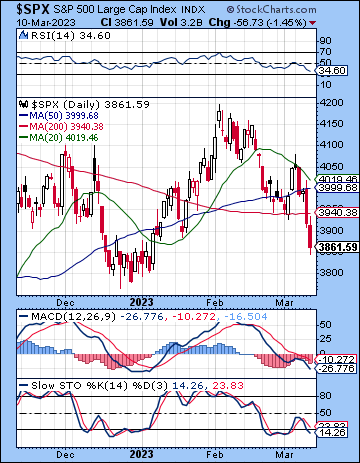

(12 March 2023) Stocks fell hard last week as the failure of SVB Financial raised fears of contagion as many regional banks are now feeling the effects of sharply higher interest rates. The S&P 500 plunged more than 4% on the week to 3861 while the Nasdaq-100 finished the week at 11,830. This bearish outcome was quite unexpected as I thought we might have seen more late week upside on the complex Jupiter alignments. Nonetheless, the decline was broadly in keeping with our medium term bearish outlook with the approach of the Saturn-Ketu alignment.

(12 March 2023) Stocks fell hard last week as the failure of SVB Financial raised fears of contagion as many regional banks are now feeling the effects of sharply higher interest rates. The S&P 500 plunged more than 4% on the week to 3861 while the Nasdaq-100 finished the week at 11,830. This bearish outcome was quite unexpected as I thought we might have seen more late week upside on the complex Jupiter alignments. Nonetheless, the decline was broadly in keeping with our medium term bearish outlook with the approach of the Saturn-Ketu alignment.

Suddenly, sentiment has turned ugly as the long-awaited fallout from higher rates has begun. While SVB could be an isolated case of mismanagement, markets are betting that there could be other smaller banks that are similarly vulnerable as surging rates have created huge bond losses. The bond market is now so wary of the impact of a financial sector meltdown that yields fell sharply last week reflecting significantly lower inflation expectations. In a sense, the insolvency of SVB has done the Fed’s bidding as yields on the 2-year fell to 4.60%, with the 10-year collapsing to 3.70%. Yields fell not only from the usual flight to safety, but also as markets began to price in less inflation and elevated recession risk given the danger of a major credit event not unlike 2007-2008. While higher rates may inflict some necessary short term pain, the Fed knows the economy cannot sustain significantly higher rates for very long as government and corporate debt would no longer be serviceable. Even if Powell appears willing to raise the terminal rate well above 5% this year, this would only directly impact the short end of the curve (2-year and less) while the benchmark 10-year Treasury could stay below that crucial 4% threshold.

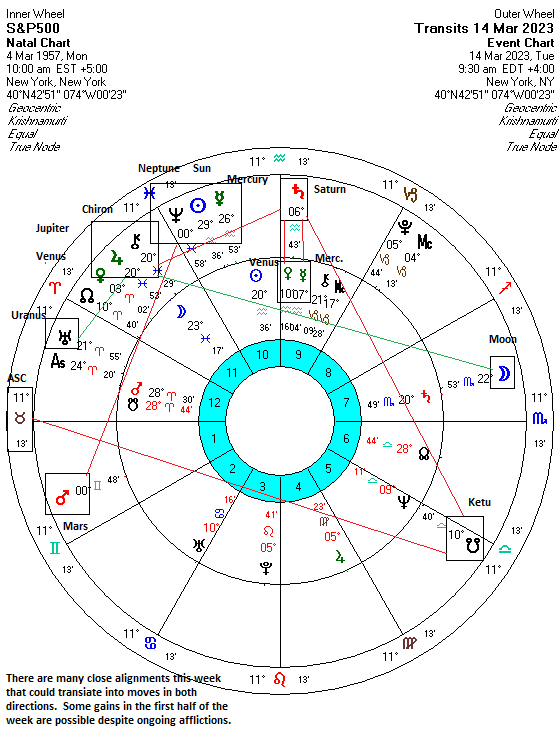

The planetary outlook is mixed. Despite last week’s misfire, the short term outlook still leaves the door open to some upside as we approach the FOMC meeting on March 22. The Jupiter alignments with Chiron (March 12) and Uranus (March 19) are still in play in the coming days, even if they may now only produce an oversold bounce. Since the 13-day and 27-day progressed cycles have a bearish bias for the coming weeks, it seems less likely that these Jupiter transits can materially improve the technical outlook…

Click here to subscribe and read the rest of this week’s newsletter