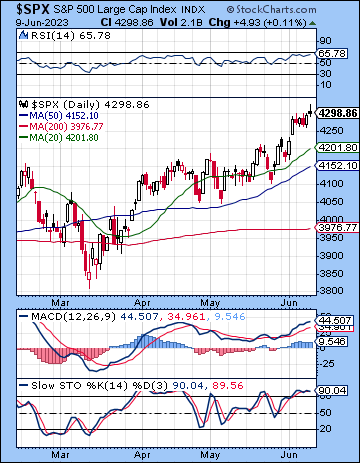

(11 June 2023) Stocks edged higher last week as traders anticipated a pause in the Fed’s tightening cycle at the upcoming FOMC meeting. The S&P 500 added just 16 points to 4298 while the Nasdaq-100 was fractionally lower on the week at 14,528. This bullish outcome was more or less in line with expectations as I thought that the combined effects of the Venus-Rahu-Pluto and Jupiter-Uranus-Chiron-alignments would be mostly positive.

(11 June 2023) Stocks edged higher last week as traders anticipated a pause in the Fed’s tightening cycle at the upcoming FOMC meeting. The S&P 500 added just 16 points to 4298 while the Nasdaq-100 was fractionally lower on the week at 14,528. This bullish outcome was more or less in line with expectations as I thought that the combined effects of the Venus-Rahu-Pluto and Jupiter-Uranus-Chiron-alignments would be mostly positive.

According to the math, we’re in a new bull market. The blue chips have advanced the requisite 20% off their October lows and are now apparently pointing towards higher highs later in the year if the pundits are to be believed. Bulls are exuding confidence here amid more signs of improving breadth as buyers are rotating out of big tech into small caps. Markets have largely discounted a pause in rate hikes at this Wednesday’s Fed meeting, although there is a 70% probability of another hike in July. The bond market remains concerned about inflation risks, however, as the 10-year yield finished higher last week at 3.75%. It is inching closer to the falling trend line resistance at 3.9% just in time for Tuesday’s CPI release. Certainly, another print below April’s 4.9% would be further evidence of a continued downtrend and would be bearish for yields and bullish for stocks.

And yet the complicating factor here is the new debt issuance from the Treasury in the wake of the debt ceiling deal. All that fresh supply of debt over the next three months will exert an upward pressure on yields and drain liquidity from the stock market as investors buy up bonds. And with the Treasury intent on rebuilding the Treasury General Account to $400 Billion by the end of June — up from less than $50 Billion before the debt ceiling deal — the consequent loss of market liquidity seems likely to have an negative impact on stock prices. While it is difficult to estimate the size of this impact, it nevertheless seems safe to say it will be a headwind for stocks.

The planetary outlook seems to be looking more bearish with the approach of the Saturn retrograde station on June 17. While the annual Saturn stations aren’t always bearish, they can often highlight changes in trend. A bearish change in trend is more likely this time around since Saturn is involved in a slow-moving bearish midpoint alignment of Saturn-Uranus/Neptune-Pluto. In addition to Saturn’s strengthening (=bearish), bullish Jupiter may be less prominent here as it separates from last week’s alignment with Uranus and Chiron. Also, we can see that Jupiter is moving away from its exact alignments with natal Venus and the Ascendant in the SPX horoscope. A similar diminution of Jupiter’s energy will likely occur in the Nasdaq horoscope in June. The approaching conjunction of Venus and Mars should also be seen as a potential negative influence on sentiment, even if the conjunction never quite culminates due to the Venus retrograde station on July 22…

Click here to subscribe and read the rest of this week’s newsletter