(Updated October 11, 2009) After its huge rally through the spring and summer, crude oil seems poised to correct significantly here. The Saturn-Pluto square with is exact in November may not be kind to stocks and commodities generally and crude oil is unlikely to escape unscathed. The Crude Futures chart (March 30, 1983) shows two difficult transits occuring simultaneously: Saturn in square aspect to the natal Rahu and transiting Rahu squaring the natal Mars. Together, these aspects seem indicative of greater weakness in October and November.

(Updated October 11, 2009) After its huge rally through the spring and summer, crude oil seems poised to correct significantly here. The Saturn-Pluto square with is exact in November may not be kind to stocks and commodities generally and crude oil is unlikely to escape unscathed. The Crude Futures chart (March 30, 1983) shows two difficult transits occuring simultaneously: Saturn in square aspect to the natal Rahu and transiting Rahu squaring the natal Mars. Together, these aspects seem indicative of greater weakness in October and November.

With Jupiter changing direction on Tuesday October 13, it will once again move towards Neptune for another conjunction in early December. This powerful Jupiter-Neptune conjunction was the source of much of the stock and commodity rally off the lows of winter 2009. Jupiter symbolizes optimism and confidence while Neptune is associated with visions and images. Together, they were the astrological basis of a "hope rally". Not very durable, but real enough to move prices higher.

So it seems likely we will some kind of boost for crude moving into December. It’s less likely to be as long lasting or formidable as the spring rally because Jupiter will be moving quickly this time around, as compared with its slow velocity from May to July around the retrograde station that elongated its contact with Neptune.

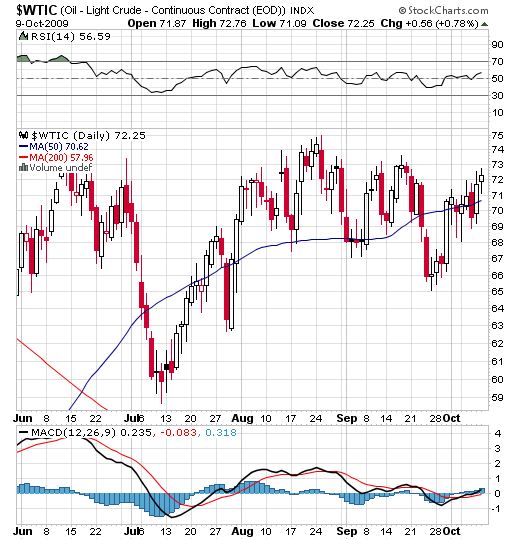

The crude stock chart has been showing signs of technical weakness in the past two months as it has failed to exceed its summer highs. Meanwhile, the MACD indicator looks iffy at best as a bearish divergence with prices is evident.

(Updated March 1, 2009) With the deepening global recession, crude oil has fallen from its lofty heights when it traded near $150 a barrel. Plummeting demand forecasts has meant a collapse in prices to under $40, as the price has closely tracked economic activity. While I had expected some retreat in oil prices in previous entries, the extent of the decline was surprising, as the recession came on very quickly. I predicted that a spring rally was likely as Uranus separated from Saturn and Jupiter moved into a more favourable position in the Futures chart. This basic geometry of planets still points to a strong recovery in crude prices in the near term. At the moment, oil is attempting to break out of a bottoming pattern where it has traded between $30-45. I doubt it can rally very far in the coming weeks, but April looks much better for crude. Prices will likely go higher as Jupiter and Neptune conjoin in early sidereal Aquarius and will aspect the natal Rahu in the Futures chart. This has the possibility for a very rapid rise in prices as there will be speculation (Rahu) of growth (Jupiter) that is rooted in hope (Neptune). It could well be another price bubble that is driven by speculators rather than fundamentals.

(Updated September 21, 2008) Oil is currently struggling to stay above $100 a barrel. With the negative economic outlook as the financial crisis deepens, oil is likely to fall to perhaps $80-90 over the next few months. It’s possible crude may rally in over the next few weeks before heading lower over the winter season. While I still believe that there is a long term bull market in crude for reasons enumerated in previous posts, it is likely there will be a correction over the coming months. Saturn, the significator for oil, will be opposed by Uranus and this is likely to result in unpredictable and often negative price moves. There is a chance for a temporary price collapse down to $70 over the winter but prices are likely to strengten by spring 2009 as Uranus moves away from Saturn and Jupiter assumes a more benefic position in the 9th house in the crude Futures chart.

(Updated August 6, 2008) Although oil has come off its high of $147, the high prices are likely to continue as the Jupiter dasha that began in 1998 continues to favour the bull market in crude. The Venus subperiod will run until November 2008 and also guarantees that prices will not come down that much. At the time of writing, oil is $118. I think we may see a pullback down to $110, or possibly briefly to $100 over the next couple of weeks but the rally will resume into the autumn. Prices may decline again in December as the Sun subperiod begins. But there is every reason to believe that the Sun subperiod will extend this bull market. It is well placed in the 11th house (gains) in the Futures chart and receives an aspect from Jupiter, the dasha lord. The Sun’s subperiod will last until the end of 2009 so we can expect prices to top $150 at some point between now and then. $200 is also possible as a temporary spike. Beyond that point, prices will stay high during the Moon subperiod in 2010, although they are less likely to be as as subject to speculative tops as we have experienced this past summer.

(Updated January 25, 2008) Oil futures have fallen from their $100 USD highs in the Fall. Current prices around $88-90 appear to be a relatively solid price support. I believe oil and other commodities will go a bit of a run here as confidence in the world economy is restored following the Fed rate cut. Next week looks strong, so expect price rises from Jan 29-31. The market will maintain a bullish bias until at least Feb 18. We may hit $95. But my predictive model is not looking good in the medium term.

Saturn is moving retrograde towards the IC which will cast its 3rd house (60 degree) aspect to the Moon-Saturn aspect in the Oil futures chart. This is a depressing effect on prices. The time around March 1 looks like a moderate short term selloff as transit Mars conjoins natal Rahu. The current period as a whole up to March 2008 looks fairly unimpressive for oil although the late summer will probably feature another major spike in prices, probably over $100. The real bull market will begin anew after April 2009 and the beginning of the Sun antardasha. $150 oil is possible. Investors should look a pullbacks as excellent buying opportunities.

Please see the Weekly Market Forecast for more updates.

Update October 2007

While I was correct in my forecast over $80+ oil for the summer, oil remains near $80 per barrel. It’s important to note, however, that prices denominated in other currencies have fallen sharply owing to the precipitous decline in the US dollar. In Canada, for example, oil and gasoline have fallen 20% from their previous peaks this year. Much the same trend can be seen in Europe. In that sense, I feel my prediction has been mostly correct. So I’ll stick to my forecast that further price drops on the order of 10-20% are in store, although they may only occur outside the US. If the dollar finds a bottom and stabilizes soon, then the US price will likely fall into the $60-70 range by Christmas.

___________________

(March 2007) After oil’s huge price rise in the past two years, it slipped back under $60 a barrel in February 2007. While the long term price movement of oil reflects changes in supply and demand, geopolitical concerns also have had a strong short term effect on prices. As the Middle East remains a source of uncertainty, prices will continue to move with events. In keeping with Jupiter’s symbolism of expansion, much of the price increase has occurred since the beginning of the Jupiter dasha in 1998. We can also see that prices have peaked during the favourable Venus bhukti which started in 2005.

Crude Oil with transits for August 1, 2007The chart I use for oil prices is the first trade NYMEX chart for March 30, 1983 9.30 am New York. This chart looks quite strong for at least the first half of the year. You can see some of the key transit support for the high prices — Jupiter aspecting the ascendant near its April 5th station. Jupiter will continue to prevent significant declines as it moves retrograde and aspects Sun and then Mercury. Look for a price peak around the direct Jupiter station in early August. This will aspect the natal Sun within one degree.

Crude Oil with transits for August 1, 2007The chart I use for oil prices is the first trade NYMEX chart for March 30, 1983 9.30 am New York. This chart looks quite strong for at least the first half of the year. You can see some of the key transit support for the high prices — Jupiter aspecting the ascendant near its April 5th station. Jupiter will continue to prevent significant declines as it moves retrograde and aspects Sun and then Mercury. Look for a price peak around the direct Jupiter station in early August. This will aspect the natal Sun within one degree.

The actual numbers we’ll see remains beyond my capabilities. At the time of writing (late March), oil sits at $62 per barrel. I would expect these transits would keep above $50 for any incident short term lows. More likely, I would think the average price would be around $60-$70. In July-August, price spikes may push it closer to $80-90. These are just speculative guesses however, but hopefully will reflect the direction of the main trends.

Prices may weaken substantially in the Fall as the nodes aspect the Moon-Saturn conjunction and then hit the MC-IC. Prices may drop sharply to under $60, if not lower. I’ll try to update this article as we go along.