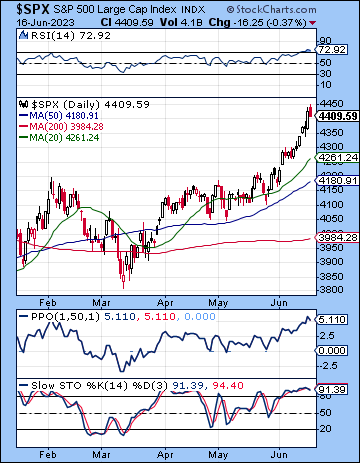

(18 June 2023) Stocks extended their rally last week as the Fed paused its rate hike cycle after another decline in CPI inflation. The S&P 500 gained more than 2% on the week to 4409 while the Nasdaq-100 added more than 3% to 15,083. The gains were spread unevenly, however, as the small cap Russell 2000 and the Dow rose by more modest amounts. This bullish outcome was unexpected as I thought we might have seen more downside following Wednesday’s FOMC statement. The early week gains were somewhat less surprising given the Sun-Uranus-Chiron alignment, however.

(18 June 2023) Stocks extended their rally last week as the Fed paused its rate hike cycle after another decline in CPI inflation. The S&P 500 gained more than 2% on the week to 4409 while the Nasdaq-100 added more than 3% to 15,083. The gains were spread unevenly, however, as the small cap Russell 2000 and the Dow rose by more modest amounts. This bullish outcome was unexpected as I thought we might have seen more downside following Wednesday’s FOMC statement. The early week gains were somewhat less surprising given the Sun-Uranus-Chiron alignment, however.

As headline inflation falls back down to earth, equity investors remain hopeful for a soft landing that avoids a recession with a further cooling of inflation. While the Fed is still talking up that distinctly bullish possibility, the bond market is more focused on further rate hikes. Even if the 4.0% CPI headline number provided ample bullish fuel last week, the core CPI print of 5.3% was unchanged in May and suggested that inflation remains sticky. This is the main reason why the FedWatch tool now shows a 75% probability for another hike at the July 26 meeting. Moreover, the Fed members’ dot plots now target for a 5.6% terminal Federal funds rate which translates into two additional hike later this year. In other words, barring any unforeseen geopolitical and financial developments, further tightening is likely. And with liquidity trending lower given the refilling of the Treasury’s General Account following the debt ceiling deal, there may be less cash available for stocks in the weeks ahead.

This continued monetary tightening has kept bond yields high as the 10-year is still close to falling trend line resistance at 3.77%. While the market has recently shrugged off higher yields in the face of the AI-driven rally, significantly higher yields remain a major headwind for stocks. Despite last week’s moderating inflation data, yields actually rose on the week. If yields move past 3.9% on the 10-year, stocks are more likely to suffer the consequences.

The planetary outlook now leans more bearish. While the late May and early June rally has been very strong, we have reached a potential turning point with the June 17 Saturn retrograde station. While the annual Rx station of Saturn doesn’t always coincide with bearish reversals, this year’s station is more likely to bring some downside since Saturn is involved in a larger alignment with Neptune, Uranus and Pluto. Specifically, the Saturn-Uranus midpoint (19 Pisces) is exactly 45 degrees from the Neptune-Pluto midpoint (4 Aquarius). This sets up a significant resonance which is more likely to turn sentiment bearish in the near term. I would also note that the bullish Jupiter influences are now separating and thus the energies that fueled this rally should soon be waning. The various PCI progressed cycles also look more bearish here, especially in the SPX and NYSE charts. We should note, however, that these progressed cycles look somewhat more bearish in July than in June. Even if these progressions are less precise as timers, we should be open to the possibility that the larger share of the upcoming pullback may occur in July, probably before the Venus retrograde station on July 22.

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: R. V. Jantzen