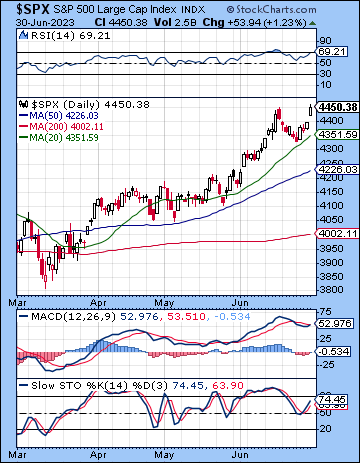

(2 July 2023) Stocks rebounded strongly last week as inflation showed more signs of abating while Q1 GDP growth was higher than expected at 2%. The S&P 500 gained more than 2% on the week to 4450 while the Nasdaq-100 finished at 15,179. This bullish outcome was quite unexpected as I thought the early week Mars-Uranus square might have coincided with a larger decline. While we did get some selling on Monday, buyers took over for the rest of the week, with the largest gains coinciding with the late week bullish alignment of the Sun, Mercury and Jupiter.

(2 July 2023) Stocks rebounded strongly last week as inflation showed more signs of abating while Q1 GDP growth was higher than expected at 2%. The S&P 500 gained more than 2% on the week to 4450 while the Nasdaq-100 finished at 15,179. This bullish outcome was quite unexpected as I thought the early week Mars-Uranus square might have coincided with a larger decline. While we did get some selling on Monday, buyers took over for the rest of the week, with the largest gains coinciding with the late week bullish alignment of the Sun, Mercury and Jupiter.

With the second quarter finishing on a positive note, more investors are now hoping for a soft landing as inflation moderates while the economy continues to expand, albeit at a slower pace. Certainly, there is good reason to think a recession can be avoided if the data holds up. Housing, retail sales and employment look quite healthy and suggest that consumers are adjusting to significantly higher interest rates. Even though markets now fully expect the Fed to hike one or two more times this year, it is unclear if the full impact of the rate hikes have yet to be felt. Typically, the tightening effect of Fed rate hikes take 12-18 months to work through the economy. Since the Fed started hiking in early 2022, the full impact of the interest rate increases may not be felt until Q4 2023 or Q1 2024. While markets may have priced in some tepid growth, one wonders what the reaction will be if the employment picture suddenly deteriorates as the tighter monetary conditions work their way through the system. The yield curve is a big part of this puzzle as the 2/10y inverted further last week testing the March low at -1.06%. While there is no law that says a recession must occur after inversion, it is nonetheless a strong correlation. If a recession does come, stocks will have to pay the price. Moreover, the benchmark 10-year continues to test technical resistance at 3.90% as increased debt issuance is keeping an upward pressure on yields as buyers demand higher premium. If growth forecasts remain modest but yields move above 4%, there would be increased risk of a significant correction in the stock market.

The planetary outlook leans bearish for July. While we could see some additional upside this week upcoming, both the transits and the progressions suggest some significant downside is likely in the next few weeks. The net score on the Progressions Calendar (see below) is negative for most weeks in July and reflect some of the difficult alignments that lie ahead…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Steve Jurvetson