- Probable early week rally followed by possible steep declines by Friday

- Markets heading for retest of 2008 lows by late February, early March

- Gold to continue rally, possibly to $1000 by Feb 13

- Crude oil trading neutral to bearish this week

- Probable early week rally followed by possible steep declines by Friday

- Markets heading for retest of 2008 lows by late February, early March

- Gold to continue rally, possibly to $1000 by Feb 13

- Crude oil trading neutral to bearish this week

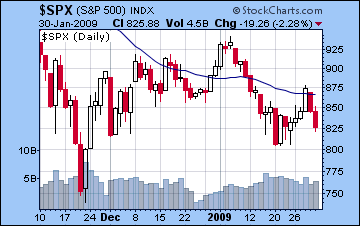

Stocks in New York were volatile last week rising into Wednesday on optimism about the government’s bad bank proposal only to fall below last week’s levels by Friday. The Dow once again fell below its 50-day moving average to 8000 and the SPX ended at 825. While I missed the timing of the rally, the market did end up fairly close to where it started the week. Monday’s Mercury-Mars conjunction was nowhere near as bearish as I feared and the market actually began rising, a trend that continued into Wednesday and the Sun-Rahu conjunction. In retrospect, the rally resulted from the connection between nakshatra lords in these key configurations. Mercury was conjunct with malefic Mars but it occurred in Uttarashada, which is ruled by the Sun. This became a more positive influence because the Sun was conjunct Jupiter and Rahu, two planets that together symbolize buying and speculative excess. I had expected some of that energy to manifest later in the week thinking that the Sun had to first clear Rahu’s influence, but Rahu turned out to be quite positive, presumably owing to its conjunction with Jupiter. Overall, the weak conclusion to January trading leaves the bear market very much intact here as we look ahead to February and the prospect of several difficult astrological alignments, not the least of which is the lunar eclipse of February 9.

This week upcoming looks generally difficult so the trend will likely continue to be down. Saturn will exactly oppose Uranus on Thursday and thereby provide a tense energy that will await a trigger from a faster-moving planet to release. The week may start off bullish as the Moon is in Aries and its ruler Mars is exalted in early Capricorn without an obvious affliction. The Moon continues its transit of Aries on Tuesday, so both days have the potential for gains. In addition, Moon will transit Venus-ruled Bharani Monday and with Venus exalted in Pisces right now, that may provide an extra lift. Wednesday may be somewhat negative as Venus enters its debilitated Virgo navamsa where it will remain the rest of the week. Thursday will feature the Saturn-Uranus aspect and with a potential trigger: the Moon forms a t-square shortly before the start of trading. Another possible trigger is the Venus-Pluto square that comes exact early Friday. This may begin to be felt on Thursday or we may have to wait until Friday for the full effect, but it is very likely to be a big down day when it decides to hit. Friday has the added difficulty of a Moon transit through Ardra which is considered one of the more negative nakshatras.

This week upcoming looks generally difficult so the trend will likely continue to be down. Saturn will exactly oppose Uranus on Thursday and thereby provide a tense energy that will await a trigger from a faster-moving planet to release. The week may start off bullish as the Moon is in Aries and its ruler Mars is exalted in early Capricorn without an obvious affliction. The Moon continues its transit of Aries on Tuesday, so both days have the potential for gains. In addition, Moon will transit Venus-ruled Bharani Monday and with Venus exalted in Pisces right now, that may provide an extra lift. Wednesday may be somewhat negative as Venus enters its debilitated Virgo navamsa where it will remain the rest of the week. Thursday will feature the Saturn-Uranus aspect and with a potential trigger: the Moon forms a t-square shortly before the start of trading. Another possible trigger is the Venus-Pluto square that comes exact early Friday. This may begin to be felt on Thursday or we may have to wait until Friday for the full effect, but it is very likely to be a big down day when it decides to hit. Friday has the added difficulty of a Moon transit through Ardra which is considered one of the more negative nakshatras.

Even with an early week rally, I think the action overall will likely push the market back down towards its recent support levels of 7900 Dow and 805 SPX. If the early week rally isn’t very strong and doesn’t take us back to Wednesday’s highs, then there’s a reasonable chance that even those support levels may be broken. The lunar eclipse of Feb 9 doesn’t look very bullish despite the Jupiter-Rahu conjunction. Once again the problem is Saturn, as it is in close quincunx aspect to the Sun. This will likely negatively influence the market for the balance of the month. I think the market will trend lower towards the end of February as it enters uncharted waters on the downside by March. Significantly, the Venus retrograde cycle begins March 6 and lasts until April 18. This is usually a negative influence, so it’s hard to see this market moving substantially higher until that cycle has been completed.

Trading Outlook: It’s hard to imagine any rallies to 930 now, so traders may want to take short positions on rallies closer to recent resistance levels of 850 or 875. If we see a rally Monday or Tuesday, a speculative short may be worthwhile, perhaps waiting until Tuesday to wait for the last possible highs before heading down into Thursday and Friday. Since I am expecting to break the November lows by March at the latest, short positions taken now maybe covered at that time. I would not consider keeping any long positions open for more than a day or two as the market will likely stay quite choppy until April. Shorts will have the luxury of staying open longer until the probable lows are made around late March.

Dalal Street rebounded last week on earnings optimism and the stabilization of the market after the Satyam scam. Major indices climbed 7% as the Sensex closed Friday at 9424 and the Nifty at 2874. Stocks performed better than forecast, mostly on the basis of Tuesday’s strong rally on the Mercury-Mars conjunction. While I did not preclude the possibility of a gain, I had expected more bearishness from Mars’ malefic energy. In the end, the energy of the conjunction in Uttarashada had a positive manifestation through the powerful condition of the Sun, the nakshatra lord. The Sun’s placement in Capricorn with Jupiter and Rahu was enough to transform the increase of energy into more buyers and a greater sense of risk taking. Friday was higher as expected on the comfort offered by the Moon-Venus conjunction in Pisces. As heartening as the rally was, however, it is very unlikely to change the basic dynamic in this bear market.

This week may see the bears take control as the Saturn-Uranus opposition comes exact on Thursday. Some early week gains are probable as the Moon transits Aries, thus giving greater initiative for investors taking positions. With Aries ruler Mars exalted in Capricorn, there’s a good chance that buyers will rule the day Monday and possibly Tuesday. One complicating factor to Monday’s session is that the Moon will transit Ketu-ruled Ashwini. This may not be as supportive of optimism as Venus-ruled Bharani, which the Moon transits on Tuesday. Nonetheless, there’s a good chance the Nifty will be above 2900 by Tuesday, but it will likely bleed red through most of the rest of the week. By Friday, Mercury will be conjunct the 12th house of loss in the Sensex natal chart and Venus will be in tense aspect with Pluto. The end of the week looks extremely negative, so it’s possible we could see the Nifty tumble back to 2700 depending on previous trading.

This week may see the bears take control as the Saturn-Uranus opposition comes exact on Thursday. Some early week gains are probable as the Moon transits Aries, thus giving greater initiative for investors taking positions. With Aries ruler Mars exalted in Capricorn, there’s a good chance that buyers will rule the day Monday and possibly Tuesday. One complicating factor to Monday’s session is that the Moon will transit Ketu-ruled Ashwini. This may not be as supportive of optimism as Venus-ruled Bharani, which the Moon transits on Tuesday. Nonetheless, there’s a good chance the Nifty will be above 2900 by Tuesday, but it will likely bleed red through most of the rest of the week. By Friday, Mercury will be conjunct the 12th house of loss in the Sensex natal chart and Venus will be in tense aspect with Pluto. The end of the week looks extremely negative, so it’s possible we could see the Nifty tumble back to 2700 depending on previous trading.

February will likely see lower highs and lower lows as the bearish mood will deepen. Next week may start off positive before the lunar eclipse hits, but the bears will likely move in and erase any gains fairly quickly. The October lows stand to be broken in late February or early March at the latest. And with Venus going retrograde from March 6 to April 18, we can look for the market to sink lower still with a possible key low around March 23. Markets will likely bounce around near their bottom through April before turning higher into spring.

Trading Outlook: Shorting any rallies remains a compelling strategy as markets drift lower. If the market rallies as expected on Monday and into Tuesday, a speculative short position could be taken with the intention of covering by Friday. Additionally, longer term short positions may be scaled into if rallies are particularly strong. With markets heading lower until March, these may be open for a number of weeks.

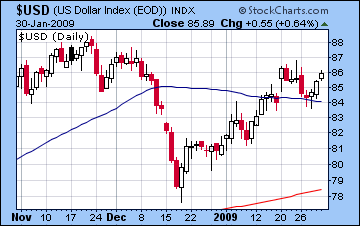

The US dollar stayed strong last week in response to continued economic worries as the dollar index finished near 86. The Euro tumbled another cent and fell close to 1.28 as transiting Venus aspected the natal Saturn in the Euro chart Friday and pulled sentiment down. Look for the Euro to rise against the US dollar early in the week, especially Monday as Venus will be exactly conjunct the Descendant. The Euro could easily rise above 1.30 on this configuration. The US dollar will probably recover and then some by Friday as Sun aspects the powerful natal conjunction of Asc-Mercury-Uranus in the Dollar Index natal chart. By Friday, the dollar index may be between 85-87. Last week the Rupee lost some ground and finished down at 48.8. Despite some early week gains that could push it towards 48, the Rupee is likely to fall back to close to current levels by week’s end. Longer term, I am expecting the US dollar to stay strong through this period of weakness in stocks through March. A possible top in the US dollar may occur around March 15 when Jupiter will favourably aspect the natal Mars in the Dollar Index chart.

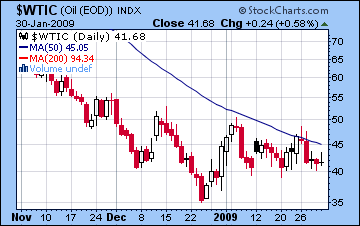

The US dollar stayed strong last week in response to continued economic worries as the dollar index finished near 86. The Euro tumbled another cent and fell close to 1.28 as transiting Venus aspected the natal Saturn in the Euro chart Friday and pulled sentiment down. Look for the Euro to rise against the US dollar early in the week, especially Monday as Venus will be exactly conjunct the Descendant. The Euro could easily rise above 1.30 on this configuration. The US dollar will probably recover and then some by Friday as Sun aspects the powerful natal conjunction of Asc-Mercury-Uranus in the Dollar Index natal chart. By Friday, the dollar index may be between 85-87. Last week the Rupee lost some ground and finished down at 48.8. Despite some early week gains that could push it towards 48, the Rupee is likely to fall back to close to current levels by week’s end. Longer term, I am expecting the US dollar to stay strong through this period of weakness in stocks through March. A possible top in the US dollar may occur around March 15 when Jupiter will favourably aspect the natal Mars in the Dollar Index chart. The brief rally in crude oil came to an abrupt end last week as it fell back below $42. I had expected the recent gains to last a little longer but the late week declines were foreseen through the Mars aspect to its natal position in the Futures chart. Some early week strength is likely as the Sun aspects the natal Mercury and Venus moves deeper into the 11th house of gains. As the same time, Mars is moving into tense aspect with the Moon-Saturn conjunction in the natal chat. So I don’t think $50 is possible under this pattern but it may get to $45. Later in the week, however, Venus moves into tense aspect with Saturn and Mercury will be sitting on the malefic 8th house cusp. This pattern is likely to push crude down to $40 once again. Even with a short rally around Feb 16, crude seems destined to fall towards $30 through this month. By early March, it will likely move below $30. March 14 is a possible significant low after which prices may stabilize and begin to move higher. One open question concerns the effect of Venus retrograde on crude. Its station on March 6 will conjoin the natal Mercury in the Futures chart. Although normally a bullish indicator, it will probably be offset by the bearish influence of Saturn as significator of oil. The Venus station occurs at 21 Pisces and this will be in tense aspect to Saturn at 24 Leo.

The brief rally in crude oil came to an abrupt end last week as it fell back below $42. I had expected the recent gains to last a little longer but the late week declines were foreseen through the Mars aspect to its natal position in the Futures chart. Some early week strength is likely as the Sun aspects the natal Mercury and Venus moves deeper into the 11th house of gains. As the same time, Mars is moving into tense aspect with the Moon-Saturn conjunction in the natal chat. So I don’t think $50 is possible under this pattern but it may get to $45. Later in the week, however, Venus moves into tense aspect with Saturn and Mercury will be sitting on the malefic 8th house cusp. This pattern is likely to push crude down to $40 once again. Even with a short rally around Feb 16, crude seems destined to fall towards $30 through this month. By early March, it will likely move below $30. March 14 is a possible significant low after which prices may stabilize and begin to move higher. One open question concerns the effect of Venus retrograde on crude. Its station on March 6 will conjoin the natal Mercury in the Futures chart. Although normally a bullish indicator, it will probably be offset by the bearish influence of Saturn as significator of oil. The Venus station occurs at 21 Pisces and this will be in tense aspect to Saturn at 24 Leo.

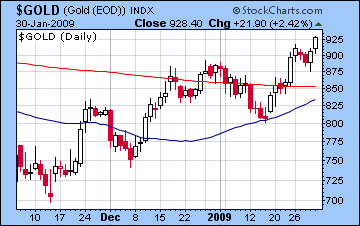

Gold traded higher last week and ended Friday at $928. While it fell back in advance of the Sun-Rahu conjunction in accordance with the forecast, it resumed its upward climb as momentum players abandoned stocks. Although bullion has been trading with stocks for the past few months, since January 15, it has assumed an inverse pattern with equities. Clearly our expectation for lower prices has not occurred as the Sun is still infused with a lot of speculative energy. In this instance, the conjunction of Jupiter and Rahu in Capricorn has energized the whole sign and all planets in it, including the Sun. With this in mind, it is unlikely that Gold will fall as long as the Sun stays in Capricorn. The Sun enters Aquarius on Feb 12 and even then, we may see it rise a little further. Another possible break in the Gold momentum may occur when Mars has conjoined Jupiter and Rahu on Feb 17. Some kind of retracement is likely this week, but the upward trend is unlikely to be broken here. It is possible that we will see Gold break $1000 over the next two weeks before it starts to fall.

Gold traded higher last week and ended Friday at $928. While it fell back in advance of the Sun-Rahu conjunction in accordance with the forecast, it resumed its upward climb as momentum players abandoned stocks. Although bullion has been trading with stocks for the past few months, since January 15, it has assumed an inverse pattern with equities. Clearly our expectation for lower prices has not occurred as the Sun is still infused with a lot of speculative energy. In this instance, the conjunction of Jupiter and Rahu in Capricorn has energized the whole sign and all planets in it, including the Sun. With this in mind, it is unlikely that Gold will fall as long as the Sun stays in Capricorn. The Sun enters Aquarius on Feb 12 and even then, we may see it rise a little further. Another possible break in the Gold momentum may occur when Mars has conjoined Jupiter and Rahu on Feb 17. Some kind of retracement is likely this week, but the upward trend is unlikely to be broken here. It is possible that we will see Gold break $1000 over the next two weeks before it starts to fall.