- Pullback in stocks likely this week on Mars-Uranus conjunction

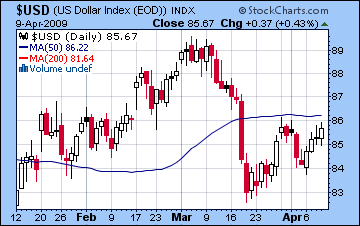

- Dollar may rally strongly back to 89

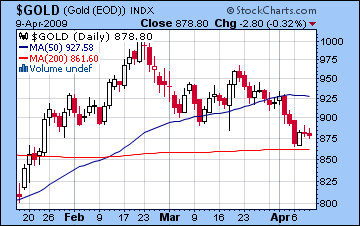

- Gold up early then down late in the week

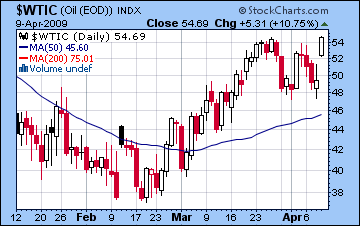

- Crude oil likely to fall back below $48

- Pullback in stocks likely this week on Mars-Uranus conjunction

- Dollar may rally strongly back to 89

- Gold up early then down late in the week

- Crude oil likely to fall back below $48

At the risk of sounding repetitive, this week also looks bearish, although given the recent tenacity of the bulls, we need to be aware of possible snap back rallies that may again occur late in the week. While the Uranus ingress into Pisces did not produce much of anything, there may be another opportunity for its energies to be expressed. On Wednesday, malefic Mars will conjoin Uranus in the first degree of Pisces, so this is another potential triggering factor for Uranus, and indeed for the larger Mars-Saturn-Uranus alignment. The effects may be felt as soon as Monday, however, as the Moon will be debilitated in Scorpio and will therefore form a t-square with Saturn and Mars. The total energy available for Monday gets an additional boost by the ingress of the Sun into Aries, its sign of exaltation. With Mars entering Pisces on Tuesday and then conjoining Uranus the following day, there is a potential for another move down. The resiliency of this bull run should caution us against expecting too much on the down side, so we may only once again move to the bottom of the current upward price channel, possibly around 7700/810. That said, I would not rule out a larger decline here. There is a chance for some bounce back at the end of the week as Mercury will trine Saturn on Friday. However, this is much less promising than last Thursday’s alignment since the Moon is with Rahu. My sense is any bounce will be smaller than what we saw Thursday so that we should end the week below current levels.

At the risk of sounding repetitive, this week also looks bearish, although given the recent tenacity of the bulls, we need to be aware of possible snap back rallies that may again occur late in the week. While the Uranus ingress into Pisces did not produce much of anything, there may be another opportunity for its energies to be expressed. On Wednesday, malefic Mars will conjoin Uranus in the first degree of Pisces, so this is another potential triggering factor for Uranus, and indeed for the larger Mars-Saturn-Uranus alignment. The effects may be felt as soon as Monday, however, as the Moon will be debilitated in Scorpio and will therefore form a t-square with Saturn and Mars. The total energy available for Monday gets an additional boost by the ingress of the Sun into Aries, its sign of exaltation. With Mars entering Pisces on Tuesday and then conjoining Uranus the following day, there is a potential for another move down. The resiliency of this bull run should caution us against expecting too much on the down side, so we may only once again move to the bottom of the current upward price channel, possibly around 7700/810. That said, I would not rule out a larger decline here. There is a chance for some bounce back at the end of the week as Mercury will trine Saturn on Friday. However, this is much less promising than last Thursday’s alignment since the Moon is with Rahu. My sense is any bounce will be smaller than what we saw Thursday so that we should end the week below current levels.

The markets have advanced a long way in a hurry so it’s entirely predictable that some kind of retracement is likely over the coming weeks. The planets confirm this view as we will likely see choppier trading in the next few weeks as Saturn moves into the 22nd degree of Leo, which is where it will finally station on May 16. Interestingly, this is the same degree it was in at the beginning of the market meltdown in late September and early October. Of course, we can’t make too much of this, since other planets have moved from their positions and astrology is ultimately about the interrelationship of planetary positions, if nothing else. But Saturn’s return to the same place as the October decline still means that it will be activating any significant points at 21-22 Leo in the relevant natal charts of the various exchanges and stock indexes around the world. I believe this will make it difficult for stocks to rise much further above current levels and it will also increase the likelihood of greater pullbacks. Another interesting development will occur April 17 when Venus ends its retrograde cycle and returns to direct forward motion. Given that the rally began very soon after Venus began its retrograde cycle on March 6, the culmination of this cycle is another possible sign that we are entering a new market phase.

More immediately, if we do finally see some decline this week, next week may be more positive, particularly between April 22-24. April 27-28 looks negative given the Mars-Ketu-Pluto aspect so that may take us down again, but by May 1 or May 4, another big up day is possible as Venus aspects both Ketu and Pluto. Perhaps a more significant bearish signal will be the approaching Mercury retrograde period which begins May 7 and lasts until May 31. In keeping with its symbolism, a backwards Mercury is often implicated in retracement moves, and here it is more likely to be a negative influence because it will begin its retrograde cycle under the aspect of shadowy Rahu. A similar Mercury retrograde-Rahu aspect occurred in late May 2008 and was correlated with the decline that lasted through June and part of July. Overall, I think a retracement down to 7200-7500/750-780 is very possible over the next several weeks before we move higher into the summer.

Last week stocks in Mumbai rose further as the bulls stampeded for another 3% gain in a holiday-shortened trading week. At Thursday’s close, the Nifty stood at 3342 and the Sensex at 10,803. These gains were frustrating given my bearish assessment of the Mars-Saturn-Uranus pattern. The failure of the market to correct on cue, however, does not negate the pessimistic energy that is contained within this formation, but rather focuses our attention on correctly identifying the necessary trigger factor. Clearly, Uranus’ entry into Pisces was not enough to release the pent up bearishness as the approaching Sun-Mars-Jupiter alignment took precedence. The big up move on Wednesday was not entirely unexpected given this positive energy available for later in the week.

Certainly, this market is overdue for a correction. This week again appears to hold sufficient negative energy to produce a pullback. This time the trigger is likely to be Mars, which conjoins Uranus on Wednesday. The sell off may well begin before the conjunction is exact, since these two planets are less than two degrees away by Monday. On Tuesday, the Sun enters Aries, its sign of exaltation. While this may provide some positive support for government- or gold-related shares, it is important to note that Mars rules Aries and it will be entering watery and weakening Pisces early on Wednesday. This may limit the upside for those companies that are symbolized by the Sun. This simultaneous shift in signs is also likely to increase volatility in the markets generally as traders will be responding to increased amounts of assertive energy. Besides the transit patterns, Ketu is forming a close aspect with the natal Saturn in the Nifty Options chart while Rahu is close to that natal ascendant. This is very often a negative influence. Until recently, this chart was being supported by Jupiter’s aspect to the natal Jupiter and this was one of the key ingredients for the rally. That aspect begins to separate this week, however, so it is only a matter of days before there is a significant shift in planetary energy. This may well arrive as soon as Monday, but given the strength of the rally, we need to be cautious about predicting a quick and definitive reversal. So I would expect Monday as being possible, but Wednesday at the latest. Some upside is also possible here late week, as Friday will feature an aspect between Mercury and Saturn. Thursday the aspect will be somewhat less exact but the Moon’s mutual trine aspect may be sufficient glue to bring the two planets together.

Certainly, this market is overdue for a correction. This week again appears to hold sufficient negative energy to produce a pullback. This time the trigger is likely to be Mars, which conjoins Uranus on Wednesday. The sell off may well begin before the conjunction is exact, since these two planets are less than two degrees away by Monday. On Tuesday, the Sun enters Aries, its sign of exaltation. While this may provide some positive support for government- or gold-related shares, it is important to note that Mars rules Aries and it will be entering watery and weakening Pisces early on Wednesday. This may limit the upside for those companies that are symbolized by the Sun. This simultaneous shift in signs is also likely to increase volatility in the markets generally as traders will be responding to increased amounts of assertive energy. Besides the transit patterns, Ketu is forming a close aspect with the natal Saturn in the Nifty Options chart while Rahu is close to that natal ascendant. This is very often a negative influence. Until recently, this chart was being supported by Jupiter’s aspect to the natal Jupiter and this was one of the key ingredients for the rally. That aspect begins to separate this week, however, so it is only a matter of days before there is a significant shift in planetary energy. This may well arrive as soon as Monday, but given the strength of the rally, we need to be cautious about predicting a quick and definitive reversal. So I would expect Monday as being possible, but Wednesday at the latest. Some upside is also possible here late week, as Friday will feature an aspect between Mercury and Saturn. Thursday the aspect will be somewhat less exact but the Moon’s mutual trine aspect may be sufficient glue to bring the two planets together.

We are likely entering a period of price consolidation over the next few weeks as some investors take profits in advance of the next move upward. With Venus returning to its normal forward motion on April 18, this is another clue that we may be on the verge of entering a new phase in this bullish run. It is noteworthy that the rally began around the same time as Venus turned retrograde on March 6. The completion of this backwards cycle for Venus may indicate that the time of fast gains has come to a close. Even if we see a pullback this week to 3200/10,300, next week will likely see the bulls return, although this looks more concentrated to later in the week. More weakness seems likely in the following week (Apr 27 – May 1) as malefic Mars forms an alignment with Ketu and Pluto. Some gains are likely when Jupiter enters Aquarius on May 1, especially in the hi-tech sector which is governed by Aquarius. The week of May 4 – 8 may be bearish as Mercury begins its retrograde cycle (lasting until May 31) and it will be in aspect with unpredictable Rahu. The month of May appears to have an added burden since Saturn will end its retrograde cycle on May 16. The beginning and ending of Saturn’s retrograde cycles sometimes correlate with changes in market trends. The top in early January coincided with the beginning of Saturn’s retrograde cycle. So a 50% retracement from this week’s highs to the early March lows would be equal to about Nifty 2950 and Sensex 9500. This level is quite possible by mid-May but we also cannot rule out a deeper retracement. I will reassess this possibility after watching next week play out.

In keeping with expectations, the dollar rose last week closing near 86 although much of the gain was at the expense of the Euro. The Sun transit to the natal ascendant did prove helpful as it turned out, as the Mars-Saturn opposition in hard aspect to the ascendant did not cause any significant weakening. We could be on the verge of a big move up in the dollar this week or next as Venus will station exactly on the part of fortune/punya saham in the natal chart and will closely trine the Sun-Saturn conjunction in the first house. This may produce a move close to its March highs near 89. Friday may be the worst day for the dollar as the Mercury-Saturn trine will activate the malefic 6th house cusp.

In keeping with expectations, the dollar rose last week closing near 86 although much of the gain was at the expense of the Euro. The Sun transit to the natal ascendant did prove helpful as it turned out, as the Mars-Saturn opposition in hard aspect to the ascendant did not cause any significant weakening. We could be on the verge of a big move up in the dollar this week or next as Venus will station exactly on the part of fortune/punya saham in the natal chart and will closely trine the Sun-Saturn conjunction in the first house. This may produce a move close to its March highs near 89. Friday may be the worst day for the dollar as the Mercury-Saturn trine will activate the malefic 6th house cusp.

The Euro fell back last week under 1.32 on economic and banking fears. The Euro looks like it will continue to weaken here as the Sun’s entry into Aries will soon produce a negative conjunction with natal Saturn. The Mars-Uranus conjunction on the natal Jupiter also foretells a lot of energy this week, but it seems uncontrollable rather than effervescent. As Jupiter moves to conjoins the natal Ketu in the Euro chart in the next couple of weeks, I think we could see it fall back under 1.30 and indeed, go all the way back to 1.25. That would be an extreme result, but it is within the realm of possibility. The Indian Rupee stubbornly held onto recent gains last week as it closed below 50 for the second straight week. Although buoyed by the recent rally in stocks in Mumbai, it seems unlikely that it will withstand the flight to the dollar this week.

After slipping under $50 early last week, crude mounted an explosive rally Thursday which took it back to its current resistance levels of $54. Crude did in fact trade briefly below $48 as expected on the Mercury-Mars conjunction, but Thursday’s rally was surprising. Certainly, I anticipated some late week gains on the Sun-Mars-Jupiter alignment, but I thought it would not return to last week’s highs. Once again, the extent of bullish sentiment for crude (and stocks) has caught me off guard. The approach of Jupiter’s aspect to the ascendant in the Futures chart is one important source of renewed confidence in oil prices.

After slipping under $50 early last week, crude mounted an explosive rally Thursday which took it back to its current resistance levels of $54. Crude did in fact trade briefly below $48 as expected on the Mercury-Mars conjunction, but Thursday’s rally was surprising. Certainly, I anticipated some late week gains on the Sun-Mars-Jupiter alignment, but I thought it would not return to last week’s highs. Once again, the extent of bullish sentiment for crude (and stocks) has caught me off guard. The approach of Jupiter’s aspect to the ascendant in the Futures chart is one important source of renewed confidence in oil prices.

This week looks negative for the most part as the Sun will conjoin the natal Mars in early Aries. The early part of the week may see more strength, as Monday’s Moon will contact the natal Jupiter. At the same time, Mars will conjoin the Mercury in the ETF chart, so that’s a wash at best. It’s probably not enough of an influence to push prices much higher, but at least it may prevent a larger drop. Later in the week looks weaker as Mars moves nearer to stationary Venus in early Pisces. This conjunction will form a square with the Ketu/Neptune aspect in the Futures chart. This aspect will be closest on Friday and next Monday the 20th and will likely correspond with a significant price move. Given the presence of Mars, it seems most likely that this move will be down. I think by next Monday, crude will be below $48. There’s probably support around $40, so that may be the next stop over the coming two or three weeks. Before we get there, some gains are likely towards the end of next week which may move up crude 10%.

Gold continued to decline last week as Wednesday’s rally failed to reverse the trend and it closed at $878. While I had expected weakness on both Sun and Mercury’s transit to the Futures natal Saturn, prices did not fall very far overall thanks to the Moon’s transit of natal Jupiter during trading hours on Wednesday afternoon.

Gold continued to decline last week as Wednesday’s rally failed to reverse the trend and it closed at $878. While I had expected weakness on both Sun and Mercury’s transit to the Futures natal Saturn, prices did not fall very far overall thanks to the Moon’s transit of natal Jupiter during trading hours on Wednesday afternoon.

This week may see some bounce in gold as the Sun will aspect the natal Venus in the ETF chart Monday and Tuesday, with Tuesday looking to be the more positive of the two as the Moon will transit the ascendant. The overall trend is somewhat harder to figure, however, as there are conflicting energies at play here. On the bulllish side, Venus is stationing exactly on the equal 4th house cusp on Friday so this could conceivably improve sentiment for gold for several days on either side of the station. On the other hand, Mars (1 Pisces) will be aspecting the natal Venus (1 Libra) Wednesday and Thursday. This Mars influence is unlikely to support prices and may be take them down. An additional bearish factor is the transiting Sun coming under the aspect of natal Saturn in the ETF chart on Thursday and Friday. Perhaps we will see some major moves in both directions this week with the end of the week more bearish. Some gains are more likely at the end of April and the beginning of May as Jupiter enters Aquarius.