- Maintain overall bearish stance until mid-December

- Probable retest of Dow 8000/SPX 840 Monday

- Possible retest of Sensex 8500/Nifty 2525 Tuesday

- Midweek rally begins and may last until end of November

- Gold likely to move significantly higher

- Maintain overall bearish stance until mid-December

- Probable retest of Dow 8000/SPX 840 Monday

- Possible retest of Sensex 8500/Nifty 2525 Tuesday

- Midweek rally begins and may last until end of November

- Gold likely to move significantly higher

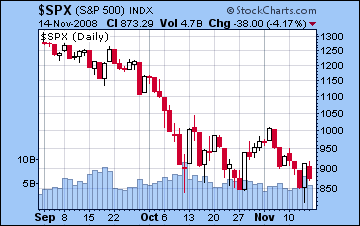

Given the continuing bearish mood, a retest of 8000 on the Dow and 840 on the SPX is probable early in the week. Monday is shaping up quite negatively as Mercury comes under the influence of Saturn. This looks like it will be a more convincing down day, so investors may have more time to trade near or below retest levels than they had on Thursday. Tuesday is shaping up as a possible reversal day. A down open is possible here but sentiment may improve through the day. Once the Moon moves past its conjunction with Ketu in the early afternoon, the market may be headed higher. As the week progresses, I am expecting more positive sentiment to take hold with the approach of the Jupiter-Saturn aspect. Thursday and Friday look most bullish as the Moon enters Venus-ruled Purva Phalguni in time for Thursday’s session in New York.

Given the continuing bearish mood, a retest of 8000 on the Dow and 840 on the SPX is probable early in the week. Monday is shaping up quite negatively as Mercury comes under the influence of Saturn. This looks like it will be a more convincing down day, so investors may have more time to trade near or below retest levels than they had on Thursday. Tuesday is shaping up as a possible reversal day. A down open is possible here but sentiment may improve through the day. Once the Moon moves past its conjunction with Ketu in the early afternoon, the market may be headed higher. As the week progresses, I am expecting more positive sentiment to take hold with the approach of the Jupiter-Saturn aspect. Thursday and Friday look most bullish as the Moon enters Venus-ruled Purva Phalguni in time for Thursday’s session in New York.

Overall, markets are still tentative here as most participants are not convinced the bottom has been reached. Once another retest of Dow 8000 has been completed early week, I believe there will be an attempt to rally that may last until late November, or perhaps even the first days of December. Assuming this week’s lows are fairly close to Dow 8000, there is a chance that the rally may push prices up 15-20%, perhaps to Dow 9500 and SPX 1000. Look for another sharp move down in December, however, as a very negative alignment will form around Saturn and Neptune at that time. Saturn will provide an extra layer of pessimism to the mix by virtue of being near its retrograde station. Moreover, Sun and Mars will contribute additional energy to this negative configuration. At this point, there is a very good chance that the lows set then will be significantly lower than those set this week, and will constitute a successful retest of the 2002-2003 lows of 7500/800. I will provide more specific timing details for the low as we move closer to it.

Possible Trading Strategies: The Monday/Tuesday lows will present a good opportunity to cover outstanding shorts for those traders who do not wish to wait until December. While I am not certain the December lows will be lower, I do think it will be an excellent trading opportunity. More active traders may wish to cover shorts early this week, and then short the late November rally in anticipation of more declines in December. We may consider 9000/960 and 9500/1020 as possible shorting thresholds. More active investors may consider taking modest long positions Monday or Tuesday. Given this rally may be marked by a lot of volatility, investors may do well to cover quickly and be content with modest gains. Investors seeking longer term long positions should wait until after the mid-December lows have been reached.

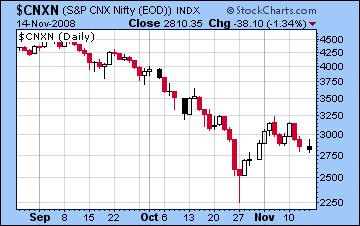

Stocks in Mumbai succumbed to the gloomy global mood as markets declined over 5% last week. Despite a strong rally Monday that pushed both indices above major psychological levels, the Sensex ended trading Friday at 9385 while the Nifty stood at 2810. While my forecast last week did not account for this decline, the silver lining was that I erred on the downside which was in keeping with our overall bearish stance. Look for a difficult start to the week as Mercury comes under Saturn’s negative influence on Monday. We can look forward to a significant decline in the range of 5% at least. Tuesday’s trading looks worse, however, as the Moon approaches malefic Ketu. Tuesday afternoon looks like it may be the intraday low. It is possible that markets could retest the closing lows of 27 October (8500/2525). As Mercury finally moves out of Libra and away from Saturn’s malefic influence on Wednesday, markets may have the necessary energy to move higher. This positive development will be further bolstered by Jupiter’s growing influence on Saturn by Friday. Since Saturn represents fear and pessimism, Jupiter’s optimism can offset Saturn’s tendency towards contraction and loss. Friday looks very bullish and will likely be the high for the week.

A modest rally is likely between this week’s low and late November/early December. Nifty 3000-3200 is possible at some point, although I am not certain that it will reach these levels. The lows we see this week may well be taken out by a significant mid-December decline that will form around a tense aspect between a stationary Saturn and Neptune. Just how low the markets will fall is uncertain. There is the potential for a rapid decline similar in scope to what we saw in October. As a worse case scenario, I would not rule out 2000 on the Nifty and 6500 on the Sensex, although 2200-2400 is more likely.

A modest rally is likely between this week’s low and late November/early December. Nifty 3000-3200 is possible at some point, although I am not certain that it will reach these levels. The lows we see this week may well be taken out by a significant mid-December decline that will form around a tense aspect between a stationary Saturn and Neptune. Just how low the markets will fall is uncertain. There is the potential for a rapid decline similar in scope to what we saw in October. As a worse case scenario, I would not rule out 2000 on the Nifty and 6500 on the Sensex, although 2200-2400 is more likely.

Possible Trading Strategies: The best opportunity to cover outstanding shorts for the next few weeks will occur Monday and especially Tuesday. As per our basic outlook, investors should consider shorting rallies above Sensex 10,000/Nifty 3000 with an eye on December’s coming swoon. It’s possible that the rally may not be that strong since next week looks very mixed. Investors taking any long positions in this market should be prepared to cover them fairly quickly and be content with modest gains. Those seeking longer term long positions should wait until after the mid-December lows have been reached.

The US dollar rose against most world currencies this week as economic fears drove investors to safe havens. The Euro fell back to 1.26 and we can expect more weakness in the early going but look for a strong rally by the end of the week as transiting Venus conjoins the natal Sun in the Euro chart. A rally above 1.30 is in the cards here but by December, we can expect to see the Euro trade below 1.20, perhaps well below as Saturn will station opposite natal Jupiter. The Rupee also fared poorly last week and slid back to 48.8. This week should see it improve to 48.0 by Friday with 47 possible over the next week or so. December may be difficult for the Rupee, however, as it will likely get sideswiped by the return to a more tumultuous financial environment. A return to the 50-52 range is very likely then.

Crude oil plunged below $60 last week on recession worries and opens Monday at $57. We can look for some more weakness in the early going as the transiting Sun and Mercury are close to the 6th house cusp of the Futures chart. $55 is very likely, but there is a risk of falling closer to $50. I think crude will largely return to current levels by week’s end. It’s hard to see a lot of upside to crude in the coming days or weeks. With transiting Ketu bearing down on the natal Jupiter, crude seems destined to fall further in December, perhaps to $40.

On the strength of Friday’s 7% rise, Gold managed to eke out a modest gain last week and opens Monday at $742. Now that the Sun has moved out of Libra its sign of debilitation, gold has a greater chance to move higher. We can look forward to more gains in gold this week, although some pullback is likely early in the week. Look for significant gains on Thursday and Friday. I think $800 is well within reach over the next week or two. The rally in gold is likely to fall apart as we move into December, however, and a retesting of the $650 support level is very possible.