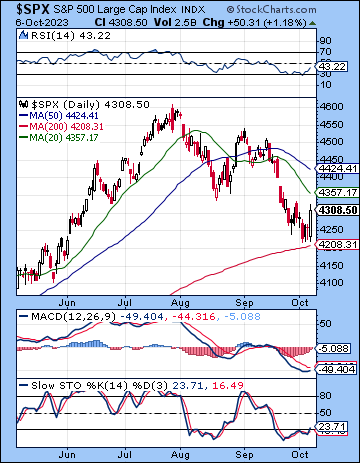

(8 October 2023) US stocks rebounded last week as Friday’s strong jobs report provided more evidence for a soft landing in the face of ongoing inflation risks. Despite falling to new lows early in the week, the S&P 500 gained a half of one percent on the week to 4308 while the Nasdaq-100 gained almost 2%. The broader markets were weaker, however, as the Russell 2000, the Dow and the NYSE Composite were all lower on the week. This mostly bullish outcome was somewhat unexpected, although the intraweek lower lows fulfilled the bearish influence of the Mars-Ketu-Neptune alignment. The late week bounce also closely coincided with Friday’s bullish alignment of the Sun, Moon and Jupiter.

(8 October 2023) US stocks rebounded last week as Friday’s strong jobs report provided more evidence for a soft landing in the face of ongoing inflation risks. Despite falling to new lows early in the week, the S&P 500 gained a half of one percent on the week to 4308 while the Nasdaq-100 gained almost 2%. The broader markets were weaker, however, as the Russell 2000, the Dow and the NYSE Composite were all lower on the week. This mostly bullish outcome was somewhat unexpected, although the intraweek lower lows fulfilled the bearish influence of the Mars-Ketu-Neptune alignment. The late week bounce also closely coincided with Friday’s bullish alignment of the Sun, Moon and Jupiter.

After last week’s recovery, the market is showing signs of accepting higher inflation even if it means living with the Fed funds rate above 5% well into next year. Friday’s unexpectedly strong NFP jobs report suggested that the economy may well be able to avoid a recession without necessarily stoking more inflation. The monthly wage growth of 0.2% came in below expectations and hinted at a possible lessening of inflation pressures. Whatever the headline CPI number we get this Thursday, if wage growth stays low it could effectively take the 1970s stagflation scenario off the table. Without the inflationary feedback loop of higher wage growth leading to ever-higher prices, inflation is more likely to be brought under control in the coming months. Interestingly, last week’s rally in large cap stocks came despite bond yields rising for the fifth straight week. With the benchmark 10-year Treasury now closing in on 5%, it remains to be seen if the economy can deliver enough growth to justify the higher cost of money…

[…]

This week (Oct 9-13) looks mixed. The early week has some downside risk as Mars squares Pluto on Sunday and Monday and Venus opposes Saturn on Monday and Tuesday. While the Venus-Saturn pairing is bearish, I am uncertain how much downside we can expect. Similarly, the Mars-Pluto leans bearish but it may not produce much selling since it is exact overnight on Sunday and very early on Monday. Tuesday morning’s Moon-Venus-Saturn alignment looks bearish but may act as a short term low after which stocks are more likely to rally once again. While there are some bearish influences here, this looks like it could be a partial retracement of Friday’s gain rather a chance for a major breakdown of 4200. Wednesday’s Moon-Mercury-Jupiter alignment looks more bullish with the morning looking more bullish than the afternoon. Thursday’s Mercury-Jupiter alignment could be somewhat bullish as well. Friday’s Mars-Saturn alignment looks more bearish, although the 120 degree aspect is usually less negative than the 90 or 180 degree aspect. Nonetheless, bulls should be careful at the end of the week. Given the range of influences, I would keep an open mind about weekly outcomes. The progressions calendar score looks fairly neutral (+1) and argues for a small weekly move. A retest of last week’s low is possible at some point although I would be surprised if the SPX closed at or below 4200. A strongly positive week also seems unlikely and suggests that bulls may have difficulty moving above the 20 DMA at 4357…

Click here to subscribe and read the rest of this week’s newsletter

Photo Credit: Fiat Chrysler