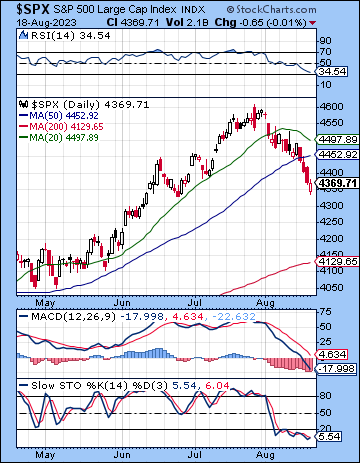

(20 August 2023) Stocks extended their losing streak last week as bond yields pushed to new highs following hawkish Fed minutes and strong retail sales data. The S&P 500 tumbled 2% on the week to 4369 while the Nasdaq-100 finished at 14,694. This bearish outcome was not unexpected given the ongoing Venus retrograde cycle, even if I thought we might have seen a bit more early week upside on the Moon-Sun-Uranus-Venus alignment. The selling in the second half was more closely reflective of the bearish Moon-Saturn alignment and the twin sidereal ingresses of the Sun and Mars.

(20 August 2023) Stocks extended their losing streak last week as bond yields pushed to new highs following hawkish Fed minutes and strong retail sales data. The S&P 500 tumbled 2% on the week to 4369 while the Nasdaq-100 finished at 14,694. This bearish outcome was not unexpected given the ongoing Venus retrograde cycle, even if I thought we might have seen a bit more early week upside on the Moon-Sun-Uranus-Venus alignment. The selling in the second half was more closely reflective of the bearish Moon-Saturn alignment and the twin sidereal ingresses of the Sun and Mars.

Markets are finally waking up the reality that interest rates will really be ‘higher for longer’. Strong retail sales and robust employment are two reasons why last week’s GDPNow number came in at a stunning 5.8% for Q3. While some observers rightly question its accuracy, the bond market is taking it seriously enough as the benchmark 10-year traded at new highs and finished the week at 4.26% — right at the same level as its October 2022 high. And with the dollar also strengthening above the key 103 level, stocks may be facing more headwinds here ahead of a potential gathering storm. While last week’s rout in the bond market was a red flag, a double top and subsequent reversal lower in yields is still possible in the near term and could spark a significant rebound in equities. For now, traders are assuming no Fed rate hike at its next meeting on Sep 20, although a further 25 basis point is now probable at its November meeting. All eyes will be on Fed Chair Powell at this Friday’s Jackson Hole speech as he will update his thinking on the possible timing of rate cuts in light of the continued strength in the economy.

The planetary outlook remains mostly bearish. While last week’s decline was in keeping with the general effect of the Venus retrograde cycle, the progressions calendar was only slightly bearish, albeit with a lower score than the previous week. This week’s progressions score is more negative (-6) and should continue to give the bears the benefit of the doubt in terms of the overall trend…

Click here to subscribe and read the rest of this week’s newsletter