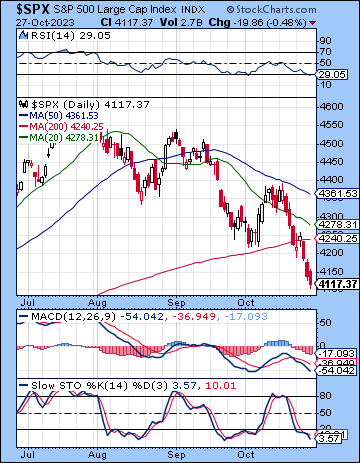

(29 October 2023) Stocks slumped again last week on growing concerns of a possible escalation of the Israel-Hamas war against a backdrop of more robust economic data. The S&P 500 fell 2.5% to 4117 while the Nasdaq-100 finished at 14,180. While I had noted increasing downside risk with the approaching the Saturn direct station in early November, this bearish outcome was unexpected as I thought we might have seen more intraweek upside from the Jupiter alignment with Venus and Mercury.

(29 October 2023) Stocks slumped again last week on growing concerns of a possible escalation of the Israel-Hamas war against a backdrop of more robust economic data. The S&P 500 fell 2.5% to 4117 while the Nasdaq-100 finished at 14,180. While I had noted increasing downside risk with the approaching the Saturn direct station in early November, this bearish outcome was unexpected as I thought we might have seen more intraweek upside from the Jupiter alignment with Venus and Mercury.

Many investors moved to the sidelines last week on news that an invasion of Gaza is now underway. Even if the outcome of this war is unpredictable, the escalation of hostilities coupled with the movement of more US forces into the region were good enough reasons to reduce risk exposure until the smoke clears. While the history of previous Middle East military engagements would support the logic of ‘buying the invasion’ as the point of maximum volatility, the risk of a wider regional conflict this time around makes that logic somewhat less compelling. In addition, rising bond yields remain a major concern as last week’s strong GDP and PCE data suggested that the Fed would not be cutting rates anytime soon. While the 10-year yield actually fell last week, a significant reversal has yet to take place. Yields may have to fall below 4.25% before the ‘all-clear’ can be sounded. This week’s FOMC meeting will shed some light on the trajectory of yields, even if the Fed is widely expected to stand pat on rates. For now, the market is not pricing in another hike, especially given the current geopolitical uncertainty. If Powell delivers a sufficiently dovish forward guidance, it could give stocks reason to rally. A more steadfast commitment to reach the Fed’s 2% inflation target would be less warmly received, however.

[…]

This week (Oct 30-Nov 3) looks mixed with moves in both directions. The early week has some downside risk as Monday’s Moon-Saturn square could be bearish. This is exact near noon on Monday and increases the odds of a gap down to start the week. Once the Moon starts to separate by midday, sentiment could improve by the close. Tuesday morning’s Moon-Mars aspect suggests a weak opening once again, although the Venus-Uranus alignment leans a bit bullish and hints at some strength, perhaps later in the afternoon. We could see some upside on Wednesday and the FOMC given the Sun-Jupiter alignment although this does not look very strong. Both the close on Wednesday and the open on Thursday have some downside risk. Thursday and Friday look somewhat more bullish, however, as Jupiter aligns with the Moon on Thursday afternoon and Venus aligns with Rahu and Neptune on Friday. Given the mix of influences, we could see both lower lows to start the week and a sizable bounce, probably after the FOMC on Thursday and Friday. While I would maintain a default bearish bias here, I would not be surprised to see a positive weekly outcome. Of course, a lot will depend on the magnitude of any potential early week decline…

Subscribe to the MVA Investor Newsletter to read the rest

Photo Credit: The Times of Gaza