Continued from Part 1

(Synopsis: This analysis suggests the Venus retrograde station often signals a change in the prevailing stock market trend whereby prices reverse from negative to positive and to a lesser extent from positive to negative. Venus Rx station appears to have no effect if prices are not trending in any direction at the time of the station. This reversal phenomenon may be partially attributable to normal mean reversion, however.)

Part 2: Disaggregation by price trend

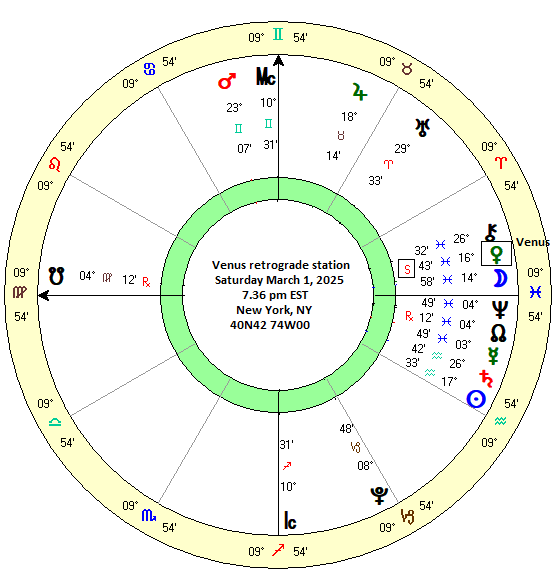

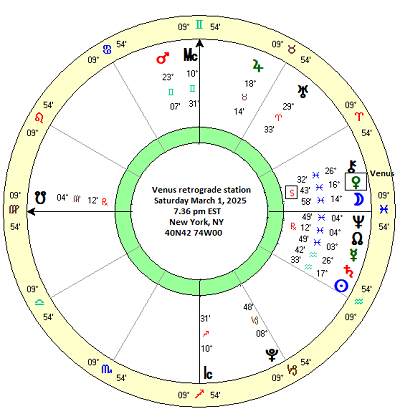

(19 February 2025) As we have seen, there is no obvious correlation with price when taking all 37 previous cases of the Venus retrograde cycle since 1965. However, if we disaggregate the data, a different picture emerges. The central feature of the famous March 2009 bear market low was not just that prices declined into the Venus retrograde station, but that they reversed higher thereafter. Therefore, we need to test the possibility that the Venus retrograde and direct stations may provide timing signals for changes in prevailing price trends.

(19 February 2025) As we have seen, there is no obvious correlation with price when taking all 37 previous cases of the Venus retrograde cycle since 1965. However, if we disaggregate the data, a different picture emerges. The central feature of the famous March 2009 bear market low was not just that prices declined into the Venus retrograde station, but that they reversed higher thereafter. Therefore, we need to test the possibility that the Venus retrograde and direct stations may provide timing signals for changes in prevailing price trends.

But how to measure these price trends? I decided to separate the pre-retrograde station negative price trends from the positive price trends. Further, I chose to sub-divide these negative and positive differences into two batches: the first contained cases of moderate price changes of more than 1% and and second contained cases of larger price trends of more than 2%. My assumption was that if a reversal was going to occur after the Rx station, it would more likely occur if the price change was relatively large. Of course, this could also be a normal reversion to the mean after a large move in the opposite direction. This is certainly possible, but I nonetheless tabulated the averages of these cases to see the size of the effect. I formed a separate group of cases where there was little change in prices before the Rx station, i.e. from >-1% to <1%.

1. Retrograde Station Bullish Reversals (down before the station, reverse higher after the station)

Looking first at the 10-day window (-5d to 5d) of declines greater than 1% into the retrograde station, we can see that there appears to be a consistent reversal effect. After an average decline of 2.36%, stocks reversed higher in 9 out of 12 cases for an average gain of 1.67% 5 days after the Rx station. While the size of the 2009 case (8.19%) somewhat skews this average across a small number of cases, there is nonetheless a fairly consistent effect.

Limiting the analysis to larger declines of 2% or more before the Rx station shows a similar effect as 5 out of 6 cases had positive reversals for an average gain of 2.67%. Again, this could just be the result of mean reversion and the distorting effect of the huge 2009 8.19% move. But it is still noteworthy given its consistency.

Similar outcomes can be seen in the 20-day window (-10d to 10d). For greater than a 1% decline into the Rx station, 11 of 14 cases had bullish reversals for an average gain of 2.39%. For declines of more than 2% heading into the Rx station, 8 of 12 cases showed bullish reversals for an average gain of 1.98%.

The consistency of the Rx station trend reversal weakened as the interval window lengthened to 30 days (-15d 15d). Here only 12 of 18 cases exhibited bullish reversals with an average gain of 2.36%. While this was a larger average gain than the 20-day window (-10d 10d), the huge size of the 2009 15-day rebound (17.34%) no doubt skews that number considerably.

Verdict: a strong effect

2. Retrograde Station Bearish Reversals (up before the station, reverse lower after the station)

Now what happens if stocks have been rising going into the Venus retrograde station? Are they more likely to reverse lower after the station? If prices have risen by more than 1% before the Venus Rx station, there was no evidence for a bearish reversal using our shortest 10-day window (-5d 5d). Only 3 out of 12 cases were negative and the average return was a negligible -0.12%. The results were equally unimpressive for 2% or more gains before the station. Only 3 out of 9 cases were negative for an average return of -0.39%.

Results became more compelling by lengthening the window to 20 days (-10d 10d). After a 2.99% average gain before the Venus Rx station, stocks reversed lower in 8 out of 13 cases for an average return of -0.82%. This still does not match the consistency or the size of the bullish reversals but it is noteworthy. And one might reasonably attribute it to simple mean reversion.

Restricting our analysis to rising trends of more than 2%, the effect looks a little weaker. Only 6 out of 11 cases show bearish reversals with an average decline of -0.58%. The 30-day window (-15d 15d) looked more mixed with only 7 of 16 cases having a bearish reversal, although the average decline was larger at -1.17%.

Verdict: a weak effect

3. Direct Station Bullish Reversals (down before the station, reverse higher after the station)

The retrograde cycle is defined by two dates: the date of the retrograde station and the date of the direct station about 40 days later. If the retrograde station appears to coincide with an increased likelihood of a change in trend, we can now consider the effect of the direct station. Here I lowered the threshold a little from 1% before the station to 0.75% in order to increase the number of cases in each category. One of the characteristics of the direct station (DS) is that the magnitude of the reversals is smaller than they are for the retrograde station.

For the cases with a greater than 0.75% decline into the direct station, bullish reversals occurred in 6 of 9 cases for an average gain of 1.14%. Taking cases with greater than a 2% decline into the DS, 4 of 4 cases had bullish reversals for an average gain of 2.28%. It is difficult to generalize based on only 4 cases, but that may be a significant reversal, even if it is partially mean reversion.

Expanding the window to 20 days (-10d 10d), the smaller -0.75% decline batch featured a bullish reversal in 12 of 16 cases with an average gain of 1.13%. Limiting our purview to larger preceding declines of more than 2% saw a weakening of bullish reversals to just 3 of 6 cases with an average gain of 0.67%. The lengthening of the time interval to 20 days generated less of an effect.

Paradoxically, a further expansion of the window to 30 days (-15d 15d) brought a mild strengthening of the reversal effect. 8 of 10 cases were bullish with an average gain of 1.20%. The instances with larger than 2% declines showed a bullish reversal in 3 of 5 cases for an average gain of 1.32%. Overall, the bullish reversal phenomenon after the direct station is much weaker than after the retrograde station.

Verdict: a moderate effect

4. Direct Station Bearish Reversals (up before the station, reverse lower after the station)

Using the same two price thresholds (0.75% and 2%), we can examine to what extent prices reverse lower after trending higher before the Venus direct station. This change in trend from rising prices to falling prices is known as a bearish reversal. The short 10-day window (-5d 5d) with the lowest 0.75% threshold showed only a modest reversal. While the average gain heading into the direct station was 1.95%, the average post-DS reversal was only -0.29%. Of the 13 total cases, 8 were negative. This is a fairly weak effect. Taking the stronger >2% rallies into the direct station, only 2 of the 6 cases experienced bearish reversals and the average post-DS change was actually positive at 0.83%. There is no bearish reversal there at all.

Taking the longer 20-day window (-10d 10d), there was also no evidence of any bearish reversal. Only 6 of 15 cases were negative and the average change after the direct station was 0.34%. It was a similar story with the larger 2% threshold as only 3 of 9 cases were negative with an average change of 0.66%.

The longer 30-day window ("-15d 15d") also showed no evidence of a bearish reversal using the lower 0.75% threshold. Only 7 of 17 cases were negative with an average change of 0.50%. The >2% threshold also didn't deliver evidence for a bearish reversal. While 5 of 9 cases were negative after the direct station, the average change was still 0.34%. Clearly, there is little support for bearish reversals following a direct station. This follows a similarly weaker effect with bearish reversals following retrograde stations. It seems that if stocks are trending higher into either a retrograde or direct station, they are less likely to reverse lower after the station.

Verdict: no effect

Conclusion

In light of this analysis, it seems that the historic reversal on March 6, 2009 was not a one-off. The evidence presented here suggests the Venus retrograde station does tend to correlate with bullish reversals but only if prices have been trending lower before the retrograde station. Although March 2009 was the largest bullish reversal considered here, there were several other reversals that centered around a Venus retrograde station. In general, the bigger the decline before the Rx station, the bigger the reversal we can expect after the Rx station.

This bullish reversal is about equally likely to occur in the 10-day and 20-day windows. The >1% 10-day window (-5d 5d) saw 9 of 12 cases turn bullish (average=1.67%) while the >1% 20-day window (-10d 10d) saw 11 of 14 cases experience a bullish reversal.

A stronger reversal was somewhat more likely to occur following a larger >2% decline into the Rx station. Using the 10-day window (-5d 5d), the average gain was 2.67% in 5 out of 6 cases while the 20-day window was less impressive -- a 1.98% average gain with only 8 of 12 cases reversing positive. This would suggest that the shorter 10-day window is a more reliable interval for this bullish reversal phenomenon.

The bearish reversal following an uptrend looks mostly weaker. The 10-day window had barely any effect, while the longer, 20-day window had a modest effect of -0.83% with 8 of 13 cases exhibiting a reversal following gains leading into the retrograde station.

One important caveat to this analysis is that some of this apparent reversal following a Venus retrograde station may simply be a reversion to the mean. When prices have been clearly trending in one direction, there is an increased likelihood that prices will take a breather and undergo some kind of pullback. This is a reasonable objection since overbought and oversold conditions are closely tracked and are the basis for investment tools such as RSI, Bollinger Bands and the like. But since stocks can remain in an oversold condition for some time, we can never be certain exactly when prices will reverse after becoming oversold.

Thus, the Venus retrograde station may be a useful tool to determine when an oversold bullish reversal is more likely to take place. While not foolproof, its effect is strong enough to consider its use as part of a broad-based approach to market analysis.