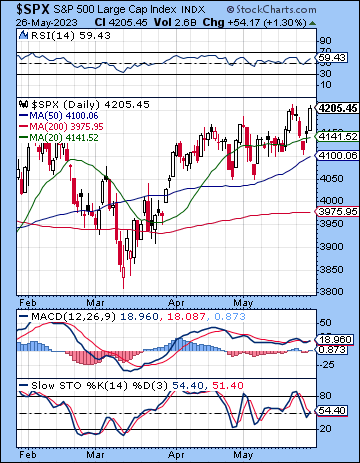

(28 May 2023) Stocks were mostly higher last week as optimism over an imminent debt ceiling deal combined with AI euphoria to push the major indexes higher. The S&P 500 finished marginally higher on the week at 4205 while the Nasdaq-100 surged more than 3% to 14,298 after Nvidia earnings guidance. The broader indexes continued to lag, however, as the Dow and the NYSE Composite were lower by more than 1% on the week while the small cap Russell 2000 ended flat. While this mostly bullish outcome was somewhat unexpected, the week unfolded more or less as forecast as selling was concentrated in the first half of the week on the Mars-Jupiter-Rahu alignment after which the bullish influence of the Venus-Uranus-Chiron took over and coincided with gains on Thursday and Friday.

(28 May 2023) Stocks were mostly higher last week as optimism over an imminent debt ceiling deal combined with AI euphoria to push the major indexes higher. The S&P 500 finished marginally higher on the week at 4205 while the Nasdaq-100 surged more than 3% to 14,298 after Nvidia earnings guidance. The broader indexes continued to lag, however, as the Dow and the NYSE Composite were lower by more than 1% on the week while the small cap Russell 2000 ended flat. While this mostly bullish outcome was somewhat unexpected, the week unfolded more or less as forecast as selling was concentrated in the first half of the week on the Mars-Jupiter-Rahu alignment after which the bullish influence of the Venus-Uranus-Chiron took over and coincided with gains on Thursday and Friday.

Investors continue to see the half-full glass here despite a wide array of negative intermarket divergences and numerous sources of uncertainty. Optimism surrounding the possible debt ceiling settlement before the June 1 deadline was enough to entice the standing army of dip buyers to do their duty once again. Treasury Secretary Janet Yellen has now moved the X-date to June 5, although that may also be subject to revision depending on new data. While a default is unthinkable, the uncertainty surrounding the changing deadline date could inadvertently cause problems either with cementing the deal or getting the deal finally passed in Congress.

As usual, the bond market offers a more complex view than that of sanguine stock traders. The recent rise in bond yields reflects not only the significant amount of new debt issuance after a deal but it is also is factoring in sticky inflation after last week’s higher than expected PCE report. The benchmark 10-year is quickly approaching its falling channel resistance of 3.90%. While higher rates and a higher dollar are typically headwinds for stocks, we have yet to see much evidence of trouble as the markets are focused on the very near term of averting a debt default and reaping early rewards of the supposed AI revolution. In that sense, the negative impact of higher rates on borrowing and growth prospects may only be felt over a period of weeks or even months. For now, markets are choosing to ignore that writing on the wall.

The planetary outlook leans bearish for the near term. The PCI progressed cycles remain a reservoir of potential bearish energy over the next several weeks. While we have yet to see much evidence of these negative cycles other than a protracted sideways market, there are some bearish progressed patterns in the coming weeks which could still upset the current balance…

Click here to subscribe and read the rest of this week’s newsletter