- Gains more likely into Wednesday but downtrend to remain intact

- Dollar weak into Wednesday with possible recovery afterwards; medium term bullish trend still in place

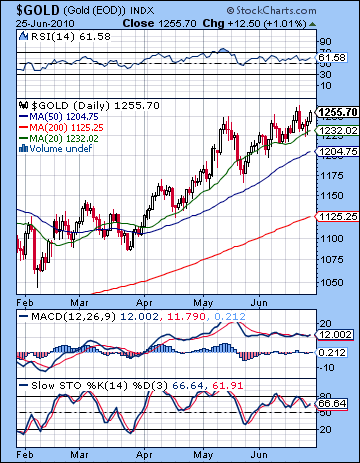

- Gold could reach $1270 this week but profit taking more likely after Wednesday

- Crude prone to declines, especially after midweek

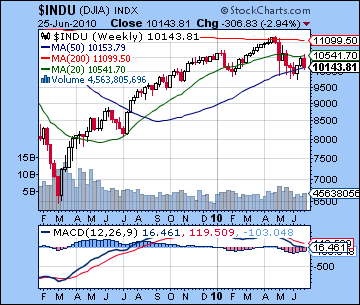

Stocks in New York fell by almost 3% last week as fears of a double dip recession grew on shaky housing data. After making an interim high on Monday morning of 10,600, the bears ruled the roost as the Dow closed at 10,143 and the S&P at 1076. The week was somewhat perplexing as I had expected more strength from the bulls here on the Sun aspects to Uranus and Jupiter. On the bright side, the Sun-Uranus aspect did produce higher prices, although they barely lasted an hour as sellers moved in once the indexes retreated off their 50 DMA and fell back down to earth. But the absence of any positive closes has forced me to question my assumptions about how the current planetary set up might be actually working. One plausible explanation is that the separation of the Jupiter-Uranus conjunction that had provided a substantial lift the previous week was further away and hence that much weaker. In fact, I noted this last week that the widening gap between Jupiter and Uranus might mean that "the gains may not be as strong nor as reliable". What this means is that there may less of a reservoir of bullish planetary energy here and thus the prospect for significant upside moves could become more limited. Certainly, the entry of Mercury into Gemini on Tuesday appeared to satisfy bearish expectations as we saw significant selling pressure, especially on Wednesday afternoon and Thursday which marked the closest aspect between Mercury and Saturn. As expected Friday was not as bad as Thursday, perhaps owing to Mercury’s square aspect to Jupiter on Friday. Overall, the grinding of the cosmic gears appears to be broadly proceeding according to plan, albeit with some inevitable twists and turns. If Jupiter and Uranus are indeed losing their bullish potential, then we could see a quicker and steeper decline in the near term. Since I had wondered if we could take out the May 25 low of 1040 on the S&P in the near term, this past week would suggest that outcome is somewhat more likely. It is by no means "in the bag", but I would expect more downside here into early July. In order to break 1040 soon what is important is that upside is limited to the 200 DMA of 1112. That will be a key technical level to watch. On the bearish side, control-obsessed Saturn is again approaching its final opposition aspect with freedom-loving Uranus and the results are unlikely to be pretty. The exact opposition occurs on July 26 but the situation will receive a major catalyst when Uranus begins its retrograde cycle on July 5. I am expecting the time around this date to perhaps mark an interim low. Since we can expect a little more bullish action with the end of Q2 on Wednesday, June 30, it may be that the down move will tend to occur after that date. Fund managers tend to pad their portfolios ahead at quarter ends in order to bolster their performance. This often translates into more buying that the fundamentals and technicals would otherwise warrant.

Stocks in New York fell by almost 3% last week as fears of a double dip recession grew on shaky housing data. After making an interim high on Monday morning of 10,600, the bears ruled the roost as the Dow closed at 10,143 and the S&P at 1076. The week was somewhat perplexing as I had expected more strength from the bulls here on the Sun aspects to Uranus and Jupiter. On the bright side, the Sun-Uranus aspect did produce higher prices, although they barely lasted an hour as sellers moved in once the indexes retreated off their 50 DMA and fell back down to earth. But the absence of any positive closes has forced me to question my assumptions about how the current planetary set up might be actually working. One plausible explanation is that the separation of the Jupiter-Uranus conjunction that had provided a substantial lift the previous week was further away and hence that much weaker. In fact, I noted this last week that the widening gap between Jupiter and Uranus might mean that "the gains may not be as strong nor as reliable". What this means is that there may less of a reservoir of bullish planetary energy here and thus the prospect for significant upside moves could become more limited. Certainly, the entry of Mercury into Gemini on Tuesday appeared to satisfy bearish expectations as we saw significant selling pressure, especially on Wednesday afternoon and Thursday which marked the closest aspect between Mercury and Saturn. As expected Friday was not as bad as Thursday, perhaps owing to Mercury’s square aspect to Jupiter on Friday. Overall, the grinding of the cosmic gears appears to be broadly proceeding according to plan, albeit with some inevitable twists and turns. If Jupiter and Uranus are indeed losing their bullish potential, then we could see a quicker and steeper decline in the near term. Since I had wondered if we could take out the May 25 low of 1040 on the S&P in the near term, this past week would suggest that outcome is somewhat more likely. It is by no means "in the bag", but I would expect more downside here into early July. In order to break 1040 soon what is important is that upside is limited to the 200 DMA of 1112. That will be a key technical level to watch. On the bearish side, control-obsessed Saturn is again approaching its final opposition aspect with freedom-loving Uranus and the results are unlikely to be pretty. The exact opposition occurs on July 26 but the situation will receive a major catalyst when Uranus begins its retrograde cycle on July 5. I am expecting the time around this date to perhaps mark an interim low. Since we can expect a little more bullish action with the end of Q2 on Wednesday, June 30, it may be that the down move will tend to occur after that date. Fund managers tend to pad their portfolios ahead at quarter ends in order to bolster their performance. This often translates into more buying that the fundamentals and technicals would otherwise warrant.

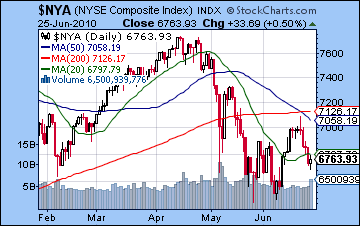

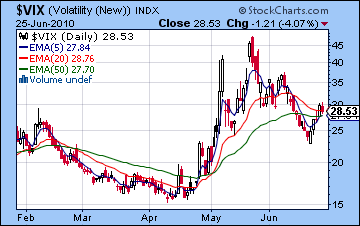

The technicals moved back in favor of the bears last week as Friday’s close was below all three major moving averages — the 20, 50 and 200 DMA. The Dow briefly touched its 50 DMA on Monday, but the S&P failed even to reach that level. The emerging picture is likely making more bullish investors nervous as stocks failed to sufficiently rally from the apparently promising double bottom and break above key resistance levels. More may be wondering if that was the last time prices will be near the 50 DMA for a while. It’s certainly possible, although even with my bearish stance, I do not want to rule out another test of that resistance level in the near term. As a sign of our bearish future, we did see a death cross of the 50 and 200 DMA on the NYSE Composite ($NYA) this week. The blue chip indexes are still about a 2% drop away from similar death crosses. This is an extremely bearish indicator that would could spark wider selling and initiate a break down of support at the 1040 level on the S&P. The week of falling prices has seen the $VIX pop back up to 28 which is slightly above its 50 DMA. And while they are very close, we have not yet seen a new bearish crossover of the 5 and 20 DMA. This is one potentially significant bullish indicator that could suggest that the bulls may attempt another run higher. We should note that even with Monday’s weak attempt to climb back to the 50 DMA at 1133 (now at 1127), we still have a plausible head and shoulders pattern as we stand now. The right shoulder is significantly lower than the left shoulder and nowhere near as broad, but it is substantial enough to count in the minds of many technically-oriented investors. It’s still possible it could "beef up" somewhat with another rally attempt, but it is nonetheless a bearish set up. The daily SPX chart shows MACD on the verge of a bearish crossover while Stochastics (43) are in mid-fall and appear headed below 20 and the oversold zone. Until they get there, the downside momentum will likely carry prices lower. RSI (42) is bearish but does not show any clear divergences either way. Volume was unremarkable this week, although Friday saw an increase. This is actually a better scenario for bulls since the doji candlestick on high volume after a down week may indicate a reversal is in the offing. And in light of next week’s Sun-Mercury conjunction, we certainly would expect some upward movement. Prices are currently perched at the top end of a falling channel that began with the morning high on June 21. If prices should fall back into that channel, then the decline would likely continue towards the next support level around 1050. Below that is 1040 and a major reorganization of pricing patterns. Resistance will occur around 1090 and then near 1105. Climbing above the 200 DMA at 1112 will be yet another hurdle for the bulls. And after that, 1127-1133 would likely bring in more sellers and finally 1150 and the possibility of the perfectly balanced head and shoulders pattern. Reading the technicals alone, I would think it is quite likely we see a test of 1105 at least before heading back down with a somewhat less likely chance to retest 1130.

The technicals moved back in favor of the bears last week as Friday’s close was below all three major moving averages — the 20, 50 and 200 DMA. The Dow briefly touched its 50 DMA on Monday, but the S&P failed even to reach that level. The emerging picture is likely making more bullish investors nervous as stocks failed to sufficiently rally from the apparently promising double bottom and break above key resistance levels. More may be wondering if that was the last time prices will be near the 50 DMA for a while. It’s certainly possible, although even with my bearish stance, I do not want to rule out another test of that resistance level in the near term. As a sign of our bearish future, we did see a death cross of the 50 and 200 DMA on the NYSE Composite ($NYA) this week. The blue chip indexes are still about a 2% drop away from similar death crosses. This is an extremely bearish indicator that would could spark wider selling and initiate a break down of support at the 1040 level on the S&P. The week of falling prices has seen the $VIX pop back up to 28 which is slightly above its 50 DMA. And while they are very close, we have not yet seen a new bearish crossover of the 5 and 20 DMA. This is one potentially significant bullish indicator that could suggest that the bulls may attempt another run higher. We should note that even with Monday’s weak attempt to climb back to the 50 DMA at 1133 (now at 1127), we still have a plausible head and shoulders pattern as we stand now. The right shoulder is significantly lower than the left shoulder and nowhere near as broad, but it is substantial enough to count in the minds of many technically-oriented investors. It’s still possible it could "beef up" somewhat with another rally attempt, but it is nonetheless a bearish set up. The daily SPX chart shows MACD on the verge of a bearish crossover while Stochastics (43) are in mid-fall and appear headed below 20 and the oversold zone. Until they get there, the downside momentum will likely carry prices lower. RSI (42) is bearish but does not show any clear divergences either way. Volume was unremarkable this week, although Friday saw an increase. This is actually a better scenario for bulls since the doji candlestick on high volume after a down week may indicate a reversal is in the offing. And in light of next week’s Sun-Mercury conjunction, we certainly would expect some upward movement. Prices are currently perched at the top end of a falling channel that began with the morning high on June 21. If prices should fall back into that channel, then the decline would likely continue towards the next support level around 1050. Below that is 1040 and a major reorganization of pricing patterns. Resistance will occur around 1090 and then near 1105. Climbing above the 200 DMA at 1112 will be yet another hurdle for the bulls. And after that, 1127-1133 would likely bring in more sellers and finally 1150 and the possibility of the perfectly balanced head and shoulders pattern. Reading the technicals alone, I would think it is quite likely we see a test of 1105 at least before heading back down with a somewhat less likely chance to retest 1130.

This week will see a high number of planetary aspects that should correlate with significant moves in both directions. Monday is perhaps the busiest as we will get a Sun-Mercury conjunction and a Mars-Rahu aspect. The Sun-Mercury aspect occurs in Gemini and should be seen as a bullish influence. It is exact before the start of trading in New York, however, so that is a slight blemish on its potential. The Mars-Rahu aspect is more clearly bearish and that is more exact during the afternoon. This is a tough day to call given the potentially offsetting quality to the planets involved. I would lean to a bearish outcome. Tuesday looks more bullish as the Moon aspects Venus while Wednesday, the end of Q2, may actually be bearish on the Mercury-Ketu conjunction. I’m hesitant in making this prediction given the window dressing effect, but the affliction to Mercury by Ketu ought to at least temper our expectations for the size of any melt up rally. Nonetheless, Monday to Wednesday appears to have a bullish bias. The end of the week seems more bearish as the Moon opposes Mars on Thursday, especially in the afternoon, and Friday will see the Sun come very close to Ketu. The most likely scenario is that we finish within the current trading range of 1060 and 1100, although I would lean bearish overall here. If Monday ends up flat or higher, then there’s a good chance of getting back to 1105 or higher by midweek before drifting lower again by Friday, perhaps ending close to current levels But if Monday is down, then we increase our chances to pushing lower and perhaps even retesting 1040. Certainly, there is the potential for another major move down this week although I cannot quite bring myself to completely expect it.

This week will see a high number of planetary aspects that should correlate with significant moves in both directions. Monday is perhaps the busiest as we will get a Sun-Mercury conjunction and a Mars-Rahu aspect. The Sun-Mercury aspect occurs in Gemini and should be seen as a bullish influence. It is exact before the start of trading in New York, however, so that is a slight blemish on its potential. The Mars-Rahu aspect is more clearly bearish and that is more exact during the afternoon. This is a tough day to call given the potentially offsetting quality to the planets involved. I would lean to a bearish outcome. Tuesday looks more bullish as the Moon aspects Venus while Wednesday, the end of Q2, may actually be bearish on the Mercury-Ketu conjunction. I’m hesitant in making this prediction given the window dressing effect, but the affliction to Mercury by Ketu ought to at least temper our expectations for the size of any melt up rally. Nonetheless, Monday to Wednesday appears to have a bullish bias. The end of the week seems more bearish as the Moon opposes Mars on Thursday, especially in the afternoon, and Friday will see the Sun come very close to Ketu. The most likely scenario is that we finish within the current trading range of 1060 and 1100, although I would lean bearish overall here. If Monday ends up flat or higher, then there’s a good chance of getting back to 1105 or higher by midweek before drifting lower again by Friday, perhaps ending close to current levels But if Monday is down, then we increase our chances to pushing lower and perhaps even retesting 1040. Certainly, there is the potential for another major move down this week although I cannot quite bring myself to completely expect it.

Next week (July 5-9) will be a holiday shortened trading week and could feature an interim bottom in this pullback. Uranus turns retrograde on Monday the 5th so that could increase tensions and mark a reversal of the trend, give or take a few days either side. This could mean we could get the low as soon as July 2 or as late as perhaps July 9. Mercury and Venus will move into an alignment with Saturn towards the end of the week so that may also correspond with a down move. Whether or not we break below 1040 will depend how close we are to that level in the previous week. The following week (July 12-16) looks unremarkable and if we’ve been lower before this time, then we should see some kind of bounce. The following week Mars enters Virgo to join Saturn and it could well be crunch time. Jupiter turns retrograde on July 23, so that could mark an interim high. Monday, July 26 could be a big move down as Mercury will form a minor aspect to the Saturn-Uranus opposition with Mars in close proximity. It is definitely a noteworthy alignment. At the same time, it is important to remember that big moves do not always coincide with the day of an exact aspect. So for example, we will see the exact Mars-Saturn conjunction on Friday, July 30 but the market may not move that much on that day. Larger moves may occur a few days prior to that date due to angles formed with other planets. In any event, I expect the direction of the market to be mostly down from here until early September around Labor Day. If everything goes according to plan (which of course it won’t), we should be somewhere between 800 and 920 by this time. I expect a significant rally after this low that lasts into October. It’s possible a rally could take us all the way back to 1040 but that would be the most bullish scenario. November and December look pretty negative as the decline could morph into something of a rout. I am expecting the US Dollar and US equities to fall in tandem here for the first time in this de-leveraging process that began in 2008, so we should see another big move lower.

Next week (July 5-9) will be a holiday shortened trading week and could feature an interim bottom in this pullback. Uranus turns retrograde on Monday the 5th so that could increase tensions and mark a reversal of the trend, give or take a few days either side. This could mean we could get the low as soon as July 2 or as late as perhaps July 9. Mercury and Venus will move into an alignment with Saturn towards the end of the week so that may also correspond with a down move. Whether or not we break below 1040 will depend how close we are to that level in the previous week. The following week (July 12-16) looks unremarkable and if we’ve been lower before this time, then we should see some kind of bounce. The following week Mars enters Virgo to join Saturn and it could well be crunch time. Jupiter turns retrograde on July 23, so that could mark an interim high. Monday, July 26 could be a big move down as Mercury will form a minor aspect to the Saturn-Uranus opposition with Mars in close proximity. It is definitely a noteworthy alignment. At the same time, it is important to remember that big moves do not always coincide with the day of an exact aspect. So for example, we will see the exact Mars-Saturn conjunction on Friday, July 30 but the market may not move that much on that day. Larger moves may occur a few days prior to that date due to angles formed with other planets. In any event, I expect the direction of the market to be mostly down from here until early September around Labor Day. If everything goes according to plan (which of course it won’t), we should be somewhere between 800 and 920 by this time. I expect a significant rally after this low that lasts into October. It’s possible a rally could take us all the way back to 1040 but that would be the most bullish scenario. November and December look pretty negative as the decline could morph into something of a rout. I am expecting the US Dollar and US equities to fall in tandem here for the first time in this de-leveraging process that began in 2008, so we should see another big move lower.

5-day outlook — bearish SPX 1050-1070

30-day outlook — bearish-neutral SPX 1020-1070

90-day outlook — bearish SPX 850-950

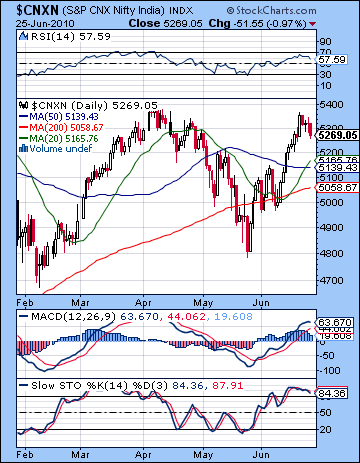

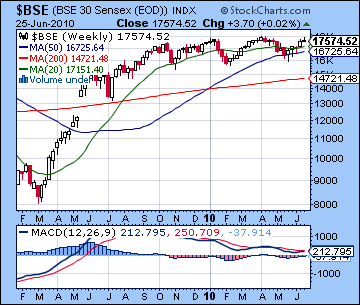

Stocks in Mumbai were mostly unchanged last week as domestic growth prospects were offset by ongoing global worries over a possible double dip recession. After rising to within a couple hundred points of its high for the year, the Sensex finished flat at 17,574 while the Nifty ended Friday at 5269. While I had expected strength to last a little longer than it did, this neutral outcome was not significantly out of line with my forecast. We did get the major up days in the early part of the week on the Sun-Uranus and Sun-Jupiter aspects, although I mistakenly thought Tuesday would be more bullish. Nonetheless, the early week period was net positive as per the forecast as sellers predominated after Mercury had entered Gemini on Tuesday. I had anticipated some significant weakness from this influence and it arrived more or less on schedule as the bigger down days were on Thursday when Mercury was in aspect with Saturn and Friday, when the Sun was in aspect with Pluto. Overall, we are holding more or less to our forecast for the establishing of the right shoulder that may be a technical pre-condition before see get another major move down. I had wondered just how bullish the Jupiter-Uranus aspect would be here and last week’s action suggested that it may be fading. Monday’s gain was quite solid (2%) but Tuesday was down when the Sun was arguably in a positive position with respect to Jupiter. So there is some evidence that the bullish fuel from this conjunction may be running out and with it, the possibility of a higher interim high. At the same time, we need to closely monitor the effects of the approaching Saturn-Uranus opposition on 26 July. This pattern may actually develop in two distinct phases. Uranus will turn retrograde on 6 July around the time when we could see an interim bottom formed as its tension with Saturn will increase. But the time of the exact opposition on 26 July is likely to be more significant in terms of signalling a down move, much the way that the April 26 opposition also marked the beginning of a new wave of selling pressure. The reason why the next major move down will likely be greater is that Pluto will now join the fray as it makes a very stressful square aspect with both Saturn and Uranus in August and September. As we know, the last time these three planets formed such a tense aspect was in the early 1930s when there were high levels of economic dislocation and social change.

Stocks in Mumbai were mostly unchanged last week as domestic growth prospects were offset by ongoing global worries over a possible double dip recession. After rising to within a couple hundred points of its high for the year, the Sensex finished flat at 17,574 while the Nifty ended Friday at 5269. While I had expected strength to last a little longer than it did, this neutral outcome was not significantly out of line with my forecast. We did get the major up days in the early part of the week on the Sun-Uranus and Sun-Jupiter aspects, although I mistakenly thought Tuesday would be more bullish. Nonetheless, the early week period was net positive as per the forecast as sellers predominated after Mercury had entered Gemini on Tuesday. I had anticipated some significant weakness from this influence and it arrived more or less on schedule as the bigger down days were on Thursday when Mercury was in aspect with Saturn and Friday, when the Sun was in aspect with Pluto. Overall, we are holding more or less to our forecast for the establishing of the right shoulder that may be a technical pre-condition before see get another major move down. I had wondered just how bullish the Jupiter-Uranus aspect would be here and last week’s action suggested that it may be fading. Monday’s gain was quite solid (2%) but Tuesday was down when the Sun was arguably in a positive position with respect to Jupiter. So there is some evidence that the bullish fuel from this conjunction may be running out and with it, the possibility of a higher interim high. At the same time, we need to closely monitor the effects of the approaching Saturn-Uranus opposition on 26 July. This pattern may actually develop in two distinct phases. Uranus will turn retrograde on 6 July around the time when we could see an interim bottom formed as its tension with Saturn will increase. But the time of the exact opposition on 26 July is likely to be more significant in terms of signalling a down move, much the way that the April 26 opposition also marked the beginning of a new wave of selling pressure. The reason why the next major move down will likely be greater is that Pluto will now join the fray as it makes a very stressful square aspect with both Saturn and Uranus in August and September. As we know, the last time these three planets formed such a tense aspect was in the early 1930s when there were high levels of economic dislocation and social change.

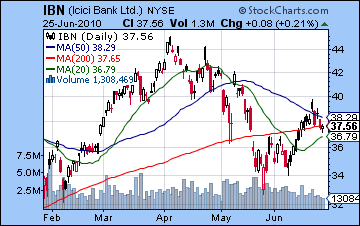

The technical situation improved slightly for the bulls last week as there was a bullish crossover of the 20 and 50 DMA. And since both are now above the 200 DMA, the bulls can at least point to a positive momentum now, however fleeting this stacked arrangement may be. The bullish case for higher prices in the near term was also supported by the volume story. Monday’s gain came on good volume of 26k while the flat to negative days came on much lower volume around 15-17k. This is a possible sign that investors are choosing to hang on to their shares when prices are falling in the expectation of higher prices down the road. MACD is still in a bullish crossover although the histograms are shrinking. And it should be also be said there is no major divergence here with respect to the previous April high. RSI (57) is bullish but is turning down. Stochastics look bullish although they remain in overbought territory. Once it falls below the 80 line, the selling will intensify and we will have rapid declines in price. Since the market has already lost 2% while remaining overbought, we have set the stage for greater downside. MACD on the weekly Sensex chart continues to show a clear negative divergence, a sign of lower prices to come. Financials such as ICICI (IBN) continue to be under pressure as we are on the verge of a very bearish death cross of the 50 and 200 DMA. The last time this happened was in March 2008 when prices fell 10% in short order. While this is a bearish signal that few investors should ignore, it is important to remember that prices can temporarily climb back up to the 50 DMA as they did briefly in May 2008. ICICI also closed below its 50 and 200 DMA, another sign of weakness going forward. The Nifty as a whole is in a relatively stronger position although I believe it will only be a matter of time before the rest of the market shows the weakness that financials are now displaying. So we are still anticipating some kind of head and shoulders or double top pattern to form here with the major indices before they move significantly lower. There is a reasonable chance we have seen the interim high last week. If not, we may allow for a small increase in price this week that challenges the April high. Volume will be an important consideration since new highs should be made on good volume (>25k?) otherwise the high is not confirmed. For next week, the Nifty will begin near the support level in a falling channel. If this is broken, it could fall to the 5150 level and the 20 and 50 DMA. A move higher would meet with resistance at the top of this channel around 5320. If this should be broken, then it will likely take a run to 5400. While I am not ruling out a run to 5400, I don’t think this is the most likely scenario. Probably we move lower and test support at 5150 with perhaps an up day mixed in. Below that, the 200 DMA at 5058 could bring in new buyers as it did in early June. None of those support levels are of crucial importance technically, however, since the market will be forming higher lows. For the bearish interpretation to take root, previous lows have to be violated, i.e. 4800. Once this support level is broken, the market will likely unravel quickly.

The technical situation improved slightly for the bulls last week as there was a bullish crossover of the 20 and 50 DMA. And since both are now above the 200 DMA, the bulls can at least point to a positive momentum now, however fleeting this stacked arrangement may be. The bullish case for higher prices in the near term was also supported by the volume story. Monday’s gain came on good volume of 26k while the flat to negative days came on much lower volume around 15-17k. This is a possible sign that investors are choosing to hang on to their shares when prices are falling in the expectation of higher prices down the road. MACD is still in a bullish crossover although the histograms are shrinking. And it should be also be said there is no major divergence here with respect to the previous April high. RSI (57) is bullish but is turning down. Stochastics look bullish although they remain in overbought territory. Once it falls below the 80 line, the selling will intensify and we will have rapid declines in price. Since the market has already lost 2% while remaining overbought, we have set the stage for greater downside. MACD on the weekly Sensex chart continues to show a clear negative divergence, a sign of lower prices to come. Financials such as ICICI (IBN) continue to be under pressure as we are on the verge of a very bearish death cross of the 50 and 200 DMA. The last time this happened was in March 2008 when prices fell 10% in short order. While this is a bearish signal that few investors should ignore, it is important to remember that prices can temporarily climb back up to the 50 DMA as they did briefly in May 2008. ICICI also closed below its 50 and 200 DMA, another sign of weakness going forward. The Nifty as a whole is in a relatively stronger position although I believe it will only be a matter of time before the rest of the market shows the weakness that financials are now displaying. So we are still anticipating some kind of head and shoulders or double top pattern to form here with the major indices before they move significantly lower. There is a reasonable chance we have seen the interim high last week. If not, we may allow for a small increase in price this week that challenges the April high. Volume will be an important consideration since new highs should be made on good volume (>25k?) otherwise the high is not confirmed. For next week, the Nifty will begin near the support level in a falling channel. If this is broken, it could fall to the 5150 level and the 20 and 50 DMA. A move higher would meet with resistance at the top of this channel around 5320. If this should be broken, then it will likely take a run to 5400. While I am not ruling out a run to 5400, I don’t think this is the most likely scenario. Probably we move lower and test support at 5150 with perhaps an up day mixed in. Below that, the 200 DMA at 5058 could bring in new buyers as it did in early June. None of those support levels are of crucial importance technically, however, since the market will be forming higher lows. For the bearish interpretation to take root, previous lows have to be violated, i.e. 4800. Once this support level is broken, the market will likely unravel quickly.

This week could prove very eventful as there are a high number of aspects to consider. Generally the early part of the week favours the bulls more, with declines more likely later on with the bears likely carrying the week. Monday begins with a pairing of a bullish Sun-Mercury conjunction and a potentially bearish Mars-Rahu aspect. These could conceivably cancel each other out, although the overall pattern seems negative. Tuesday looks somewhat more promising as the Moon opposes Venus, although this is not a strongly bullish influence. Wednesday will see Mercury approaching its conjunction with disruptive Ketu so that tilts towards the bears. Thursday does not feature any close aspects so that is harder to call. The Sun approaches Ketu on Friday while the Moon opposes Mars so that appears to be a more clearly bearish day. So a run towards 5400 is quite possible here by, say, Wednesday, with declines deepening by Friday to take the Nifty back to current levels. That is perhaps the more bullish scenario. A more bearish scenario would see Monday significantly lower, perhaps below 5200, with midweek rally attempts, towards current levels and the falling channel. In this scenario, the rally attempt would return to the previous support level and fall back as it turned into resistance. We would then head towards the 20 and 50 DMA around 5150 by Friday.

Next week (July 5-9) looks mostly bearish as the Sun remains in conjunction with Ketu on Monday ahead of the solar eclipse on the 11th. Venus also enters Leo where it will join malefic Mars. This may further dampen enthusiasm for stocks. We could see some gains later in the week, with Friday perhaps more likely green than Thursday. Wednesday and Thursday may also be damaged by virtue of the Saturn influence on Mercury and Venus on those days. So we may see an interim low formed at this time, perhaps somewhere in the vicinity of 4800. The following week (Jul 12-16) will likely see some kind of rebound as Mercury is in aspect with Jupiter in the early part of the week. It is possible we could see the bounce extend towards 23 July and the Sun-Jupiter aspect that immediately precedes the Jupiter retrograde cycle. Assuming we stay above the 4800 level by 9 July, I would expect a 50% retracement from the highs, perhaps back to 5100-5200. After that, the situation darkens considerably as Mars enters Virgo and then conjoins Saturn on 30 July. Of course, the market is likely to begin to slide before this Mars-Saturn conjunction but it is the focus of planetary energy. After about a two-week pullback, another rally attempt is likely in mid-August. This will likely produce a lower high in classic bear market fashion. Then the end of August into mid-September will see another wave lower, perhaps taking the Nifty below 4500 with even 4000 as a possibility. A Nifty 4000 level by September requires 4800 by early July and then a larger decline in late July. Both are probable, although we will have to wait and see how things unfold. If either move down does not live up to expectations, then the 4000 level may have to wait until November.

Next week (July 5-9) looks mostly bearish as the Sun remains in conjunction with Ketu on Monday ahead of the solar eclipse on the 11th. Venus also enters Leo where it will join malefic Mars. This may further dampen enthusiasm for stocks. We could see some gains later in the week, with Friday perhaps more likely green than Thursday. Wednesday and Thursday may also be damaged by virtue of the Saturn influence on Mercury and Venus on those days. So we may see an interim low formed at this time, perhaps somewhere in the vicinity of 4800. The following week (Jul 12-16) will likely see some kind of rebound as Mercury is in aspect with Jupiter in the early part of the week. It is possible we could see the bounce extend towards 23 July and the Sun-Jupiter aspect that immediately precedes the Jupiter retrograde cycle. Assuming we stay above the 4800 level by 9 July, I would expect a 50% retracement from the highs, perhaps back to 5100-5200. After that, the situation darkens considerably as Mars enters Virgo and then conjoins Saturn on 30 July. Of course, the market is likely to begin to slide before this Mars-Saturn conjunction but it is the focus of planetary energy. After about a two-week pullback, another rally attempt is likely in mid-August. This will likely produce a lower high in classic bear market fashion. Then the end of August into mid-September will see another wave lower, perhaps taking the Nifty below 4500 with even 4000 as a possibility. A Nifty 4000 level by September requires 4800 by early July and then a larger decline in late July. Both are probable, although we will have to wait and see how things unfold. If either move down does not live up to expectations, then the 4000 level may have to wait until November.

5-day outlook — bearish-neutral NIFTY 5100-5250

30-day outlook — bearish-neutral NIFTY 5000-5200

90-day outlook — bearish NIFTY 4000-4500

As the Euro extended its dead cat bounce last week, the Dollar stumbled further before closing near its 50 DMA just above 85. This was more or less as expected, although I thought it would languish earlier in the week on the Sun-Jupiter aspect. I wondered if we would see more upside later in the week but it turned out to be even worse. The greenback is really slipping here and perhaps more importantly, we can see the beginning of a decoupling of the Dollar and equities. Up until last week, a weak Euro/strong Dollar meant bad news for stocks as Europe’s troubles were seen as a threat to economic recovery. Now that central banks appear to be propping up the Euro, it’s everyone’s favourite long trade with the Dollar getting dumped along with shrinking US recovery prospects. The double dip recession talk is getting louder these days, and that may not be good news for the greenback. In the event of a new bout of uncertainty, it is likely to resume its safe haven status, but more investors may be getting edgy about its long term viability. As European economies bite the bitter pill of austerity and Obama administration contemplates printing a few trillion more dollars as part of Stimulus 2.0, the contrast in futures will only become more stark. The technical situation is weak as daily MACD is in a bearish crossover and hurdling towards the zero line. RSI (43) has turned bearish and like MACD, shows a growing negative divergence with respect to previous levels. Stochastics (16) shows a clear oversold condition although it may be poised to break out higher. Volume has not been too high on the down days this week which suggests that many long positions are continuing to hold out for higher prices down the line. Support is offered by the 50 DMA but a break below it may cause a rush to the exits and a move down to the rising trendline at 83. I don’t quite see this happening here but it is a scenario to keep in mind.

As the Euro extended its dead cat bounce last week, the Dollar stumbled further before closing near its 50 DMA just above 85. This was more or less as expected, although I thought it would languish earlier in the week on the Sun-Jupiter aspect. I wondered if we would see more upside later in the week but it turned out to be even worse. The greenback is really slipping here and perhaps more importantly, we can see the beginning of a decoupling of the Dollar and equities. Up until last week, a weak Euro/strong Dollar meant bad news for stocks as Europe’s troubles were seen as a threat to economic recovery. Now that central banks appear to be propping up the Euro, it’s everyone’s favourite long trade with the Dollar getting dumped along with shrinking US recovery prospects. The double dip recession talk is getting louder these days, and that may not be good news for the greenback. In the event of a new bout of uncertainty, it is likely to resume its safe haven status, but more investors may be getting edgy about its long term viability. As European economies bite the bitter pill of austerity and Obama administration contemplates printing a few trillion more dollars as part of Stimulus 2.0, the contrast in futures will only become more stark. The technical situation is weak as daily MACD is in a bearish crossover and hurdling towards the zero line. RSI (43) has turned bearish and like MACD, shows a growing negative divergence with respect to previous levels. Stochastics (16) shows a clear oversold condition although it may be poised to break out higher. Volume has not been too high on the down days this week which suggests that many long positions are continuing to hold out for higher prices down the line. Support is offered by the 50 DMA but a break below it may cause a rush to the exits and a move down to the rising trendline at 83. I don’t quite see this happening here but it is a scenario to keep in mind.

This week will see the completion of the aspect between Saturn and the natal Sun in the USDX chart. This aspect is one of the main sources of recent weakness for the Dollar and so there is a good chance we will see an interim low made this week, presumably in the early going. While the Saturn-Sun aspect is quite strong Monday, there is a potentially offsetting Venus aspect that could minimize the downside damage. I would therefore lean towards a negative start to the week, but I am agnostic on the outcome. Tuesday looks more clearly negative as Mercury falls under the aspect of natal Ketu. Wednesday tends towards the negative also although it could go either way given the minor Mercury aspect in play to the natal Moon and Jupiter. The late week looks more consistently bullish as Mercury aspects natal Venus. There is no clear sailing here at all so I definitely do not want to rule out a fall to 83, but I have to expect some upside here. The Dollar is likely to get more reliable support next week as Mercury and Venus will aspect the natal Sun. After that, the greenback may fall off the radar a bit, as there are no strong aspects. I am interpreting this is weakness, but hopefully nothing too shocking. The retrograde stations of Uranus (July 6) and Jupiter (July 23) may figure prominently in the trends since both are likely to be bullish. Of the two, the Jupiter is far more bullish and may reverse a down trend up to the 23rd. The Dollar would then appreciate going into September. A key reversal lower is likely in October.

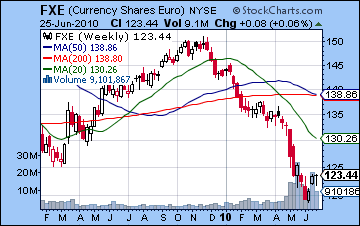

The Euro was the beneficiary of some deep central bank pockets last week as it held its own near 1.23 amidst more recession worries. I thought we might see a little more upside given the temporary strength in the Euro horoscope, but the early week weakness undermined further rally attempts. The technical picture shows signs of life as MACD is still in a bullish crossover although a slight bearish divergence is evident in the histograms. A bounce up to the 50 DMA of 1.25 is very much in the cards and we should not even rule out an eventual rise to the falling trendline at 1.28. This week looks mixed with a decent chance for gains early in the week. The Sun-Mercury conjunction on Monday is especially promising in this regard. It aspects the natal Jupiter so that may well lead to a meaningful rise. Later in the week the influence of Ketu may make Euro vulnerable to selling, however, so it may well wind up back where it started the week. Next week looks more bearish as Venus enters Leo which is the 12th house of losses in the Euro natal chart. We should see the Euro sell off sharply near July 6 at the latest as Uranus stations opposite Saturn. As Mars moves to conjoin Saturn in early Virgo exactly on the ascendant of the Euro in late July, we may see a massive move down in a short time. I would not be surprised to see five cent decline over a few days. Meanwhile, the Rupee lost some ground last week closing at 46.4 More volatility is likely over the next couple of weeks as we could see short up moves to 46 countered by declines that take it back below 47.

The Euro was the beneficiary of some deep central bank pockets last week as it held its own near 1.23 amidst more recession worries. I thought we might see a little more upside given the temporary strength in the Euro horoscope, but the early week weakness undermined further rally attempts. The technical picture shows signs of life as MACD is still in a bullish crossover although a slight bearish divergence is evident in the histograms. A bounce up to the 50 DMA of 1.25 is very much in the cards and we should not even rule out an eventual rise to the falling trendline at 1.28. This week looks mixed with a decent chance for gains early in the week. The Sun-Mercury conjunction on Monday is especially promising in this regard. It aspects the natal Jupiter so that may well lead to a meaningful rise. Later in the week the influence of Ketu may make Euro vulnerable to selling, however, so it may well wind up back where it started the week. Next week looks more bearish as Venus enters Leo which is the 12th house of losses in the Euro natal chart. We should see the Euro sell off sharply near July 6 at the latest as Uranus stations opposite Saturn. As Mars moves to conjoin Saturn in early Virgo exactly on the ascendant of the Euro in late July, we may see a massive move down in a short time. I would not be surprised to see five cent decline over a few days. Meanwhile, the Rupee lost some ground last week closing at 46.4 More volatility is likely over the next couple of weeks as we could see short up moves to 46 countered by declines that take it back below 47.

Dollar

5-day outlook — bearish-neutral

30-day outlook — neutral

90-day outlook — bullish

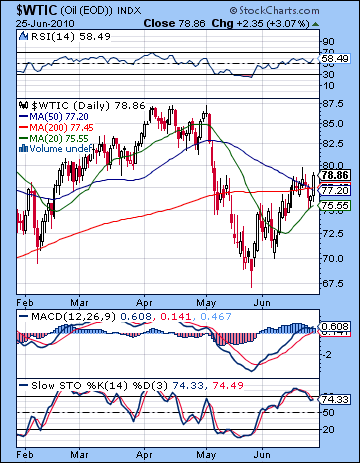

Boosted by fears of supply disruption with the arrival of the US hurricane season, crude oil rose last week closing just below $79 on the continuous contract. This outcome was not out of line with expectations as I had forecast a possible move to $80 on the Sun-Jupiter-Uranus pattern. I was off in my timing of the rise, however, as I thought most of the gains would arrive by midweek with the late week being more bearish. As it happened, aside from Monday’s push to $80, the big move for the week occurred on Friday when hurricane warnings became more urgent. I missed this run-up although in hindsight we could distinguish a plausible agent as Mercury was forming a square aspect with Uranus while Venus was in trine with natal Mercury in the Futures chart. Despite the gain, the technical picture is not edifying to bulls. We got a death cross of the 50 and 200 DMA on Wednesday which remained in effect by Friday’s close. This is a clear bearish signal that points to lower prices going forward. On the other hand, current prices are above all three moving averages. Daily MACD is in a bullish crossover although it may be in the early stages of rolling over. RSI (58) is bullish and turning higher. Stochastics (74) have come down from the overbought area and may be vulnerable to further declines. This is perhaps the more clearly bearish indicator of the three as it will likely induce more selling when key support levels are broken. Support is wrapped up in the moving averages here, all of them clustered around $75-77. Prices found support last week from the 20 DMA ($75.55) so this should be seen as providing more support this week. The rising trend line from the May 25 low will also provide more significant support around the $76 level this week. A break down of that line would likely see crude tumble back towards $70. Resistance is likely found around $80 and $82 and would complete a large head and shoulders topping pattern over the past six months. The lower low of May suggests that the right shoulder may also be lower than the left shoulder ($84), so we could see a top form very soon here near $80-82.

Boosted by fears of supply disruption with the arrival of the US hurricane season, crude oil rose last week closing just below $79 on the continuous contract. This outcome was not out of line with expectations as I had forecast a possible move to $80 on the Sun-Jupiter-Uranus pattern. I was off in my timing of the rise, however, as I thought most of the gains would arrive by midweek with the late week being more bearish. As it happened, aside from Monday’s push to $80, the big move for the week occurred on Friday when hurricane warnings became more urgent. I missed this run-up although in hindsight we could distinguish a plausible agent as Mercury was forming a square aspect with Uranus while Venus was in trine with natal Mercury in the Futures chart. Despite the gain, the technical picture is not edifying to bulls. We got a death cross of the 50 and 200 DMA on Wednesday which remained in effect by Friday’s close. This is a clear bearish signal that points to lower prices going forward. On the other hand, current prices are above all three moving averages. Daily MACD is in a bullish crossover although it may be in the early stages of rolling over. RSI (58) is bullish and turning higher. Stochastics (74) have come down from the overbought area and may be vulnerable to further declines. This is perhaps the more clearly bearish indicator of the three as it will likely induce more selling when key support levels are broken. Support is wrapped up in the moving averages here, all of them clustered around $75-77. Prices found support last week from the 20 DMA ($75.55) so this should be seen as providing more support this week. The rising trend line from the May 25 low will also provide more significant support around the $76 level this week. A break down of that line would likely see crude tumble back towards $70. Resistance is likely found around $80 and $82 and would complete a large head and shoulders topping pattern over the past six months. The lower low of May suggests that the right shoulder may also be lower than the left shoulder ($84), so we could see a top form very soon here near $80-82.

This week looks mixed for crude as gains may be more likely in the early going. Monday and Tuesday’s Mars-Rahu aspect is a tricky one to gauge and I would not rule out declines especially since it will activate the natal Venus in the Futures chart. If the early part of the week is equivocal, the latter part of the week looks more solidly bearish as transiting Mars will aspect the natal Mercury. Mars is an upsetting energy, so this transit may weaken sentiment, particularly on Friday. We will have a shortened trading week next week and prices are likely to have a bearish bias. Gains are possible on Tuesday July 6, but look for significant declines after that until perhaps Friday. Going forward I am expecting crude to participate in the general pullback over the next two months. Weather concerns and the ongoing issues surrounding the Gulf oil spill may create some positive divergences here and there especially in mid-July, but generally prices should weaken until September. Regardless of what is happening in the equity markets, however, I am expecting a rebound to begin sometime in September and to carry through until perhaps November. Retrograde Jupiter will gradually move into a very positive position with respect to the Futures chart and this will encourage higher prices.

5-day outlook — bearish-neutral

30-day outlook — neutral

90-day outlook — bearish

Gold continued its recent strength last week as it closed at $1255 just under its previous high, albeit slightly lower overall. I expected more upside from gold but the Sun-Uranus and Sun-Jupiter actually did very little to prices. Since breaking out of its trading range in April, gold appears to be forming a bearish rising wedge as new highs have not kept pace with higher lows. Gold is already in a much longer term bearish wedge pattern that dates back to 2008 and similarly indicates that a reversal is not too far off. Momentum may be flagging as the Stochastic indicator shows a series of lower prices that are divergent with higher prices. Daily MACD is flat and also showing a divergence with the recent new highs. RSI (61) rounds out the divergent indicators. Gold received support from the 20 DMA last week (now at $1232) and so this will be a key level to watch in the near term. This also roughly corresponds to the bottom of the small rising wedge so a break below that would interrupt the rise, at least temporarily. Below that, the 50 DMA around $1200 may provide intermediate term support in the event of a larger pullback. The $1200 level also roughly corresponds to the bottom trend line in the long term wedge. The resistance line in the small rising wedge is around $1275 this week and this is a little below the resistance line generated from the long term wedge. We cannot rule out a test of this resistance level in the short term. Volume in the GLD ETF does not provide any new clues as up day volume is generally comparable to down day volume. While volume decreased last week it is not that unusual given the volume spike that accompanied the new high. If gold makes another new high this week we will pay close attention to volume to see if it matches the late May levels. If not, it will reveal the fragility of current levels.

Gold continued its recent strength last week as it closed at $1255 just under its previous high, albeit slightly lower overall. I expected more upside from gold but the Sun-Uranus and Sun-Jupiter actually did very little to prices. Since breaking out of its trading range in April, gold appears to be forming a bearish rising wedge as new highs have not kept pace with higher lows. Gold is already in a much longer term bearish wedge pattern that dates back to 2008 and similarly indicates that a reversal is not too far off. Momentum may be flagging as the Stochastic indicator shows a series of lower prices that are divergent with higher prices. Daily MACD is flat and also showing a divergence with the recent new highs. RSI (61) rounds out the divergent indicators. Gold received support from the 20 DMA last week (now at $1232) and so this will be a key level to watch in the near term. This also roughly corresponds to the bottom of the small rising wedge so a break below that would interrupt the rise, at least temporarily. Below that, the 50 DMA around $1200 may provide intermediate term support in the event of a larger pullback. The $1200 level also roughly corresponds to the bottom trend line in the long term wedge. The resistance line in the small rising wedge is around $1275 this week and this is a little below the resistance line generated from the long term wedge. We cannot rule out a test of this resistance level in the short term. Volume in the GLD ETF does not provide any new clues as up day volume is generally comparable to down day volume. While volume decreased last week it is not that unusual given the volume spike that accompanied the new high. If gold makes another new high this week we will pay close attention to volume to see if it matches the late May levels. If not, it will reveal the fragility of current levels.

This week looks fairly solid for gold with the early week indicating the probability of more upside. Monday’s Sun-Mercury conjunction tends to be bullish for gold, although the picture is admittedly more complicated by the nasty Mars-Rahu aspect. Tuesday perhaps has a better chance for a gain on the Moon-Venus opposition. The situation becomes more equivocal by Wednesday as Mercury conjoins Ketu. While neither of these planets is directly related to gold, the condition of Mercury may be significant since the Sun, the main significator, is in the sign of Gemini. Since Mercury is said to rule Gemini, then its affliction by Ketu could have consequences for gold prices. By Friday, the Sun itself comes to within one degree of Ketu so that may add further pressure to gold. So a rise to $1270 is very much in play here perhaps earlier, but a pullback below $1250 is also quite possible by Friday. While we could see gold top out around current levels, I am uncertain if we will see much downside before late July. I am not ruling out a retest of $1200 before July 28 but it seems unlikely. A smaller correction that maintains the integrity of both the large and small rising wedges may be the most probable outcome. We will have to watch the effect of the Uranus retrograde station on July 6. A previous Uranus station on December 1, 2009 corresponded with an important interim top in gold so it does increase the possibility somewhat of a reversal. Nonetheless, I think the deeper pullback will more likely occur starting in late July and August after Mars enters Virgo and conjoins Saturn. A bottom is possible in late September or October after which another major rally is likely as the US Dollar is likely to undergo significant selling pressure.

5-day outlook — neutral

30-day outlook — bearish-neutral

90-day outlook — bearish