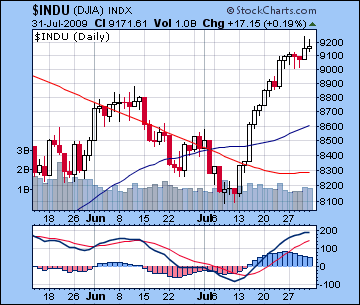

- Stocks likely to rise further this week; but rally will end very soon

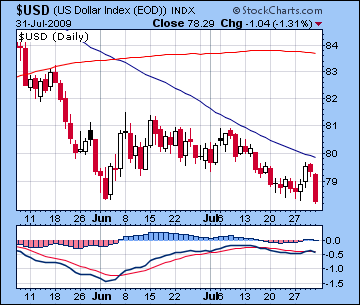

- Dollar to retest June lows below 78

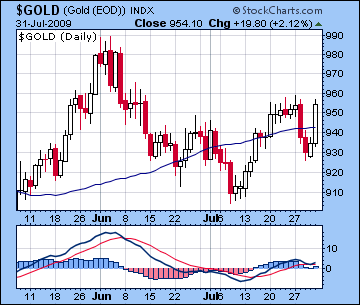

- Gold will move higher towards June highs

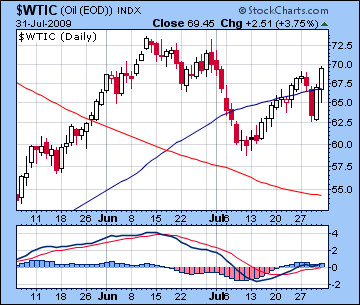

- Crude rally to continue as it moves above $70

- Stocks likely to rise further this week; but rally will end very soon

- Dollar to retest June lows below 78

- Gold will move higher towards June highs

- Crude rally to continue as it moves above $70

The technical picture has not changed significantly from last week as MACD remains positive, albeit with some leveling of the short term moving averages. On the bearish side, volume has been fairly consistent and undistinguished while the Relative Strength Index is now getting very close to 70 — a potential sign of topping and imminent reversal. The indexes are running up against some key levels of resistance here dating back to November which would tend to reduce the amount of upside potential here. The S&P topped out at 1010 in November 2008 on that first post-crash bounce (with the Dow at 9600) so it seems unlikely that the market can punch through that this week, or indeed perhaps at all this month. I had previously wondered if this rally could go as high as SPX 1100, but the failure of last week’s favourable planetary aspects to produce much more upside has reduced the chances of that kind of significant upward move. It’s still conceivable, but increasingly unlikely now. Forecasting levels is perhaps the most difficult task in financial astrology, so levels are best understood as a moving target that need to be re-calibrated with the passing of each new week.

This week we will see the third and final eclipse in this series as a lunar eclipse will occur at 19 degrees of sidereal Capricorn on Wednesday the 5th after the close of trading. While eclipses are not exact timers, they often signal uncertainty and an impending change in the status quo. Along with retrograde Jupiter’s entry into Capricorn last Friday, this eclipse is another cosmic indicator that the current rally is on its last legs. Nonetheless, with benefics Mercury and Venus moving into sextile aspect by Friday, this week has a reasonable chance for further upside. Monday is something of a conundrum given a bearish Mercury-Rahu-Pluto aspect that coincides with a bullish Moon-Venus aspect. While I think the bullish scenario will prevail here, I want to acknowledge the possibility that the Mercury affliction could carry the day. If Monday is higher, then Tuesday is likely to be down as the Moon approaches destabilizing Rahu. The afternoon looks particularly vulnerable to profit taking. Eclipse day Wednesday seems neutral to bearish as the Moon stays in cautious Capricorn while Mercury forms a minor aspect with Saturn. Thursday should see optimism return as the Mercury-Venus aspect tightens and the Moon approaches Jupiter. Friday could go either way, since the Mercury-Venus aspect is quite tight, but the bearish Mars-Saturn square is fast coming exact early next week and it’s possible it could manifest early in a selloff. I would lean towards Friday being negative. Along with the positive Monday scenario, Thursday appears to be the most bullish day of the week. If Monday sees a gain as forecast, it is possible that Thursday could be a significant top for the market. As I’ve said before, I think the downside potential from now until the end of the year greatly outweighs any further upside we may see here in August.

This week we will see the third and final eclipse in this series as a lunar eclipse will occur at 19 degrees of sidereal Capricorn on Wednesday the 5th after the close of trading. While eclipses are not exact timers, they often signal uncertainty and an impending change in the status quo. Along with retrograde Jupiter’s entry into Capricorn last Friday, this eclipse is another cosmic indicator that the current rally is on its last legs. Nonetheless, with benefics Mercury and Venus moving into sextile aspect by Friday, this week has a reasonable chance for further upside. Monday is something of a conundrum given a bearish Mercury-Rahu-Pluto aspect that coincides with a bullish Moon-Venus aspect. While I think the bullish scenario will prevail here, I want to acknowledge the possibility that the Mercury affliction could carry the day. If Monday is higher, then Tuesday is likely to be down as the Moon approaches destabilizing Rahu. The afternoon looks particularly vulnerable to profit taking. Eclipse day Wednesday seems neutral to bearish as the Moon stays in cautious Capricorn while Mercury forms a minor aspect with Saturn. Thursday should see optimism return as the Mercury-Venus aspect tightens and the Moon approaches Jupiter. Friday could go either way, since the Mercury-Venus aspect is quite tight, but the bearish Mars-Saturn square is fast coming exact early next week and it’s possible it could manifest early in a selloff. I would lean towards Friday being negative. Along with the positive Monday scenario, Thursday appears to be the most bullish day of the week. If Monday sees a gain as forecast, it is possible that Thursday could be a significant top for the market. As I’ve said before, I think the downside potential from now until the end of the year greatly outweighs any further upside we may see here in August.

Next week (Aug 10-14) looks very bearish early on with the Mars-Saturn square. Depending on if we see a decline this Friday (Aug 7), Monday or Tuesday could see a big decline on the order of 2-4% in one day. This could completely change investor sentiment and increase the chances for the start of a negative trend. However, the end of that week looks quite positive so some kind of major rebound is likely by Friday. How high it bounces is difficult to say but it should be a significant rise (2-4%) above the lows set earlier in the week. It seems unlikely that it will match the highs we put in this week (or last week in case this week is less bullish than expected). The following week (Aug 17-21) features that portentous alignment of Mercury-Saturn-Jupiter along with Sun-Mars-Uranus and that will be the last chance for any more upside. Indeed, that alignment may well mark the beginning of the real decline as we move headlong into the Saturn-Uranus opposition in September. This period that we are about to enter may be very tumultuous both financially and geopolitically. Take all appropriate precautions with your investments and your assets. This could be quite scary.

5-day outlook — neutral-bullish

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — bearish

As prospects for an Asian recovery brightened, stocks in Mumbai moved ahead by a further 2% last week. After trading below 15,000 on Wednesday, the Sensex closed Friday at 15,670 while the Nifty finished at 4636. At one point during Friday’s session the Sensex made a new 2009 high as the rally tested resistance of the previous June highs. This bullish outcome was largely in keeping with expectations as the auspicious Mercury-Jupiter aspect delivered higher prices more or less on schedule later in the week. I had expected bigger moves early in the week with the Venus-Jupiter aspect coinciding with a Mercury-Saturn influence but these aspects offset each other and the market was largely flat. Wednesday was negative which represented a delay in the Mercury-Jupiter influence, although the intraday low occurred near noon and this allowed for a strong gain in the afternoon which continued well into Friday. I had expected more weakness Friday, although it is interesting that we did see significant selling once the European markets opened. Overall, the the June highs were largely matched in the Nifty and actually exceeded on the Sensex. Despite recent gains, there is still a large amount of overhead resistance in many stocks and it may be difficult for the market to make any moves higher. Until the Nifty confirms the new highs on the Sensex, the market may be quite choppy. Nonetheless, MACD is still quite positive and the 50-day moving average is still rising, both solid indicators of a bullish orientation. But while the technical indicators seem favourable for a continuation of this rally perhaps as high as 5000-5250, the astrological indicators are much less supportive. In fact, it seems increasingly unlikely that we will see 5000 on the Nifty.

This week features the third and last eclipse in the current series as a lunar eclipse occurs before trading on Thursday the 6th. While we can’t rely on eclipses to tell us exactly when the markets will go up or down, they are very useful general indicators of increased uncertainty and interruptions in the status quo. Along with entry of Jupiter into Capricorn, its sign of debilitation last Friday, the triple eclipse here in late July and early August are cosmic markers of an imminent move down. That said, the strength of the Mercury-Venus aspect this week may actually take us a little higher before sentiment turns more definitively sour. Monday could be negative as Mercury forms an aspect with both Rahu and Pluto. Watch for a significant recovery on Tuesday, however, as the Moon approaches Jupiter, with the greatest strength in the morning. Wednesday is harder to predict, although I would assume a bullish bias on the approach of Mercury-Venus. We could see a possible intraday high around midday on Wednesday as the Moon forms a nice alignment with both Mercury and Venus. Thursday seems quite bullish, although the morning may be bearish in the aftermath of the lunar eclipse. Friday could go either way, but a large move is possible here. I would be cautious about long positions here since the Moon will be in Aquarius opposite Saturn at this time. In addition, Mars will be moving towards its bearish aspect with Saturn so that could be enough to overturn any bullish energy that is prevailing up to that point. So it’s likely we will see the market trade above current levels at some point this week, although I’m less certain that it will close higher overall for the week.

This week features the third and last eclipse in the current series as a lunar eclipse occurs before trading on Thursday the 6th. While we can’t rely on eclipses to tell us exactly when the markets will go up or down, they are very useful general indicators of increased uncertainty and interruptions in the status quo. Along with entry of Jupiter into Capricorn, its sign of debilitation last Friday, the triple eclipse here in late July and early August are cosmic markers of an imminent move down. That said, the strength of the Mercury-Venus aspect this week may actually take us a little higher before sentiment turns more definitively sour. Monday could be negative as Mercury forms an aspect with both Rahu and Pluto. Watch for a significant recovery on Tuesday, however, as the Moon approaches Jupiter, with the greatest strength in the morning. Wednesday is harder to predict, although I would assume a bullish bias on the approach of Mercury-Venus. We could see a possible intraday high around midday on Wednesday as the Moon forms a nice alignment with both Mercury and Venus. Thursday seems quite bullish, although the morning may be bearish in the aftermath of the lunar eclipse. Friday could go either way, but a large move is possible here. I would be cautious about long positions here since the Moon will be in Aquarius opposite Saturn at this time. In addition, Mars will be moving towards its bearish aspect with Saturn so that could be enough to overturn any bullish energy that is prevailing up to that point. So it’s likely we will see the market trade above current levels at some point this week, although I’m less certain that it will close higher overall for the week.

Next week (Aug 10-14) looks very bearish to begin with as Mars squares Saturn. This negative energy will be doubly bearish for Indian markets because it will occur just three degrees from the ascendant of the NSE natal chart. While some substantial bounce is probable by Friday, it’s unclear if the market will finish next week near this week’s closing levels. There is a good chance that Friday’s rally will fail to reach the market highs. The following week (Aug 17-21) looks very volatile indeed as the multi-planet alignment of Mercury-Jupiter-Saturn and Sun-Mars-Uranus occurs on the 17-18th. This is an extremely powerful pattern that could very well break the ongoing rally decisively on the downside. While it looks quite bearish, investors should allow for big moves in both directions around that time, with the possibility of bearish fallout occurring afterwards. This configuration will mark a major disruption in the market direction and indeed, in the financial world as a whole. Investors should take appropriate defensive measures to protect their capital and assets as we move deeper into this period of turbulence starting in mid to late August. We will likely revisit the state of high anxiety that characterized much of 2008 as we move deeper into September and the Saturn-Uranus opposition. This will coincide with a very nasty looking Mercury retrograde cycle which begins 6 September.

5-day outlook — neutral-bullish

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — bearish-neutral

As expected, the US dollar fell last week as risk appetite increased and investors went in search of greater yields. The dollar closed barely above 78 and sits precariously at its June lows. We saw some strength on Tuesday and Wednesday in the aftermath of the Venus-Jupiter aspect. But Friday saw a huge plunge as the Sun squared the natal nodes in the index chart while Mars approached the ascendant. MACD continues to occupy a grey neutral area here as the dollar remains below its 50-day moving average. While this is could be a bullish double-bottom pattern, I don’t see the dollar moving higher just yet. In fact, we may see it probe below 78 as Mars aspects the Mercury-Uranus in the natal chart early in the week. Actually the early week has both positive and negative elements so I would not rule out a possible down day followed by a strong up day. Wednesday looks fairly positive as the Moon conjoins the natal Jupiter opposite the Sun. Thursday may be negative, but some upward movement is likely on Friday as the Sun trines the natal ascendant. Next week looks positive for Monday or Tuesday on the Mars-Saturn square but the rally may not extend very far. As uninspired as the dollar chart looks right now, early this week will go a long way in determining if the current technical levels (USDX=78) are going to hold.

As expected, the US dollar fell last week as risk appetite increased and investors went in search of greater yields. The dollar closed barely above 78 and sits precariously at its June lows. We saw some strength on Tuesday and Wednesday in the aftermath of the Venus-Jupiter aspect. But Friday saw a huge plunge as the Sun squared the natal nodes in the index chart while Mars approached the ascendant. MACD continues to occupy a grey neutral area here as the dollar remains below its 50-day moving average. While this is could be a bullish double-bottom pattern, I don’t see the dollar moving higher just yet. In fact, we may see it probe below 78 as Mars aspects the Mercury-Uranus in the natal chart early in the week. Actually the early week has both positive and negative elements so I would not rule out a possible down day followed by a strong up day. Wednesday looks fairly positive as the Moon conjoins the natal Jupiter opposite the Sun. Thursday may be negative, but some upward movement is likely on Friday as the Sun trines the natal ascendant. Next week looks positive for Monday or Tuesday on the Mars-Saturn square but the rally may not extend very far. As uninspired as the dollar chart looks right now, early this week will go a long way in determining if the current technical levels (USDX=78) are going to hold.

After some midweek selling, the Euro rallied to close slightly higher last week as it traded at 1.425. This was largely in keeping with expectations, although I had thought we could see more upside. As it happened, the midweek did in fact see declines on the Venus-Saturn aspect while the rally at the end of the week coincided nicely with Venus conjoining the natal Midheaven. The Euro looks more mixed this week, although I would retain an upward bias given the transit of Venus in the 10th house. Monday and Tuesday could see a large move as Sun aspects natal Uranus. While we could see the Euro drift higher this week perhaps above 1.43, early next week will likely produce a sharp decline as the Mars-Saturn square will set up on the natal Mercury. I would not be surprised to see a 1-2% move down at that time. The Indian Rupee rallied last week below 48 to close at 47.8. This week also should see further gains as it edges closer to 47.

Dollar

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — bullish

1-year outlook — bullish

Crude oil extended its recent rally last week as it closed above $69. I thought it might break above $70 but the aftermath of the Venus-Jupiter aspect saw a major pullback midweek. I had expected some kind of to occur early in the week so this was a little wide of the mark. Happily, the Mercury-Jupiter aspect Thursday put crude back in favour with a huge two-day gain. This was a perfect validation of the crude Futures chart as Venus conjoined natal Rahu while Sun trined Uranus and Mercury trined Mars. Crude remains in a fairly positive technical position as MACD is moderately bullish and the price has once again moved above the 50-day moving average. With Jupiter (29 Capricorn) now exactly aspecting the ascendant in the Futures chart ( 29 Taurus), crude is likely very close to its interim high here. As Jupiter moves backwards into Capricorn, its positive aspect will gradually lose power to move prices higher and it will be increasingly vulnerable to correction.

Crude oil extended its recent rally last week as it closed above $69. I thought it might break above $70 but the aftermath of the Venus-Jupiter aspect saw a major pullback midweek. I had expected some kind of to occur early in the week so this was a little wide of the mark. Happily, the Mercury-Jupiter aspect Thursday put crude back in favour with a huge two-day gain. This was a perfect validation of the crude Futures chart as Venus conjoined natal Rahu while Sun trined Uranus and Mercury trined Mars. Crude remains in a fairly positive technical position as MACD is moderately bullish and the price has once again moved above the 50-day moving average. With Jupiter (29 Capricorn) now exactly aspecting the ascendant in the Futures chart ( 29 Taurus), crude is likely very close to its interim high here. As Jupiter moves backwards into Capricorn, its positive aspect will gradually lose power to move prices higher and it will be increasingly vulnerable to correction.

This week looks fairly positive but there is a good chance for a big down day or two. Monday should be positive and move it over $70 as the Sun trines natal Jupiter while Venus trines the Moon-Saturn conjunction. There is a possibility of profit taking Tuesday and Wednesday but Thursday looks very strong as Moon will conjoin Jupiter in a near perfect trine to the natal ascendant. Friday is a toss-up with some selling possible ahead of the Mars-Saturn square. This aspect is likely to be quite devastating to the price of crude because it will occur close to the ascendant. So if crude trades in the $70-72 range this week and even tests the June highs, there is a possibility of a sudden fall early next week. If it’s a big enough drop, it will eliminate the possibility of new highs in crude in 2009. The late week bounce around the 14th is likely to be quite strong but may not bring crude back to this week’s highs.

5-day outlook — bullish

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — bearish-neutral

After a crushing selloff to $930 earlier in the week, gold edged higher to close at $954 on Friday. While I had been more bullish, I did correctly note the possibility of a correction Tuesday and also noted the probable gain later in the week. The late week gain was very easy to see as transiting Venus aspected the ascendant while Mercury and Jupiter activated the natal Venus. Tuesday’s decline presents more of a puzzle, however, as there is a dearth of possible suspects there. Potential explanations might be the Sun had just passed a square with Mars, or Venus was semi-sextile to Saturn. Neither are particularly convincing but the fact remains that gold may be losing momentum. MACD is inconclusive although it is now trading above its rising 50-day moving average.

After a crushing selloff to $930 earlier in the week, gold edged higher to close at $954 on Friday. While I had been more bullish, I did correctly note the possibility of a correction Tuesday and also noted the probable gain later in the week. The late week gain was very easy to see as transiting Venus aspected the ascendant while Mercury and Jupiter activated the natal Venus. Tuesday’s decline presents more of a puzzle, however, as there is a dearth of possible suspects there. Potential explanations might be the Sun had just passed a square with Mars, or Venus was semi-sextile to Saturn. Neither are particularly convincing but the fact remains that gold may be losing momentum. MACD is inconclusive although it is now trading above its rising 50-day moving average.

Gold will likely move higher early this week but be prone to selling as we get closer to Friday. Monday sees Venus in aspect with natal Uranus while Sun is sextile natal Jupiter. Between those two aspects, there should be enough positive energy to move gold to $960 and beyond. Gold may even drift towards $980 its June high by Thursday. I’m not certain about Friday, however, as Mars is in tense aspect with natal Mercury. This has the potential to move prices down significantly although it may well wait until the following Monday, the 10th. Assuming Monday is higher, gold has a chance of reaching $980 this week. Next week will be very volatile with a big drop early on followed by another big rise late in the week. September and October will be very unkind to gold as transiting Ketu conjoins natal Saturn, and transiting Saturn aspects the natal Sun. We could see gold fall all the way back below $800, maybe lower.

5-day outlook — bullish

30-day outlook — bearish

90-day outlook — bearish

1-year outlook — neutral