(Synopsis: This analysis suggests the Venus retrograde station often signals a change in the prevailing stock market trend whereby prices reverse from negative to positive and to a lesser extent from positive to negative. Venus Rx station appears to have no effect if prices are not trending in any direction at the time of the station. This reversal phenomenon may be partially attributable to normal mean reversion, however.)

(19 February 2025) One of the most well-known dates in recent stock market history is March 6, 2009. On that date, the S&P 500 formed its Biblical intraday low of 666 in the midst of the Great Recession and sub-prime meltdown. Over the previous eighteen months, stocks had fallen by more than 50% as the economy faced up to the consequences of years of excessive lending in the housing market. March 6, 2009 marked the bottom of the bear market after which stocks rebounded sharply as the interventions from the Federal Reserve and the US government eventually took hold.

(19 February 2025) One of the most well-known dates in recent stock market history is March 6, 2009. On that date, the S&P 500 formed its Biblical intraday low of 666 in the midst of the Great Recession and sub-prime meltdown. Over the previous eighteen months, stocks had fallen by more than 50% as the economy faced up to the consequences of years of excessive lending in the housing market. March 6, 2009 marked the bottom of the bear market after which stocks rebounded sharply as the interventions from the Federal Reserve and the US government eventually took hold.

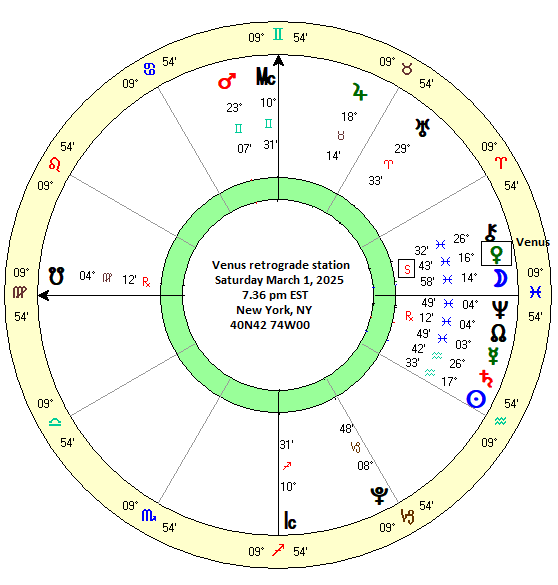

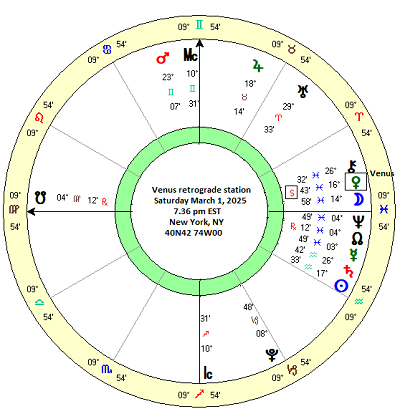

Another thing that happened on March 6, 2009 was that Venus turned retrograde. Venus goes retrograde about every 18 months or so when it appears to move backwards in the sky from our vantage point on Earth. The retrograde cycle lasts about 40 days as Venus traverses about 15 to 20 degrees of arc. But this historic stock market reversal in March 2009 raises the question: was this market bottom somehow related to Venus turning retrograde the exact same day? Did the change in direction of Venus from forwards to backwards correlate with a change in market direction from down to up? Or was it all just a one-off coincidence? While we can’t expect Venus retrograde to always signal a major turning point, the importance of the 2009 bear market bottom nonetheless suggests a possible correlation worthy of further study.

Venus Retrograde

Retrograde cycles have a bad rap in astrology. Planets are said to be weakened when they are in apparent backwards motion and can produce disappointing or unwanted outcomes. This is most closely associated with Mercury retrograde, but Venus retrograde also has a bad reputation through its association with delays in marriage, divorce and other divergent outcomes in the natal charts of individuals.

In financial astrology, the retrograde cycle of Venus also carries some element of caution. While normally a benefic planet that often pushes stocks higher, there is some uncertainty about its effects when it is retrograde. If it is retrograde, then Venus alignments may be less reliably bullish, even if they are not quite bearish. However, this question has not been studied systematically and thus there is no consensus about its influence. And with Venus due to turn retrograde on March 1, 2025, we have an opportunity to see in real time any fluctuations in the markets that may be attributed to the approach of this important retrograde cycle.

Method

Therefore, I thought it would be useful to leave behind the guesswork and deductive bias and examine the actual evidence. Using the 60-year Trading View database (1965-2025), I constructed a sample of 37 cases of the retrograde cycle of Venus. I recorded the closing price of the Dow Jones Industrial Average at various intervals both before and after the Venus retrograde station. The retrograde station is the moment that Venus reverses its normal forward motion and begins to move backwards. After approximately 40 days of retrograde motion, it stations direct and resumes its normal forward motion.

Prices were recorded at 5- and 10-day intervals depending on the proximity of the two stations. Thus, pre-Venus retrograde prices were recorded at 30 days before, 20 days before, 15 days before, 10 days before and 5 days before. To measure the post-retrograde station effect, prices 5 days after, 10 days after and 15 days after were recorded. A similar sequence of intervals were used for prices before and after the direct station of Venus. For this study, the “0-day” measurement at the retrograde and direct station was the first full day Venus was retrograde and direct. Thus, the famous March 6, 2009 bear market bottom case lists “7-Mar-09” as the 0-day inflection point from which other intervals were measured. Using the exact day of the retrograde and direct stations would also be an reasonable approach and would likely deliver very similar results. By comparing prices at various intervals for all 37 cases, we can reach a more accurate understanding of the effect of the retrograde and direct stations of Venus.

Hypothesis

Using the example of the March 2009 bear market low, one obvious idea worth testing is whether the Venus retrograde station is correlated with price trends reversals, especially if stocks have been falling before the retrograde station. Of course, the opposite may also be true: if prices have been rising into the Venus retrograde station, then they could reverse lower after the station. Due to my own uncertainty about the effects of the entire 40-day retrograde period, I did not have a strong expectation of the effects of this period. It is possible it could be somewhat bearish given the chequered reputation of retrograde periods in general.

I also considered the possibility that the period after Venus resumed direct motion would be more positive for markets. That would be easily tested by comparing prices at the time of the direct station with prices 30 days after the station. If the market was indeed bullish after the completion of the retrograde cycle, it should show up across these 37 cases. In a perfect world, we would have a larger sample size, since it is impossible to attain standard statistical significance with just 37 cases. And yet if an effect is consistent and large enough, it still might yield results that are useful, if not scientifically valid.

Results

At first glance, the results don't show any clear effect. Looking at the first two columns on the left hand side of the table of percentage differences that compare prices 5 days before the retrograde station with 5 days after the station, the cumulative average across all 37 cases is less than 0.1%. (The columns are labeled "-5d 0dr" and "0dr 5d" meaning price change from 5 days before the retrograde station and the "0" day(d) of the retrograde ("r") station. This suggests that for the shortest time interval (10 days total), the Venus retrograde station is not bearish or bullish. It's just neutral. It is a fairly similar story for other intervals.

Venus retrograde station

If we take the next two columns which show 10-days before and 10-days after (-10d 0dr; 0dr 10d) , there is a slight average bullish bias (0.53%) after Venus turns retrograde compared with a slight bearish bias before the retrograde station (-0.20%). The 15-day intervals (-15d 0dr; 0dr 15d) are similarly slightly bullish but nothing to write home about. Moreover, the number of positive results ("# pos") doesn't show much variation across different time intervals, either before or after the retrograde station. Certainly, there isn't a large enough effect before and after the retrograde station to justify a stand-alone trading strategy, especially given the small number of cases.

Verdict: weak effect (bullish)

40-day Venus retrograde period

What about the whole 40-day retrograde cycle? This result is displayed in the 7th column in the above table marked "RxS DS" meaning price difference between the retrograde station (RxS) and the direct station (DS). The cumulative average is 0.93% with 18 positive cases out of 37 total cases . This is very much in line with the expected value for this 40-day period which is about 0.8%, assuming a long term 7.2% average annual return. In other words, there is not much of an effect here. And with about half the cases being positive (18/37), it seems there is no bias one way or the other for the whole Venus retrograde period.

Verdict: no effect

Venus direct station

The time intervals focused around the direct station look similarly unremarkable, although perhaps there is a slight bullish bias since there are no cumulative negative averages. The last column (0dd 30d) measures the average price change from the time of the direct station until 30 days afterwards. This produced the most positive result with an average gain of 1.05% with 24 out of 37 cases finishing positive. Since the average gain for any 30-day period is 0.6%, this period after the direct station is a bit more bullish than expected. While this is not a strong correlation, it is worth further investigation.

Verdict: weak effect (bullish)

To sum up, this aggregate approach to the Venus retrograde cycle does not generate any strong correlations with price fluctuations in the stock market. Overall, it seems that Venus retrograde really isn't bullish or bearish at all. But one of the lessons of the March 6, 2009 bear market low was not just that stocks declined into the retrograde station but that they reversed higher thereafter. The price reversal scenario warrants a different analysis that divides the cases into smaller batches consisting of up trending and down trending markets. And that is what we have attempted to do in Part 2 of this study.