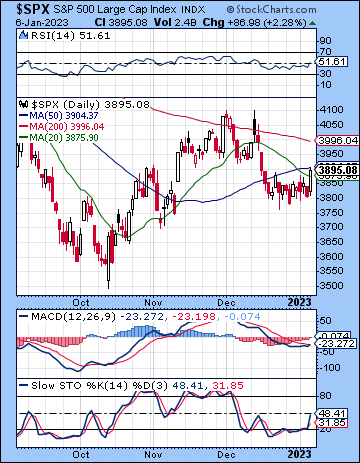

(7 January 2023) Stocks rebounded last week as relatively modest wage growth in Friday’s jobs report reduced the probability of additional rate hikes from the Fed. The S&P 500 gained more than 1% on the week to 3895 while the Nasdaq-100 finished the week at 11,040. This bullish outcome was not unexpected as I thought the midweek Venus-Jupiter alignment and the four-planet Sun-Mercury and Mercury-Venus alignments would likely coincide with some upside. Tuesday’s decline to start off the New Year was also reflective of the bearish Mercury-Saturn-Neptune alignment, although I did not anticipate the extent of Friday’s gain given the uncertainty of the Full Moon.

(7 January 2023) Stocks rebounded last week as relatively modest wage growth in Friday’s jobs report reduced the probability of additional rate hikes from the Fed. The S&P 500 gained more than 1% on the week to 3895 while the Nasdaq-100 finished the week at 11,040. This bullish outcome was not unexpected as I thought the midweek Venus-Jupiter alignment and the four-planet Sun-Mercury and Mercury-Venus alignments would likely coincide with some upside. Tuesday’s decline to start off the New Year was also reflective of the bearish Mercury-Saturn-Neptune alignment, although I did not anticipate the extent of Friday’s gain given the uncertainty of the Full Moon.

The moderating wage increases were music to bulls’ ears as they effectively negated a 1970s-style inflationary spiral scenario. With diminished inflation expectations, the dollar and bond yields fell sharply as more money flowed into stocks in search of better returns. Bulls may now be entertaining the possibility of a soft landing where the Fed’s higher rates successfully bring inflation under control while not tipping the economy into recession. If the inflation threat has largely been neutralized, the recession threat is likely the bears’ best hope now as Friday’s ISM manufacturing data came in below 50 and was the lowest print since 2020. If data continues to weaken, bond yields will continue to fall, although investors will have to monitor that grey area where lower yields stop being bullish because of falling inflation and instead become bearish as growth disappears. One possible signpost in that regard could be a move below the December low of 3.4%. The 2/10y yield curve (-0.69%) fell again last week and remained below the key technical level of -0.50%. Thus, the inversion is still in force and suggests that recession risks are minimal for now. When the yield curve begins to return to normal, there will be likely be a decline in the 2-year yield which will reflect slowing economic activity and falling corporate earnings. This will usher in a more recessionary period which will be bearish for stocks.

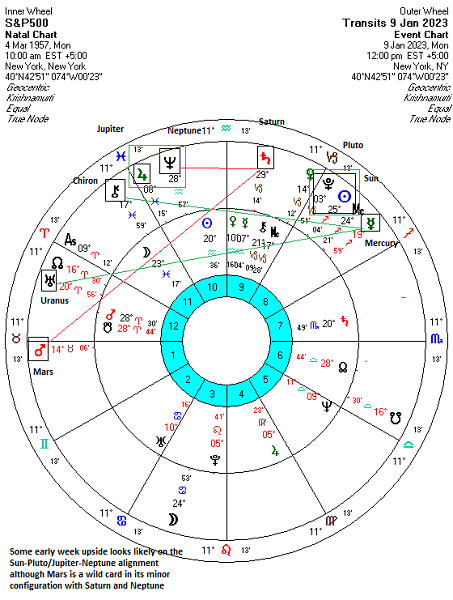

The planetary outlook suggests continued downside risk for the month of January. That said, the bearish effect of the Saturn-Neptune alignment is now mostly behind us as bears could not crack support at 3800. Some upside is possible this week as Jupiter transits over the midpoint of Neptune and Chiron which could also resonate with some faster moving transits of Mercury and the Sun. However, the mid-January period of Jan 12 -20 still looks more vulnerable to declines as Mars stations direct on the 12th while Mercury stations direct on the 18th…

Click here to subscribe and read of the rest of this week’s MVA Investor newsletter.