Summary for week of May 30 – June 3

Summary for week of May 30 – June 3

- Stocks could be bearish early in the week with gains more likely later in week

- Dollar gains probable into midweek; late week looks more negative

- Crude looks mixed this week; Friday’s Neptune retrograde could be a wild card

- Gold probably lower this week, especially midweek on Sun-Saturn aspect

Stocks closed lower for the fourth week in a row as the global economic outlook remained uncertain. Despite a late week rally on the usual promising noises from the G-8 meeting, the Dow was down slightly on the week closing at 12,441 while the S&P500 finished at 1331. Some hits, some misses. While we did see the early week downside correlate quite nicely with the Venus-Mars pairing on Monday, the market mostly bounced after Tuesday’s bottom. I thought we might see more damage closer to Wednesday’s Mars-Saturn aspect but all the downside was concentrated in the first two trading days. The late week was somewhat disappointing as I thought we could see a decline on at least one of those days. So although some of my expectations proved mistaken, we nonetheless did break below the 50 DMA on Tuesday and remained there until Thursday. Friday’s gain saw the 50 DMA act as support as the bulls appeared to take the upper hand. Nonetheless, we seem to be neatly following a declining channel since the May 2 high and the bulls will have to push above 1335 in order to break this bearish trend.

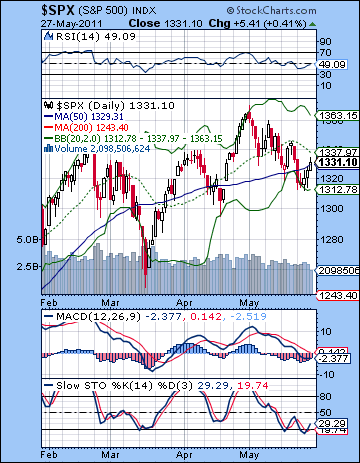

Stocks closed lower for the fourth week in a row as the global economic outlook remained uncertain. Despite a late week rally on the usual promising noises from the G-8 meeting, the Dow was down slightly on the week closing at 12,441 while the S&P500 finished at 1331. Some hits, some misses. While we did see the early week downside correlate quite nicely with the Venus-Mars pairing on Monday, the market mostly bounced after Tuesday’s bottom. I thought we might see more damage closer to Wednesday’s Mars-Saturn aspect but all the downside was concentrated in the first two trading days. The late week was somewhat disappointing as I thought we could see a decline on at least one of those days. So although some of my expectations proved mistaken, we nonetheless did break below the 50 DMA on Tuesday and remained there until Thursday. Friday’s gain saw the 50 DMA act as support as the bulls appeared to take the upper hand. Nonetheless, we seem to be neatly following a declining channel since the May 2 high and the bulls will have to push above 1335 in order to break this bearish trend.

The market remains in correction mode here but thus far there haven’t been any downside fireworks. In fact, we’ve only fallen a grand total of 60 points on the SPX since early May which only amounts to 5%. Saturn may be ruling the roost here, but it’s not exactly a planetary dictatorship. Frankly, I expected more downside by now as Saturn has strengthened ahead of its direct station and square aspect with Pluto on June 13. Clearly, it has been battling a protracted war of attrition with bullish Jupiter all along the way. A benevolent dictatorship one might say. Jupiter is likely increasing its profile here as it prepares to aspect Neptune on June 8, and then Uranus on June 25 and Pluto on July 7. That means that. on balance, rallies will tend to increase in scale and duration as we move into June. So if the gathering presence of Jupiter may have prevented any severe declines thus far in this Saturnian-fueled correction, it is still possible that we will have more downside. But just where and when the bottom occurs is unclear. After this week upcoming, the most likely candidate for the intermediate low might be sometime between June 8 and June 25. In other words, sometime around that Saturn station on June 13. But if the market does rally just before then as I expect it will, then we could have a very choppy situation indeed. This may make it difficult for both bulls and bears as support and resistance may be tested in quick succession. While Saturn would appear to have the upper hand for a little while longer, the market may not have enough bearishness to break below that important support at 1300 from the rising trend line off the March 2009 low. It seems doubtful that we will see 1300 broken next week and I’m not even sure there will be enough force to break it in mid-June. This would be quite frustrating as it would keep the this QE2 rally going. But maybe that is the necessary technical set up for the summer rally I am expecting.

For the bears, a downward channel is better than nothing I suppose. Wednesday morning’s low of 1312 on the SPX bounced off support of this declining channel from the May 2 high and the bulls duly took over running prices back to resistance around 1335. Until that resistance is broken and we see the SPX trade close above 1335, the market will still be bearish and the correction will continue. If we get a close above 1335, then we could see a run to the previous supporting rising trend line from the March low which now stands at 1360. This is about where the penultimate high was and might be a place where weaker bulls decide to take their money and run. If resistance from the declining channel holds at 1335, then it will be up to the bears to retest support at 1305. Again, the 1300 level is an increasingly important support level since it matches the rising trend line from the March 2009 low. The fact that these support levels are essentially intersecting this week around 1300-1305 underlines just how pivotal the current technical situation is for the market. A close below both trend lines would be very bearish and would likely hasten a decline to previous lows of 1249. Astrologically, I don’t fully believe there is the bearish energy to accomplish such a double breakdown in support this week. It looks bearish, but maybe not bearish enough.

For the bears, a downward channel is better than nothing I suppose. Wednesday morning’s low of 1312 on the SPX bounced off support of this declining channel from the May 2 high and the bulls duly took over running prices back to resistance around 1335. Until that resistance is broken and we see the SPX trade close above 1335, the market will still be bearish and the correction will continue. If we get a close above 1335, then we could see a run to the previous supporting rising trend line from the March low which now stands at 1360. This is about where the penultimate high was and might be a place where weaker bulls decide to take their money and run. If resistance from the declining channel holds at 1335, then it will be up to the bears to retest support at 1305. Again, the 1300 level is an increasingly important support level since it matches the rising trend line from the March 2009 low. The fact that these support levels are essentially intersecting this week around 1300-1305 underlines just how pivotal the current technical situation is for the market. A close below both trend lines would be very bearish and would likely hasten a decline to previous lows of 1249. Astrologically, I don’t fully believe there is the bearish energy to accomplish such a double breakdown in support this week. It looks bearish, but maybe not bearish enough.

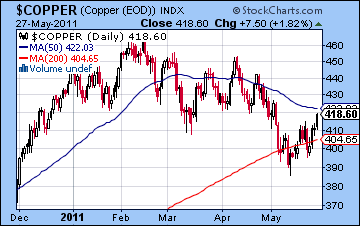

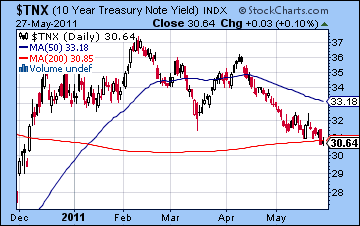

MACD is still in a bearish crossover but it appears to be leveling off. This may give some weaker bears pause and make them more likely to cover short positions. RSI (41) is still bearish but it is forming a positive divergence with respect to the previous low. Again, this is not very welcome news for bears. And here’s another piece of potentially bullish information: the Dow bounced off the 20 WMA at 12,263 last week as it has done in previous shallow corrections. Sometimes it has overshot this support (March) so it needn’t be definitive. But it offers bulls the opportunity to see if they can break this 4-week losing streak. The slew of negative economic data pulled the rug out from the Dollar last week and this gave a boost to the risk trade and commodities. Copper is still strong here at 417 and finding good support at the 200 DMA. This is an important intermarket indicator that suggests that there may not be much more downside as long as copper stays at or above this level. It still doesn’t look exactly bullish, however, and remains well below its falling trend line off the February high. On the other hand, bond yields continue to fall and are in a sharp divergence with equities here. More importantly, the yield on the 10-year treasury broke below 3.10% and the 200 DMA which was an important support level. Obviously, it could still bounce here and catch up with equities and ride some QE3 rumor rally. In fact, I have seen articles that are speculating about the growing possibility of a QE3 or at least a QE2.5. Last week’s bad US economic data somewhat increases the likelihood that Bernanke will produce another rabbit out of his hat and extend the floor under the economy for another few months. It’s certainly possible. It will be worth watching these yields for any clues of a possible QE3 since it will likely cause yields to rise fairly quickly once again. Whether or not QE3 would be as bullish for stocks as QE2 was is less certain. Probably, it will be bullish in the short run as investors take advantage of the increased liquidity and the fall in the Dollar. But QE3 may also be a signal that the US economy is weaker than many thought and it could frighten some participants out of US stocks into other arenas with perceived levels of greater safety.

With Monday’s closing for Memorial Day, this week will likely begin negatively as there are two bearish looking aspects. The first one actually occurs on Monday as Mercury is in aspect with Rahu (North Lunar Node). This is likely to damage international markets so the US may open negatively as investors react to Monday’s moves. Also the Sun is in aspect with Saturn on Tuesday so that is likely to act as an additional burden in the early week time frame. It is possible that we could see the low for the week on Wednesday as the Moon and Sun conjoin while still in close aspect to Saturn. An intraday reversal is possible on Wednesday, however, especially if the indexes have hit support. It’s possible they could go all the way down to 1305 and the touch the falling trend line support, although I don’t think that is likely. What we may get instead might be a retracement back to 1320 which would match penultimate lows. Wednesday and Thursday are somewhat more likely to be bullish owing to a Mercury-Jupiter aspect. Friday is more uncertain as Venus is in aspect with Rahu while Neptune turns retrograde while in square aspect with Mercury. This Neptune effect is harder to ascertain although I would tend to think it skews bearish. Mercury-Neptune contacts offer symbolize confused communication or distorted thinking. Any economic news released later in the week could have some of these qualities, although cynics would say that anything coming out of the Fed these days might qualify. Overall, I think there is a good chance the market will be lower but we may not break support at 1305. I wouldn’t rule it out especially since the Mercury-Neptune aspect could have some surprising effects, but it does not seem probable. The lows of the week could occur on Wednesday or perhaps Friday if Neptune happens to show its nastier side.

With Monday’s closing for Memorial Day, this week will likely begin negatively as there are two bearish looking aspects. The first one actually occurs on Monday as Mercury is in aspect with Rahu (North Lunar Node). This is likely to damage international markets so the US may open negatively as investors react to Monday’s moves. Also the Sun is in aspect with Saturn on Tuesday so that is likely to act as an additional burden in the early week time frame. It is possible that we could see the low for the week on Wednesday as the Moon and Sun conjoin while still in close aspect to Saturn. An intraday reversal is possible on Wednesday, however, especially if the indexes have hit support. It’s possible they could go all the way down to 1305 and the touch the falling trend line support, although I don’t think that is likely. What we may get instead might be a retracement back to 1320 which would match penultimate lows. Wednesday and Thursday are somewhat more likely to be bullish owing to a Mercury-Jupiter aspect. Friday is more uncertain as Venus is in aspect with Rahu while Neptune turns retrograde while in square aspect with Mercury. This Neptune effect is harder to ascertain although I would tend to think it skews bearish. Mercury-Neptune contacts offer symbolize confused communication or distorted thinking. Any economic news released later in the week could have some of these qualities, although cynics would say that anything coming out of the Fed these days might qualify. Overall, I think there is a good chance the market will be lower but we may not break support at 1305. I wouldn’t rule it out especially since the Mercury-Neptune aspect could have some surprising effects, but it does not seem probable. The lows of the week could occur on Wednesday or perhaps Friday if Neptune happens to show its nastier side.

Next week (Jun 6-10) tilts bullish, especially later as Venus joins an alignment with Jupiter and Neptune. While I would not rule out some early week selling on Tuesday’s Mercury-Saturn aspect, it may not do much damage on the downside. So the market is likely to rise in this week, perhaps back to the top of the falling channel resistance or higher. I would expect at least two solid up days here, perhaps three. There is a small chance of a decline on Friday’s approaching Mars-Rahu aspect although I suspect this will more likely wait until Monday the 13th. The following week (June 13-17) could be very interesting indeed as Saturn ends its retrograde cycle on Monday and Mars is in aspect with Rahu. And if that wasn’t enough, the Sun and Mercury will conjoin Ketu (South Lunar Node). All three of these patterns look bearish so we there is an increased likelihood of a sudden and sharp decline. The first half of the week looks more negative than the second half. It may well be enough to wipe out the previous week’s gains. For that reason, it is quite possible we could see a lower low. I would not rule out something in the neighbourhood of 1250 although there is a long time between now and then and we will have to see if the market behaves according to expectations. In any event, there is a chance of a break below channel support at that time. After that, Saturn may be less dominant and Jupiter could begin to carry the day, especially as we move towards its aspects with Uranus on June 25 and Pluto on July 7. It seems a little too neat that the market should bottom near the Saturn station in mid-June and then simply rise until mid-August. And yet that seems like the most probable scenario at the moment. I would say the chances of a higher high above 1370 are still 50-50 but much will depend on what kind of bearish payoff Saturn delivers in the next few weeks. If it’s a sizable decline to 1250 or below then that would lessen the likelihood that the market could climb all the way back to 1370 by August.

Next week (Jun 6-10) tilts bullish, especially later as Venus joins an alignment with Jupiter and Neptune. While I would not rule out some early week selling on Tuesday’s Mercury-Saturn aspect, it may not do much damage on the downside. So the market is likely to rise in this week, perhaps back to the top of the falling channel resistance or higher. I would expect at least two solid up days here, perhaps three. There is a small chance of a decline on Friday’s approaching Mars-Rahu aspect although I suspect this will more likely wait until Monday the 13th. The following week (June 13-17) could be very interesting indeed as Saturn ends its retrograde cycle on Monday and Mars is in aspect with Rahu. And if that wasn’t enough, the Sun and Mercury will conjoin Ketu (South Lunar Node). All three of these patterns look bearish so we there is an increased likelihood of a sudden and sharp decline. The first half of the week looks more negative than the second half. It may well be enough to wipe out the previous week’s gains. For that reason, it is quite possible we could see a lower low. I would not rule out something in the neighbourhood of 1250 although there is a long time between now and then and we will have to see if the market behaves according to expectations. In any event, there is a chance of a break below channel support at that time. After that, Saturn may be less dominant and Jupiter could begin to carry the day, especially as we move towards its aspects with Uranus on June 25 and Pluto on July 7. It seems a little too neat that the market should bottom near the Saturn station in mid-June and then simply rise until mid-August. And yet that seems like the most probable scenario at the moment. I would say the chances of a higher high above 1370 are still 50-50 but much will depend on what kind of bearish payoff Saturn delivers in the next few weeks. If it’s a sizable decline to 1250 or below then that would lessen the likelihood that the market could climb all the way back to 1370 by August.

5-day outlook — bearish SPX 1300-1320

30-day outlook — bearish SPX 1250-1300

90-day outlook — neutral-bullish SPX 1330-1400

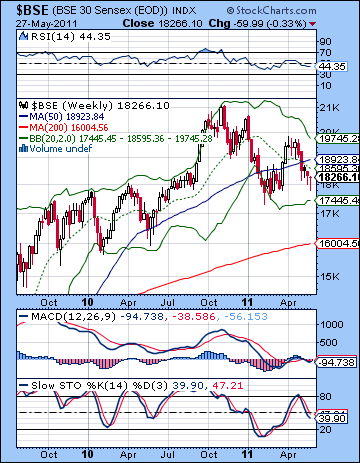

Despite a good lift at the end of the week, stocks closed slightly lower last week as the global economic situation remained murky. After trading below 18K for the first time since March, the Sensex rebounded and closed at 18,266 while the Nifty finished at 5476. The week unfolded more or less according to expectations as the early week bearish aspects took prices lower and tested support. Monday’s Venus-Mars conjunction coincided nicely with a significant pullback as the Nifty closed below 5400. As expected, Tuesday saw a rebound on the Sun-Uranus aspect although stocks barely managed to hang onto intraday gains. Wednesday’s Mars-Saturn aspect arrived on schedule just as the market lost another 1%. While I thought we could see two positive days here, I somewhat underestimated their strength as Thursday and Friday saw back-to-back gains. The rally at the end of the week therefore undermined the accuracy my forecast although it did not inflict significant damage to the larger bearish case.

Despite a good lift at the end of the week, stocks closed slightly lower last week as the global economic situation remained murky. After trading below 18K for the first time since March, the Sensex rebounded and closed at 18,266 while the Nifty finished at 5476. The week unfolded more or less according to expectations as the early week bearish aspects took prices lower and tested support. Monday’s Venus-Mars conjunction coincided nicely with a significant pullback as the Nifty closed below 5400. As expected, Tuesday saw a rebound on the Sun-Uranus aspect although stocks barely managed to hang onto intraday gains. Wednesday’s Mars-Saturn aspect arrived on schedule just as the market lost another 1%. While I thought we could see two positive days here, I somewhat underestimated their strength as Thursday and Friday saw back-to-back gains. The rally at the end of the week therefore undermined the accuracy my forecast although it did not inflict significant damage to the larger bearish case.

The month of May has seen more downward pressure on stocks after April’s rounded top, as it seems we are in the midst of a retest of February’s lows. This downtrend has largely been in keeping with our expectations since Saturn appears to be strengthening ahead of its direct station on 13 June. The global outlook remains uncertain here as sovereign debt worries in Europe threaten equities as the precariousness of the recovery becomes more transparent. All that borrowed money may have been enough to boost economic activity for a while, but it may not provide a sustainable source of growth over the long term. Now that spendthrift countries are faced with repayment, there may be a reduction in the amount of government liquidity in the system. At this point, it’s anyone’s guess if the world economy is strong enough to walk on its own two feet once these stimulus measures are withdrawn. Bears, of course, believe that the economy is very fragile and that the end of of the Fed’s QE2 and various European austerity measures will result in another slow down that could lead to recession. The growing strength of Saturn here over the next few weeks suggest that this view will continue to attract its share of adherents. For their part, the bulls are perhaps hedging their bets somewhat. Some bulls are confident that the economy can begin to grow even without Bernanke’s intervention while others simply put their faith in the Fed. They believe that if US economic data continues to be weak, the Fed will move in a prop it up once again with QE3 or perhaps some lesser version which some have dubbed QE2.5. Whether the equities market thinks further government indebtedness is a good idea remains to be seen. A third round of Fed intervention might alarm some investors since it would signal that the US economy was weaker than expected. In any event, much of this bullish view is closely associated with the planet Jupiter. We can see that it may gradually become more prominent over the next two to three months as it forms aspects with Neptune, Uranus and Pluto. Over the next month, its return to strength may simply be enough to prevent a large decline since Saturn will likely continue to exercise a strong influence on the mood of the crowd. The bottom line is I think it is fairly unlikely we will see any huge declines in the near future. We could test some lower support levels here at 5200, but I suspect we are unlikely to break all the way down to Nifty 4800.

In technical terms it was a mixed week. The midweek close below 5400 did some technical damage to the bulls as the March lows were tested. While this was a bearish development, it more or less extended the correction for another week but did not magnify it. For their part, the bulls rallied back at the end of the week and broke above resistance from the immediate falling channel. Friday’s close was at the 20 DMA, which is likely a short term barrier to further upside. Now that the falling wedge has been violated on the upside, there is a greater likelihood for a rally to perhaps 5600 and the highs of early May. While somewhat bullish, this would still be below the 50 DMA and well below the falling channel from the 2010 highs which now comes in at 5800.

In technical terms it was a mixed week. The midweek close below 5400 did some technical damage to the bulls as the March lows were tested. While this was a bearish development, it more or less extended the correction for another week but did not magnify it. For their part, the bulls rallied back at the end of the week and broke above resistance from the immediate falling channel. Friday’s close was at the 20 DMA, which is likely a short term barrier to further upside. Now that the falling wedge has been violated on the upside, there is a greater likelihood for a rally to perhaps 5600 and the highs of early May. While somewhat bullish, this would still be below the 50 DMA and well below the falling channel from the 2010 highs which now comes in at 5800.

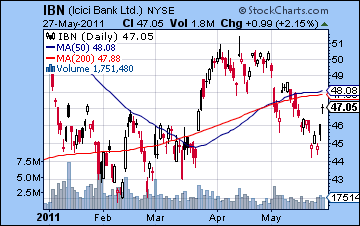

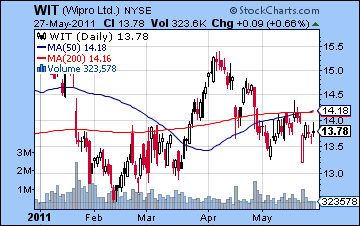

MACD is looking more bullish here as it is on the verge of a bullish crossover and is flattening out. RSI (46) is still bearish but it pointing higher after making a higher low thus creating a positive divergence with respect to its early May low. Stochastics (30) has moved above the 20 line and may be headed higher. It is therefore possible to interpret these indicators as evidence of a period of consolidation before prices move higher. The weekly BSE chart has stubbornly held on to its rising trend line that connects the lows all the way back to August 2009. This is an important trend of a series of higher lows that was respected in last week’s action. While the Sensex traded below that line on an intraweek basis, it closed above it. This may give more encouragement to bulls seeking to go long from here. Nonetheless, the Sensex is still trading below its 20 and 50 WMA here. RSI and MACD are showing positive divergences with respect to the February lows so that may add more evidence to the short term bullish case. While the overall technical picture seems somewhat bullish, the Nifty has to close above 5500 before it can make a realistic run to the next resistance level at 5600. If it fails to close above 5500 or thereabouts, then it may be susceptible to more selling. Individual charts such as ICICI Bank (IBN) offer more evidence for at least a short term technical bounce as Friday’s gain broke above resistance of the falling wedge pattern. Whether it can break above the the 50 and 200 DMA and the falling trend line from the 2010 highs remains to be seen, however. If the banking sector looks poised for more upside, the same cannot be said for outsourcers such as INFY which has not kept pace with the broader market (chart not shown). The IT sector has fared somewhere in the middle perhaps as Wipro (WIT) has yet to break above its falling trend line resistance since April. It is very close to doing so but until it does, it may continue to be a candidate for selling. Cautious bulls may be waiting for a close above the 50 and 200 DMA before going long. Even that would be an uphill battle as the longer term falling trendline from Nov 2010 would still act as a drag on price as it moved higher.

This week seems to tilt bearish again as there are a couple of difficult aspects in the first half of the week. Monday will feature a Mercury-Rahu aspect that makes gains less likely. It’s perhaps less obviously bearish, but it does not stack the odds in favour of the bulls. On Tuesday, the Sun forms an aspect with Saturn which looks more bearish so there is perhaps a greater chance of declines here. Wednesday could see some hangover from this Sun-Saturn, especially if there has been less downside than expected. Therefore, there is a chance that we might see a gain on Monday or Tuesday but if that’s the case, then Wednesday is more likely to be negative. Generally, I think the three-day period from Mon-Wed will be net negative, and probably significantly so. The problem is that the astrology does not fit easily with a more bullish technical outlook. With the falling wedge breaking up last week, there is a better chance for gains. When astrology and technicals differ, it’s best to tread more carefully. I would favour the astrology where there is such a discrepancy, but perhaps that would reduce my confidence somewhat. Some late week rebound is likely as Mercury forms an aspect with Jupiter on Thursday. Friday is another matter, however, as Neptune turns retrograde while in aspect with Mercury. This seems like a bearish influence, although it is perhaps less bearish on paper than the Sun-Saturn aspect on Tuesday-Wednesday. So there is a good chance for a decline here. A more bullish outcome would see a gain Monday that takes the Nifty above 5500 but then falling again to 5350-5400 by Wednesday. The rest of the week would be mildly bullish with a close somewhere around current levels of 5450-5500. A more bearish scenario — which I think is more likely — would see a decline to perhaps 5300-5350 by midweek and then some recovery Thursday but Friday would see a return to selling. Perhaps the Nifty might finish below 5400. This would be a significant technical development as it would break the series of higher lows on the weekly chart. It’s definitely possible, although the divergence with the technical outlook does make me wonder if it will really happen that way. Time will tell.

This week seems to tilt bearish again as there are a couple of difficult aspects in the first half of the week. Monday will feature a Mercury-Rahu aspect that makes gains less likely. It’s perhaps less obviously bearish, but it does not stack the odds in favour of the bulls. On Tuesday, the Sun forms an aspect with Saturn which looks more bearish so there is perhaps a greater chance of declines here. Wednesday could see some hangover from this Sun-Saturn, especially if there has been less downside than expected. Therefore, there is a chance that we might see a gain on Monday or Tuesday but if that’s the case, then Wednesday is more likely to be negative. Generally, I think the three-day period from Mon-Wed will be net negative, and probably significantly so. The problem is that the astrology does not fit easily with a more bullish technical outlook. With the falling wedge breaking up last week, there is a better chance for gains. When astrology and technicals differ, it’s best to tread more carefully. I would favour the astrology where there is such a discrepancy, but perhaps that would reduce my confidence somewhat. Some late week rebound is likely as Mercury forms an aspect with Jupiter on Thursday. Friday is another matter, however, as Neptune turns retrograde while in aspect with Mercury. This seems like a bearish influence, although it is perhaps less bearish on paper than the Sun-Saturn aspect on Tuesday-Wednesday. So there is a good chance for a decline here. A more bullish outcome would see a gain Monday that takes the Nifty above 5500 but then falling again to 5350-5400 by Wednesday. The rest of the week would be mildly bullish with a close somewhere around current levels of 5450-5500. A more bearish scenario — which I think is more likely — would see a decline to perhaps 5300-5350 by midweek and then some recovery Thursday but Friday would see a return to selling. Perhaps the Nifty might finish below 5400. This would be a significant technical development as it would break the series of higher lows on the weekly chart. It’s definitely possible, although the divergence with the technical outlook does make me wonder if it will really happen that way. Time will tell.

Next week (June 6-10) looks more bullish as Jupiter aspects Neptune. The beginning of the week may be fairly choppy with a possible decline on Tuesday’s Mercury-Saturn aspect. But the second half of the week should see significant gains. There is a reasonable chance that we will see some resistance levels broken here with 5600 very much in play. The following week (June 13-17) is more bearish and there is a chance that the downside could be big. Monday sees Saturn return to forward motion while Mars aspects Rahu. On Tuesday, the Sun and Mercury conjoin Ketu. The net effect of these contacts will likely be quite bearish and may be enough to erase any gains from the previous week. It is possible that we could make a lower low (<5300) in June although that is not certain. The rest of June looks like a mixed bag, but we could see some gradual upward momentum take hold as Jupiter forms aspects with Uranus and Pluto in late June and early July. This period could well form the basis for a rally that lasts into August. I would expect a rally of at least 10% off the probable June low. Assuming that the Nifty holds above 5300, that would suggest that resistance from the falling trend line at 5700-5800 could be in reach by August. September looks bearish, however, as Saturn falls under the aspect of Ketu. This is likely to hit Indian markets very hard as the BSE chart will be heavily afflicted. After a relief rally in October, the market will likely stumble lower still in November and December. I would still not rule out a test of support at 4000 on the Nifty by the end of the year.

Next week (June 6-10) looks more bullish as Jupiter aspects Neptune. The beginning of the week may be fairly choppy with a possible decline on Tuesday’s Mercury-Saturn aspect. But the second half of the week should see significant gains. There is a reasonable chance that we will see some resistance levels broken here with 5600 very much in play. The following week (June 13-17) is more bearish and there is a chance that the downside could be big. Monday sees Saturn return to forward motion while Mars aspects Rahu. On Tuesday, the Sun and Mercury conjoin Ketu. The net effect of these contacts will likely be quite bearish and may be enough to erase any gains from the previous week. It is possible that we could make a lower low (<5300) in June although that is not certain. The rest of June looks like a mixed bag, but we could see some gradual upward momentum take hold as Jupiter forms aspects with Uranus and Pluto in late June and early July. This period could well form the basis for a rally that lasts into August. I would expect a rally of at least 10% off the probable June low. Assuming that the Nifty holds above 5300, that would suggest that resistance from the falling trend line at 5700-5800 could be in reach by August. September looks bearish, however, as Saturn falls under the aspect of Ketu. This is likely to hit Indian markets very hard as the BSE chart will be heavily afflicted. After a relief rally in October, the market will likely stumble lower still in November and December. I would still not rule out a test of support at 4000 on the Nifty by the end of the year.

5-day outlook — bearish NIFTY 5350-5450

30-day outlook — bearish NIFTY 5100-5400

90-day outlook — neutral-bullish NIFTY 5400-5800

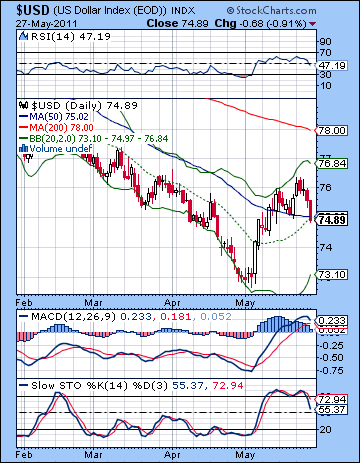

The Dollar hit a speed bump last week as some bad economic data reduced the likelihood of a rate hike in 2011. After climbing to 76.4 early in the week, the USDX finished below 75. The Euro ended the week at 1.432 while the Rupee weakened to 45.35. So much for the rally. I had been more bullish here, although at least I added the caveat that I was less confident in my forecast for a higher Dollar. I was correct in calling for early week gains on the Venus-Mars conjunction but all we got was one up day before the train was derailed. I had wondered if the Euro could fall straight through its 200 WMA at 1.40. As it turned out, it didn’t. The early week saw a pullback to 1.40 before rebounding higher. Friday’s close in the Dollar was actually slightly below the 20 and 50 DMA so we will see how strong a support those lines are on Monday. It may be that the Dollar retraces back to support at 74 from the top of the declining channel that previously acted as resistance. We didn’t quite see it hit the top Bollinger band last week although that may well become an important level of resistance going forward since it is close to the longer term falling channel at 77. Of course, the all-important 200 DMA is only a little beyond that at 78. A close above that crucial dividing line in sentiment would definitely signal a major change in the market. It’s unclear if we can get there in this current rally, however. The technical indicators are looking fatigued here as Stochastics (55) is rapidly falling from its lofty perch above the 80 line. RSI (47) has slumped below the 50 line now and MACD is commencing a bearish crossover. Not a pretty picture for Dollar bulls, in other words.

The Dollar hit a speed bump last week as some bad economic data reduced the likelihood of a rate hike in 2011. After climbing to 76.4 early in the week, the USDX finished below 75. The Euro ended the week at 1.432 while the Rupee weakened to 45.35. So much for the rally. I had been more bullish here, although at least I added the caveat that I was less confident in my forecast for a higher Dollar. I was correct in calling for early week gains on the Venus-Mars conjunction but all we got was one up day before the train was derailed. I had wondered if the Euro could fall straight through its 200 WMA at 1.40. As it turned out, it didn’t. The early week saw a pullback to 1.40 before rebounding higher. Friday’s close in the Dollar was actually slightly below the 20 and 50 DMA so we will see how strong a support those lines are on Monday. It may be that the Dollar retraces back to support at 74 from the top of the declining channel that previously acted as resistance. We didn’t quite see it hit the top Bollinger band last week although that may well become an important level of resistance going forward since it is close to the longer term falling channel at 77. Of course, the all-important 200 DMA is only a little beyond that at 78. A close above that crucial dividing line in sentiment would definitely signal a major change in the market. It’s unclear if we can get there in this current rally, however. The technical indicators are looking fatigued here as Stochastics (55) is rapidly falling from its lofty perch above the 80 line. RSI (47) has slumped below the 50 line now and MACD is commencing a bearish crossover. Not a pretty picture for Dollar bulls, in other words.

This week offers a good chance for gains for the Dollar, especially early in the week. I would not be surprised to see it climb back to 76 by Wednesday. The late week looks bearish again, however, as Thursday’s Mercury-Jupiter aspect falls on a sensitive point in the Euro chart. While I would not rule out a lower close next week, it seems there could be enough upside to at least tread water, if not rise. The following week may follow a similar pattern with Dollar gains likely early in the week but then declines as we near the Jupiter-Neptune aspect on the 9th. More upside looks likely in mid-June as Saturn ends its retrograde cycle. There is the possibility of a large move in this third week of June. I think there is a good chance (70-30%) that the Dollar should benefit from these aspects. This could well represent an interim top for the Dollar, however, as the risk trade will likely return sometime in June. July and August look very choppy although I would lean towards a period of rough consolidation before the next rally begins, probably in late August.

Dollar

5-day outlook — neutral-bullish

30-day outlook — neutral-bullish

90-day outlook — bearish

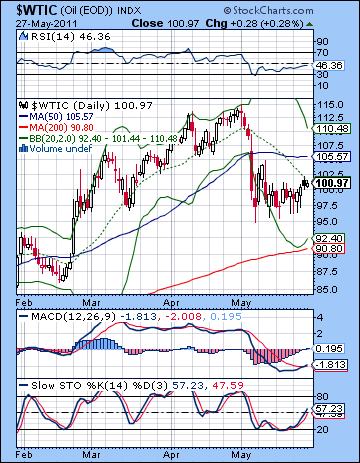

With more disappointing US economic data weighing down the Dollar, crude oil moved modestly higher closing above $100. I thought we would see more downside, especially around the early week Mars and Saturn contacts. While Monday was lower, support held firm around $96 on an intraday basis as buyers moved in to buy the dips. Although the late week saw further gains, these were not unexpected given the strength of the Moon in Pisces. Nonetheless, it was a disappointing week. Support seems increasingly solid at the $95-96 level as repeated attempts to pierce below it have failed. Bulls have managed to reverse the downtrend somewhat lately, although they have only barely push prices above $100 again. The 20 DMA appears to be acting as resistance here as the late week gains could rise above this level, now at $101.44. The technical indicators are also looking more bullish as MACD is now in a bullish crossover and is turning higher. This is perhaps more noteworthy because it is so far below the zero line. RSI (46) appears to be picking up steam and created a positive divergence with respect to previous closes around $95. Stochastics (57) is also breaking higher as it seems to be heading for the 80 line. If support is at $95, one may wonder where resistance is. Aside from the 20 DMA, the 50 DMA at $105 may be the next stop in the event of any further rally attempt. What is interesting about $105 is that it might form a sloppy head and shoulders pattern with the March 7th high at $107 as the right shoulder. This is definitely not a clean example of a H&S, but it is worth considering if prices move higher.

With more disappointing US economic data weighing down the Dollar, crude oil moved modestly higher closing above $100. I thought we would see more downside, especially around the early week Mars and Saturn contacts. While Monday was lower, support held firm around $96 on an intraday basis as buyers moved in to buy the dips. Although the late week saw further gains, these were not unexpected given the strength of the Moon in Pisces. Nonetheless, it was a disappointing week. Support seems increasingly solid at the $95-96 level as repeated attempts to pierce below it have failed. Bulls have managed to reverse the downtrend somewhat lately, although they have only barely push prices above $100 again. The 20 DMA appears to be acting as resistance here as the late week gains could rise above this level, now at $101.44. The technical indicators are also looking more bullish as MACD is now in a bullish crossover and is turning higher. This is perhaps more noteworthy because it is so far below the zero line. RSI (46) appears to be picking up steam and created a positive divergence with respect to previous closes around $95. Stochastics (57) is also breaking higher as it seems to be heading for the 80 line. If support is at $95, one may wonder where resistance is. Aside from the 20 DMA, the 50 DMA at $105 may be the next stop in the event of any further rally attempt. What is interesting about $105 is that it might form a sloppy head and shoulders pattern with the March 7th high at $107 as the right shoulder. This is definitely not a clean example of a H&S, but it is worth considering if prices move higher.

This week looks mixed with a good chance of some downside early in the week on Tuesday’s Sun-Saturn aspect. Gains are a somewhat more likely outcome on Wednesday and Thursday, however, as Mercury forms an aspect with Jupiter. That may simply keep crude trading in its current range of $96 to $102. On Friday, Neptune turns retrograde while in aspect to Mercury. This is something of a wild card as Neptune has a symbolic association with oil. It could well increase the size of any price move at the end of the week and it may be somewhat more bearish than bullish in its effects. Where we might finish this week is therefore hard to say. I would not be surprised if we ended up testing support at $95 again, nor would I be surprised if crude rose to $105 and the 50 DMA. The following week may begin bearishly as Mercury is in aspect with Saturn. That may produce a day or two of declines but watch for another big rebound higher by the second half of the week as Venus enters a bullish alignment with Jupiter and Neptune. The end of Saturn’s retrograde cycle on June 13 is likely to coincide with another decline that may last a day or two. Buyers will again move in by the end of the week and take prices higher. It is possible that the declines we see in this week are sharper than in previous weeks. For this reason, we can speculate if we might get an intermediate low around this time. It’s very possible, although the Jupiter-Neptune aspect on June 8-10 looks like it could add 3-5% to crude. If crude has fallen significantly ahead of this rise, then perhaps the June 13-15 period has a better chance of being a significant low. However, the inability for bears to break below $95 does make me wonder if there is enough negative planetary energy to reach $80-86 in the near term. It’s still possible but it’s not exactly probable. We will get a better idea of the possibilities in the week ahead and the effect of the start of the Neptune retrograde cycle on Friday.

5-day outlook — neutral

30-day outlook — bearish-neutral

90-day outlook — bullish

Gold continued to benefit from all conceivable scenarios as it gained another 2% closing at $1536 on the continuous contract. It rises when Eurozone debt worries pop up as they did last week and it also rises when the Dollar sells off on disappointing economic data which makes a rate hike less likely. It’s a bit like the old saying, "tails I win, heads you lose". As usual, I was too bearish thinking there would be more downside on the Venus affliction by Mars and Saturn. We saw some very small pullbacks in the middle of the week but the bulls continued their control of the market. Gold is now within just 2% of its all-high from May 2. The recent advance has pushed the RSI (61) closer to overbought levels although there is still some room to go before they get there. MACD is in the beginnings of a bullish crossover although it is likely going to show a huge negative divergence with respect to the previous high if it ever climbs back to that previous high of $1575. Stochastics (87) have already reached the overbought area although in a sustained bull market like we have seen recently, this is essentially meaningless since an overbought condition can persist for many weeks. The rising trend line from the 2009 lows looks like fairly solid support at $1420. A more recent rising trend line off the January 2011 low is now providing support at $1500. A close below $1500 could hasten a decline back to $1420. Even then, this market looks bullish. The first level of resistance is probably the previous high at $1575, and after that the top of the rising channel which comes in around $1600-1620. Basically, there is no reason to expect any significant downside from gold unless and until it breaks that trend line at $1500.

Gold continued to benefit from all conceivable scenarios as it gained another 2% closing at $1536 on the continuous contract. It rises when Eurozone debt worries pop up as they did last week and it also rises when the Dollar sells off on disappointing economic data which makes a rate hike less likely. It’s a bit like the old saying, "tails I win, heads you lose". As usual, I was too bearish thinking there would be more downside on the Venus affliction by Mars and Saturn. We saw some very small pullbacks in the middle of the week but the bulls continued their control of the market. Gold is now within just 2% of its all-high from May 2. The recent advance has pushed the RSI (61) closer to overbought levels although there is still some room to go before they get there. MACD is in the beginnings of a bullish crossover although it is likely going to show a huge negative divergence with respect to the previous high if it ever climbs back to that previous high of $1575. Stochastics (87) have already reached the overbought area although in a sustained bull market like we have seen recently, this is essentially meaningless since an overbought condition can persist for many weeks. The rising trend line from the 2009 lows looks like fairly solid support at $1420. A more recent rising trend line off the January 2011 low is now providing support at $1500. A close below $1500 could hasten a decline back to $1420. Even then, this market looks bullish. The first level of resistance is probably the previous high at $1575, and after that the top of the rising channel which comes in around $1600-1620. Basically, there is no reason to expect any significant downside from gold unless and until it breaks that trend line at $1500.

This week again offers the decent possibility of a pullback as Tuesday’s Sun-Saturn aspect would appear to be tailor-made for gold bears. Wednesday’s New Moon will also be in close aspect to Saturn so it is possible that the downbeat mood may last for a second day. However, the late week period looks somewhat better so there is a good chance we could have one or two up days. I would not rule out any outcome here, although I would lean bearish. It seems doubtful we will break below that trendline at $1500, however. And if Tuesday and Wednesday see only modest pullbacks, then the odds increase that we might even finish higher for the week. Next week looks more bullish on the Venus-Jupiter-Neptune pattern that is exact on Thursday. This looks likely to keep gold above $1500 for another week, perhaps somewhere between $1520-$1550. A more likely time to test that trend line may be in mid-June and the Saturn direct station. This will coincide with the Sun-Ketu conjunction that is another probable bearish influence. Together these patterns may have a stronger downward thrust on price action. But even if support is broken at that time — a big if to be sure — the growing strength of Jupiter in the second half of June and July looks bullish on balance. It’s a perplexing picture since a significant down move in June would break support but the subsequent bullish planetary energies would appear to go against the inference of technical analysis. It may well be that the late June-July period is less bullish for gold than it is for stocks. The Jupiter aspects may end up only supporting some asset classes and not others. Certainly, the Sun’s transit of Gemini from June 15 to July 15 suggests a less than positive influence.

5-day outlook — bearish-neutral

30-day outlook — bearish

90-day outlook — neutral-bullish