must reach 80 before reversing, but it nonetheless adds more credibility to the bullish case for more upside. A push to 10,700 on the Dow (1130 on the SPX) may well push Stochastics to the 80 level. The $VIX tread water last week and still sits near some crucial support around 22. As long as it stays close to its 200 DMA at 24, it can pop back up and thus coincide with an equities selloff. Meanwhile the intermarket dynamics continue to suggest a reversal lower is at hand. Bonds fell back to their trendline support last week and this may well foretell another upward move. An important gap was filled on the TLT ETF that may be the necessary precursor to such a move higher. It is much the same story in the EUR/USD which appeared to back test a broken trend line last week but has since been falling once again. As long as bonds and the Euro trade within those parameters, the current rally in stocks is unlikely to go much further. If TLT falls below 101, however, then that scenario would be called into question.

The technical picture stayed in the bulls favor, despite the marginal gains coming on low volume. The 200 DMA at 1115 remained intact as resistance and was not directly challenged at any point last week. In that sense, the bears can still claim that the rally is very much on a short leash here. However, the falling trendline on the S&P was slightly violated on the upside with Friday’s positive outcome. This is one piece of evidence that might suggest a push to the previous high of 1130 is in the offing. At the same time, it’s worth noting that the falling trendline has not yet been broken on either the DJIA or the small cap Russell 2000. So advantage bulls, although perhaps not substantially. It remains a battle of contradictory patterns as we can see a smaller head and shoulders pattern forming on several charts around the early August top while at the same time there is a bullish inverse head and shoulders around the July bottom. Prices are still at the top Bollinger band suggesting that some kind of pullback may be forthcoming, at least back to the 20 DMA at 1077. Interestingly, a more thoroughgoing correction would test support at the bottom band at 1038 — very close to the line in the sand at 1040. Technical indicators are telling much the same story as last week as they are looking bullish. Stochastics (93) are still overbought while RSI and MACD are on the rise. The next resistance level is likely 1115 but I doubt that will exercise much influence on prices and 1130 may prove to be a more important level. In terms of support, 1070-1080 may bring in new buyers so any pullback to that level may bounce quickly. The weekly Dow chart shows prices still in the neighborhood of the 20 WMA, although they have now risen slightly above it. MACD is near flat here and RSI (52) is leaning only slightly towards the bulls. Perhaps the most bullish indication here is the Stochastics (66) which has a little ways to go yet before reaching the overbought area. This is not to say that it must reach 80 before reversing, but it nonetheless adds more credibility to the bullish case for more upside. A push to 10,700 on the Dow (1130 on the SPX) may well push Stochastics to the 80 level. The $VIX tread water last week and still sits near some crucial support around 22. As long as it stays close to its 200 DMA at 24, it can pop back up and thus coincide with an equities selloff. Meanwhile the intermarket dynamics continue to suggest a reversal lower is at hand. Bonds fell back to their trendline support last week and this may well foretell another upward move. An important gap was filled on the TLT ETF that may be the necessary precursor to such a move higher. It is much the same story in the EUR/USD which appeared to back test a broken trend line last week but has since been falling once again. As long as bonds and the Euro trade within those parameters, the current rally in stocks is unlikely to go much further. If TLT falls below 101, however, then that scenario would be called into question.

This week appears to give the nod to the bears as Saturn is involved with more aspect activity, especially towards the end of the week. After Mercury (11 Leo) turns direct on Sunday, it will be very close to a minor aspect with Saturn (11 Virgo). This is not at all a positive pairing and it is conceivable we could see a down day Monday. At the same time, there is a more bullish pattern involving the Moon and Mars with Jupiter through much of the trading day that makes me think that we could rise on Monday. Since the Moon-Jupiter aspect is closer in the morning, it is possible we could go higher early and then weaken somewhat by the close. Pluto will reverse its direction on Tuesday so this may be an important marker in sentiment this week. If we are higher on Monday, then Tuesday is a good candidate for seeing a reversal lower. On Wednesday, Mercury will be in exact aspect with Saturn so that is more likely to depress the mood. Mercury is moving very slowly here, so some of its effects may linger into the later part of the week. In addition, Venus will form a similar minor aspect with Saturn on Thursday and into Friday. Thursday’s open might be particularly volatile as the Moon conjoins Rahu. Friday has the added burden of being the first day of the Sun’s entry into the sign of Virgo. This is likely to a slightly bearish influence over the next month or so since Saturn also currently resides in Virgo. This Sun-Saturn pairing may weaken investor confidence and raise levels of caution. So a more bullish scenario would be a gain Monday — perhaps towards 1120-1130 — with a reversal intraday Tuesday and then generally lower into Friday with a close at or below current levels, say around 1090-1110. A more bearish scenario would be a rise Monday that mostly reverses midday and then weakness building into Friday with a close between 1070-1090. I would lean towards the bearish outcome here, although to be on the safe side, we should allow the possibility of early week gains.

This week appears to give the nod to the bears as Saturn is involved with more aspect activity, especially towards the end of the week. After Mercury (11 Leo) turns direct on Sunday, it will be very close to a minor aspect with Saturn (11 Virgo). This is not at all a positive pairing and it is conceivable we could see a down day Monday. At the same time, there is a more bullish pattern involving the Moon and Mars with Jupiter through much of the trading day that makes me think that we could rise on Monday. Since the Moon-Jupiter aspect is closer in the morning, it is possible we could go higher early and then weaken somewhat by the close. Pluto will reverse its direction on Tuesday so this may be an important marker in sentiment this week. If we are higher on Monday, then Tuesday is a good candidate for seeing a reversal lower. On Wednesday, Mercury will be in exact aspect with Saturn so that is more likely to depress the mood. Mercury is moving very slowly here, so some of its effects may linger into the later part of the week. In addition, Venus will form a similar minor aspect with Saturn on Thursday and into Friday. Thursday’s open might be particularly volatile as the Moon conjoins Rahu. Friday has the added burden of being the first day of the Sun’s entry into the sign of Virgo. This is likely to a slightly bearish influence over the next month or so since Saturn also currently resides in Virgo. This Sun-Saturn pairing may weaken investor confidence and raise levels of caution. So a more bullish scenario would be a gain Monday — perhaps towards 1120-1130 — with a reversal intraday Tuesday and then generally lower into Friday with a close at or below current levels, say around 1090-1110. A more bearish scenario would be a rise Monday that mostly reverses midday and then weakness building into Friday with a close between 1070-1090. I would lean towards the bearish outcome here, although to be on the safe side, we should allow the possibility of early week gains.

Next week (Sep 20-24) we enter the start of the post-Jupiter phase as its bullish influence should gradually ease while Saturn’s grows stronger. This does not mean the markets will go straight down but it means that red days should begin to outnumber green days. The early week period tilts bearish as Venus is aspected by Ketu while the Sun approaches its conjunction with Saturn. A rebound up day is possible on Tuesday and the Sun’s aspect with Jupiter. Friday also looks negative as Mars approaches its minor aspect with Saturn. Overall, this looks like a down week, although perhaps not hugely so. There is a good chance that we will still be in the trading range between 1040 and 1130. The following week (Sep 27-Oct 1) appears to favor the bears also as the Sun conjoins Saturn in the afternoon on Thursday, Sep 30. Here is where we may have the first legitimate opportunity to break below 1040. I would not quite say it’s likely, but its more possible. After that, the planets in early October continue to look bearish as Mercury conjoins Saturn while happy Venus turns retrograde while in conjunction with nasty Mars. This is perhaps a better, safer bet for a break below 1040 (Dow 9950). As I have mentioned previously, we could see an interim bottom formed around this time. If that comes to pass, then the bottom may be a somewhat underwhelming 975 on the S&P500. I think there’s still a decent chance we go lower than that, either because the decline is short but steep or it actually drags on into mid-October. This later scenario is quite possible to my mind because the planets don’t look that great. While there are no big bad aspects involving Saturn in October, there do seem to be a fair number of bad ones involving faster planets like Mars and Mercury. If a decline lasted until mid to late October, then that of course would increase the chances of seeing a lower low, like 920 or even lower. Some significant rally is likely at the end of October and into early November that could be more than 10% above the low. Mid-November looks bearish from here, with some kind of low around Nov 18. We should have a more positive bias going into December. Late December may begin another major move lower as the planets around the Saturn retrograde station in January 2011 look very bearish. This should be at least another 10% move to the downside. The big question is whether it will take out any lower we make in October or November. I will have to revisit this question in future newsletters.

Next week (Sep 20-24) we enter the start of the post-Jupiter phase as its bullish influence should gradually ease while Saturn’s grows stronger. This does not mean the markets will go straight down but it means that red days should begin to outnumber green days. The early week period tilts bearish as Venus is aspected by Ketu while the Sun approaches its conjunction with Saturn. A rebound up day is possible on Tuesday and the Sun’s aspect with Jupiter. Friday also looks negative as Mars approaches its minor aspect with Saturn. Overall, this looks like a down week, although perhaps not hugely so. There is a good chance that we will still be in the trading range between 1040 and 1130. The following week (Sep 27-Oct 1) appears to favor the bears also as the Sun conjoins Saturn in the afternoon on Thursday, Sep 30. Here is where we may have the first legitimate opportunity to break below 1040. I would not quite say it’s likely, but its more possible. After that, the planets in early October continue to look bearish as Mercury conjoins Saturn while happy Venus turns retrograde while in conjunction with nasty Mars. This is perhaps a better, safer bet for a break below 1040 (Dow 9950). As I have mentioned previously, we could see an interim bottom formed around this time. If that comes to pass, then the bottom may be a somewhat underwhelming 975 on the S&P500. I think there’s still a decent chance we go lower than that, either because the decline is short but steep or it actually drags on into mid-October. This later scenario is quite possible to my mind because the planets don’t look that great. While there are no big bad aspects involving Saturn in October, there do seem to be a fair number of bad ones involving faster planets like Mars and Mercury. If a decline lasted until mid to late October, then that of course would increase the chances of seeing a lower low, like 920 or even lower. Some significant rally is likely at the end of October and into early November that could be more than 10% above the low. Mid-November looks bearish from here, with some kind of low around Nov 18. We should have a more positive bias going into December. Late December may begin another major move lower as the planets around the Saturn retrograde station in January 2011 look very bearish. This should be at least another 10% move to the downside. The big question is whether it will take out any lower we make in October or November. I will have to revisit this question in future newsletters.

5-day outlook — bearish SPX 1080-1110

30-day outlook — bearish SPX 980-1040

90-day outlook — bearish SPX 1000-1050

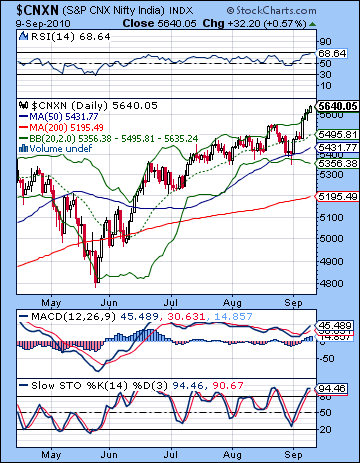

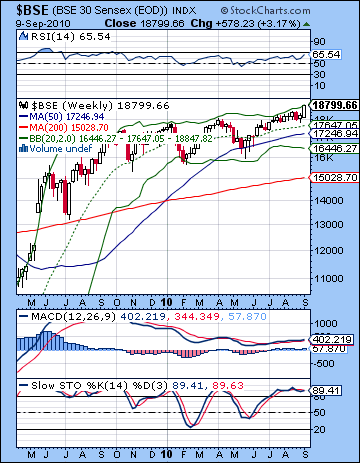

Stocks in Mumbai made new highs for the year as optimism for domestic growth prospects increased in interest among local investors and FII alike. The Sensex rose on all four trading days in the holiday-shortened week closing more than 3% higher at 18,799 while the Nifty finished at 5640. While I had expected some upside here going into midweek, the extent of the gains was surprising. I thought there was a reasonable chance the Nifty could climb to 5550 on the Venus-Jupiter aspect but I never fully considered the possibility of reaching all the way to 5650. Monday proved to be the biggest gain of the week and this was only one day before the closest Venus aspect to Uranus and Jupiter. That said, I thought we might see enthusiasm dampened somewhat from the entry of Mars into Libra for Monday’s session. As has been the case recently, bullish patterns have generally played out in spades while apparently bearish influences have been either muted or overwhelmed entirely. Another source of error was the late week action. I expected more downside to accompany the approach of the Mercury-Saturn aspect but Thursday actually saw a decent gain. Given the abnormally slow speed of Mercury around its direct station, this aspect is going to last well into this coming week so that bearishness may be postponed to some extent. Nonetheless, it was an impressive show by the bulls to take the market substantially higher. More observers are now openly talking about when an all-time high can reached as the Nifty seems intent on breaching the 6000 level once again. I don’t think new highs are likely anytime soon although clearly the Indian markets are in far better shape than most bourses around the world. We’ve seen some very impressive Jupiter energy here over the past week or two as Jupiter prepares to conjoin the planet Uranus on 18 September. I have previously noted how this pairing is reliably bullish and had the potential to take prices higher or prevent any significant down draft. While I have underestimated the strength of this Jupiter influence in the Indian markets, I am not overly surprised that the bulls still have control over Dalal Street. True, the bearish effects of the Mercury retrograde cycle (Aug 20-Sep12) have dissolved in the face of this onslaught of Jupiterian bullishness. But Jupiter cannot continue to strengthen indefinitely. After its conjunction with Uranus, it will become weaker as time goes on. So that is one important reason why this rally will cool. Moreover, the other side of the equation is that Saturn appears to be getting stronger. Since Saturn is the planet of pessimism, a prominent and active Saturn will tend to take prices lower. Through its various aspects with Uranus, Jupiter and Pluto, Saturn was prominent through most of August and we saw how most world markets suffered a correction. That fate was avoided by the Indian market because of the resilient natal horoscope of the NSE. Saturn will again become more powerful through several aspects with other planets starting this week and extending into October. For this reason, I still expect the downside to outweigh the upside for the next several weeks. The key aspect in this respect is the Saturn-Ketu square aspect on 27 September. The exact timing of its bearish effects is difficult and yet as a rule of thumb, we should allow for some negativity to manifest at least a week before it reaches its exactitude. At the same time, we have seen how some aspects appear to work only after their exact conjunction, as if they usher in a new investment climate in the wake of their celestial encounter. In this case, I think the negativity will likely manifest mostly after the aspect becomes exact (27 Sept), mostly due to the fact that Jupiter will still be fairly strong in the leading in period, and also because there are other difficult aspects that will follow after this aspect is exact.

Stocks in Mumbai made new highs for the year as optimism for domestic growth prospects increased in interest among local investors and FII alike. The Sensex rose on all four trading days in the holiday-shortened week closing more than 3% higher at 18,799 while the Nifty finished at 5640. While I had expected some upside here going into midweek, the extent of the gains was surprising. I thought there was a reasonable chance the Nifty could climb to 5550 on the Venus-Jupiter aspect but I never fully considered the possibility of reaching all the way to 5650. Monday proved to be the biggest gain of the week and this was only one day before the closest Venus aspect to Uranus and Jupiter. That said, I thought we might see enthusiasm dampened somewhat from the entry of Mars into Libra for Monday’s session. As has been the case recently, bullish patterns have generally played out in spades while apparently bearish influences have been either muted or overwhelmed entirely. Another source of error was the late week action. I expected more downside to accompany the approach of the Mercury-Saturn aspect but Thursday actually saw a decent gain. Given the abnormally slow speed of Mercury around its direct station, this aspect is going to last well into this coming week so that bearishness may be postponed to some extent. Nonetheless, it was an impressive show by the bulls to take the market substantially higher. More observers are now openly talking about when an all-time high can reached as the Nifty seems intent on breaching the 6000 level once again. I don’t think new highs are likely anytime soon although clearly the Indian markets are in far better shape than most bourses around the world. We’ve seen some very impressive Jupiter energy here over the past week or two as Jupiter prepares to conjoin the planet Uranus on 18 September. I have previously noted how this pairing is reliably bullish and had the potential to take prices higher or prevent any significant down draft. While I have underestimated the strength of this Jupiter influence in the Indian markets, I am not overly surprised that the bulls still have control over Dalal Street. True, the bearish effects of the Mercury retrograde cycle (Aug 20-Sep12) have dissolved in the face of this onslaught of Jupiterian bullishness. But Jupiter cannot continue to strengthen indefinitely. After its conjunction with Uranus, it will become weaker as time goes on. So that is one important reason why this rally will cool. Moreover, the other side of the equation is that Saturn appears to be getting stronger. Since Saturn is the planet of pessimism, a prominent and active Saturn will tend to take prices lower. Through its various aspects with Uranus, Jupiter and Pluto, Saturn was prominent through most of August and we saw how most world markets suffered a correction. That fate was avoided by the Indian market because of the resilient natal horoscope of the NSE. Saturn will again become more powerful through several aspects with other planets starting this week and extending into October. For this reason, I still expect the downside to outweigh the upside for the next several weeks. The key aspect in this respect is the Saturn-Ketu square aspect on 27 September. The exact timing of its bearish effects is difficult and yet as a rule of thumb, we should allow for some negativity to manifest at least a week before it reaches its exactitude. At the same time, we have seen how some aspects appear to work only after their exact conjunction, as if they usher in a new investment climate in the wake of their celestial encounter. In this case, I think the negativity will likely manifest mostly after the aspect becomes exact (27 Sept), mostly due to the fact that Jupiter will still be fairly strong in the leading in period, and also because there are other difficult aspects that will follow after this aspect is exact.

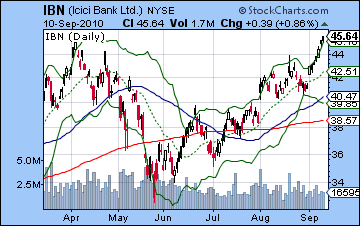

The technical picture is largely unchanged, but that still means the bulls are firmly in control. As has been the case over the course of this three month rally, prices again pushed to the top Bollinger band. In strongly trending markets, the upper Bollinger band may not act as resistance but merely as a guide to take prices ever higher. In this case, however, we can see that the market is quite overbought. Stochastics (94) are in the overbought area although they do not show any significant divergence with previous levels. Daily MACD is again rising and has now eliminated the previous divergence with respect to the previous high. This is generally a bullish indication and suggests that the market may have further to rise. However, the RSI (68) is getting very close to the 70 line where more investors would be tempted to take profits at any opportunity. It is the close proximity to this 70 line that should give bulls some pause about expecting significantly higher prices in the near term. Profit taking would appear to be the most sensible strategy here and that alone may become a self-fulfilling prophecy. Friday’s high coincides with a rising trendline from the tops formed in June and July, so that is another technical reason for a pullback in the near term. The moving averages are all rising and support would initially come from the 20 DMA at 5500 and after that, the 50 DMA at 5431. Either of these lines are likely to act as real support in the event of the first pullback. Once the correction gets going, the 200 DMA at 5200 would likely entice more buyers to come in and support prices, although as we have seen in the previous correction, prices will tend to overshoot this level on the downside. In terms of resistance, prices are currently at the top of a trendline so we would have to go all the way back to 2008 top at 6000 for the next meaningful level of technical resistance. The weekly chart of the BSE also shows prices bumping up against the top Bollinger band (18,847). With the exception of the May 2009 breakout, the upper weekly Bollinger band has been a reliable resistance line. Since the bands have narrowed, pullbacks are usually to the bottom band, now around 16,400. This equates to about 4930 on the Nifty and this should be seen as a very plausible downside target during the next correction. Stochastics (85) are still overbought here and increase the likelihood of a pullback in the near future. MACD and RSI are still gently rising, although both remain in a negative divergence with respect to previous price highs. The daily chart of ICICI Bank (IBN) shows the strength of the bulls here. While I had been skeptical about its prospects for beating the April high, it succeeded in doing just that as Friday’s gain sent it over the top by almost 1%. It is still significantly lower than its 2008 peak, however, so we can’t read too much into this yearly high. We may also note that volume for this high was substantially lower than the previous April high, thus suggesting that these levels are not sustainable in the long run. So while the overall technical picture favours the bulls in the medium term, the short term indications do suggest a pullback may not be far away.

The technical picture is largely unchanged, but that still means the bulls are firmly in control. As has been the case over the course of this three month rally, prices again pushed to the top Bollinger band. In strongly trending markets, the upper Bollinger band may not act as resistance but merely as a guide to take prices ever higher. In this case, however, we can see that the market is quite overbought. Stochastics (94) are in the overbought area although they do not show any significant divergence with previous levels. Daily MACD is again rising and has now eliminated the previous divergence with respect to the previous high. This is generally a bullish indication and suggests that the market may have further to rise. However, the RSI (68) is getting very close to the 70 line where more investors would be tempted to take profits at any opportunity. It is the close proximity to this 70 line that should give bulls some pause about expecting significantly higher prices in the near term. Profit taking would appear to be the most sensible strategy here and that alone may become a self-fulfilling prophecy. Friday’s high coincides with a rising trendline from the tops formed in June and July, so that is another technical reason for a pullback in the near term. The moving averages are all rising and support would initially come from the 20 DMA at 5500 and after that, the 50 DMA at 5431. Either of these lines are likely to act as real support in the event of the first pullback. Once the correction gets going, the 200 DMA at 5200 would likely entice more buyers to come in and support prices, although as we have seen in the previous correction, prices will tend to overshoot this level on the downside. In terms of resistance, prices are currently at the top of a trendline so we would have to go all the way back to 2008 top at 6000 for the next meaningful level of technical resistance. The weekly chart of the BSE also shows prices bumping up against the top Bollinger band (18,847). With the exception of the May 2009 breakout, the upper weekly Bollinger band has been a reliable resistance line. Since the bands have narrowed, pullbacks are usually to the bottom band, now around 16,400. This equates to about 4930 on the Nifty and this should be seen as a very plausible downside target during the next correction. Stochastics (85) are still overbought here and increase the likelihood of a pullback in the near future. MACD and RSI are still gently rising, although both remain in a negative divergence with respect to previous price highs. The daily chart of ICICI Bank (IBN) shows the strength of the bulls here. While I had been skeptical about its prospects for beating the April high, it succeeded in doing just that as Friday’s gain sent it over the top by almost 1%. It is still significantly lower than its 2008 peak, however, so we can’t read too much into this yearly high. We may also note that volume for this high was substantially lower than the previous April high, thus suggesting that these levels are not sustainable in the long run. So while the overall technical picture favours the bulls in the medium term, the short term indications do suggest a pullback may not be far away.

This week would be appear to confirm the short term bearish technical assessment as Saturn appears to set to assume a greater role. Monday begins on the heels of Mercury’s reversal of direction as it now moves forward. Reversals in Mercury’s direction often mirror reversals in the market’s direction. So if the market has been rising, then perhaps this is a clue that it will begin falling within a few days of the reversal. While I would not be surprised to see prices begin to fall Monday, I think there could be at least one more bullish day as there is a Moon-Mars-Jupiter aspect on Monday that could well take prices higher. On Tuesday, Pluto follows Mercury’s lead and also changes its direction and begins forward motion. This is another possible correspondence with significant reversals in market direction this week. As noted above, Saturn plays a greater role in this week’s activity through its aspects with Mercury and Venus. Due to Mercury’s unusually slow velocity this week, it is within range of Saturn for an extended period and this may have a very depressing effect. The exact aspect is on Wednesday. Venus then forms an aspect with Saturn on Thursday and Friday, with Friday being the closest aspect. Thursday has the added feature of the Moon in conjunction with Rahu so that is likely going to destabilize sentiment somewhat. Even if we get an up day Monday, it seems likely that the prices should end up lower by Friday. In a bullish scenario, Monday’s rise would add another 50-100 points to the Nifty with a possible midday high and reversal on Tuesday. We could then see negativity prevail that erases any previous gains and take the indices lower for the week, perhaps to 5500-5600 near the middle Bollinger band. A more bearish scenario would see a more muted rise (or fall) Monday with steeper losses for the rest of the week. 5400-5500 might be the downside target if this more bearish scenario were to unfold. I would lean towards the bullish scenario out of deference to the background influence of the ongoing Jupiter-Uranus conjunction but if Monday and Tuesday do not show much upside, then the bearish scenario is a more likely outcome.

This week would be appear to confirm the short term bearish technical assessment as Saturn appears to set to assume a greater role. Monday begins on the heels of Mercury’s reversal of direction as it now moves forward. Reversals in Mercury’s direction often mirror reversals in the market’s direction. So if the market has been rising, then perhaps this is a clue that it will begin falling within a few days of the reversal. While I would not be surprised to see prices begin to fall Monday, I think there could be at least one more bullish day as there is a Moon-Mars-Jupiter aspect on Monday that could well take prices higher. On Tuesday, Pluto follows Mercury’s lead and also changes its direction and begins forward motion. This is another possible correspondence with significant reversals in market direction this week. As noted above, Saturn plays a greater role in this week’s activity through its aspects with Mercury and Venus. Due to Mercury’s unusually slow velocity this week, it is within range of Saturn for an extended period and this may have a very depressing effect. The exact aspect is on Wednesday. Venus then forms an aspect with Saturn on Thursday and Friday, with Friday being the closest aspect. Thursday has the added feature of the Moon in conjunction with Rahu so that is likely going to destabilize sentiment somewhat. Even if we get an up day Monday, it seems likely that the prices should end up lower by Friday. In a bullish scenario, Monday’s rise would add another 50-100 points to the Nifty with a possible midday high and reversal on Tuesday. We could then see negativity prevail that erases any previous gains and take the indices lower for the week, perhaps to 5500-5600 near the middle Bollinger band. A more bearish scenario would see a more muted rise (or fall) Monday with steeper losses for the rest of the week. 5400-5500 might be the downside target if this more bearish scenario were to unfold. I would lean towards the bullish scenario out of deference to the background influence of the ongoing Jupiter-Uranus conjunction but if Monday and Tuesday do not show much upside, then the bearish scenario is a more likely outcome.

Next week (Sep 20-24) looks more mixed with the early week looking somewhat bearish on the Venus-Ketu aspect. Some rebound is likely by Tuesday and perhaps Wednesday on the Sun-Jupiter aspect but the late week period again inclines towards bearishness. I would not be surprised to see a down week here, although that is uncertain. The following week (Sep 27-Oct 1) seems more negative as the Sun conjoins Saturn while Saturn squares Ketu. The exact conjunction occurs on Friday, October 1 and coincides with a Moon-Ketu aspect so that day may be particularly bearish. The early part of this week may be mixed, but the end of the week could see a significant decline. After that, we will see Venus turn retrograde on 7 October just as Mercury conjoins Saturn. Both are bearish influences so the decline should continue well into October. We could see a possible bottom in the third week of October as transiting Ketu will aspect the natal Moon in the NSE chart. Around that time, Jupiter will aspect the ascendant in the NSE chart so prices should begin to lift in the end of October and into the beginning of November. We should expect a significant decline in the middle of November around the Mercury-Mars conjunction and then prices will rally once again into December. It is unlikely that any highs formed in November or December will be higher than the September high. December’s high will likely be higher than November’s high. Late December and January look more negative, however, so the September highs may stand for some time to come.

5-day outlook — bearish NIFTY 5500-5600

30-day outlook — bearish NIFTY 4900-5200

90-day outlook — bearish NIFTY 5000-5500

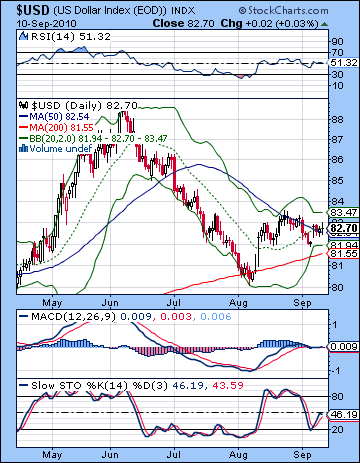

The Dollar got back on track last week as the USDX climbed to 82.7 while the EUR/USD fell to 1.271. This was a welcome result as I had been expecting a return to a bullishness for the greenback. We saw the bulk of the gains come on Tuesday, however, very near the Venus-Jupiter aspect that was supposed to boost risk appetite. I had originally thought this pattern would boost the Euro and while the Euro recovered somewhat on Wednesday, Tuesday’s gain came a little out of left field. The explanation lies in USDX natal chart, where the transiting Venus created a minor aspect with the Sun and thereby pulled in some of that energy from Jupiter also. In any event, the technical situation is still quite vulnerable at this point. After its initial breakout in August, the Dollar has been going mostly sideways. In fact, we can spot a small head and shoulders pattern around the Aug 24 high so that may some bulls second thoughts about adding any more positions. Current prices sit on the 20 DMA so there is a possibility for a quick run to the top Bollinger band at 83.47. Current levels also sit close to the 50 DMA at 82.5. This has been a resistance level for the past month so any significant rally will have to break above this line. Friday’s close was slightly above, but not by much. A close above 83 might be enough to convincingly begin a new move higher. Indicators are still quite listless, however, as MACD is flat and sitting on the zero line, as if to underscore the current tentative situation. RSI (52) is also fairly indecisive at this stage. Stochastics (46) offer more substantial hope to the bulls since it still has a ways to run before it gets overbought. In the event of a retracement, 82 would likely act as good support while resistance is likely found at the previous high around 83.5. A break above this level would like allow the Dollar to rise significantly higher.

The Dollar got back on track last week as the USDX climbed to 82.7 while the EUR/USD fell to 1.271. This was a welcome result as I had been expecting a return to a bullishness for the greenback. We saw the bulk of the gains come on Tuesday, however, very near the Venus-Jupiter aspect that was supposed to boost risk appetite. I had originally thought this pattern would boost the Euro and while the Euro recovered somewhat on Wednesday, Tuesday’s gain came a little out of left field. The explanation lies in USDX natal chart, where the transiting Venus created a minor aspect with the Sun and thereby pulled in some of that energy from Jupiter also. In any event, the technical situation is still quite vulnerable at this point. After its initial breakout in August, the Dollar has been going mostly sideways. In fact, we can spot a small head and shoulders pattern around the Aug 24 high so that may some bulls second thoughts about adding any more positions. Current prices sit on the 20 DMA so there is a possibility for a quick run to the top Bollinger band at 83.47. Current levels also sit close to the 50 DMA at 82.5. This has been a resistance level for the past month so any significant rally will have to break above this line. Friday’s close was slightly above, but not by much. A close above 83 might be enough to convincingly begin a new move higher. Indicators are still quite listless, however, as MACD is flat and sitting on the zero line, as if to underscore the current tentative situation. RSI (52) is also fairly indecisive at this stage. Stochastics (46) offer more substantial hope to the bulls since it still has a ways to run before it gets overbought. In the event of a retracement, 82 would likely act as good support while resistance is likely found at the previous high around 83.5. A break above this level would like allow the Dollar to rise significantly higher.

This week seems fairly mixed as the early week Mars-Jupiter aspect may not be as kind to the Dollar as last week’s Venus-Jupiter was. There is also some evidence to expect early week strength in the Euro chart, especially on or near Tuesday, so a short term pullback may be the most likely outcome. The latter part of the week may be somewhat better although the astro evidence for this view is not as strong as I would like it. So far, the Jupiter-Uranus conjunction at 4 Pisces has not really delivered the boost to the natal Sun (4 Scorpio) that I thought it would. One possible explanation is that transiting Ketu (15 Gemini) has been afflicting the natal Ketu (15 Libra) for roughly the same duration. This Ketu affliction appears to be moving off now, so the gains may come somewhat more easily. This week still doesn’t look as good as next week, however. There is a very bold alignment of planets near September 21 that ought to boost the Dollar significantly and may be the critical moment when the next stage of the Dollar rally gets going. The up trend will likely stay in place into October although gains may be more modest then. I expect a more significant reversal in late October and November as Mars enters Scorpio and thereby afflicts the first house of the Dollar horoscope.

Dollar

5-day outlook — neutral-bullish

30-day outlook — bullish

90-day outlook — bullish

As economic sentiment improved last week, so did the price of crude climbing over $76 on the continuous contact. I had been fairly bullish in my forecast last week so this was in line with expectations although the gains did not come exactly when I thought they would. Tuesday’s loss was somewhat unnerving coming as it did on front end of the Venus-Jupiter aspect, although prices rebounded strongly on Wednesday at the back end. More puzzling was Friday’s powerful rise which came without any obvious planetary correlation. Overall, however, crude is only a little higher than expected as the Jupiter-Uranus conjunction has buoyed sentiment around the economy while the Saturn-Ketu aspect has yet to have any significant bearish impact. The technical picture is mixed here, as prices have rallied back to top Bollinger band and closed above the the 50 DMA. They remain a little below the 200 DMA, however, and this is another reason why crude is vulnerable to greater pullbacks. In addition, we can see a bearish head and shoulders pattern developing with the early August high as the head. To complete this pattern, prices would probably have to rise a little further to match the June highs around $79, although head and shoulders patterns do not have to be perfectly symmetrical. I would therefore expect a lot of resistance around the $78-79 level. Support is likely found at the bottom Bollinger band near $72 and below that $68. The recent rise has pushed the MACD into a bullish crossover although it has yet to move across the zero line. It’s worth noting that even if it does complete the head and shoulders pattern and gets back to $79, the right shoulder will likely display a negative divergence with respect to the left shoulder. Stochastics (82) are now in the overbought area and this may induce more profit taking at the earliest opportunity in the event of a pullback.

As economic sentiment improved last week, so did the price of crude climbing over $76 on the continuous contact. I had been fairly bullish in my forecast last week so this was in line with expectations although the gains did not come exactly when I thought they would. Tuesday’s loss was somewhat unnerving coming as it did on front end of the Venus-Jupiter aspect, although prices rebounded strongly on Wednesday at the back end. More puzzling was Friday’s powerful rise which came without any obvious planetary correlation. Overall, however, crude is only a little higher than expected as the Jupiter-Uranus conjunction has buoyed sentiment around the economy while the Saturn-Ketu aspect has yet to have any significant bearish impact. The technical picture is mixed here, as prices have rallied back to top Bollinger band and closed above the the 50 DMA. They remain a little below the 200 DMA, however, and this is another reason why crude is vulnerable to greater pullbacks. In addition, we can see a bearish head and shoulders pattern developing with the early August high as the head. To complete this pattern, prices would probably have to rise a little further to match the June highs around $79, although head and shoulders patterns do not have to be perfectly symmetrical. I would therefore expect a lot of resistance around the $78-79 level. Support is likely found at the bottom Bollinger band near $72 and below that $68. The recent rise has pushed the MACD into a bullish crossover although it has yet to move across the zero line. It’s worth noting that even if it does complete the head and shoulders pattern and gets back to $79, the right shoulder will likely display a negative divergence with respect to the left shoulder. Stochastics (82) are now in the overbought area and this may induce more profit taking at the earliest opportunity in the event of a pullback.

This week looks mixed as the early week leans towards the bulls with the late week looking less promising. On the bullish side, the Moon is in Scorpio on Monday and Tuesday and therefore will come under the helpful influence of Jupiter. This is often a positive influence on crude, and all the more so here because of the Mars-Jupiter aspect. In terms of the natal chart, Venus will set up on the Moon-Saturn conjunction so that is another fairly positive influence. So there is a reasonable likelihood for gains on Monday and perhaps into Tuesday also. There are fewer clear influences later in the week and given the enhanced role of Saturn at that time, we should allow for a more bearish tone to settle over the market. Thursday may stand out in this respect as the Moon conjoins Rahu. Next week looks more negative and that is when we may see a sharper break with recent trading patterns. The Saturn-Ketu aspect is due on September 27 and this is likely to correspond with a significant decline. I expect the bulk of the decline to occur after this aspect, mostly because Saturn will be forming a negative aspect in the natal chart in October. The set up of Saturn against the natal Sun is very bearish and should take prices down more than 10%. We could see an important low formed near Monday, October 18.

5-day outlook — neutral

30-day outlook — bearish

90-day outlook — bearish

Gold had an exciting week as it briefly traded at new highs early in the week although it pulled back below $1250 by Friday’s close and was largely unchanged on the week. This neutral result was in line with expectations as I thought we would see early strength on the Venus-Jupiter aspect followed some weakness later in the week. For all the hype surrounding this week’s new high, it will be more important to see what the follow up will be. The new high was not confirmed on the continuous futures chart and therefore should be regarded with some skepticism. At the moment, gold may only be in the midst of a double top formation. For this reason, the next move is crucial: will investors take profits or push prices higher? The technical situation would suggest some profit taking in the near future as MACD is now falling and on the verge rolling over into a bearish crossover. RSI (60) is falling and worse still is coming off several touches of the 70 line which marks an overbought situation. This may convince some investors that gold’s best days are behind it. Stochastics (73) have been slipping here and creating a negative divergence and now may be heading for a larger retracement down to the 20 line. Friday’s intraday low touched the middle Bollinger band (20 DMA) so that may have offered some support in the short term. But these indicators would suggest a deeper correction is at hand, at least down to the bottom band and the 50 DMA around $1215.

Gold had an exciting week as it briefly traded at new highs early in the week although it pulled back below $1250 by Friday’s close and was largely unchanged on the week. This neutral result was in line with expectations as I thought we would see early strength on the Venus-Jupiter aspect followed some weakness later in the week. For all the hype surrounding this week’s new high, it will be more important to see what the follow up will be. The new high was not confirmed on the continuous futures chart and therefore should be regarded with some skepticism. At the moment, gold may only be in the midst of a double top formation. For this reason, the next move is crucial: will investors take profits or push prices higher? The technical situation would suggest some profit taking in the near future as MACD is now falling and on the verge rolling over into a bearish crossover. RSI (60) is falling and worse still is coming off several touches of the 70 line which marks an overbought situation. This may convince some investors that gold’s best days are behind it. Stochastics (73) have been slipping here and creating a negative divergence and now may be heading for a larger retracement down to the 20 line. Friday’s intraday low touched the middle Bollinger band (20 DMA) so that may have offered some support in the short term. But these indicators would suggest a deeper correction is at hand, at least down to the bottom band and the 50 DMA around $1215.

This week looks like a mixed bag for gold. Monday’s Mars-Jupiter-Uranus aspect could well be a replay of last week’s Venus aspect that correlated with a rise. Mars isn’t as benefic as Venus, so that is one reason why the net result may not be quite as positive. Plus Saturn’s growing influence here may erode some confidence in speculative ventures of all kinds. Nonetheless, some early week strength is a more likely scenario followed by weakness later in the week. Thursday and Friday are important in this respect as the Moon will conjoin Rahu on Thursday while the Sun enters Virgo on Friday. As we know, the Sun is closely associated with gold and its astrological condition can reveal important clues about the price of gold. The Sun’s transit of Leo has been good to gold, but now that the Sun enters Virgo, it will find it a tougher go. Saturn is placed squared in the middle of sidereal Virgo here, so the Sun’s entry in this sign will tend to depress sentiment in gold. The Sun will transit Virgo until October 17 so that may be another factor that will tend to depress prices in the medium term. I would therefore expect the bearish mood around gold to last from next week into mid to late October. At a minimum, we should expect a retracement down to the 200 DMA at the $1160 level but there is definitely an opportunity for lower prices than that.

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — bearish