- Markets likely to move lower this week, and heading generally lower into first week of March

- Monday-Tuesday planetary symmetry may be wild card — possible big up or down

- Gold to continue rally, possibly to $1000 by Feb 20

- Crude oil to bounce back over $40

- Markets likely to move lower this week, and heading generally lower into first week of March

- Monday-Tuesday planetary symmetry may be wild card — possible big up or down

- Gold to continue rally, possibly to $1000 by Feb 20

- Crude oil to bounce back over $40

This week may see more downside probing as a very rare and symmetrical configuration involving no less than five planets dominates the sky on Monday and Tuesday. In addition to the Mars-Jupiter-Rahu conjunction at 15 degrees of Capricorn on Tuesday, Venus at 15 Pisces falls under the exact aspect Ketu at 15 Cancer on Monday. This is an unpredictable energy that could be expressed in different ways since Rahu and Ketu govern sudden and surprising events. Venus is a materialistic planet, so its involvement here could conceivably provide a sudden interest in buying stocks, but I would not bank on that outcome. The Moon joins the pattern during the trading day (EST) on Tuesday and forms a grand trine with Venus and Ketu. This configuration may increase the likelihood of a big percentage move Monday or Tuesday, although I am agnostic on the direction. Given the preponderance of negative energy, I would think it should push prices down, but the presence of both Venus and Jupiter with both nodes means that the potential for gains is still there. We will get another tense Mercury-Saturn 135 degree aspect likely manifesting Wednesday so that will take stocks lower. The previous Mercury-135-Saturn aspect in early January took the market down over 2%. This is even more likely to be negative because of the Moon square with Saturn during the trading day. So if the early week is down, then the Mercury-Saturn will be another significant drop. That seems to be a tall order of bearishness even for this market, so it’s possible that the early week may actually see a rally.

This week may see more downside probing as a very rare and symmetrical configuration involving no less than five planets dominates the sky on Monday and Tuesday. In addition to the Mars-Jupiter-Rahu conjunction at 15 degrees of Capricorn on Tuesday, Venus at 15 Pisces falls under the exact aspect Ketu at 15 Cancer on Monday. This is an unpredictable energy that could be expressed in different ways since Rahu and Ketu govern sudden and surprising events. Venus is a materialistic planet, so its involvement here could conceivably provide a sudden interest in buying stocks, but I would not bank on that outcome. The Moon joins the pattern during the trading day (EST) on Tuesday and forms a grand trine with Venus and Ketu. This configuration may increase the likelihood of a big percentage move Monday or Tuesday, although I am agnostic on the direction. Given the preponderance of negative energy, I would think it should push prices down, but the presence of both Venus and Jupiter with both nodes means that the potential for gains is still there. We will get another tense Mercury-Saturn 135 degree aspect likely manifesting Wednesday so that will take stocks lower. The previous Mercury-135-Saturn aspect in early January took the market down over 2%. This is even more likely to be negative because of the Moon square with Saturn during the trading day. So if the early week is down, then the Mercury-Saturn will be another significant drop. That seems to be a tall order of bearishness even for this market, so it’s possible that the early week may actually see a rally.

While I am holding out the possibility for a big one day gain early on, I think the most likely scenario is for another major down week, possibly retesting the November lows. I remain bearish in my outlook here as stocks are unlikely to lift significantly while under the shadow of this difficult lunar eclipse and the approaching Venus retrograde cycle. We could see some significant lows formed next week, possibly on Friday the 27th, or alternatively around March 8 and the Sun-Saturn opposition, or around April 4 and the Mars-Saturn opposition.

Trading Outlook: If we do see some kind of sudden rally Monday or Tuesday, then that would be a reasonable shorting opportunity given the proximity of the Mercury-Saturn aspect midweek and continued bearishness next week. Any rallies that pop up between significant sell offs will be shortable, with fairly quick turnaround times of a week or two. Investors looking to take longer term long positions should wait until the first week of March at the earliest. Given the possibility of lower lows until early April, long positions should be taken cautiously, by averaging in.

Stocks in Mumbai rallied on optimism that government stimulus would kick start the economy and normalize lending. Friday’s rally put markets firmly in the green overall as the Nifty closed at 2948 and the Sensex at 9634, which was largely in keeping with expectations. Certainly, Indian markets fared better than most as they have moved closer to the top end of recent trading ranges. Unlike the case in New York, the approaching Mars-Jupiter-Rahu conjunction seems to have had a positive effect on Mumbai, perhaps due to the fact that Jupiter was in close harmonic aspect with the ascendant of the NSE chart.

With the budget coming down Monday, it’s perhaps fitting that the sky should feature an extremely rare and powerful five-planet configuration at that time. Mars is conjoining Rahu and Jupiter near 15 degrees of Capricorn while money-loving Venus (15 Pisces) will be in exact aspect with mysterious Ketu (15 Cancer). This may indicate that the budget may contain some surprises. The presence of both nodes in this symmetrical pattern opens the door for a possible large move in either direction, although I think the most likely outcome is a decline. Nonetheless, given that Jupiter has not moved very far from its favourable position last week from the NSE ascendant, investors need to be prepared for the possibility of a sudden rally in the early week. Nonetheless, there will likely be some downward pressure by Wednesday or Thursday at the latest as Mercury forms a difficult aspect with Saturn. Overall, we should be negative, although if there’s a budget rally, that may keep the indices close to their current levels. A more likely outcome is for the Nifty to once again move towards 2850, with further downside likely next week, which seems more decidedly negative.

With the budget coming down Monday, it’s perhaps fitting that the sky should feature an extremely rare and powerful five-planet configuration at that time. Mars is conjoining Rahu and Jupiter near 15 degrees of Capricorn while money-loving Venus (15 Pisces) will be in exact aspect with mysterious Ketu (15 Cancer). This may indicate that the budget may contain some surprises. The presence of both nodes in this symmetrical pattern opens the door for a possible large move in either direction, although I think the most likely outcome is a decline. Nonetheless, given that Jupiter has not moved very far from its favourable position last week from the NSE ascendant, investors need to be prepared for the possibility of a sudden rally in the early week. Nonetheless, there will likely be some downward pressure by Wednesday or Thursday at the latest as Mercury forms a difficult aspect with Saturn. Overall, we should be negative, although if there’s a budget rally, that may keep the indices close to their current levels. A more likely outcome is for the Nifty to once again move towards 2850, with further downside likely next week, which seems more decidedly negative.

So Nifty 3150 looks unattainable for the time being, and even in the event of a one-day rally early on, we are unlikely to see it climb much above 3050. With the negative scenario more likely particularly into next week, I expect Indian markets may retest January lows (Nifty 2700) as soon as Feb 27 or Mar 2. Markets will likely move sideways or retest lows until mid-April when a stronger rally will ensue on transiting Jupiter’s aspect to the natal Mercury in the NSE chart. This looks like a very strong rally that should move indices by 10% over a one- or two-week period.

Trading Outlook: If we see an early week rally, then it may be worthwhile taking a short position. If the rally does not arrive and we go straight down, investors may have to wait until after approximately March 8 to take any long positions, and even then, they should be small and speculative. Investors seeking an entry point for an extended long position may consider waiting until early April in advance of the Jupiter rally.

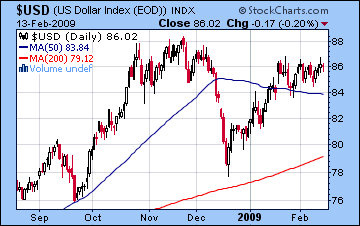

The US dollar rose 1% last week on continued worries about the effectiveness of the US bailout and the financial prospects for 2009. The USDX closed above 86 as it moved closer to its previous November highs above 88. I was somewhat off in my timing for the dollar rally as I expected more of it to come this week, but the dollar is on track to make another run at its late 2008 highs. The USDX chart looks quite strong again this week with Jupiter building into to aspect its natal position in the coming days. Wednesday may see a pullback however, as Mars will conjoin the natal Jupiter while Sun is in square aspect to the natal Saturn. Friday may also see a weakening of the dollar which will continue into early next week. Overall, the week may finish above current levels, especially if the early week sees continued dollar strength. The Euro slumped back to 1.28 this week with the growing sense that the ECB will have to cut rates to address the depths of the slowdown in Europe. This week looks mixed as Mars afflicts the natal Uranus in the early going, opening the possibility of sudden declines, perhaps to 1.27. But with Jupiter approaching the natal Uranus in the Euro chart, there will be a return towards 1.30 by next week. However, it is likely to fall below current levels in the first week of March. The Rupee closed modestly lower last week at 48.6. Any gains achieved early this week will likely be short-lived, and it will fall towards 49 by late next week.

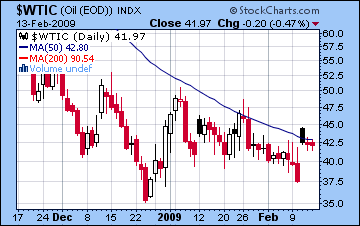

The US dollar rose 1% last week on continued worries about the effectiveness of the US bailout and the financial prospects for 2009. The USDX closed above 86 as it moved closer to its previous November highs above 88. I was somewhat off in my timing for the dollar rally as I expected more of it to come this week, but the dollar is on track to make another run at its late 2008 highs. The USDX chart looks quite strong again this week with Jupiter building into to aspect its natal position in the coming days. Wednesday may see a pullback however, as Mars will conjoin the natal Jupiter while Sun is in square aspect to the natal Saturn. Friday may also see a weakening of the dollar which will continue into early next week. Overall, the week may finish above current levels, especially if the early week sees continued dollar strength. The Euro slumped back to 1.28 this week with the growing sense that the ECB will have to cut rates to address the depths of the slowdown in Europe. This week looks mixed as Mars afflicts the natal Uranus in the early going, opening the possibility of sudden declines, perhaps to 1.27. But with Jupiter approaching the natal Uranus in the Euro chart, there will be a return towards 1.30 by next week. However, it is likely to fall below current levels in the first week of March. The Rupee closed modestly lower last week at 48.6. Any gains achieved early this week will likely be short-lived, and it will fall towards 49 by late next week. With demand expectations collapsing and supply gluts in the offing, crude oil fell sharply last week trading under $35 on Thursday and closed at $37. While I am still bearish on crude, I frankly missed this decline, as I forecast a rally on the more positive Venus aspect in the Futures chart. This aspect should finally be felt early this week, so we can expect a comeback to $40, or perhaps even a little higher. Transiting Venus will conjoin the Futures natal Sun and then move under the benefic aspect of natal Jupiter Tuesday and Wednesday. Some weakening is likely later in the week as Mars is in a difficult aspect with natal Venus on Friday. While the slowing Venus will be positive for the crude Futures chart, it is unlikely to rally prices anytime soon. Its station in early March occurs just one degree from the natal Mercury at 20 Pisces. The difficulty is that Mars will conjoin the 9th house cusp around this time, and will prevent any substantial rally from occurring. At this point, there is significant affliction in the chart for the second week of March that could possibly mark an interim low in crude.

With demand expectations collapsing and supply gluts in the offing, crude oil fell sharply last week trading under $35 on Thursday and closed at $37. While I am still bearish on crude, I frankly missed this decline, as I forecast a rally on the more positive Venus aspect in the Futures chart. This aspect should finally be felt early this week, so we can expect a comeback to $40, or perhaps even a little higher. Transiting Venus will conjoin the Futures natal Sun and then move under the benefic aspect of natal Jupiter Tuesday and Wednesday. Some weakening is likely later in the week as Mars is in a difficult aspect with natal Venus on Friday. While the slowing Venus will be positive for the crude Futures chart, it is unlikely to rally prices anytime soon. Its station in early March occurs just one degree from the natal Mercury at 20 Pisces. The difficulty is that Mars will conjoin the 9th house cusp around this time, and will prevent any substantial rally from occurring. At this point, there is significant affliction in the chart for the second week of March that could possibly mark an interim low in crude.

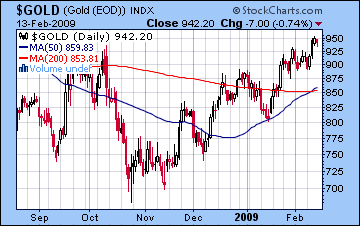

Amidst the fall in US stocks, gold continued its safe haven rally as it traded above $950 for the first time in months before settling at $942 on Friday. This is in keeping with our revised bullish outlook on gold. There appears to be more upside this week as the GLD chart features a number of favourable transit hits to the natal Jupiter. Tr. Jupiter is closing in on a trine aspect to its natal position while tr. Mars will fall under the same aspect. While Mars is a malefic planet, I don’t expect its presence there to bring down prices since Mars generally works well with Jupiter’s energy. Additionally, the transiting Sun aspects the ascendant this week and tr. Venus will aspect the natal Jupiter. Given the combined strength of these aspects, it is possible that we will see gold hit $1000 this week. Wednesday or Thursday this week looks less positive as Mercury comes under the aspect of the natal Mars. While gold will likely make another large gain next Monday Feb 23 with Mercury conjoining Jupiter in aspect to the natal Jupiter, the rest of next week looks more negative.

Amidst the fall in US stocks, gold continued its safe haven rally as it traded above $950 for the first time in months before settling at $942 on Friday. This is in keeping with our revised bullish outlook on gold. There appears to be more upside this week as the GLD chart features a number of favourable transit hits to the natal Jupiter. Tr. Jupiter is closing in on a trine aspect to its natal position while tr. Mars will fall under the same aspect. While Mars is a malefic planet, I don’t expect its presence there to bring down prices since Mars generally works well with Jupiter’s energy. Additionally, the transiting Sun aspects the ascendant this week and tr. Venus will aspect the natal Jupiter. Given the combined strength of these aspects, it is possible that we will see gold hit $1000 this week. Wednesday or Thursday this week looks less positive as Mercury comes under the aspect of the natal Mars. While gold will likely make another large gain next Monday Feb 23 with Mercury conjoining Jupiter in aspect to the natal Jupiter, the rest of next week looks more negative.