- Markets mixed this week, with possible interim lows formed Monday or Friday

- Key support levels likely to hold

- Gold unlikely to move much higher

- Crude continued weak

- Markets mixed this week, with possible interim lows formed Monday or Friday

- Key support levels likely to hold

- Gold unlikely to move much higher

- Crude continued weak

This week looks more mixed as there may be offsetting planetary energies at work. Mercury will conjoin Jupiter on Tuesday so this may provide a general baseline of support for prices. Tuesday evening will also feature the Aquarius New Moon which looks much more positive than the previous New Moon. Situated for New York, this lunation chart contains the Mercury-Jupiter conjunction in close aspect to the ascendant, and exalted Venus in Pisces near the Descendant. The Moon is ruled by Rahu and Mercury, both plausibly favourable lords given their proximity to Jupiter. What is most important here is that the influence of this New Moon will extend until late March, so it should be seen as background positive energy that can still be overridden by negative transits. At the same time, Mercury, the planet of commerce, is subject to changing influences. Once it leaves Jupiter’s field of energy, it will approach Mars, a more malefic planet and make an exact conjunction on Saturday. Also, Mars is moving into closer aspect with Saturn by the weekend, so that may indicate that the end of the week could see a return to bearishness. The middle of the week looks the most bullish for stocks, with the week starting with a possible down day Monday. It is possible that we will see a reversal from down to up Monday, although this may occur Tuesday. Friday looks bearish, as Mars aspects Saturn and the Moon joins Venus in Pisces and thereby falls under the malefic aspect of Ketu. If Monday is significantly down, then I think the week may be negative with any gains likely to be erased by Friday’s down action. If we see a trend reversal Monday and it finishes in the green, then the week could be a net gain which moves the market back to the 7700/800 level.

This week looks more mixed as there may be offsetting planetary energies at work. Mercury will conjoin Jupiter on Tuesday so this may provide a general baseline of support for prices. Tuesday evening will also feature the Aquarius New Moon which looks much more positive than the previous New Moon. Situated for New York, this lunation chart contains the Mercury-Jupiter conjunction in close aspect to the ascendant, and exalted Venus in Pisces near the Descendant. The Moon is ruled by Rahu and Mercury, both plausibly favourable lords given their proximity to Jupiter. What is most important here is that the influence of this New Moon will extend until late March, so it should be seen as background positive energy that can still be overridden by negative transits. At the same time, Mercury, the planet of commerce, is subject to changing influences. Once it leaves Jupiter’s field of energy, it will approach Mars, a more malefic planet and make an exact conjunction on Saturday. Also, Mars is moving into closer aspect with Saturn by the weekend, so that may indicate that the end of the week could see a return to bearishness. The middle of the week looks the most bullish for stocks, with the week starting with a possible down day Monday. It is possible that we will see a reversal from down to up Monday, although this may occur Tuesday. Friday looks bearish, as Mars aspects Saturn and the Moon joins Venus in Pisces and thereby falls under the malefic aspect of Ketu. If Monday is significantly down, then I think the week may be negative with any gains likely to be erased by Friday’s down action. If we see a trend reversal Monday and it finishes in the green, then the week could be a net gain which moves the market back to the 7700/800 level.

More generally, I think the Dow 7000 will not be broken in the days ahead, and SPX 750 may also be unbroken, although that is less certain. Next week looks somewhat more positive, although even here there is significant downside risk with the market subject to big down days of 2% or more. Therefore, I don’t see a significant rally until at least after the start of the Venus retrograde cycle on March 6. The period from approximately March 10 to March 23 looks the most solidly positive, so a rally of perhaps 10-20% off the lows here is possible in that time frame. Given the somewhat tense Jupiter-Saturn aspect that will be forming throughout that time window, it should be noted that such a rally is only a probability and not a certainty. Late March and early April will likely see a significant pullback before the market prepares a more sustainable rally starting in mid-April that will run until June, July and perhaps even into August.

Trading Outlook: With the market fairly close to its near term lows, it may be risky to go short here. A possible speculative play might be to short any midweek rally in advance of the some declines that occur late this week and into early next week. Establishing medium term long positions may be more prudent, so investors may want to gradually scale into long positions on market declines that approach key support levels (e.g SPX 750). Just in case my forecast for a March rally is incorrect, investors may wish to move into a long position in stages, say this week, next week, the first week of April, and during a probable significant pullback in May during the Mercury retrograde cycle. These positions may be held for several weeks (as in the case of the possible short term March top) or for several months and the probable summer top. Even with the likelihood of a spring-summer rally, investors should only take on any long positions with appropriate caution as this bear market is far from over.

Dalal Street lost another 8% last week as Monday’s budget did little to quell investors’ anxieties over the likelihood of a long and deep recession. As the indices sank further below their 50-day moving averages, the Sensex ended Friday at 8843 while the Nifty stood at 2736. The negative performance was in keeping with expectations, although the decline exceeded our forecast as Monday’s five-planet alignment starring Mars and Rahu turned out to be very bearish indeed. The midweek Mercury-Saturn aspect did not deliver decline exactly as anticipated as Friday proved to be more bearish than either Wednesday or Thursday. As markets move closer to the lower end of recent trading range, one wonders if the January lows of 2675 will hold, since if they are broken, then the October lows of Nifty 2525 will likely be quickly revisited.

This week looks mixed, with the best chance for gains occurring midweek. With markets shut for Monday’s holiday, Mumbai will begin the week with the Mercury-Jupiter conjunction on Tuesday. While this is a positive influence, it is unclear if it will be strong enough to counteract the negative energy of Mars which lies just three degrees beyond. Tuesday may turn out to be negative though as the Sun conjoins the Saturn in the NSE chart. There is a 50-50 chance that we will see the January lows of 2675 retested at that time. The New Moon will occur at sunrise on Wednesday and this is likely to give a broad boost to stocks over its 4-week tenure given that exalted Venus is placed in the second house of wealth in the lunation chart. Wednesday and Thursday may well turn out to be the most positive for stocks as the Sun will be transiting through the Mercury-ruled sections of Satabisha. On Friday, the Moon conjoins Venus in Pisces in Uttarabhadra. While this may be nominally positive, the fact that both will fall under the aspect of Ketu makes this combination more precarious. The Friday Feb 27-Monday March 3 period seems more negative for the Mumbai market overall, so this will be another opportunity to move towards the January lows.

This week looks mixed, with the best chance for gains occurring midweek. With markets shut for Monday’s holiday, Mumbai will begin the week with the Mercury-Jupiter conjunction on Tuesday. While this is a positive influence, it is unclear if it will be strong enough to counteract the negative energy of Mars which lies just three degrees beyond. Tuesday may turn out to be negative though as the Sun conjoins the Saturn in the NSE chart. There is a 50-50 chance that we will see the January lows of 2675 retested at that time. The New Moon will occur at sunrise on Wednesday and this is likely to give a broad boost to stocks over its 4-week tenure given that exalted Venus is placed in the second house of wealth in the lunation chart. Wednesday and Thursday may well turn out to be the most positive for stocks as the Sun will be transiting through the Mercury-ruled sections of Satabisha. On Friday, the Moon conjoins Venus in Pisces in Uttarabhadra. While this may be nominally positive, the fact that both will fall under the aspect of Ketu makes this combination more precarious. The Friday Feb 27-Monday March 3 period seems more negative for the Mumbai market overall, so this will be another opportunity to move towards the January lows.

At this point, I would say there is a chance of a retest of the October lows here, but it is not likely. Nifty 2600 by the first week of March is more probable, after which the market may find more stability and begin to head higher. While some kind of March buoyancy is likely, it is unlikely to reach Nifty 3150 given that the Venus retrograde cycle will tend to act as a drag on optimism. Early April looks quite negative again as a Sun-Mercury-Mars-Saturn alignment will give encouragement to the bears, although the market will likely start to move higher after that. After a nasty mid-May retrograde Mercury cycle, I expect the rally will continue in earnest and extend into summer.

Trading Outlook: With the market looking weaker over the next week or two, investors may consider establishing long positions with the intention of covering in the event of a March rally or sometime in the summer. By July, we may see the Nifty rise to 3500-4000. There will be several possible entry points that will coincide with declines, including this Tuesday (if negative), early next week (i.e. March 2-4), the early April Sun-Mercury-Mars-Saturn alignment, and the mid-May Mercury retrograde cycle. More conservative investors may wish to wait until April or May before putting significant resources into the market.

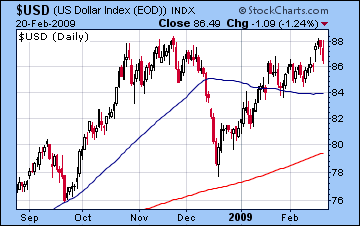

With recurring fears about the viability of the global financial system, the dollar rose as anticipated last week as the USDX traded above 88, matching its November highs. It settled back to 86.5 after Friday’s session. There may be further gains to 88 early in the week but some losses are likely midweek that may take it back below 86. The end of the week action looks more bullish again so we could a return to 88 by next week. The approaching Venus station at 21 Pisces will be a true test of the dollar index chart since it will incorporate the positive effect of the Asc-Mercury-Uranus trine (20-23 Scorpio) but also have to deal with the more malefic influence of the Mars opposition (21 Virgo). This seems generally bullish for the dollar until March 6, but it will not be a clearly positive influence so it seems unlikely it can climb to 90. As expected, the Euro fell early last week all the way below 1.26 before recovering somewhat by Friday to 1.28. While some gains are likely midweek on the Jupiter-Uranus aspect in the Euro chart, they are unlikely to hold. If Monday is negative and the Euro falls below 1.27, then 1.30 may be too tall an order this week. Next week also looks quite volatile, so we can look for the Euro to move between 1.25 and 1.30 over the next two weeks. Like most world currencies, the Rupee fell against the dollar and traded above 50 at one point, before closing Friday at 49.8. This week looks difficult again so we can expect it to move between 49 and 50 until early March.

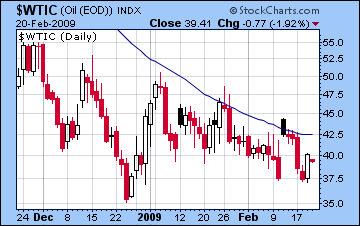

With recurring fears about the viability of the global financial system, the dollar rose as anticipated last week as the USDX traded above 88, matching its November highs. It settled back to 86.5 after Friday’s session. There may be further gains to 88 early in the week but some losses are likely midweek that may take it back below 86. The end of the week action looks more bullish again so we could a return to 88 by next week. The approaching Venus station at 21 Pisces will be a true test of the dollar index chart since it will incorporate the positive effect of the Asc-Mercury-Uranus trine (20-23 Scorpio) but also have to deal with the more malefic influence of the Mars opposition (21 Virgo). This seems generally bullish for the dollar until March 6, but it will not be a clearly positive influence so it seems unlikely it can climb to 90. As expected, the Euro fell early last week all the way below 1.26 before recovering somewhat by Friday to 1.28. While some gains are likely midweek on the Jupiter-Uranus aspect in the Euro chart, they are unlikely to hold. If Monday is negative and the Euro falls below 1.27, then 1.30 may be too tall an order this week. Next week also looks quite volatile, so we can look for the Euro to move between 1.25 and 1.30 over the next two weeks. Like most world currencies, the Rupee fell against the dollar and traded above 50 at one point, before closing Friday at 49.8. This week looks difficult again so we can expect it to move between 49 and 50 until early March. With more bearish demand forecasts, crude oil fell again last week and closed under $39 for the March Futures contract after trading as a low as $35. This weakness is largely in keeping with expectations, although we missed the late week recovery. More bearishness is likely this week as Mercury approaches Mars. Some sharp gains like we saw Thursday are still possible this week, but crude is unlikely to put many of those up days together and make a rally. We may have to wait until the second week of March for crude to trade consistently above $40. We will see crude rally strongly this summer as there are a number of positive indications for a major recovery in prices. Jupiter will conjoin the MC in the Futures chart along with Neptune, and Mercury, Venus, Neptune and Pluto form a very favourable alignment in the progressed chart from approximately May to July. Together, these signatures suggest a powerful rally in crude oil that could see it rise to $80. While that level is a guesstimate, it is clear that this will not be a mere 30-40% rally (i.e to $50-55) from current levels. A more plausible reading of these complimentary influences is that crude will undergo a much stronger increase in price.

With more bearish demand forecasts, crude oil fell again last week and closed under $39 for the March Futures contract after trading as a low as $35. This weakness is largely in keeping with expectations, although we missed the late week recovery. More bearishness is likely this week as Mercury approaches Mars. Some sharp gains like we saw Thursday are still possible this week, but crude is unlikely to put many of those up days together and make a rally. We may have to wait until the second week of March for crude to trade consistently above $40. We will see crude rally strongly this summer as there are a number of positive indications for a major recovery in prices. Jupiter will conjoin the MC in the Futures chart along with Neptune, and Mercury, Venus, Neptune and Pluto form a very favourable alignment in the progressed chart from approximately May to July. Together, these signatures suggest a powerful rally in crude oil that could see it rise to $80. While that level is a guesstimate, it is clear that this will not be a mere 30-40% rally (i.e to $50-55) from current levels. A more plausible reading of these complimentary influences is that crude will undergo a much stronger increase in price.

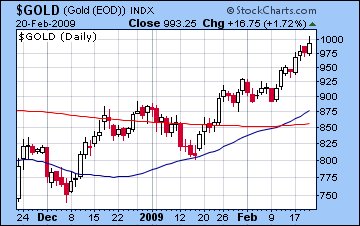

As expected, gold continued its rally last week and did in fact trade over $1000 on Friday, before closing at $995. This week looks more mixed, with some gains likely on the Mercury-Jupiter conjunction on Monday and possibly Tuesday, but midweek will likely feature profit-taking. Thursday in particular may be negative for bullion as transiting Mars conjoins the Moon in the GLD chart. Friday may see a recovery as Moon and Venus conjoin in Pisces opposite the GLD Jupiter. Overall, however, I don’t expect gold to move too much above $1000 here and it may well end up close to its current levels by Friday. More lift is likely early next week as we approach the Venus station on March 6, but gold is unlikely to climb much above its previous high of March 2008 when it reached $1020. Referring to the gold futures chart, we can see that transiting Jupiter makes its exact aspect to the Moon on March 4, which is very close to that date. This is another indication that we may be very near the high in gold here. It is also possible that the highs in gold over the next two weeks may be the highs for the year. The summer looks very bearish for gold, and the decline may well begin sooner.

As expected, gold continued its rally last week and did in fact trade over $1000 on Friday, before closing at $995. This week looks more mixed, with some gains likely on the Mercury-Jupiter conjunction on Monday and possibly Tuesday, but midweek will likely feature profit-taking. Thursday in particular may be negative for bullion as transiting Mars conjoins the Moon in the GLD chart. Friday may see a recovery as Moon and Venus conjoin in Pisces opposite the GLD Jupiter. Overall, however, I don’t expect gold to move too much above $1000 here and it may well end up close to its current levels by Friday. More lift is likely early next week as we approach the Venus station on March 6, but gold is unlikely to climb much above its previous high of March 2008 when it reached $1020. Referring to the gold futures chart, we can see that transiting Jupiter makes its exact aspect to the Moon on March 4, which is very close to that date. This is another indication that we may be very near the high in gold here. It is also possible that the highs in gold over the next two weeks may be the highs for the year. The summer looks very bearish for gold, and the decline may well begin sooner.