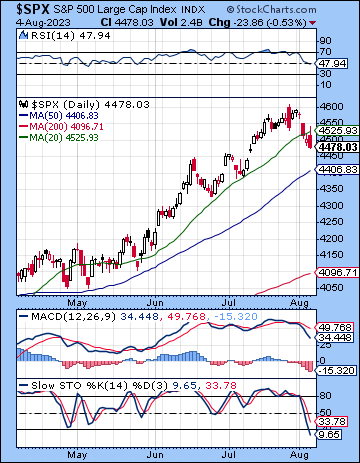

(6 August 2023) Stocks were lower last week as the Fitch credit downgrade spooked investors and pushed bond yields back up towards their recent highs. The S&P 500 fell 2% to 4478 while the Nasdaq-100 lost 3% to 15,274. This bearish outcome was in line with expectations as I thought the midweek Mercury-Saturn opposition would coincide with some significant selling.

(6 August 2023) Stocks were lower last week as the Fitch credit downgrade spooked investors and pushed bond yields back up towards their recent highs. The S&P 500 fell 2% to 4478 while the Nasdaq-100 lost 3% to 15,274. This bearish outcome was in line with expectations as I thought the midweek Mercury-Saturn opposition would coincide with some significant selling.

While the US credit downgrade may or may not prove to be significant in the long run, the move higher in yields was bad news for the stock market. The bond market has largely accepted the “higher for longer” thesis for Fed rates as the 10-year came to within a whisker of its October 2022 high of 5.25 %. In an environment of muted economic growth, higher rates increase borrowing costs and restrict lending. While Friday’s mixed jobs report may have offered a lifeline to bonds, the 10-year yield chart still looks mostly bullish and therefore should be seen as a medium term headwind for equities. This Thursday’s CPI report will be critical in that respect as number above the July 3% headline number could see yields move higher once again. Recall that the low inflation print in the July report may have been the result of a base effect since inflation peaked at 9% in June 2022, exactly one year before. Since inflation started to ease after June 2022, inflation now could prove to be stickier than some expect. As oil and other commodities have moved higher in recent weeks, the US economy could once again come under increased inflationary pressure. Clearly, any rebound in inflation would be bearish for stocks.

The planetary outlook has continued downside risk. Last week’s pullback not only coincided nicely with the Mercury-Saturn alignment, but it kept alive the bearish Venus retrograde scenario. With most indexes peaking a few days either way of the Venus retrograde station on July 22, the stage has apparently been set for more downside in the near term. I use the word “apparently” because the Venus retrograde cycle isn’t a guaranteed bearish indicator. Nonetheless, it should be considered a high probability indicator for a change-in-trend which would translate into further downside in the month of August. That said, the progressions calendar do not offer strong confirmation for additional downside this week or even next week. The net weekly progression scores actually tilt positive this week and are neutral in mid-August…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: kavitakapoor