- Significant downside risk until first week of January

- neutral outlook this week

- continuation of narrow trading range — Dow 8400-9000/SPX 860-930

- Nifty trading between 2950-3150/Sensex 9800-10,500

- Gold will fall to $820

- Significant downside risk until first week of January

- neutral outlook this week

- continuation of narrow trading range — Dow 8400-9000/SPX 860-930

- Nifty trading between 2950-3150/Sensex 9800-10,500

- Gold will fall to $820

Trading volumes will likely be lower in this holiday-shortened week, but some sizable price moves are still possible, as there are some potentially significant planetary aspects. Monday could go either way as Mars is in close aspect to Jupiter. The negative side of Mars might be somewhat more likely to come out with the Moon squaring Rahu late in the day. Volatility may be greater Monday, with large swings towards the close. Tuesday looks more positive as Mercury and Venus are in close aspect. This uptrend will likely continue into Wednesday as both benefics are in aspect with Uranus. Wednesday is likely to be the high point for week, since Friday has the potential for a major sell off as the Moon conjoins Mars and Pluto and Mercury is in aspect with Saturn. The Friday decline may well offset the midweek gains, so if Monday is lower, then the week will likely be moderately lower overall, perhaps between Dow 8400-8600. If Monday closes higher, however, we may end between 8500-8800.

Trading volumes will likely be lower in this holiday-shortened week, but some sizable price moves are still possible, as there are some potentially significant planetary aspects. Monday could go either way as Mars is in close aspect to Jupiter. The negative side of Mars might be somewhat more likely to come out with the Moon squaring Rahu late in the day. Volatility may be greater Monday, with large swings towards the close. Tuesday looks more positive as Mercury and Venus are in close aspect. This uptrend will likely continue into Wednesday as both benefics are in aspect with Uranus. Wednesday is likely to be the high point for week, since Friday has the potential for a major sell off as the Moon conjoins Mars and Pluto and Mercury is in aspect with Saturn. The Friday decline may well offset the midweek gains, so if Monday is lower, then the week will likely be moderately lower overall, perhaps between Dow 8400-8600. If Monday closes higher, however, we may end between 8500-8800.

The market will likely break below Dow 8400 next week, possibly on Monday December 29 with the Mars-Pluto conjunction. I now believe the near term market low will occur sometime between Friday January 2 and Tuesday January 6 on the heels of the Saturn retrograde station. If the market goes below 8400 by Dec 29, then the low should be below 8100. The chances of a retest of Dow 7400 have risen somewhat but I would not say they are a probability at this point. Looking further into January, the rally off the lows should be rapid and the market will likely move higher until the Obama inauguration on January 20. Depending on what the early January lows are, we could see a decent rally to Dow 9700. After that there will be some kind of sell off, although another short leg up is possible until about February 10. February and March generally look more negative with a possible tradeable low around March 23.

Trading Outlook: Given the likelihood of more downside, investors might consider covering most their long positions that have a short term time horizon. A midweek rally would be the best time for closing out these long positions. Those wishing to keep long positions open can cover them in mid to late January. Some good shorting opportunities may occur if the market rises midweek towards 8800.

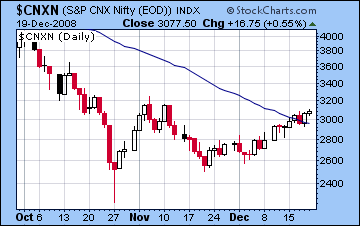

Stocks in Mumbai rallied 5% last week as the indices punched through key psychological levels and traded above the 50-day moving average. The Sensex closed at 10,099 and the Nifty at 3077. The Venus-Rahu conjunction did bring out buyers early in the week but the Mars transit to the NSE ascendant failed to cause declines but rather moved the market higher. Mumbai continues to outperform most global markets but it is running up against resistance at Nifty 3150. While I had thought we would be much lower by now, I am maintaining a generally bearish outlook until at least January 6th. The failure of stocks to sell off last week does not mean that the negative planetary energy of the Saturn-Neptune aspect has dissipated. It is still there waiting to be manifested in significantly lower prices. All it requires is the sufficient triggering energy of faster moving planets. These are now most likely to occur in the first week of January 2009.

This week looks neutral to modestly negative although much depends on Monday’s session. There are potentially offsetting energies at play Monday as the Moon transits the 11th house of the NSE chart but transiting Mercury falls under the disruptive influence of natal Ketu. The close aspect between Mars and Jupiter may make for large intraday price swings. Tuesday and Wednesday look more positive as Mercury aspects Venus. The Moon conjunction with the NSE Rahu on Tuesday morning may signal a significant intraday decline. Friday looks more clearly negative in advance of the Mars-Pluto conjunction. Around midday, the Moon squares Saturn, so that may give further impetus to selling pressure. Overall, I think the Nifty could move to 3000 by Friday if Monday’s session is even moderately negative.

This week looks neutral to modestly negative although much depends on Monday’s session. There are potentially offsetting energies at play Monday as the Moon transits the 11th house of the NSE chart but transiting Mercury falls under the disruptive influence of natal Ketu. The close aspect between Mars and Jupiter may make for large intraday price swings. Tuesday and Wednesday look more positive as Mercury aspects Venus. The Moon conjunction with the NSE Rahu on Tuesday morning may signal a significant intraday decline. Friday looks more clearly negative in advance of the Mars-Pluto conjunction. Around midday, the Moon squares Saturn, so that may give further impetus to selling pressure. Overall, I think the Nifty could move to 3000 by Friday if Monday’s session is even moderately negative.

Next week, we will likely see more declines as the Nifty will fall below 2850 as Mercury and Venus are in aspect to Saturn. A possible interim low may occur near January 5-8. Look for a strong rally soon after which could take the Nifty to 3500 or above by February 10. Mid-February looks decidedly negative with the conjunction of Mars, Jupiter, and Rahu so this may begin a significant new down trend in market indices through February and March. Watch for a possible low near March 23.

Trading outlook: Since we are expecting some significant downside over the next three weeks, short term long positions could be closed out this week, particularly during any midweek rise. Long positions with less time urgency can safely wait until late January for closing. New shorting opportunities will likely arise this week before the 24th.

The US dollar went into free fall last week as a result of the Federal Reserve’s unprecendented rate cut to zero. The Euro went into orbit and hit 1.45 by midweek before falling back to 1.39 by Friday. The rise came as a result of two simultaneous transits: Jupiter to the natal Venus in the Euro chart and Venus to the natal Uranus. The strength of these two transits completely overwhelmed negative energy of the Saturn-Mars square to the natal Mercury-Jupiter. I expect the US dollar to continue to strengthen this week and the Euro should fall back to 1.35. By January 2, the Euro should approach its support level of 1.25, if not below. The Rupee similarly gained strength last week on dollar weakness as it closed near 47. Some further strengthening is possible this week, but by Friday it may push it back down below 47.5. Next week looks more bearish for the Rupee.

Last week saw the collapse of crude oil resume as the January contract closed below $34 — a shocking 25% drop in one week. Much of the extreme bearishness can be attributed to transiting Saturn, now moving to its retrograde station, which is sitting just a couple of degrees from the 4th house cusp in the Futures chart. Crude is likely headed lower still this week as transiting Mars conjoins the natal Ketu while transiting Sun is aspected by natal Saturn. Even if Monday is positive, this will likely push crude below $30 for the January contract, or down to $40 for the February contract.

Gold is coming off a very volatile week where it traded above $880 midweek before crashing back to $837 by Friday’s close. I think gold is headed lower this week, although we may see a significant up day, most likely on Tuesday as transiting Venus conjoins the Moon in the GLD chart. By Friday, gold should be near $820. I expect gold to fall a lot further over the next few weeks.