(5 March 2023) Stocks broke their losing streak last week as yields reversed off their highs on hopes of a possible pause in rate hikes. The S&P 500 gained 2% on the week to 4045 while the Nasdaq-100 bounced off lower lows to finish at 12,290. While I was uncertain about the weekly outcome, this decisive bullish result was somewhat unexpected as I did not foresee the strength of the late week rally amid the wide range of planetary influences. However, Thursday morning’s lows did closely correspond with the exact Mercury-Saturn conjunction before buyers moved in once again.

(5 March 2023) Stocks broke their losing streak last week as yields reversed off their highs on hopes of a possible pause in rate hikes. The S&P 500 gained 2% on the week to 4045 while the Nasdaq-100 bounced off lower lows to finish at 12,290. While I was uncertain about the weekly outcome, this decisive bullish result was somewhat unexpected as I did not foresee the strength of the late week rally amid the wide range of planetary influences. However, Thursday morning’s lows did closely correspond with the exact Mercury-Saturn conjunction before buyers moved in once again.

As usual, the stock market has been more selective about which information it chooses to find pertinent. Despite the surge of bond yields to new 10-year highs, stocks shrugged off the implications of this tightened liquidity regime as investors assumed that earnings could somehow keep pace with even higher terminal interest rates from the Fed. And yet even now, the 2-year yield at 4.86% is higher than the earnings yield of S&P 500 at 4.73%. This is no longer just a case of the Fed being ‘behind the curve’ (i.e. the Fed funds rate of 4.63% is less than the market’s 2-year yield of 4.86%), but stocks as an asset class is fast becoming less competitive with bonds from a yield perspective. Corporate earnings will have to rise through the year just to keep pace with bond yields if stocks hope to stay competitive as an investment destination. The problem is that with inflation still elevated, earnings are likely to come under more pressure later in the year as consumers may be forced to further adjust spending habits if wages continue to fall further behind prices. While these trends may not spell immediate trouble for equities, they nonetheless represent a medium term headwind.

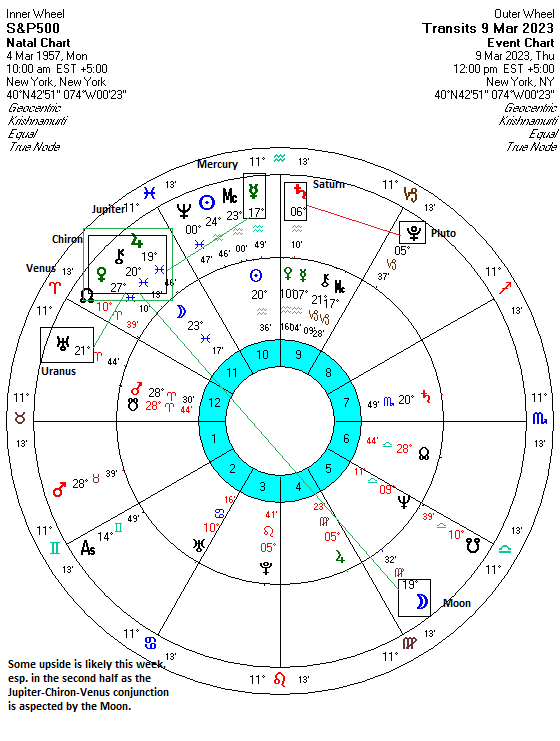

The planetary outlook remains mixed. The transit outlook is somewhat bullish in the near term as Jupiter aligns with Chiron (March 12) and Uranus (March 19). While the bearish Saturn-Pluto alignment is still within effective range, its impact could well be offset by the strengthening of the Jupiter-based alignment. The ongoing Jupiter influence here therefore reduces the prospects of a significant decline occurring in the next two weeks…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: aa440