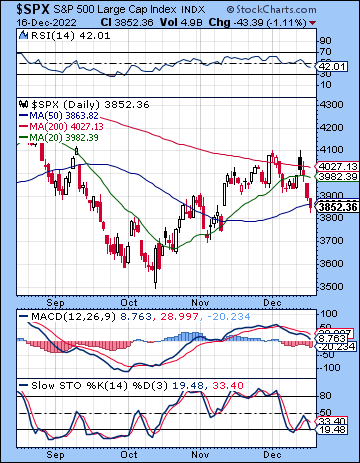

(18 December 2022) US stocks extended their sell-off last week as the Fed’s hawkish statement laid to rest any hope of an imminent pivot towards easing. The S&P 500 fell 2% on the week to 3852 while the Nasdaq-100 finished the week at 11,243. This bearish outcome was in line with expectations as I thought the Mercury-Mars-Rahu alignment would likely coincide with some downside in the second half of the week. The early week rally was not wholly unexpected given the Sun-Moon-Jupiter alignment, although the extent of the upside was surprisingly large.

(18 December 2022) US stocks extended their sell-off last week as the Fed’s hawkish statement laid to rest any hope of an imminent pivot towards easing. The S&P 500 fell 2% on the week to 3852 while the Nasdaq-100 finished the week at 11,243. This bearish outcome was in line with expectations as I thought the Mercury-Mars-Rahu alignment would likely coincide with some downside in the second half of the week. The early week rally was not wholly unexpected given the Sun-Moon-Jupiter alignment, although the extent of the upside was surprisingly large.

For all the talk of inflation and rising interest rates, it seems markets are becoming more focused on recession risks. Tuesday’s less-than-expected 7.1% CPI print was further evidence that inflation has peaked, although Powell’s comments on Wednesday suggested the Fed is not in any hurry to stand pat after hiking to 4.375%. Markets are pricing in another 25 basis points at the next FOMC meeting on Feb 1 with a probable terminal rate of 5% sometime in mid-2023. While further tightening may well be necessary to bring inflation down to more manageable levels, there are now more signs of a slowdown. After last week’s retail sales and manufacturing data came in weaker than expected, the last economic domino to fall may be unemployment, which is typically a lagging indicator of economic activity. More investors now fear the Fed will tighten too much and tip the economy into recession. One useful gauge of the relative tightness of Fed policy is to compare the overnight funds rate (now 4.375%) to the 2-year Treasury (4.17%). Historically, the Fed funds rate broadly parallels the 2-year yield. When the 2-year yield is higher that the Fed rate, as it was for all of 2021, that is an indication that the Fed is too loose and is encouraging excessive speculation and risk-taking. But when the Fed funds rate is higher than the 2-year yield as it was in 2007, for example, that is a warning that the Fed is too tight and could reduce economic activity and thereby increase the odds of a recession. As we can see, the 2-year yield has now edged below the Fed funds rate. Recession will become a more pressing concern if 2-year yield continues to trade below the Fed rate at 4.375%. And it goes without saying, that a recession would be bearish for stocks.

The planetary outlook leans bearish in the near term. While last week’s decline was largely the result of short term negative transits, we likely have yet to feel the full effects of the upcoming Saturn-Neptune alignment. This slow-moving alignment is exact on Jan 6, 2023 and suggests that we are likely to see at least one more leg lower between now and that date…

Click here to subscribe and read the rest of this week’s newsletter.