- Early week correction in stocks likely as Mars conjoins Venus

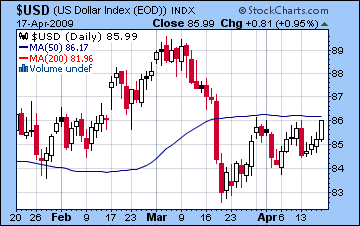

- Dollar may rally strongly back to 89

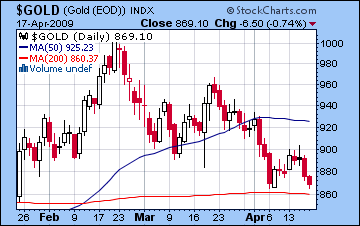

- Gold likely to stay weak

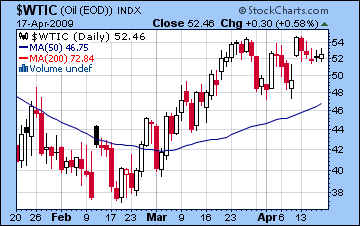

- Crude oil likely to fall back below $50

- Early week correction in stocks likely as Mars conjoins Venus

- Dollar may rally strongly back to 89

- Gold likely to stay weak

- Crude oil likely to fall back below $50

Like last week, this week looks mixed at best, and again we can make the bearish case. The early week looks most negative as malefic Mars applies towards Venus while the Moon is in Aquarius opposite Saturn. While it’s possible Monday may start higher, the whole picture for the day looks mostly negative which will likely continue into Tuesday. Wednesday will be an important test for the market because Mars will have passed Venus and the Moon will join them in Pisces. This looks fairly positive. In addition, Mercury is forming a square with Jupiter on that day, so we could see some gains there which may extend into Thursday and even into Friday. However, the Sun forms an alignment with malefics Pluto and Ketu, the South Lunar Node which could limit or even reverse any morning budding rallies on those days. By the end of the week, the Moon joins the Sun in Aries for the New Moon on Friday. At the same time, the Sun will square the nodes on Friday, which can be a signal for an unbalanced market, or one that is lacking in confidence and looking for direction. Possible lows this week are 7700/830, while late week highs could match current levels. Failure to fully recover to this week’s highs would be seen by many as evidence that the rally has run its course and that the market is beginning a significant retracement down.

Like last week, this week looks mixed at best, and again we can make the bearish case. The early week looks most negative as malefic Mars applies towards Venus while the Moon is in Aquarius opposite Saturn. While it’s possible Monday may start higher, the whole picture for the day looks mostly negative which will likely continue into Tuesday. Wednesday will be an important test for the market because Mars will have passed Venus and the Moon will join them in Pisces. This looks fairly positive. In addition, Mercury is forming a square with Jupiter on that day, so we could see some gains there which may extend into Thursday and even into Friday. However, the Sun forms an alignment with malefics Pluto and Ketu, the South Lunar Node which could limit or even reverse any morning budding rallies on those days. By the end of the week, the Moon joins the Sun in Aries for the New Moon on Friday. At the same time, the Sun will square the nodes on Friday, which can be a signal for an unbalanced market, or one that is lacking in confidence and looking for direction. Possible lows this week are 7700/830, while late week highs could match current levels. Failure to fully recover to this week’s highs would be seen by many as evidence that the rally has run its course and that the market is beginning a significant retracement down.

One key determinant in ending this rally is the effect of the planetary pattern on Monday, April 27 when Mars forms a triangular pattern with Ketu and Pluto. This has a greater likelihood of pushing markets down around that date and may break support of some key technical measurements. Stocks will likely bounce later on in that week but appear poised to drop again the week of May 4-8, when Mercury turns retrograde. So next week’s action may yet offer another chance for the bulls to feed off the optimism of the Jupiter-Neptune aspect and resume the rally in advance of the Mercury retrograde cycle (May 6-31). At this point, I think it’s possible they will succeed to take it to new highs next week, but not probable. If this week’s decline surprises on the down side, then it may be too high a hill to climb back up.

On Friday April 24, the New Moon occurs at 11 degrees of Aries. This is a useful indicator for trading in the coming four weeks. This chart features a square aspect between the Sun/Moon and the nodes, Rahu and Ketu. This pattern is generally unfavourable since the nodes combining with the Sun and Moon often weaken or distort their core meanings such as confidence and mental and emotional stability. Mercury, the planet of trading, is poorly placed off the angles in the first degree of Taurus in a tense square aspect with Jupiter and Neptune. Mercury is in a more favourable position with eccentric Uranus, so this can indicate many quick changes in direction and large price moves in both directions. Generally speaking, I think this chart supports the notion of a significant retracement through much of May. If the current highs remain in place, a 50% retracement off the March 6 lows would put us at 7400 on the Dow and 770 on the SPX. A deeper retracement is possible, but given the bullishness that is out there, it is hard to be sure that can happen. Let’s see where we are at the end of this week and at the start of the Mercury retrograde cycle on May 6. The medium term outlook remains bullish as Jupiter will turn retrograde in June and will again cross over some of the the same degrees (24-28 Capricorn) it transited during this rally. This is another clue that stocks could be in a position to move higher after June. The fall still looks very bearish, however, with the approaching Saturn-Uranus opposition and Saturn-Pluto square, so we may well see the March 6 lows taken out by the end of the year.

Stocks in Mumbai extended their phenomenal rally last week, albeit on a modest 1-2% rise. After peaking on Wednesday above 11,300, the Sensex closed Friday at 11,023 while the Nifty stood at 3384. As strong as this rally has been, it does show signs of weakening. Thursday saw some heavy profit taking, while Friday’s session could not hold onto midday gains and finished barely in the green. My bearish forecast was again incorrect, as the Mars-Uranus conjunction failed to take the markets down. Perhaps Mumbai enjoyed the benefit of its Tuesday holiday closure which allowed it to escape the prevailing negative sentiment ahead of the conjunction. Some of the patterns in the relevant natal charts finally started to manifest negatively later in the week, as the nodal affliction in the Futures chart started to bite and the Saturn aspect to Rahu in the NSE chart appears to finally be taking root. Both of these chart afflictions involve slower moving planets, so identifying exact dates is more difficult.

This week will likely begin bearishly as Mars moves into conjunction with Venus. With the Moon transiting Aquarius opposite pessimistic Saturn on Monday and Tuesday, there could be a prevailing sense of caution that will be inimical to extending the rally. Indeed, a pullback is a more likely outcome. While I would certainly welcome a large correction here, I have been sufficiently chastened by the recent run-up not to expect too much on the downside. The planets appear to improve by Wednesday on the Mercury-Jupiter aspect and the Moon entering Pisces to join Mars and Venus. If the market fails to rally here, then that is a more bearish indicator and increases the likelihood that the trend may have reversed. Gains are also more likely later in the week as Mars moves away from Venus. Even here, however, the optimism could be tempered by the approach of the square aspect between the Sun and the nodes, Rahu and Ketu. This introduces a certain amount of investor uncertainty that may undermine the strength of any rallies.

This week will likely begin bearishly as Mars moves into conjunction with Venus. With the Moon transiting Aquarius opposite pessimistic Saturn on Monday and Tuesday, there could be a prevailing sense of caution that will be inimical to extending the rally. Indeed, a pullback is a more likely outcome. While I would certainly welcome a large correction here, I have been sufficiently chastened by the recent run-up not to expect too much on the downside. The planets appear to improve by Wednesday on the Mercury-Jupiter aspect and the Moon entering Pisces to join Mars and Venus. If the market fails to rally here, then that is a more bearish indicator and increases the likelihood that the trend may have reversed. Gains are also more likely later in the week as Mars moves away from Venus. Even here, however, the optimism could be tempered by the approach of the square aspect between the Sun and the nodes, Rahu and Ketu. This introduces a certain amount of investor uncertainty that may undermine the strength of any rallies.

The current upward trend is getting very close to reversing down. We are likely within 5% of the top. If we see a sizable decline early in the week particularly into Wednesday, then it’s conceivable that the market will not be able to rally back to its highs of April 16. Choppiness will likely characterize the market for the next two weeks as pullbacks may be larger now, but they may still be followed by significant gains. The week following (May 27 – May 1) is also likely begin bearishly on the Mars-Ketu-Pluto aspect on the 27-28th after which some gains are likely. It’s really only the week of May 4-8 that looks more solidly bearish as Mercury turns retrograde. A 50% retracement is very possible through May which would take the Nifty down to 3000 and the Sensex to 9700. A deeper retracement is also possible but let’s wait and see where the market is before Mercury turns retrograde. If it’s already turned significantly lower by that date, then we may look forward to a deeper correction in the coming weeks. As before, I believe we are in a larger bull phase that should last until the late summer. By September, the market will likely turn sharply lower on the Saturn-Uranus opposition and then the Saturn-Pluto square. There is a very good chance the market will test the 2008 lows before the end of the year.

The US dollar rose slightly last week after recovering from an early week decline. We had expected somewhat larger gains so the tepid performance was somewhat disappointing but Friday’s rally nonetheless occurred on the day of the Venus direct station on the part of fortune, in trine aspect to the Sun-Saturn conjunction. Monday’s sell off was perhaps more puzzling although it did coincide with Mercury’s entanglement with the natal Rahu in the index chart. This week the dollar looks bullish as Mars joins Venus in trine with Sun-Saturn. I do think it can go back to the 89-90 area in the near term.

The US dollar rose slightly last week after recovering from an early week decline. We had expected somewhat larger gains so the tepid performance was somewhat disappointing but Friday’s rally nonetheless occurred on the day of the Venus direct station on the part of fortune, in trine aspect to the Sun-Saturn conjunction. Monday’s sell off was perhaps more puzzling although it did coincide with Mercury’s entanglement with the natal Rahu in the index chart. This week the dollar looks bullish as Mars joins Venus in trine with Sun-Saturn. I do think it can go back to the 89-90 area in the near term.

As predicted, the Euro fell last week and closed barely above 1.30. The Sun transit to the natal Saturn late in the week came off more or less according to expectations. This week Mars conjoins Venus on the descendant of the Euro chart. While this is not a textbook bearish combination, the presence of Jupiter close to natal Ketu would tend to tip the scale towards a pessimistic reading of the heavy 7th house emphasis. The Sun is still in early Aries close to Saturn and in square aspect to Neptune early in the week. This would suggest more weakness for the Euro, so we could see a close under 1.30. 1.25 is very possible over the next two or three weeks. The Indian Rupee was largely unchanged on the week as it remained below 50. As the dollar gathers strength this week and next, it should weaken and move above 50.

Crude oil eased off last week as it closed at $52. This was mostly in keeping with our forecast, although the early part of the week turned out to be more bearish than expected while the rest of the week was somewhat more positive. The large decline Monday was a clear corroboration of the ETF chart as the Mars-Uranus conjunction set up exactly on the natal Mercury. Friday’s rally attempt perhaps reflected the Mercury aspect to the natal Jupiter, again in the ETF chart. Mercury was also still in close conjunction with benefic Venus in the Futures chart so that may also have played a role in the relative buoyancy of prices at the end of the week.

Crude oil eased off last week as it closed at $52. This was mostly in keeping with our forecast, although the early part of the week turned out to be more bearish than expected while the rest of the week was somewhat more positive. The large decline Monday was a clear corroboration of the ETF chart as the Mars-Uranus conjunction set up exactly on the natal Mercury. Friday’s rally attempt perhaps reflected the Mercury aspect to the natal Jupiter, again in the ETF chart. Mercury was also still in close conjunction with benefic Venus in the Futures chart so that may also have played a role in the relative buoyancy of prices at the end of the week.

The early part of this week looks negative as Mars will aspect the natal Rahu in the Futures chart. Interestingly, Mars will also square the natal Mars in the ETF chart, so that increases the likelihood of a significant pullback in crude on Monday and Tuesday. It may well trade under $50 then. Some recovery is possible later in the week, but crude looks like it will move lower here. Transiting Ketu conjoins the Saturn in the ETF chart for the next week or two, and that is a bearish influence. On Monday April 27, Mars will conjoin the natal Rahu as part of a larger malefic configuration. It is possible that crude will retrace back to $40 where it gets support from an upward price channel based on the recent lows of $35 in December and $38 in March.

In keeping with expectations, gold slipped further last week as it closed at $869. After Monday’s rally failed, bullion tumbled the rest of the week, although fairly modestly. The early week strength was reflected closely in the Sun’s transit to the ETF natal Venus. The Mars transit to the natal Venus also proved bearish as we thought it might. The sell off Friday coincided nicely with the Sun coming under the aspect of malefic Saturn in the ETF chart.

In keeping with expectations, gold slipped further last week as it closed at $869. After Monday’s rally failed, bullion tumbled the rest of the week, although fairly modestly. The early week strength was reflected closely in the Sun’s transit to the ETF natal Venus. The Mars transit to the natal Venus also proved bearish as we thought it might. The sell off Friday coincided nicely with the Sun coming under the aspect of malefic Saturn in the ETF chart.

With Mars conjoining the 4th house cusp of the ETF chart, this week also looks difficult for gold. In addition, the Sun will meet up with the natal Rahu early in the week. The late week seems more bullish as Mercury and Jupiter move into a favourable alignment with the Midheaven. With the nodes squaring the natal Mars, however, I’m not sure gold can move higher this week. As Jupiter moves into closer aspect with natal Venus, gold should get a lift, probably after April 27th and going into the first week of May.