- Markets likely moving lower as Venus retrograde cycle begins Friday

- Dow 7000 likely will be breached with 6500 possible; Nifty 2650 in jeopardy

- Gold may recover its shine this week

- Crude to retreat back under $40 after recent rally

- Markets likely moving lower as Venus retrograde cycle begins Friday

- Dow 7000 likely will be breached with 6500 possible; Nifty 2650 in jeopardy

- Gold may recover its shine this week

- Crude to retreat back under $40 after recent rally

This week looks quite bearish as Venus stations and turns retrograde on Friday. By itself, this is can be a negative indicator, but on this occasion Venus is within three degrees of making a quincunx aspect to Saturn. This makes the Venus station all the more bearish. Moreover, we have Mercury and Mars conjoining in Capricorn, also in fairly close quincunx aspect to Saturn from the other side. It’s not a pretty picture. It seems inevitable that the Dow will fall through 7000 here, and the losses may be steep. However, there is a possibility for a technical rebound early this week. The astrology confirms this possibility, although it is by no means certain given the prevailing negative planetary energy. On Tuesday, the Sun makes a harmonic aspect with Jupiter, while Mercury has moved past Mars and the Moon is exalted in Taurus. This may point to some kind of bounce early in the week, especially Tuesday, but it’s very likely that we will move lower through the rest of the week. Wednesday and Thursday sees the trading planet Mercury conjoining the usually weakening Neptune, which is itself in a harmonic aspect with the nodes. Wednesday has the added liability of the Moon squaring Saturn, so that may well be a big down day. Some recovery is possible on either Thursday or Friday, as the Sun and Venus are in aspect.

This week looks quite bearish as Venus stations and turns retrograde on Friday. By itself, this is can be a negative indicator, but on this occasion Venus is within three degrees of making a quincunx aspect to Saturn. This makes the Venus station all the more bearish. Moreover, we have Mercury and Mars conjoining in Capricorn, also in fairly close quincunx aspect to Saturn from the other side. It’s not a pretty picture. It seems inevitable that the Dow will fall through 7000 here, and the losses may be steep. However, there is a possibility for a technical rebound early this week. The astrology confirms this possibility, although it is by no means certain given the prevailing negative planetary energy. On Tuesday, the Sun makes a harmonic aspect with Jupiter, while Mercury has moved past Mars and the Moon is exalted in Taurus. This may point to some kind of bounce early in the week, especially Tuesday, but it’s very likely that we will move lower through the rest of the week. Wednesday and Thursday sees the trading planet Mercury conjoining the usually weakening Neptune, which is itself in a harmonic aspect with the nodes. Wednesday has the added liability of the Moon squaring Saturn, so that may well be a big down day. Some recovery is possible on either Thursday or Friday, as the Sun and Venus are in aspect.

As for when the bottom might be, I think there are a few of possibilities. This week’s Venus station has no shortage of problems, and should be seen as a possible medium term low, give or take a few days either way. Given the abundance of tense aspects in the sky in the next few weeks, I would be hesitant to declare that the bottom has been reached over the next week. Readers may recall that several weeks ago, I noted the approaching Jupiter-Saturn quincunx on March 23rd and wondered if it might be a significant low. I still think that time frame will be quite vulnerable, but I would amend it somewhat to March 18th, when Mercury is opposite Saturn and Jupiter is still in a fairly close 150 degree quincunx aspect. Before that time, there will be some kind of short rally, particularly between March 10-12 as Venus is in aspect to Jupiter that will see the market lift perhaps up to 10%. As before, the period around the Mars-Saturn opposition from April 3-8 is also quite bearish and will make a significant low. At this point, I think it is more likely that it will be a higher low than what we see in March. As for levels, I would estimate we could be headed for 6000-6500 on the Dow and perhaps 620-670 on the SPX, although those are admittedly worse case scenarios. That said, I would not be surprised to see Dow 6500 sometime this week.

Trading Outlook: Any early week rallies are opportunities for speculative shorting. Otherwise, investors may consider taking long positions after big sell offs. More conservative investors seeking to buy (long) into the market are advised to proceed very cautiously and should wait until late March or April before assuming any significant positions. As before, any rally into summer is certain to fall apart by the autumn and winter, so going long in the market is at best a medium term proposition. 2010 will likely move markets lower still, with Dow 4000 a very realistic possibility.

Mumbai managed a modest 1% gain on the week, as investors shook off a terrible Tuesday open and took the market higher as the Sensex closed at 8891 and the Nifty at 2763. The major indices managed to stay above critical support levels (8500 and 2680), and hence postponed any downward probing. I had anticipated a mixed week, so this wasn’t too far off the mark. My forecast was also largely correct for midweek strength, as the Sun transited through the more friendly regions of Satabisha.

This week looks more negative as we approach the Venus retrograde station on Friday. The early part of the week may see a better chance for gains, Mercury conjoins Mars in Capricorn on Monday. While this will form a separating aspect with Saturn, there is a possibility that Mars’ exaltation in Capricorn may prevent the worse side of Mars to manifest. The Sun-Jupiter harmonic aspect in the early part of the week may also provide some support. But the Venus situation contains the potential for substantial falls since it is in a bad 6th house relationship with Saturn (i.e. 150 degrees apart). Moreover, Venus will make its station just two degrees away from the natal Ketu in the Nifty natal chart. This is another negative indication that presents the very real threat that support will be broken this week. Wednesday is more likely to be negative as the Moon squares Saturn. Thursday and Friday also may be negative as transiting Mars will square the natal Mercury in the Nifty chart as Mercury comes under the influence of weakening Neptune. And all of this takes place while Sun is lining up opposite Saturn, just two degrees short of exact by Friday. Even if we rally in the early going and get to Nifty 2800, there is a very good chance that support at 2680 will be broken at some point this week or early next week. Over the next couple weeks, there is also the greater possibility of a really big down day that could take the market down more than 5% in a single session.

This week looks more negative as we approach the Venus retrograde station on Friday. The early part of the week may see a better chance for gains, Mercury conjoins Mars in Capricorn on Monday. While this will form a separating aspect with Saturn, there is a possibility that Mars’ exaltation in Capricorn may prevent the worse side of Mars to manifest. The Sun-Jupiter harmonic aspect in the early part of the week may also provide some support. But the Venus situation contains the potential for substantial falls since it is in a bad 6th house relationship with Saturn (i.e. 150 degrees apart). Moreover, Venus will make its station just two degrees away from the natal Ketu in the Nifty natal chart. This is another negative indication that presents the very real threat that support will be broken this week. Wednesday is more likely to be negative as the Moon squares Saturn. Thursday and Friday also may be negative as transiting Mars will square the natal Mercury in the Nifty chart as Mercury comes under the influence of weakening Neptune. And all of this takes place while Sun is lining up opposite Saturn, just two degrees short of exact by Friday. Even if we rally in the early going and get to Nifty 2800, there is a very good chance that support at 2680 will be broken at some point this week or early next week. Over the next couple weeks, there is also the greater possibility of a really big down day that could take the market down more than 5% in a single session.

March is shaping up to be bearish as Jupiter (23 Capricorn) applies to its exact 6th house aspect with Saturn (23 Leo) on March 23, a date I mentioned several weeks ago as potentially significant. This negative energy will be activated by several passing trigger planets along the way, including Venus this week, and then the Sun early next week, and then Mercury on March 18th, and finally Mars around April 5. Each of these trigger planets will release a little bit more bearishness from the Jupiter-Saturn combination. At this point, I think there is a 50-50 chance that Nifty 2525 will be seriously retested at some point over the next couple of weeks. A complicating factor in calling the low is the high probability of a short but potentially strong rally from March 10-12 when Sun conjoins Uranus. This has the added feature of being in exact aspect with the natal Jupiter in the NSE chart. If the Nifty falls to, say, 2600 before that time, then this rally could easily propel it to 2900 in a few days. Another interim low is likely in the first week of April, but it may be at a higher price level.

Trading Outlook: With the prospect of lower prices, any early week rallies could be speculatively shorted. March and early April will be very volatile and feature large price swings, so taking a long position in anticipation of a spring rally should only been done cautiously on significant dips and in stages. Conservative investors may wish to wait until the early April pullback before buying into a long position.

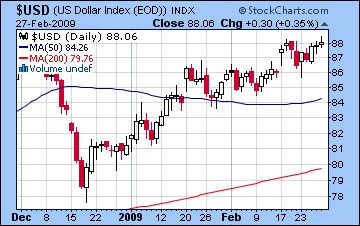

The dollar closed again above 88 last week on safe haven concerns after trading below 87 on Tuesday. This largely fulfilled expectations of a midweek pullback and a bullish finish. The approaching Venus station is likely to push the dollar higher still this week, with a possible high on Thursday when the Sun will be in aspect with Venus and both will be in close aspect to the Asc/Mercury conjunction in the USDX natal chart. 89 is very possible here, and I would not rule out 90. We can look for another peak to occur around March 18, when Mercury forms a favourable pattern with Jupiter. It’s hard to say at this point if it will equal the highs set this week or early next week. The Euro fell back under 1.27 in Friday’s trading and is poised to fall further this week, most likely testing that 1.25 support level by Friday. Mercury will first conjoin Neptune on Thursday, with Mars following close behind Friday. These conjunctions may be particularly significant for the Euro because they will occur in close conjunction with the natal Ketu. This seems like quite a bearish pattern, so we could see some big moves to the downside here. The Rupee dropped sharply last week closing above 51 for the time since November. While I had expected weakness, the depth of the retreat was surprising. This week looks worse, so we can look for the Rupee to trade above 52. Next week will see some recovery and take it again towards 50.

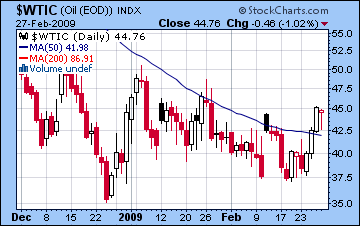

The dollar closed again above 88 last week on safe haven concerns after trading below 87 on Tuesday. This largely fulfilled expectations of a midweek pullback and a bullish finish. The approaching Venus station is likely to push the dollar higher still this week, with a possible high on Thursday when the Sun will be in aspect with Venus and both will be in close aspect to the Asc/Mercury conjunction in the USDX natal chart. 89 is very possible here, and I would not rule out 90. We can look for another peak to occur around March 18, when Mercury forms a favourable pattern with Jupiter. It’s hard to say at this point if it will equal the highs set this week or early next week. The Euro fell back under 1.27 in Friday’s trading and is poised to fall further this week, most likely testing that 1.25 support level by Friday. Mercury will first conjoin Neptune on Thursday, with Mars following close behind Friday. These conjunctions may be particularly significant for the Euro because they will occur in close conjunction with the natal Ketu. This seems like quite a bearish pattern, so we could see some big moves to the downside here. The Rupee dropped sharply last week closing above 51 for the time since November. While I had expected weakness, the depth of the retreat was surprising. This week looks worse, so we can look for the Rupee to trade above 52. Next week will see some recovery and take it again towards 50. A full-blown rally in crude got under way last week as it closed above $44 as US inventories declined. While I thought we would be prone to big up days, I did not foresee the extent of the rally. In retrospect, I think the Venus transit to Futures chart Mercury more than offset any negativity from the influence of Mars on Mercury. Now that Venus has passed Mercury, much of the benefits of that transit have ended. A more neutral to negative influence is more likely in the Mars-Neptune conjunction that forms towards the end of the week. This combination of two malefics will aspect the 12th house cusp of loss in the Futures chart and may prompt some big declines for crude this week, particularly towards the end of the week. I think we may see crude move back towards $40 here. Of course, once Venus turns retrograde on Friday, it will move back over the Futures Mercury next week and this will likely push up prices once again. March will therefore continue the consolidation pattern with another possible retest of the bottom around $35 before it can move decisively higher. After a final pullback in the first week of April, crude will likely make a very strong rally.

A full-blown rally in crude got under way last week as it closed above $44 as US inventories declined. While I thought we would be prone to big up days, I did not foresee the extent of the rally. In retrospect, I think the Venus transit to Futures chart Mercury more than offset any negativity from the influence of Mars on Mercury. Now that Venus has passed Mercury, much of the benefits of that transit have ended. A more neutral to negative influence is more likely in the Mars-Neptune conjunction that forms towards the end of the week. This combination of two malefics will aspect the 12th house cusp of loss in the Futures chart and may prompt some big declines for crude this week, particularly towards the end of the week. I think we may see crude move back towards $40 here. Of course, once Venus turns retrograde on Friday, it will move back over the Futures Mercury next week and this will likely push up prices once again. March will therefore continue the consolidation pattern with another possible retest of the bottom around $35 before it can move decisively higher. After a final pullback in the first week of April, crude will likely make a very strong rally.

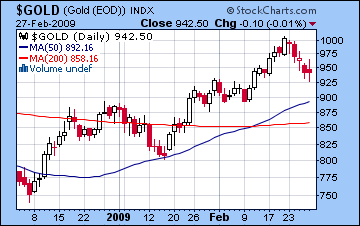

With four-digit prices fast-receding in its rear-view mirror, the shine came off gold last week as bullion dropped 5% to $942. Although I expected some profit taking last week, I did not quite anticipate the extent of this pullback. As I noted last week, the Mars conjunction to the natal Moon in the GLD chart was definitely a bearish influence. This week transiting Jupiter opposes the natal Moon in the Futures chart so we may see some rise here, especially early in the week when the aspect is exact. However, the Venus retrograde station occurs in square aspect to the Futures Saturn, so that is a bearish influence and will produce some down days especially later this week or going into next week. Overall, however, I don’t think the gold rally is completely finished here as it may rise back towards $1000 over the next three weeks as Jupiter conjoins the Moon in the GLD chart. In addition, Venus will aspect the natal Jupiter in this chart which will provide more price support. While the picture is somewhat mixed for gold over the next two months, there is still strong evidence for a substantial rally in May and June as Jupiter will station near the natal Venus in the GLD chart. If gold manages to stay above $800 through March and April, then some higher highs are very possible in June, perhaps to $1100-1200. I am still very bearish for July and August, as transiting Ketu will influence both Sun and Saturn in the GLD chart.

With four-digit prices fast-receding in its rear-view mirror, the shine came off gold last week as bullion dropped 5% to $942. Although I expected some profit taking last week, I did not quite anticipate the extent of this pullback. As I noted last week, the Mars conjunction to the natal Moon in the GLD chart was definitely a bearish influence. This week transiting Jupiter opposes the natal Moon in the Futures chart so we may see some rise here, especially early in the week when the aspect is exact. However, the Venus retrograde station occurs in square aspect to the Futures Saturn, so that is a bearish influence and will produce some down days especially later this week or going into next week. Overall, however, I don’t think the gold rally is completely finished here as it may rise back towards $1000 over the next three weeks as Jupiter conjoins the Moon in the GLD chart. In addition, Venus will aspect the natal Jupiter in this chart which will provide more price support. While the picture is somewhat mixed for gold over the next two months, there is still strong evidence for a substantial rally in May and June as Jupiter will station near the natal Venus in the GLD chart. If gold manages to stay above $800 through March and April, then some higher highs are very possible in June, perhaps to $1100-1200. I am still very bearish for July and August, as transiting Ketu will influence both Sun and Saturn in the GLD chart.