(2 August 2025) Stocks sold off last week as Friday’s weak US jobs report reawakened recession fears while Trump’s tough tariff talk undermined sentiment once again. The decline came after the Fed left rates unchanged as Chair Powell reiterated his wait-and-see approach given the uncertain inflationary impact of the new tariffs.

(2 August 2025) Stocks sold off last week as Friday’s weak US jobs report reawakened recession fears while Trump’s tough tariff talk undermined sentiment once again. The decline came after the Fed left rates unchanged as Chair Powell reiterated his wait-and-see approach given the uncertain inflationary impact of the new tariffs.

With the start of a new month, it seems that the long-awaited pullback is finally here. Given the relatively bearish seasonality of August and September, there would appear to be a compelling case for further downside in the near term. But what of the celestial seasonality?

As I noted in last week’s post, the evidence suggests the upcoming Mars-Saturn opposition on August 8 is actually bullish, despite all appearances to the contrary. Even the inclusion of Neptune in the alignment does not significantly change that bullish bias. Of course, we should be careful about jumping to any conclusions given the small sample size and the very wide distribution of results.

But we should also note the presence of other planets in the degreewise Mars-Saturn-Neptune alignment. Uranus (7 Taurus) and Pluto (8 Capricorn) form 60-degree sextiles with the Saturn-Neptune conjunction at 7 Pisces and thereby also align with Mars (7 Virgo) on August 7-9. Do the presence of these two other planets significantly alter the bullish bias of the Mars-Saturn opposition?

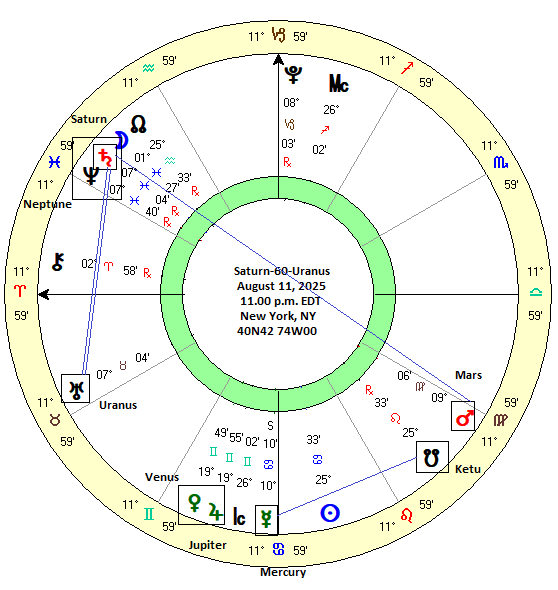

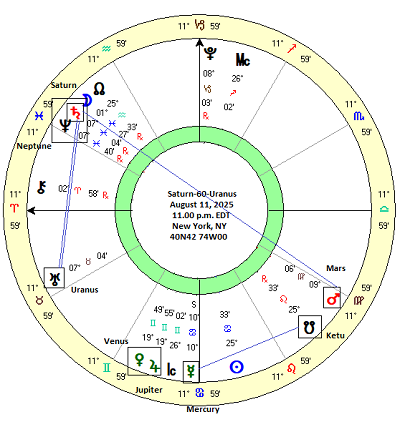

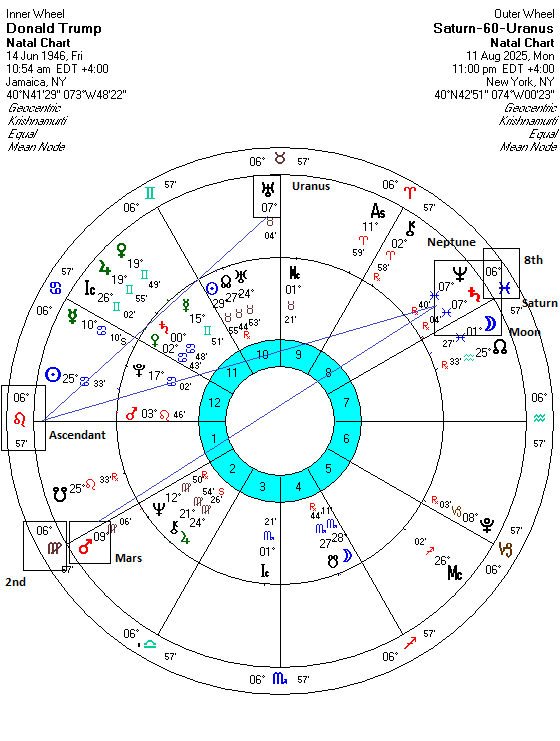

Saturn-60-Uranus

To try to answer that question, I compiled a sample of outcomes from the previous 60-degree Saturn-Uranus alignments dating back to 1896. Due to time constraints and in order to keep things simple, I chose to focus solely on Saturn-Uranus. Since both Saturn and Uranus move quite slowly, I used fairly long time intervals across which I could compare price changes of the Dow Jones Industrial Average. The first column in the table is the price 90 days (-90d) before the exact alignment, the second column is 60 days (-60d) before the exact alignment and so on. The sample size is a very modest 14 cases — not large enough to make any definitive statements but perhaps large enough to gain some insights nonetheless.

The results were bullish. The second table shows the percentage changes across various intervals starting with the 180-day window in the left hand column (“-90d 90d”). The first thing you notice is how positive the results are. The average (8.60%) and median (7.43%) of the 180-day window was way above the expected value of 2.70% based on an average annual return to 5.4% from 1896 to 2025. This bullish outcome was evident in almost all other intervals as the averages and medians were multiple times larger than the expected values. The only exception was the shortest 10-day window that preceded the alignment (“-10d 0d”) at 0.11% which was very close to the expected value of 0.15%.

So does this mean that stocks are likely to rebound by the time of the exact alignment on August 11? Well, no. Besides the usual caveats with such a tiny sample size, the longer time intervals in this study means that it is still possible for stocks to fall further before rebounding and eventually posting an overall bullish result.

Perhaps the only takeaway here is that there is a reasonable chance for a significant rebound at some point in August or September. This would fall under the “0d 30d” interval or “0d 60d” interval. Such a rebound in September would not preclude further downside in early or mid-August. And, of course, these results would not preclude a rebound starting as early as this week upcoming (Aug 4-8).

Could we see a repeat of early April?

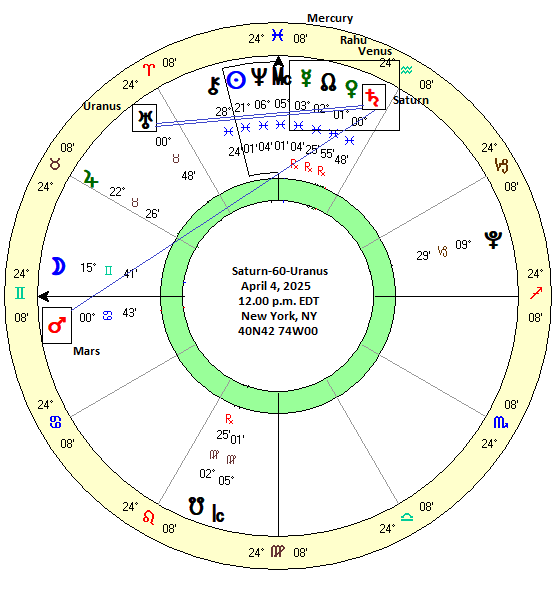

But it is intriguing that the March-April tariff sell-off coincided closely with a previous Saturn-Uranus alignment. When both planets were in direct motion, they formed an exact 60-degree alignment on April 4 — just three days before the interim low and the start of the current rebound. Despite the bullish evidence from all the previous Saturn-Uranus alignments, this April alignment was very bearish as stocks fell 10% over the 30 days that preceded the alignment.

We may well ask: what was different about the Saturn-Uranus alignment in April 2025 that it coincided with a huge decline instead of a more typical bullish outcome? Looking at the chart, we can see a few unique factors. In addition to Saturn-60-Uranus, Rahu (North Lunar Node) was conjunct Saturn along with Mercury and Venus. Moreover, Mercury was due to station direct on April 8 while in a one-degree conjunction with Rahu and Saturn. As a rule, any stationary planet takes on greater significance and can deliver amplified results depending on its condition in the horoscope. Since Mercury was in conjunction with two natural malefics — Saturn and Rahu — it is not surprising that it should have coincided with a bearish outcome.

We can also see that Mars was in an exact 60-degree alignment with Uranus (and 120-degree alignment with Saturn) at the time of the Saturn-Uranus alignment and the interim low. Mars is another natural malefic that can be associated with bearish moves. That said, the Mars-Saturn opposition isn’t bearish on average, all other things being equal.

But it raises the question: could the upcoming Saturn-Uranus alignment on August 11 somehow produce a repeat of the decline that occurred in early April? Let’s examine if all the same conditions are present on August 11. First, there is an alignment with Mars which duplicates the April 4 condition. It is not the same alignment as Mars is opposite Saturn and 120 degrees from Uranus, however, so that should be taken with a grain of salt.

Next, are there any close planetary stations in both time and location? Yes, Mercury will station direct on April 11 although it is not in close alignment with Saturn or Uranus. That only gets a small check mark, although we should note that it forms a 45-degree alignment with Ketu (South Lunar Node). This is often a bearish influence, especially around the time of the stations. On a more bullish note, Venus conjoins Jupiter on August 12 which could increase the odds of some upside that day.

Overall, there are some of the same April ingredients present in the August Saturn-Uranus alignment but not to the same degree. The Mercury-Venus conjunction with Saturn and Rahu was a key factor in the decline, and they are both missing this time around, and have no obvious functional equivalent.

Trump-Powell afflictions

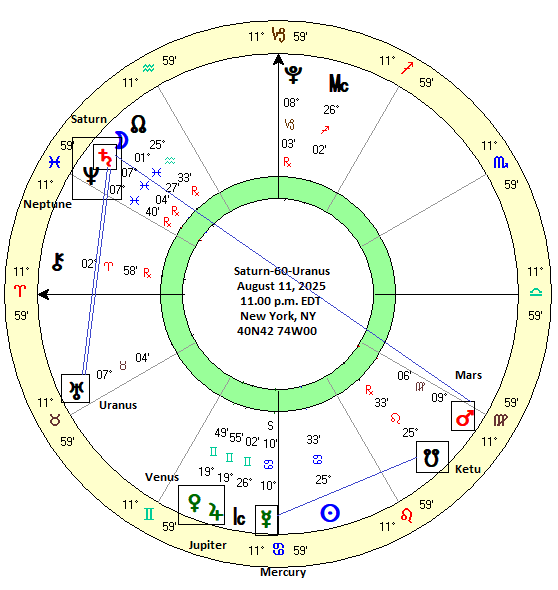

However, we should mention that the Mars-Saturn-Neptune-Uranus alignment hits the horoscopes of both President Trump and the Federal Reserve. As leader of the US, the president’s chart is a proxy for the nation as a whole, including its economy and financial markets. The Mars-Saturn opposition straddles the 2nd/8th house axis in Trump’s chart and thus could coincide with a significant event.

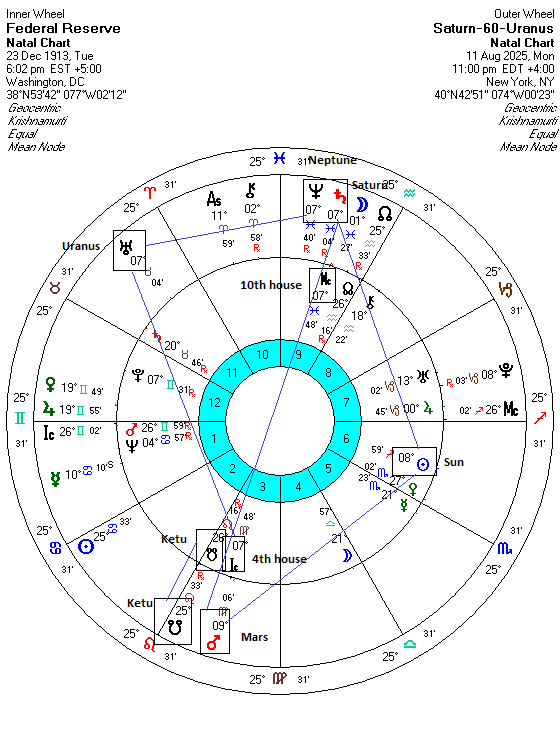

Saturn (and Neptune) in the 8th house are typically associated with scandals and major obstacles. With Mars acting as a potential trigger over the next 5-10 days transiting over the 2nd house cusp, there is a greater risk that Trump will be involved in some kind of major imbroglio. It is also possible that this could involve the Federal Reserve in some way. Trump has been hammering away at Fed Chair Jerome Powell for several months about interest rates being too high. He has been openly calling for his resignation or his dismissal so that a more malleable, Trump-friendly Fed Chair may be installed in his place. One look at the Fed chart suggests this is a possible scenario in August.

The Saturn-Neptune conjunction conjoins the MC, or unequal 10th house cusp, at the top of the chart. Mars conjoins the IC, or unequal 4th house cusp, at the bottom of the chart. This alignment also squares the Sun (8 Sagittarius). Any hits to the 4th/10th axis should be seen as very consequential to the Fed, and may be especially relevant for its leadership as embodied in the 10th house. The Sun is the planetary significator for the leader and thus the Mars-Saturn-Neptune-Uranus alignment is destabilizing the Sun. This increases the odds of fundamental changes at the Fed. Powell could be forced out through resignation or even fired, although Trump has previously backed off from that threat. As an added measure of instability, transiting Ketu conjoins its natal position at 25-26 Leo. This nodal return is often disruptive in nature of the nodes are more likely to manifest in sudden changes.

The bottom line here is that the horoscopes of Trump and the Fed are heavily afflicted in August. This could mean either: 1) Trump forces Powell out, 2) there is a major event that causes enough economic fallout that the Fed comes under increasing scrutiny. Even if Powell stays on, a political or economic event that shows up in the charts of both Trump and the Fed is likely to spell trouble for financial markets.

Implications for this week

While the historically bullish bias of the upcoming Mars-Saturn opposition should not be ignored, there are good reasons to be cautious this week. Mercury is approaching its direct station on August 11 when it will align with malefic Rahu (North Lunar Node). This could generate an undercurrent of instability throughout the week. The charts of Trump and the Federal Reserve look increasingly afflicted this week, especially towards the end of the week. This could also increase downside risk in the stock market. More specifically, Tuesday’s T-square alignment of the Moon with Mars and Saturn/Neptune looks particularly bearish.

If the market extends its decline into the Mercury direct station and Saturn-Uranus alignment on Aug 11, then a bullish reversal shortly after that date becomes more likely.