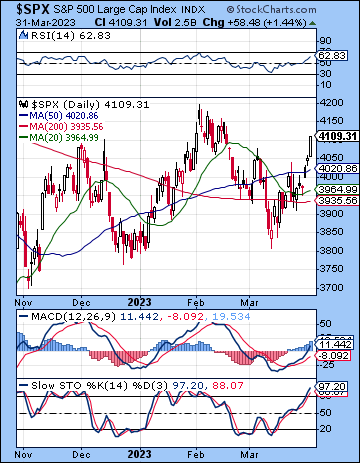

(2 April 2023) Stocks rose again last week as moderating PCE inflation data increased the odds of a Fed pivot in the near future. The S&P 500 gained more than 3% on the week to 4109 while the Nasdaq-100 finished the week at 13,181. This strongly bullish outcome was unexpected as I thought we might have seen a deeper pullback in the first half of the week on the Moon-Mars-Saturn-Ketu alignment. But dips were bought rather aggressively and set up the forecast rally on Wednesday and Thursday’s Venus-Uranus conjunction. Unfortunately, Friday’s end-of-month and end-of-quarter rally came despite the tense Mars-Saturn alignment.

(2 April 2023) Stocks rose again last week as moderating PCE inflation data increased the odds of a Fed pivot in the near future. The S&P 500 gained more than 3% on the week to 4109 while the Nasdaq-100 finished the week at 13,181. This strongly bullish outcome was unexpected as I thought we might have seen a deeper pullback in the first half of the week on the Moon-Mars-Saturn-Ketu alignment. But dips were bought rather aggressively and set up the forecast rally on Wednesday and Thursday’s Venus-Uranus conjunction. Unfortunately, Friday’s end-of-month and end-of-quarter rally came despite the tense Mars-Saturn alignment.

Investors are hoping the worst is over on the inflation story as odds of a Fed pause at the May 3 FOMC meeting now stand at 52%. While the recent banking scare may have temporarily restricted credit, a pause in rate hikes would breathe new life into the economy in anticipation of an eventual loosening of monetary policy. And while the inflation side of the ledger is mostly bullish for stocks, questions remain about the robustness of the economy as a whole. Friday’s Michigan consumer sentiment is tracking lower while consumer spending is also stuck in a down trend. No matter how data dependent Jerome Powell may be, the 4.88% Fed funds rate is still almost 80 basis points above the bellwether 2-year Treasury yield at 4.06%. The longer this gap persists, the greater the risk of an eventual slowdown as the tighter monetary condition gradually works its way through the economy. The benchmark 10-year may well be on the verge of signaling a slowdown as it continues to flirt with key support at 3.4%. Since lower yields correlate with lower growth expectations, we should carefully monitor market reaction in the event that this support level is broken.

The planetary outlook remains bearish for the near future. Despite last week’s rally, both the PCI progressed cycles and transits suggest declines are more likely than additional gains during the month of April…

Click here to subscribe and read the rest of this week’s newsletter