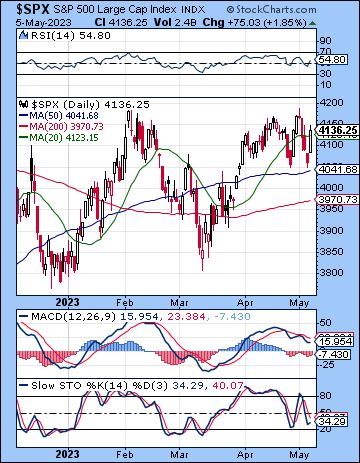

(7 May 2023) Stocks ended mostly lower on the week as the Fed delivered a slightly hawkish rate hike with no firm guarantee of a pause. Despite Friday’s strong jobs report, the S&P 500 fell by less than 1% on the week to 4136 while the Nasdaq-100 actually finished marginally higher at 13,259. This bearish outcome was generally in keeping with expectations, especially the post-FOMC sell-off on Wednesday afternoon’s Moon-Mars square and Thursday’s Mars-Saturn alignment.

(7 May 2023) Stocks ended mostly lower on the week as the Fed delivered a slightly hawkish rate hike with no firm guarantee of a pause. Despite Friday’s strong jobs report, the S&P 500 fell by less than 1% on the week to 4136 while the Nasdaq-100 actually finished marginally higher at 13,259. This bearish outcome was generally in keeping with expectations, especially the post-FOMC sell-off on Wednesday afternoon’s Moon-Mars square and Thursday’s Mars-Saturn alignment.

The market stalemate continues. Last week Fed Chair Powell did his best to limit hopes for an immediate pause and pivot on interest rates after he left the door open to further hikes if inflation remained elevated. Friday’s strong jobs report seemed to make his point as bond yields rose and thus held above key support levels at 3.4% for the benchmark 10-year Treasury. And yet even a hawkish Powell could not dampen the euphoria from Apple’s earnings beat and the ongoing strength of the US employment picture. It seems that bulls may be attempting to revive the goldilocks environment of modest soft landing growth that is sufficiently muted that it does not provoke further rate hikes. Certainly, the relative listlessness of the dollar is boosting prospects in the equity market, even with the approaching debt ceiling limit on June 1. Most market participants are convinced this is little more than a DC political game with minimal chances of any real world consequences. And yet given the current divided Congress, we cannot fully discount the possibility of some drama in the weeks ahead which may force traders to hedge their positions.

The planetary outlook leans bearish for the near term. The PCI progressed cycles still have several bearish alignments in different charts that have yet to fully manifest. So while there isn’t a compelling doom and gloom case with the 13-day and 27-day cycles, the overall progressed picture is still quite mixed and thus argues against the bullish view of new leg higher in the near term…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Ged Carroll