(14 January 2023) US stocks moved higher last week as the latest CPI report was in line with expectations thus lifting hopes that the Fed may cut rates later in the year. The S&P 500 gained more than 2.5% on the week to 3999 while the Nasdaq-100 finished at 11,541. This bullish outcome was not unexpected as I thought the Jupiter-Neptune-Chiron alignment would be positive, even if the late week pullback on the Mars direct station did not materialize.

(14 January 2023) US stocks moved higher last week as the latest CPI report was in line with expectations thus lifting hopes that the Fed may cut rates later in the year. The S&P 500 gained more than 2.5% on the week to 3999 while the Nasdaq-100 finished at 11,541. This bullish outcome was not unexpected as I thought the Jupiter-Neptune-Chiron alignment would be positive, even if the late week pullback on the Mars direct station did not materialize.

Markets seem to be on firmer footing here given the absence of any unwanted inflation surprises in last week’s report. For now, it seems likely that peak inflation is behind us and that it will continue to trend lower through 2023. The bond market reacted positively to this news as yields fell further with the 2-year closing Friday at 4.22%. In an inflationary environment, lower yields are bullish for stocks as they make bonds less attractive relative to stocks. Markets still have a slight recession bias as 2-year Treasuries are now yielding below the Fed funds rate of 4.37%. As a rule of thumb, whenever the 2-year yields less than the funds rate, the Fed is too tight and is risks recession by choking off credit. While the current spread is still very small (0.125%), we should monitor the 2-year if it falls much further, especially if the Fed is widely expected to hike another 25 basis points on Feb 1. Even if stocks are looking a bit more stable to start 2023, there is a perception that the Fed needs to pivot soon. As the 2-year yields suggest, markets are expecting the Fed to loosen later in the year as higher rates start to bite in terms of less auto loans and home financing. The problem, however, is that the Fed is still adhering to its hawkish stance by insisting that no rate cuts will be considered until 2024. If the Fed keeps rates elevated for longer than the market expects, we are more likely to see stocks underperform.

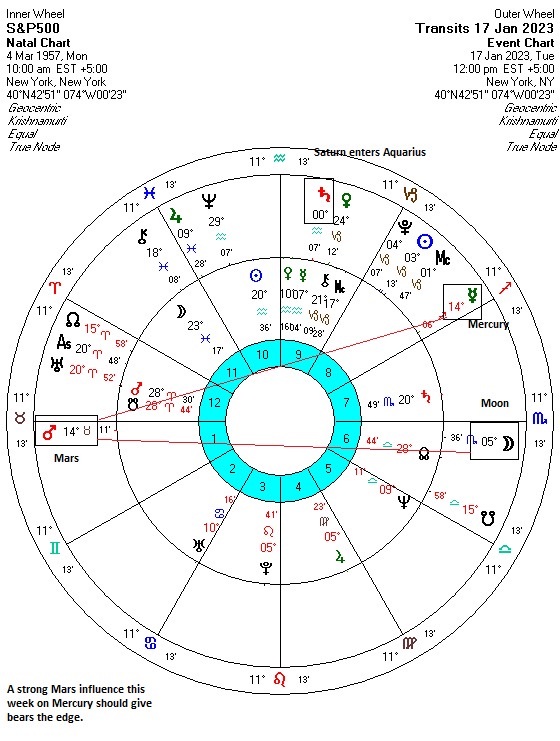

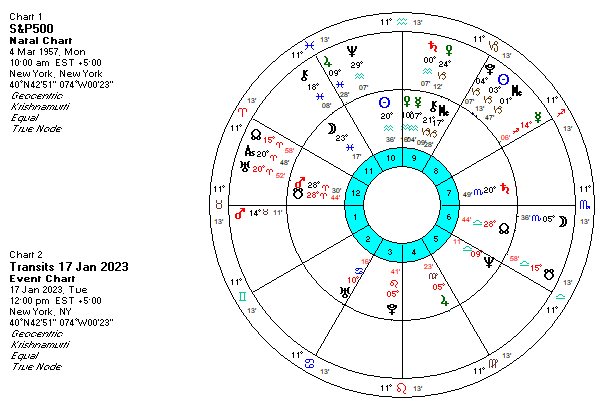

The planetary outlook leans bearish in the near term. The current rally in stocks appears to be largely the result of the influence of Jupiter as it transited the midpoint of Neptune and Chiron, in addition to forming several resonant alignments with faster-moving planets in the past two weeks. However, as of last Wednesday, the Jupiter-Neptune-Chiron alignment is now separating and thus offers less positive energy for stocks…

Click here to to subscribe and read the rest of this week’s newsletter