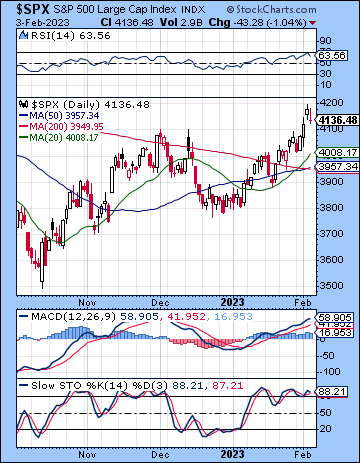

(5 February 2023) Stocks extended their rebound last week on hopes that falling inflation and a slowing economy will force the Fed to cut rates before the end of the year. The S&P 500 gained 1.6% on the week to 4136 while the Nasdaq-100 finished at 12,573. This bullish outcome was somewhat unexpected as the late week Saturn-Neptune-Pluto alignment coincided with just one down day on Friday which did not offset the preceding gains from the FOMC meeting.

(5 February 2023) Stocks extended their rebound last week on hopes that falling inflation and a slowing economy will force the Fed to cut rates before the end of the year. The S&P 500 gained 1.6% on the week to 4136 while the Nasdaq-100 finished at 12,573. This bullish outcome was somewhat unexpected as the late week Saturn-Neptune-Pluto alignment coincided with just one down day on Friday which did not offset the preceding gains from the FOMC meeting.

Suddenly, markets are awash in a sea of optimism after a non-committal Fed statement gave bullish investors new hope for a soft landing. Ironically, Friday’s strong jobs report has silenced any talk of an imminent recession, even if investors decided to hit the sell button in the face of rising bond yields and a higher dollar. On the basis of the robust jobs report, the bond market now expects the Fed to hike 25 basis points at its next two meetings with a pivot now slated for Q4. While the soft landing scenario appears dominant now, another dose of inflationary data could upset expectations. The dollar is already signaling a possible reversal here as currency traders may be factoring in further hikes after another wave of inflation. With the labor market still showing no sign of cooling, there is a real chance that inflation could remain stubbornly high for some time to come. Thus, the emergence of a 1970s-style wage-driven inflationary spiral could prevent the Fed from cutting rates until 2024. Of course, higher interest rates are generally bad news for stocks as the reduction in lending puts a damper on consumer spending and corporate earnings.

The planetary outlook leans bearish for the month of February. Despite last week’s unexpected gain, there is still good reason to be skeptical about stocks. Saturn and Mars are more prominent in the coming days as both malefics will form larger alignments which may outweigh any potentially offsetting Jupiter alignments. Friday’s Saturn-Neptune-Pluto alignment was the first such pattern, although the damage it inflicted was relatively minor…

Click here to subscribe and read the rest of the newsletter

Photo Credit: Scott Beale