- Markets tentative early in the week followed by a strong rally

- Dow 7000 possible; Nifty 2750

- Gold likely to sink lower

- Crude rally in place for most of the week

- Markets tentative early in the week followed by a strong rally

- Dow 7000 possible; Nifty 2750

- Gold likely to sink lower

- Crude rally in place for most of the week

We should see the bulls return this week as the Sun moves past its aspect with malefic Saturn and heads towards its more favourable conjunction with Uranus in Aquarius. This comes exact on Thursday so it’s more likely that we will see gains later in the week. Monday and Tuesday could see more downside probing below Dow 6500 and SPX 670 as the Moon conjoins Saturn in opposition to the Sun. This configuration will activate the natal Mars in the NYSE chart while transiting Mars is in tense aspect with the natal Mercury. I would not be surprised to see lower lows here but probably not by too much and the recovery is likely to be very sharp afterwards. Thursday and Friday are more likely to be positive because of the position of the Moon which will form beneficial aspects with the Mars-Neptune conjunction and thereby link in to the Sun-Jupiter natal aspect in the NYSE chart. In addition, Venus will be in close aspect with Jupiter and this will be triggered by the Moon, most likely on Thursday. Thursday is the most bullish day of the week, with a single day rise of 4-6% very much on the table. Overall, a ten percent gain off the bottom is not out of the question here, so depending on where that bottom occurs, we could see the Dow trading at 7000-7300 and the SPX at 720-740 at some point this week.

We should see the bulls return this week as the Sun moves past its aspect with malefic Saturn and heads towards its more favourable conjunction with Uranus in Aquarius. This comes exact on Thursday so it’s more likely that we will see gains later in the week. Monday and Tuesday could see more downside probing below Dow 6500 and SPX 670 as the Moon conjoins Saturn in opposition to the Sun. This configuration will activate the natal Mars in the NYSE chart while transiting Mars is in tense aspect with the natal Mercury. I would not be surprised to see lower lows here but probably not by too much and the recovery is likely to be very sharp afterwards. Thursday and Friday are more likely to be positive because of the position of the Moon which will form beneficial aspects with the Mars-Neptune conjunction and thereby link in to the Sun-Jupiter natal aspect in the NYSE chart. In addition, Venus will be in close aspect with Jupiter and this will be triggered by the Moon, most likely on Thursday. Thursday is the most bullish day of the week, with a single day rise of 4-6% very much on the table. Overall, a ten percent gain off the bottom is not out of the question here, so depending on where that bottom occurs, we could see the Dow trading at 7000-7300 and the SPX at 720-740 at some point this week.

I think the rally is likely to continue into next week, although we should expect some pullback by the 18th as Mercury opposes Saturn. The rest of March looks mixed at best, so I very much doubt we will see a lasting rally from this week’s action. Whether or not we form lasting lows early in the week, or indeed from last Friday morning, is still an open question. Certainly, the impending Mars-Saturn opposition in early April still promises a significant retreat that may be fairly close to any new lows we set here. Scenario One would have the markets making tentative advances through the rest of March and then pulling back in early April but at a higher low, perhaps around Dow 7000/SPX 730. Scenario Two sees choppier trading through the end of March after this week’s rally, so that new lows are set in early April, perhaps around Dow 6000/SPX 630. If the market is going to undertake a significant bear market rally that most observers agree is imminent, there should be some kind of capitulatory sell off first. While the markets were anemic this past week, no such sell off occurred. Unless we get it early this week, that should be seen as a technical reason to support Scenario Two where the final selling climax occurs in early April. Astrologically, I tend to favour Scenario Two of an April low, but I am not certain. For this reason, it may be worthwhile to hedge one’s bets somewhat where conditions permit.

Trading Outlook: The probable early week weakness may be a good opportunity to establish a speculative short term long position anticipating a rally later this week and into next. Since we are in a bottoming phase of the market now, short positions should be taken with caution since even shorting rallies may not provide enough risk/reward ratio when the downside is more limited than it has been in the past. That said, rallies may still offer shorting opportunities if they are strong enough, e.g. +10%. With an extended rally in the offing over the next few months, establishing some kind of long position on significant declines makes sense. Scaling into long positions as always remains the most prudent strategy, especially given the prospect of a tradeable April low.

Stocks in Mumbai succumbed to global pessimism last week and lost 5% as the Nifty retested key 2008 lows Thursday before closing at 2620. The Sensex continued its slide below 8500 and ended Friday’s session at 8325. The decline was mostly in keeping with expectations, as Nifty 2680 was breached. If anything, the losses were deeper than I had forecast as the early week proved to be very negative. The Mercury-Mars conjunction was a bearish indicator, and its placement in Capricorn did little to redeem the malefic Mars energy. Wednesday also defied a negative forecast as the market rallied strongly that day in the face of the Moon-Saturn aspect. Thursday and Friday were net bearish as forecast, although Friday’s recovery rally may have been boosted by the unexamined Moon alignment to Sun, Venus, and Jupiter.

Even with the holiday closing Tuesday and Wednesday, this week should see the market rally back strongly from recent lows. There are two key bullish patterns that will likely move markets higher. First, the Sun-Uranus conjunction in Aquarius occurs on Thursday and will celebrate the Sun’s escape from the bearish influence of Saturn that has helped move prices lower in recent days. Second, Venus is now slowing moving backwards towards a favourable aspect with Jupiter, so these two benefics will likely combine to give a boost to markets and limit any downside moves. Monday may begin in the red, however, as the Moon in Leo will oppose the Mars-Neptune conjunction. There is a chance the markets will close in the green, however, as the aspect begins to weaken towards the close. Thursday and Friday looks solidly bullish as the aforementioned aspects are very close to exact while the Moon is in a favourable aspect with both of them. Friday may be the better day of the two. If Monday is negative as expected, the rally at the end of the week may push the Nifty towards 2800 once again. If it does not get there by Friday, then it very well may early next week.

Even with the holiday closing Tuesday and Wednesday, this week should see the market rally back strongly from recent lows. There are two key bullish patterns that will likely move markets higher. First, the Sun-Uranus conjunction in Aquarius occurs on Thursday and will celebrate the Sun’s escape from the bearish influence of Saturn that has helped move prices lower in recent days. Second, Venus is now slowing moving backwards towards a favourable aspect with Jupiter, so these two benefics will likely combine to give a boost to markets and limit any downside moves. Monday may begin in the red, however, as the Moon in Leo will oppose the Mars-Neptune conjunction. There is a chance the markets will close in the green, however, as the aspect begins to weaken towards the close. Thursday and Friday looks solidly bullish as the aforementioned aspects are very close to exact while the Moon is in a favourable aspect with both of them. Friday may be the better day of the two. If Monday is negative as expected, the rally at the end of the week may push the Nifty towards 2800 once again. If it does not get there by Friday, then it very well may early next week.

As strong as this rally may be, it is unlikely to last much further than Monday or Tuesday next week. Mercury’s opposition to Saturn on Wednesday, March 18 looks like it will be an interruption of the bullish trend. The rest of March looks fairly mixed with major down days such as March 23 tempering any possible gains. Given the likely anxiety generated from the Mars-Saturn opposition in early April, it seems unlikely that a rally of any strength can take place in March.

Trading Outlook: With the prospect of a rally later this week, a speculative long position is potentially attractive, both on a short term basis and as part of a longer term long position that is built upon in the coming weeks as the market attempts to consolidate a bottom. Conversely, any rallies are unlikely to get very far and therefore will become shorting targets.

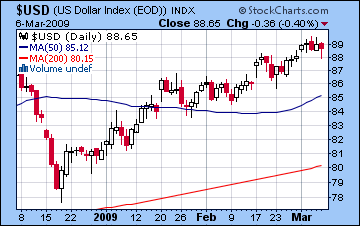

As market confidence evaporated last week, the US dollar pushed to new near-term highs, as it traded as high as 89.5 intraweek before closing at 88.65. This gain was entirely within expectations and confirmed the bullishness of Friday’s Venus retrograde station which fell in close aspect to several points in the USDX natal chart. The dollar’s weakness on Friday was somewhat at odds with the forecast, given that the Sun and Venus were still in close alignment with the ascendant in the natal chart. This anomaly may be explained by the Moon’s transit to the 8th house, although that will require further analysis. In any event, the dollar will likely fall this week as Venus retreats off that point and Mars moves into a tense square aspect with the natal Sun-Saturn conjunction. A pullback to 86 is very possible here. The most bullish days are likely Tuesday when the Moon conjoins Saturn in the 10th house and Thursday, when the Moon has moved over to conjoin the 11th house cusp. Nonetheless, any gains are unlikely to be sustained in the wake of greater selling pressure.

As market confidence evaporated last week, the US dollar pushed to new near-term highs, as it traded as high as 89.5 intraweek before closing at 88.65. This gain was entirely within expectations and confirmed the bullishness of Friday’s Venus retrograde station which fell in close aspect to several points in the USDX natal chart. The dollar’s weakness on Friday was somewhat at odds with the forecast, given that the Sun and Venus were still in close alignment with the ascendant in the natal chart. This anomaly may be explained by the Moon’s transit to the 8th house, although that will require further analysis. In any event, the dollar will likely fall this week as Venus retreats off that point and Mars moves into a tense square aspect with the natal Sun-Saturn conjunction. A pullback to 86 is very possible here. The most bullish days are likely Tuesday when the Moon conjoins Saturn in the 10th house and Thursday, when the Moon has moved over to conjoin the 11th house cusp. Nonetheless, any gains are unlikely to be sustained in the wake of greater selling pressure.

The Euro fell further this week closing at 1.265, after trading as low as its now familiar support level of 1.25. This was also in keeping with the forecast as the Mercury-Mars conjunction created negative energy for the Euro due to the proximity to the natal Ketu. The Euro seems destined to move higher this week on the strength of the Sun-Uranus conjunction which will fall exactly on its natal Jupiter. Wednesday may be the best day as the Moon forms a grand trine with the natal ascendant and Venus shortly after aspecting the Sun-Uranus-Jupiter alignment. I would not rule out 1.30 this week, as an explosive 2-3 cent daily move to the upside is in the cards. With the dollar rallying on recurring economic fears, the Rupee slid further last week trading at 52 early in the week before recovering slightly by Friday at 51.7. We can expect a significant rally this week, perhaps back to 50, as transiting Mercury conjoins Venus in the natal chart and the transiting Sun makes a positive impression on the cusp of 11th house of gains. The Rupee rally will likely last into early next week, after which we should expect another move back down.

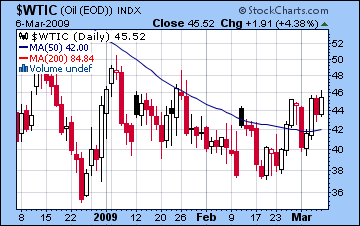

Now that Ketu is moving away from the natal Sun in the Futures chart, we can see that rallies are stronger in crude while pullbacks are more brief. The planets therefore support the notion that crude is moving off its recent lows and will move substantially higher in the near term. While crude did trade near our forecast target of $40 last week, it quickly recovered and ended higher for the week above $45. In retrospect, I underestimated the bullish influence of the Jupiter aspect to the natal Mercury. Mercury itself was still positively supported by the proximity of the stationing Venus so Jupiter’s aspect helped to override any lasting fallout from the Mars aspect to the 12th house aspect.

Now that Ketu is moving away from the natal Sun in the Futures chart, we can see that rallies are stronger in crude while pullbacks are more brief. The planets therefore support the notion that crude is moving off its recent lows and will move substantially higher in the near term. While crude did trade near our forecast target of $40 last week, it quickly recovered and ended higher for the week above $45. In retrospect, I underestimated the bullish influence of the Jupiter aspect to the natal Mercury. Mercury itself was still positively supported by the proximity of the stationing Venus so Jupiter’s aspect helped to override any lasting fallout from the Mars aspect to the 12th house aspect.

This week looks quite favourable for crude as Venus is now moving closer to that same natal Mercury while Jupiter continues to provide price support. Moreover, the Sun-Uranus conjunction will occur at 28 Aquarius which is just one degree from the equal 10th house cusp. As an added twist, towards the end of the week, transiting Mars will come under the disruptive aspect of the natal Rahu and will form a grand trine aspect with the natal Pluto. While all these planets are considered malefics, all the other positive planetary energy may well shift the negativity into the green. It’s by no means clear that such a "conversion" can occur, however, so we have to remain open to the possibility for a big pullback on Friday. The transiting Moon will also participate in this grand trine alignment on Friday thus increasing the likelihood of big price move at that time. Overall, I think the indications are positive for the week. Even allowing for the possibility of a sell off Friday, we may well see $50 at some point this week.

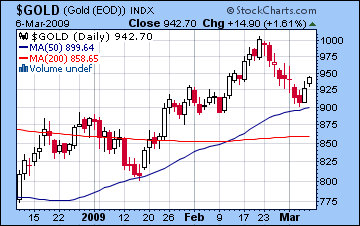

After some weakness early in the week, gold recovered to $942 to finish mostly unchanged last week. I had been somewhat ambivalent about gold last week, so this result isn’t entirely unwelcome, although I had thought there would be a rise in the early week. As it happened, the gains on Thursday and Friday may best be seen in light of the harmonic resonance between transiting Jupiter and the GLD chart.

After some weakness early in the week, gold recovered to $942 to finish mostly unchanged last week. I had been somewhat ambivalent about gold last week, so this result isn’t entirely unwelcome, although I had thought there would be a rise in the early week. As it happened, the gains on Thursday and Friday may best be seen in light of the harmonic resonance between transiting Jupiter and the GLD chart.

This week looks like more downside bias for gold in advance of the Sun-Uranus conjunction. Monday looks mixed, although the early part of the day may be more positive than the afternoon since the Moon resonates more with Jupiter in the morning while it shifts to the more bearish axis of Mercury-Rahu-Ketu in the afternoon. A red close is more likely. A similar pattern may occur Tuesday as the Moon comes under Jupiter’s influence in the morning. Wednesday looks quite negative as the Moon falls under natal Saturn’s aspect while Mars enters into a broader alignment with natal Sun and Saturn. The best chance for an up day may be Thursday as the Moon forms a positive aspect with Jupiter. Friday looks more mixed, although a positive outcome is not out of the realm of possibility. I think gold is likely to head back towards $900 this week, although it will soon resume its rally. $1000 by the end of March is very possible.