- Markets trending down this week; Dow 7000/SPX 735; Nifty 2700/Sensex 8500

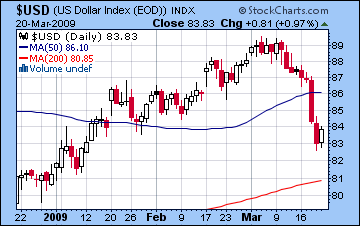

- Dollar likely to recover somewhat

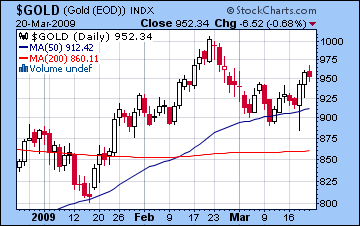

- Gold will rally higher before falling back late week

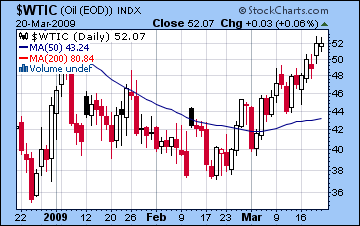

- Crude oil likely to weaken

- Markets trending down this week; Dow 7000/SPX 735; Nifty 2700/Sensex 8500

- Dollar likely to recover somewhat

- Gold will rally higher before falling back late week

- Crude oil likely to weaken

This week looks mostly negative although we will likely see at least one solid up day. There are several significant aspects forming here that appear to be mostly tense. On Monday, the Sun is square with Pluto which can indicate frustration with large firms and governments and perhaps this is a reference to Geithner’s toxic asset plan. At the same time, the Moon is hemmed in between malefics Mars and Neptune. On Tuesday, impulsive Mars is in a harmonic aspect with unsteady Rahu so this may suggest some quick and ill-thought out reactions to news announcements. While it’s conceivable that we could higher prices, I think the bias is negative for the first two days of the week. Wednesday has a good chance to be positive as the Moon enters Pisces in the afternoon (EDT) to join Mercury, Sun and Venus. Thursday features a New Moon at 12 degrees of Pisces that comes under the potentially troublesome influence of Ketu (13 Cancer). The planet of trading, Mercury, is applying to a square aspect with Pluto suggesting a big move and with overtones of possible stock manipulation. Friday sees the Mercury-Pluto aspect come exact while retrograde Venus conjoins the Sun in an even tighter aspect with Ketu. This seems like a fairly tense alignment of planets that is unlikely to move markets higher and indeed there is the potential for a substantial move down at the end of the week. Depending on the extent of any gains earlier in the week, it’s very possible we could see the Dow move to 7000 (SPX 735), with a chance of 6800/710 if the worst elements of Ketu’s energies on Thursday/Friday take control .

This week looks mostly negative although we will likely see at least one solid up day. There are several significant aspects forming here that appear to be mostly tense. On Monday, the Sun is square with Pluto which can indicate frustration with large firms and governments and perhaps this is a reference to Geithner’s toxic asset plan. At the same time, the Moon is hemmed in between malefics Mars and Neptune. On Tuesday, impulsive Mars is in a harmonic aspect with unsteady Rahu so this may suggest some quick and ill-thought out reactions to news announcements. While it’s conceivable that we could higher prices, I think the bias is negative for the first two days of the week. Wednesday has a good chance to be positive as the Moon enters Pisces in the afternoon (EDT) to join Mercury, Sun and Venus. Thursday features a New Moon at 12 degrees of Pisces that comes under the potentially troublesome influence of Ketu (13 Cancer). The planet of trading, Mercury, is applying to a square aspect with Pluto suggesting a big move and with overtones of possible stock manipulation. Friday sees the Mercury-Pluto aspect come exact while retrograde Venus conjoins the Sun in an even tighter aspect with Ketu. This seems like a fairly tense alignment of planets that is unlikely to move markets higher and indeed there is the potential for a substantial move down at the end of the week. Depending on the extent of any gains earlier in the week, it’s very possible we could see the Dow move to 7000 (SPX 735), with a chance of 6800/710 if the worst elements of Ketu’s energies on Thursday/Friday take control .

The New Moon chart itself may signal more volatility in the upcoming four weeks. The nodal influence involving the four Pisces planets suggests we may see sharp rallies and sell offs. With Sun, Moon, Venus and Mercury all in the 10th house aspected by Ketu, we can look forward to surprising and innovative developments from government in this time period. Uranus is also conjunct the Midheaven so that is another piece of evidence that late March and April may bring about sudden changes and new programs by the Obama administration. One interesting artifact of this New Moon is that it occurs just one degree from the natal Ketu, the South Lunar Node, in the NYSE chart. Six months ago in late September just before the markets crashed, the Virgo New Moon conjoined Rahu, the North Lunar Node, in this natal chart. So that can be seen either as another harbinger of a similar decline, or more broadly, as ushering in large swings and perhaps a new direction to stock prices. Perhaps once this New Moon period has finished, the market will have finally left the extreme bearishness behind — at least temporarily. If we do go down this week as expected, next week looks more positive with a significant rally likely. With the following week (April 6-10) looking again more bearish, it’s possible we may have a tradeable retest of the March 6 bottom this week. At this point, anything under 7000/735 would be a tempting buying opportunity, even if we get there as soon as this week.

Trading Outlook: With another down week in the offing, investors may consider taking long positions, especially if markets breach 7000/735. With next week (Mar 30-Apr 3) looking bullish, it’s possible that the lows we make from here on in will be progressively higher. April 6-10 may be bearish but it’s a 50-50 probability that it will be lower than any lows we see this week. If this week turns out to be less negative than expected, then investors may wait until the second or third week of April before going long.

Stocks in Mumbai continued their rally last week on optimism over the Fed’s treasuries buy back plan. The Sensex closed Friday at 8966, up 3% for the week, while the Nifty ended at 2807. I had expected lower prices last week on the Mercury-Jupiter-Saturn alignment, although I did allow for some gains early in the week. Monday was positive as forecast as Mercury and Venus came into close aspect. Tuesday saw some selling pressure, and this was also not unexpected given the difficult position of transiting Mercury in the NSE chart. However, the bears never really showed up after that, perhaps due to the lingering aspect between benefics Mercury and Jupiter in advance of any negative Saturn contact. The late week trading was fairly neutral and this was not far off the forecast, although I did expect the pent up bearishness to manifest before week’s end.

This week may well be a case of catching up on the down side, as we await a potentially disruptive New Moon on Thursday and several notably tense aspects. Monday looks problematic as Mars conjoins the natal Saturn in the NSE chart, while Sun is in a stressful aspect with Pluto. Tuesday also seems potentially bearish since the transiting Moon will conjoin Mars in Aquarius, again fairly close to the Saturn in the NSE chart. On Wednesday, markets may be quite jittery as Mars forms a partial aspect to Rahu, and the Moon moves into conjunction with unpredictable Uranus. Nonetheless, there is a chance for some gains there. Thursday may also offer an opportunity for gains as the Moon enters Pisces and applies to a conjunction with Mercury, although with the Sun and Venus coming under increasing influence from the Ketu aspect, I am not certain this can produce much upside. Friday may see more selling, especially early on as the Sun conjoins Venus, but there is a chance for a lift in the afternoon as the Moon moves away from this alignment. The Mercury-Pluto square is unlikely to be very conducive to positive sentiment, however. Overall, I think there is a negative bias to the week, with 2700/8500 as a possible target. Given the unusual nature of the Sun-Venus-Ketu pattern, we need to be prepared for the possibility that the declines could be more severe. There is a very unpredictable element in this pattern that may move prices quickly.

This week may well be a case of catching up on the down side, as we await a potentially disruptive New Moon on Thursday and several notably tense aspects. Monday looks problematic as Mars conjoins the natal Saturn in the NSE chart, while Sun is in a stressful aspect with Pluto. Tuesday also seems potentially bearish since the transiting Moon will conjoin Mars in Aquarius, again fairly close to the Saturn in the NSE chart. On Wednesday, markets may be quite jittery as Mars forms a partial aspect to Rahu, and the Moon moves into conjunction with unpredictable Uranus. Nonetheless, there is a chance for some gains there. Thursday may also offer an opportunity for gains as the Moon enters Pisces and applies to a conjunction with Mercury, although with the Sun and Venus coming under increasing influence from the Ketu aspect, I am not certain this can produce much upside. Friday may see more selling, especially early on as the Sun conjoins Venus, but there is a chance for a lift in the afternoon as the Moon moves away from this alignment. The Mercury-Pluto square is unlikely to be very conducive to positive sentiment, however. Overall, I think there is a negative bias to the week, with 2700/8500 as a possible target. Given the unusual nature of the Sun-Venus-Ketu pattern, we need to be prepared for the possibility that the declines could be more severe. There is a very unpredictable element in this pattern that may move prices quickly.

Thursday’s New Moon features an uncommon pattern whereby the Sun, Moon, Mercury and Venus are all in close aspect to Ketu. Since Ketu is a planet of sudden movements and unforeseen developments, this is a sign of significant volatility in the next four weeks. We may see sell offs followed by sharp rallies, with price trends all over the map on an intraday basis. While Ketu is often the bringer of declines, I think this negative influence will be somewhat offset by the favourable position of Jupiter in the New Moon chart, as it sits on the 4th house cusp at the bottom of the chart, indicating a kind of insurance against the worst outcomes. So while this week may well be quite negative, the following week should be mostly positive. This will likely be followed Apr 6-10 by another negative week that may retest the lows we make this week, and possibly even the lows of March 6.

Trading Outlook: A negative trend here will offer an opportunity to take long positions, particularly if some of these declines are significant and approach the early March lows. While this is unlikely to occur here, some trades below 2700 are more likely.

The US dollar sold off sharply in the wake of the Fed’s plan to buy back over a trillion dollars worth of treasuries. With Wednesday’s massive 4% move down, the dollar closed below 84 for the week. I frankly missed this move, thinking that the dollar would only break below its current trading range (85-90) later in the spring once equities were on firmer ground. Astrologically, I believed the move down would only come once Saturn had moved into the 21st degree of sidereal Leo so that it would be in a tight square aspect with natal Mercury. As it happened, the positive position of Jupiter in the USDX chart did not provide enough protection against the Mercury-Saturn opposition that was activating the 4th-10th house cusps. While the highs for the dollar are likely in place (90), I don’t think this spells the end for dollar right here. In fact, this week we should see a significant bounce, perhaps back to 86-87, as the Sun and Venus will conjoin on the 4th house cusp in the natal chart. The following week may see more weakness as Mars conjoins the natal Moon so we may move back down towards current levels. There should be another substantial rally in late April, probably around the 20th. The dollar will weaken through May and June, however, perhaps to the 75-80 range. The summer will likely see further weakness but a rally is likely by October with the Jupiter station.

The US dollar sold off sharply in the wake of the Fed’s plan to buy back over a trillion dollars worth of treasuries. With Wednesday’s massive 4% move down, the dollar closed below 84 for the week. I frankly missed this move, thinking that the dollar would only break below its current trading range (85-90) later in the spring once equities were on firmer ground. Astrologically, I believed the move down would only come once Saturn had moved into the 21st degree of sidereal Leo so that it would be in a tight square aspect with natal Mercury. As it happened, the positive position of Jupiter in the USDX chart did not provide enough protection against the Mercury-Saturn opposition that was activating the 4th-10th house cusps. While the highs for the dollar are likely in place (90), I don’t think this spells the end for dollar right here. In fact, this week we should see a significant bounce, perhaps back to 86-87, as the Sun and Venus will conjoin on the 4th house cusp in the natal chart. The following week may see more weakness as Mars conjoins the natal Moon so we may move back down towards current levels. There should be another substantial rally in late April, probably around the 20th. The dollar will weaken through May and June, however, perhaps to the 75-80 range. The summer will likely see further weakness but a rally is likely by October with the Jupiter station.

Most world currencies rallied against the greenback as the prospect of inflation from the Fed plan made the dollar less attractive. The Euro traded near 1.37 for a time late in the week before closing at above 1.35. Jupiter’s aspect to natal Mars in the Euro chart is part of the reason for last week’s surge, also transiting Venus was forming a positive aspect with Uranus. This week the Jupiter-Mars aspect becomes tighter indicating the possibility of more upside but without the support of any faster moving trigger planets, a decline seems more likely here. The Indian Rupee also gained ground last week, trading at 50.5 by Friday. This week looks more negative so we could see it trading above 51 once again.

The rally in crude oil continued last week as it closed Friday near $52. While I knew some upward energy was available through the Tuesday Moon-Jupiter conjunction and the late week transit of Venus to the natal Jupiter, I underestimated their effects. Clearly, any negative astrological influences are resulting in only brief and modest pullbacks, while favourable planetary aspects are producing larger gains. This is further evidence that the bottom in crude is firmly in place and we are in rally mode. I was correct in citing Wednesday are bearish given the Sun’s square aspect to the nodes and the Moon’s conjunction with Ketu-Neptune. However, the decline was less than 2% and this loss was erased the next day once Venus moved into closer aspect with Jupiter.

The rally in crude oil continued last week as it closed Friday near $52. While I knew some upward energy was available through the Tuesday Moon-Jupiter conjunction and the late week transit of Venus to the natal Jupiter, I underestimated their effects. Clearly, any negative astrological influences are resulting in only brief and modest pullbacks, while favourable planetary aspects are producing larger gains. This is further evidence that the bottom in crude is firmly in place and we are in rally mode. I was correct in citing Wednesday are bearish given the Sun’s square aspect to the nodes and the Moon’s conjunction with Ketu-Neptune. However, the decline was less than 2% and this loss was erased the next day once Venus moved into closer aspect with Jupiter.

This week is unlikely to see the rally extended as the positive energy is in short supply with Venus now moving out of range of natal Jupiter. Venus is still close to the natal Sun Monday and Tuesday so that may provide some support, but the Sun forms a tense aspect with natal Saturn at this time, so there may well be an offsetting effect. Monday sees Mercury in aspect with natal Mars and then a square with the nodes, so that may tip the balance towards a net decline then. Wednesday looks generally favourable as the Moon conjoins Uranus on the 10th house cusp. Thursday and Friday don’t look especially promising, as Mars moves into aspect with the Sun. Between the two days, Thursday may see the best chance for a gain with Friday more likely seeing a decline. If Monday is negative, then we may see crude fall below $50 for the week. If it hangs on to current levels on Monday or even goes higher, then it will likely finish around $50-53.

Gold posted a 2% gain last week to close at $952, after surging $65 on Wednesday on the announcement of the Fed plan. Gold’s rally came a little ahead of schedule, but the big move was not that much of a surprise as we had forecast $950 for early this week. As forecast, gold also showed substantial weakness ahead of the Fed announcement on Wednesday and traded as low as $880 before it took flight in the afternoon. Much of the gain could be seen in Jupiter’s approaching conjunction to the Moon in the GLD chart. In addition, transiting Venus was within one degree of an opposition aspect with natal Jupiter. Together, these aspects involving four benefic planets had the power to lift gold very rapidly. Friday’s minor decline could be seen through Mercury’s aspect to the natal Mars.

Gold posted a 2% gain last week to close at $952, after surging $65 on Wednesday on the announcement of the Fed plan. Gold’s rally came a little ahead of schedule, but the big move was not that much of a surprise as we had forecast $950 for early this week. As forecast, gold also showed substantial weakness ahead of the Fed announcement on Wednesday and traded as low as $880 before it took flight in the afternoon. Much of the gain could be seen in Jupiter’s approaching conjunction to the Moon in the GLD chart. In addition, transiting Venus was within one degree of an opposition aspect with natal Jupiter. Together, these aspects involving four benefic planets had the power to lift gold very rapidly. Friday’s minor decline could be seen through Mercury’s aspect to the natal Mars.

The week should begin positively as the Jupiter aspect continues to apply to the Moon. However, the rally may not last long as Jupiter begins to separate. Thursday may also be positive as the transiting Moon is in aspect with natal Jupiter, while the Sun-Venus conjunction also falls under Jupiter’s optimistic influence. Friday may be negative. We could see gold approach $1000 at some point here but a Friday close near $950 is perhaps a more likely outcome. April seems fairly mixed for gold, so I don’t expect it to rally significantly further above current levels and it may be subject to pullbacks under $900. May and June still look more bullish so we will likely see it trade over $1000 for an extended period then.