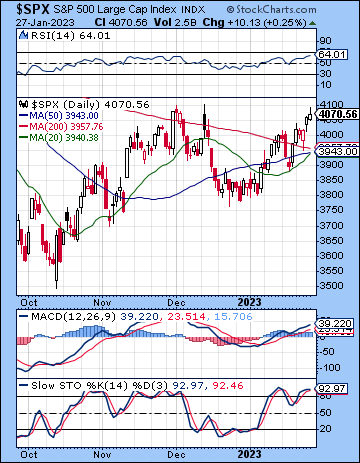

(28 January 2023) US stocks rebounded last week as strong GDP data and the continued decline of PCE inflation rekindled hopes for a soft landing later in the year. The S&P 500 gained more than 2% on the week to 4070 while the Nasdaq-100 surged almost 5% to 12,166. This bullish outcome was in line with expectations as I thought the Sun-Jupiter alignment would likely coincide with some upside.

(28 January 2023) US stocks rebounded last week as strong GDP data and the continued decline of PCE inflation rekindled hopes for a soft landing later in the year. The S&P 500 gained more than 2% on the week to 4070 while the Nasdaq-100 surged almost 5% to 12,166. This bullish outcome was in line with expectations as I thought the Sun-Jupiter alignment would likely coincide with some upside.

All eyes are on the Fed this week as markets are anticipating a less hawkish stance from Chair Powell. While a 25-point hike is a given, Powell’s remarks will be watched carefully for a possible early pivot towards easing in the second half of 2023. So far, the Fed remains committed to ‘higher for longer’ in order to bring inflation back to its long term 2% target. With unemployment remaining near all-time lows and GDP growing at a healthy 2.9% clip, there would seem to be less urgency for the Fed to suddenly become dovish. In other words, the Fed has enough room to tighten further without having to fear an imminent recession. On the other hand, some observers have sounded the alarm about the implications of a ‘higher for longer’ interest rates on the ability of the US to meet its debt obligations. If the Fed’s overnight rate is raised beyond 5% for any stretch of time, US debt servicing would rise to 25% of its total tax revenues to about $1.2 Trillion a year. The burgeoning debt burden is therefore an argument against significantly higher rates as it would put pressure on Washington to cut spending, something this administration would be very reluctant to do. A cut in spending would be just as bearish for stocks as would any significant tightening of money supply and further hikes in interest rates.

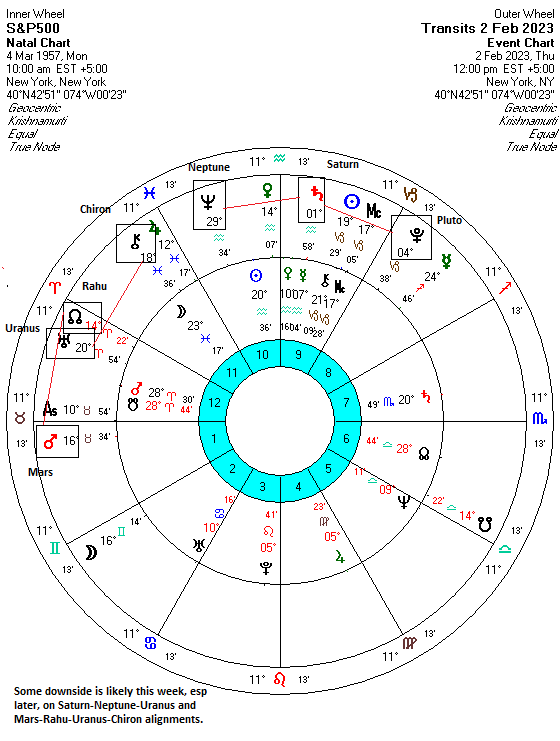

The planetary outlook is leaning more bearish here. The PCI progressed cycles are more bearish for the month of February and suggest there is a greater likelihood for a significant pullback in the near term. Both the 13-day and 27-day cycles have some significant bearish alignments that have yet to manifest and increase the odds for some downside, even if they do not preclude some additional short term gains in the coming days…

Click here to subscribe and read the rest of the newsletter