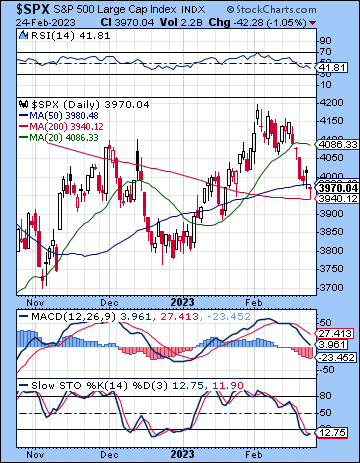

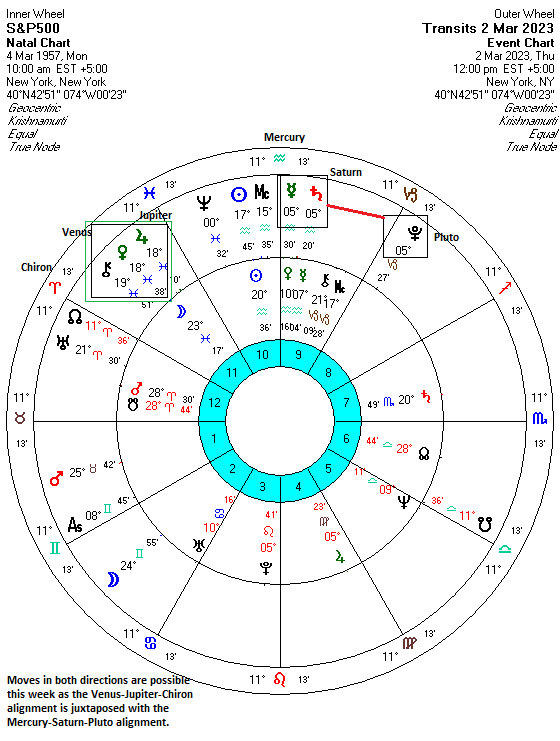

(26 February 2023) Stocks fell for the third week in a row as core PCE inflation came in hotter than expected and pushed the possibility of a Fed pivot even further into the future. The S&P 500 fell more than 2% to 3970 while the Nasdaq-100 lost 3% to 11,969. This bearish outcome was quite unexpected as I thought we might have seen more late week gains on the Sun-Venus-Rahu alignment. And while the bearish Mercury-Mars-Uranus alignment did coincide with some early week downside, the magnitude of the decline was larger than anticipated.

(26 February 2023) Stocks fell for the third week in a row as core PCE inflation came in hotter than expected and pushed the possibility of a Fed pivot even further into the future. The S&P 500 fell more than 2% to 3970 while the Nasdaq-100 lost 3% to 11,969. This bearish outcome was quite unexpected as I thought we might have seen more late week gains on the Sun-Venus-Rahu alignment. And while the bearish Mercury-Mars-Uranus alignment did coincide with some early week downside, the magnitude of the decline was larger than anticipated.

Friday’s resurgent inflation data has renewed concerns that the Fed will have no choice but to hike throughout 2023. Even a 50-point hike in March is no longer far-fetched as estimates of its terminal rate have now risen to 5.50% by mid-year with relatively little chance of a pivot until Dec 2023 at the earliest. The bond market reacted decisively to this new outlook as 2-year yields rose to new highs at 4.78% while the benchmark 10-year eclipsed its December high finishing the week at 3.95%. While the rise in bond yields was bad news for equities, it is worth noting that bond yields are now suggesting further downside in stocks. While yields have pushed past their December highs, stocks have yet to break below their December lows, thus creating a negative divergence. Since yields tend to move inversely to stocks, this divergence will need to eventually resolve itself either by yields falling on weaker economic data or by stocks falling to retest their December lows.

The planetary outlook is still mixed at best. Last week’s decline was a frustrating reminder of the uncertainties involved in forecasting across different time frames. While last week’s decline seemed less reflective of the short term transit influences which appeared more bullish, the longer term 27-day PCI progressions are nonetheless still leaning bearish for the medium term…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: William Warmby