- Early week sell off followed by weak rally into next week

- Markets heading for retest of 2008 lows in February

- Gold to begin falling this week

- Crude oil to stay strong this week

- Early week sell off followed by weak rally into next week

- Markets heading for retest of 2008 lows in February

- Gold to begin falling this week

- Crude oil to stay strong this week

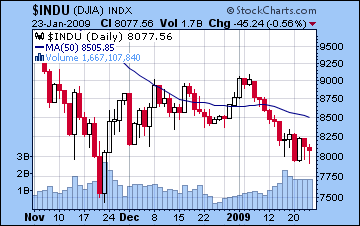

Given a higher than usual number of important astronomical events, this week promises to be volatile. First, the solar eclipse at 12 Capricorn occurs Jan 26 before the start of trading in New York. While it is possible to label this eclipse as mixed, I think the negatives outweigh the positives. Jupiter is conjunct the eclipse point which is usually positive but Saturn is making a very tight aspect to the Sun and Moon. Saturn is also conjunct the MC — a possible indicator that loss and restriction will be more prominent than usual over the next four weeks. To add fuel to the fire, retrograde Mercury is conjunct Mars, which might suggest heavier trading volumes in the early week period. Taken together, these patterns point to a big down day on Monday, possibly extending into Tuesday. I think a further retesting of 7950/805 is probable early week, and there is also a reasonable chance that those lows will be broken on the downside. Sentiment is likely to improve as the week goes on, as Venus takes up residence in Pisces, its sign of exaltation, on Tuesday, and the Sun conjoins Rahu on Wednesday. On Friday, the Moon joins Venus in Pisces and this has some potential for some bullishness. The week overall may see gains but it really depends on how negative Monday is. If the market breaks substantially below the intraday lows of last week, say, to 780 on the SPX, then it may be difficult to come all the way back to 830 by Friday. If we only revisit 805, then the chances are better than the market will end higher than 830 by Friday.

Given a higher than usual number of important astronomical events, this week promises to be volatile. First, the solar eclipse at 12 Capricorn occurs Jan 26 before the start of trading in New York. While it is possible to label this eclipse as mixed, I think the negatives outweigh the positives. Jupiter is conjunct the eclipse point which is usually positive but Saturn is making a very tight aspect to the Sun and Moon. Saturn is also conjunct the MC — a possible indicator that loss and restriction will be more prominent than usual over the next four weeks. To add fuel to the fire, retrograde Mercury is conjunct Mars, which might suggest heavier trading volumes in the early week period. Taken together, these patterns point to a big down day on Monday, possibly extending into Tuesday. I think a further retesting of 7950/805 is probable early week, and there is also a reasonable chance that those lows will be broken on the downside. Sentiment is likely to improve as the week goes on, as Venus takes up residence in Pisces, its sign of exaltation, on Tuesday, and the Sun conjoins Rahu on Wednesday. On Friday, the Moon joins Venus in Pisces and this has some potential for some bullishness. The week overall may see gains but it really depends on how negative Monday is. If the market breaks substantially below the intraday lows of last week, say, to 780 on the SPX, then it may be difficult to come all the way back to 830 by Friday. If we only revisit 805, then the chances are better than the market will end higher than 830 by Friday.

From a longer term perspective, the market appears more ready to retest the November lows of 750 on the SPX. I don’t think this will happen this week, but starting late in the first week of February we could see a strong negative trend that takes us back to those levels. The last week of February is also shaping up to be quite negative, so that is likely going to be another leg down, either to test the November lows, or perhaps to new lows, perhaps to 700 on the SPX. At this point, the market lows in late February may well turn out to be the lows for the first half of 2009, but I’m not certain. Another pullback around March 23rd is likely to be quite significant, so it’s best to leave open the possibility that the bottoming process may be protracted over two months.

Trading Outlook: As the point of maximum bearishness soon approaches, investors may want to take positions shorting any rallies that might occur here. It’s unlikely that we will see Dow 9000/SPX 930 now, but a rally to 8400-8600 is still possible, especially into next week. For the more adventurous traders, small long positions may become attractive if we see a big decline Monday and Tuesday.

Stocks in Mumbai got hammered again with the deepening economic gloom pushing down prices by 5%. The Nifty closed Friday at 2678 and the Sensex at 8674. The forecast rally did not appear as the anticipated boost from the approaching Sun-Jupiter conjunction was overshadowed by the combustion of retrograde Mercury and the growing Saturnian influence on Venus. The resulting planetary afflictions extended the market decline that has bedeviled Indian markets since the start of the year. The failure to rally last week makes the retesting of the October lows of Nifty 2500 more inevitable than ever as the indices continue to languish well below their 50-day moving average.

With a potentially malefic solar eclipse due Monday, there is very little optimism for markets this week. Even with Monday’s holiday closing, this eclipse will be one of the factors that will drive prices lower this week before then can attempt any recovery. Another potentially negative factor occurs on Tuesday when Mercury conjoins Mars at 11.40 a.m. IST. The Mars influence will intensify trader passions and likely increase market volatility. Interestingly, the conjunction occurs very close to the natal Uranus (change) in the 2nd house (wealth) of the NSE natal chart. This is another indication that the price movement on Tuesday may be quite large. While an up day is conceivable, most indicators point to a negative outcome. A bounce is likely later in the week as Mercury will be in positive aspect to the natal Jupiter in the NSE chart. If Tuesday is ugly, we could see the Nifty fall below 2600. A retest of 2525 this week is not out of the question, but it seems unlikely. The bounce afterwards may be tentative at first, but assuming the Nifty stays above October lows, it may move towards 2700.

With a potentially malefic solar eclipse due Monday, there is very little optimism for markets this week. Even with Monday’s holiday closing, this eclipse will be one of the factors that will drive prices lower this week before then can attempt any recovery. Another potentially negative factor occurs on Tuesday when Mercury conjoins Mars at 11.40 a.m. IST. The Mars influence will intensify trader passions and likely increase market volatility. Interestingly, the conjunction occurs very close to the natal Uranus (change) in the 2nd house (wealth) of the NSE natal chart. This is another indication that the price movement on Tuesday may be quite large. While an up day is conceivable, most indicators point to a negative outcome. A bounce is likely later in the week as Mercury will be in positive aspect to the natal Jupiter in the NSE chart. If Tuesday is ugly, we could see the Nifty fall below 2600. A retest of 2525 this week is not out of the question, but it seems unlikely. The bounce afterwards may be tentative at first, but assuming the Nifty stays above October lows, it may move towards 2700.

Any rally begun this week has a good chance of continuing into next week, although it is unlikely to be very strong. Nifty 2850 may be a reasonable target, although much depends on how low the market goes this week. February should be mostly bearish, with the largest decline in the last week of the month. Look for a possible new low near Feb 24 when the Sun conjoins the natal Saturn in the NSE chart and Mars aspects the natal Mars-Ketu square.

Trading Outlook: If the market sells off sharply Tuesday, investors may consider small long positions with the intention of covering late this week or next. Since we are still basically in a downward leg, rallies can be shorted with an eye to covering in late February. Nifty 2800 is one possible shorting level.

The US dollar continued to gain strength against most currencies last week as a safe haven play in response to the drop in stocks. The Euro lost 3 cents and closed Friday below 1.30. Look for the dollar to rise further in the early part of the week as the Mercury-Mars conjunction occurs in close aspect to the natal Ketu in the Euro chart. Some bounce back is likely in the Euro by Friday as Moon and Venus conjoin in early Pisces and will aspect the Euro’s ascendant. Depending on the severity of the early week losses, we may see the Euro close to current levels by the end of the week, although I think there is still a bearish bias here. The Rupee also retreated against the greenback last week closing near 49. Even with the early week volatility that should see dollar gains, some strength is likely to return to the Rupee later on. It will likely stay close to the 49 level and improve to 48.5 by early next week.

As expected, crude oil rallied last week on the prospect of a supply reduction from OPEC. On Friday, it closed above $46 as Jupiter’s conjunction with the Sun boosted the strength of Saturn, which is the significator for oil. While it failed to reach $50 for the March contract, it nonetheless rose almost 10% on the week. More gains are likely this week as Sun conjoins Rahu midweek and transits through a potentially favourable zone in Capricorn which should activate the Sun-Jupiter-Uranus alignment in the Futures chart. At the same time, the Mercury-Mars conjunction occurs on the 8th house cusp, which may offset the extent of the gains to some extent. While $50 is still possible this week, I think the gains here may be more muted. Some erosion of strength is likely towards the end of the week, especially on Friday, as transiting Mars aspects its natal position. February continues to look mostly bearish for crude, with significant lows occurring near Feb 12 and particularly Feb 27.

With global equity markets in retreat, gold once again cashed in on its safe haven status and rose sharply, ending Friday’s session at $895. This 6% gain on the week was at odds with our bearish forecast as I underestimated the bullish effects of the Sun-Jupiter conjunction on Friday. I had thought that there would be more negativity from the GLD chart as Sun and Jupiter came under the potentially malefic influence from the Mars aspect. I think this influence has merely been delayed, and now that the Sun is moving away from Jupiter, we can look forward to falling prices this week. With the Mercury-Mars conjoining in close conjunction to Venus in the Futures chart on Monday and Tuesday, we can expect rapid price swings. It’s possible that gold has one or two more up days left in this current rally, but I think the more probable scenario is that it starts falling from Tuesday. Wednesday to Friday look worst for gold as the Sun conjoins disruptive Rahu. It is quite possible that Friday’s Sun-Jupiter conjunction coincided with the top in Gold, so we can expect to see it take the long journey back down to $700 or below over the coming weeks.