(17 December 2024) Astrology has a long history that dates back many centuries to Egypt and Mesopotamia. As modern practitioners of this traditional science, we reap the benefits of the cumulative knowledge of our forebears. While this knowledge has yielded an impressive array of textual sources as varied as Parashara, Ptolemy and Valens, there remains a measure of uncertainty to astrological principles. Even if the epistemological claims of traditional authorities are the appropriate starting points to our investigations, they also reveal the incompleteness of astrological knowledge. How do we know if any of these principles are actually true?

(17 December 2024) Astrology has a long history that dates back many centuries to Egypt and Mesopotamia. As modern practitioners of this traditional science, we reap the benefits of the cumulative knowledge of our forebears. While this knowledge has yielded an impressive array of textual sources as varied as Parashara, Ptolemy and Valens, there remains a measure of uncertainty to astrological principles. Even if the epistemological claims of traditional authorities are the appropriate starting points to our investigations, they also reveal the incompleteness of astrological knowledge. How do we know if any of these principles are actually true?

The problem is that astrological knowledge is largely deductive. As it is commonly practiced, the invocation of authoritative texts is usually a sufficient basis to justify a prediction, regardless of whether the prediction turns out to be right or wrong. As I see it, astrology’s blind spot is that it does not allow enough space for inductive knowledge, that is, knowledge that comes from empirical testing of its assumptions. My recent testing of various Mars aspects is an attempt to address that oversight.

In this new study, I want to examine the effects of alignments involving Jupiter and Saturn. The interrelationship of the movements of Jupiter and Saturn is arguably at the very core of the astrological enterprise. The pairing of these distant planets reflects the natural spectrum of life outcomes from the expansive optimism of Jupiter to the constraining pessimism of Saturn. As before, I am using fluctuations in stock market prices as a simplified barometer of human sentiment writ large. Since the stock market needs no reference to a natal chart, it streamlines our analysis considerably.

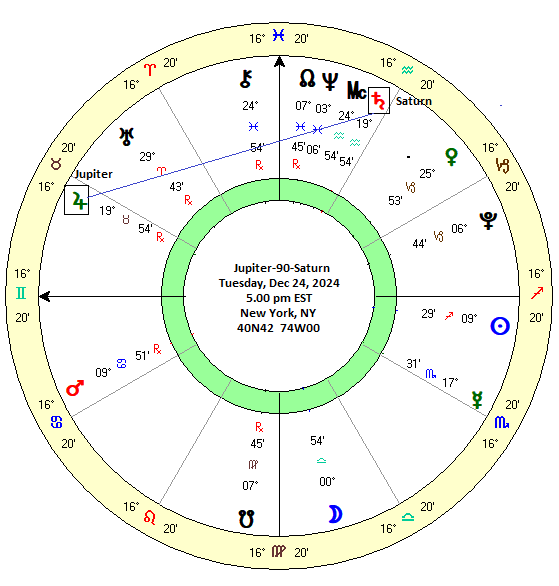

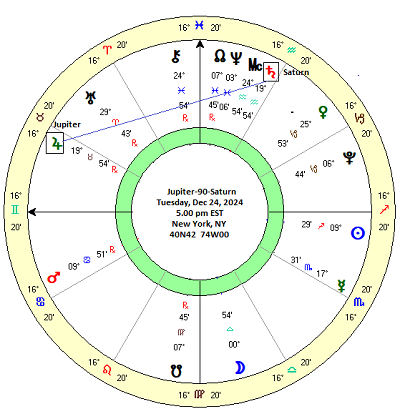

I have also chosen to focus on Jupiter-Saturn alignments because Jupiter is due to form a 90-degree square alignment with Saturn very shortly, on December 24. As we track the effects of this alignment in real time, we can see just how the current Jupiter-Saturn square measures up against the effects of previous such alignments.

Hypothesis

My working hypothesis is that Jupiter-Saturn squares should be somewhat bearish. Since Saturn is a bearish planet by nature, its aspects with other planets including benefics like Jupiter will tend to depress the public mood which may have a knock-on effect in financial markets. The 90-degree square aspect also carries a certain amount of tension, although we should note that this is not the full-strength 10th house/270 degree square aspect as outlined in Vedic texts. According to Jyotish, Saturn’s forward 4th house/90 degree aspect is not as strong and hence less malefic in its effects.

In order to increase the number of cases in the study, I have also chosen to include all other “hard” aspects involving Jupiter and Saturn. Thus, the current study includes the conjunction (0 degrees), the semisquare (45 degrees), the forward square (90 degrees), the sesquisquare (135 degrees), the opposition (180 degrees), and the backward square (270 degrees). My rationale in grouping all these aspects together is that they all result in a conjunction in the D-8 Ashtamsa chart, also known as the 8th harmonic chart.

The D-8 chart carries overtones of unwanted outcomes as it has a nominal relationship with the dussthana 8th house. In Western astrology, the hard aspects are all multiples of 45 degrees (0/45/90/135/180) and are similarly seen as somewhat direct and unforgiving, although not always malefic. But hard aspects of Jupiter and Saturn would seem to bring challenging results more often than good results since the limiting influence of Saturn is seen to override whatever blessings that Jupiter can deliver. But that is very much based on an impressionistic and deductive reading of the texts and extant knowledge. We need to test these ideas with real data in order to better understand how these influences are operating.

Method

Using the Trading View database, I recorded the closing price of the Dow Jones Industrial Average for each “hard” Jupiter-Saturn aspect dating back to 1965. This produced a total of 61 cases. For each aspect, I also recorded the DJIA closing price at various intervals before and after the exact aspect. There were seven intervals for this study: 30 days before, 10 days before, 5 days before, 0 days (exact), 5 days after, 10 days after and 30 days after. These time intervals can be used to see when the strongest effects of the aspect appears — before the exact aspect, after the exact aspect, and when its effects dissipates. The commonly accepted Western view is that aspect effects are strongest in the days leading up to their exactitude and gradually fade thereafter. The Vedic view tends to be less precise as aspects are reckoned by whole sign houses rather than specific degree alignments.

In the raw data table below, each case includes the exact degree alignment and its attributes. Since Jupiter and Saturn both have long periods of retrograde motion, I have noted if the alignment occurred when either planet was retrograde. Thus Jupiter is retrograde is shown as JuR (or JR), Saturn retrograde as SaR (or SR), and where no planet is retrograde (i.e. both are in direct motion), no notation was given. I have also included consideration of the angular separation of Jupiter and Saturn since square and semisquare aspects can occur at different points in the 20-year synodic cycle of Jupiter and Saturn. Thus, “s1” stands for the first 45 degree segment of the 360 degree cycle at conjunction, “s2” stands for the second 45 degree segment of the cycle at the semisquare and so on.

The “expected” value is based on the long term average return of the stock market. While this figure can be calculated in several different ways, I have chosen 7.2% as the average annual return and divided it up accordingly based on the different time intervals. Thus, the first column shows a 30-day window as measured by taking the difference in closing prices of 30 days before the exact aspect up until the price of the day of the exact aspect itself. The average expected return of any 30-day window should be 0.6% (365/30=12; 7.2/12=0.6%).

Results

The first table offer only weak support for the bearish hypothesis. Of the 13 time intervals under consideration, 12 of them produced an average price change that was less than the expected value. On the face of it, this is confirmation of the bearish hypothesis that hard aspects between Jupiter and Saturn (and D-8 conjunctions) correlate with market underperformance. But it is quite obvious that the difference between the outcome and the expected value is very small -- usually less than 0.5%. And only four intervals delivered actual negative returns, although here again the negative results were very modest -- all were much less than -1%. Probably this effect is too small to be useful in market timing, and it likely doesn't qualify as statistically significant either, even if the underperformance does occur in 92% of the time intervals.

But if we break down the data, we can see a more intriguing pattern emerge. The attributes column shows which planets were retrograde for each alignment. Due to the lengthy retrograde cycles of both Jupiter and Saturn, aspects will often occur when one or the other -- or both -- is retrograde. Does this make a difference? Surprisingly, it does. When we analyze the cases when only Jupiter is retrograde (n=15), we see a more negative outcome for many of the time intervals. The narrow time intervals around the time of the exact aspect are the most negative, as the -5d to 5d interval yielded negative outcomes 93% of the time (14 out of 15) and produced an average outcome of -1.70%. The 20-day window from 10 days before to 10 days after was also quite negative with an average return of -1.82% although this interval only produced negative outcomes 60% of the time. The 10-day window immediately following the aspect (0 to 10d) was also very bearish with an average return of -1.52% with 73% cases yielding negative returns. These Jupiter Rx cases had more positive returns the further away from the date of the exact aspect, especially in the 30 days after the exact aspect.

Interestingly, the 27 aspects with Saturn retrograde were less bearish. In fact, these cases were actually modestly bullish for the intervals that were more focused on the days before the exact aspect. The time after the exact aspect tended to be more bearish as the last three columns yielded negative results. That said, none of the Saturn retrograde cases produced a majority of negative results.

The 17 cases involving no retrograde planets look unremarkable (not shown). There was a fairly even split between intervals that were both bullish and bearish relative to the expected value without any clear trend. Perhaps the separating aspects following the exact aspect were somewhat more bearish with the last four columns all showing negative average results and featured a slight majority of cases (53%) yielding negative outcomes.

Conclusions: Jupiter-Saturn aspects

This study suggests that some Jupiter-Saturn hard aspects may exert a modest bearish influence on investor sentiment. Key in this respect are the hard aspects where Jupiter is retrograde. In those cases, US stocks (DJIA) fell an average of almost 2% within a 10-day window that straddled the date of the exact aspect. While this is not a strong effect, it does seem fairly consistent across most of the cases.

And it is noteworthy is the upcoming Jupiter-Saturn square on December 24 will be characterized by the aforementioned Jupiter retrograde. This may increase the likelihood of declines in the 5 to 10 days preceding and following the exact alignment. A 5-day window on either side of the aspect would translate into Dec 19 to Dec 29. A 10-day window on either side would equate to Dec 14 to Jan 3.

At the same time, we can see some possible shortcomings to this study. Because of the relatively small number of cases involved, it is difficult to extrapolate the effect into the future with confidence. In fact, if we focus solely on previous 90 degree alignments of Jupiter and Saturn (n=13), the results are broadly in line with expected values and do not show any negative bias. In this subset, all retrograde combinations were included -- JuRx, SaRx, no Rx, and both Rx. While it is always possible to divide up in the data in various ways and come up with different conclusions, there is some reason to be cautious about assuming the bearish effects of the 90-degree Jupiter-Saturn alignments compared with the other hard aspects such as 0, 45, 135 and 180 degrees.

If the hard Jupiter-Saturn aspects (i.e. D-8 Jupiter-Saturn conjunctions) aren't as bearish as one might have thought, that is another reason why a full analysis needs to include consideration all other planetary aspects. For example, we know that that the large declines associated with the aspects in 2008-2009 and 2022 occurred as Uranus had also formed a hard aspect to the ongoing Jupiter-Saturn aspect. As I've written previously, single two-planet aspects only take us so far in accounting for market fluctuations. Co-factors in the form of other alignments are usually necessary to explain the larger outcomes, both positive and negative.

So are hard aspects involving Jupiter and Saturn bearish? I would say the data suggest there is a small negative effect but one that one that has limited usefulness. However, if other factors are present, then the bearish influence of Jupiter-Saturn increases. One of these factors is Jupiter in retrograde motion, although even here, the average decline is less than 2% over a 10-day window. Not really anything to get too excited about. Other simultaneous aspects can serve as more effective amplifiers.

Now let's see how the current Jupiter-Saturn square plays out in the days ahead. Will it follow the bearish Jupiter Rx script and if so, when will it reverse to a more bullish influence? And will the approaching 45 degree semisquare between Saturn and Pluto in January act as one such bearish amplifier for ongoing Jupiter-Saturn square?

.