(9 August 2025) US stocks rebounded last week as strong earnings and semiconductor tariff exemptions provided the fuel for big-tech gains. While the major indexes have not quite recaptured their July highs, the rally has been surprisingly resilient in the face of worsening economic news and ever-present tariff threats.

(9 August 2025) US stocks rebounded last week as strong earnings and semiconductor tariff exemptions provided the fuel for big-tech gains. While the major indexes have not quite recaptured their July highs, the rally has been surprisingly resilient in the face of worsening economic news and ever-present tariff threats.

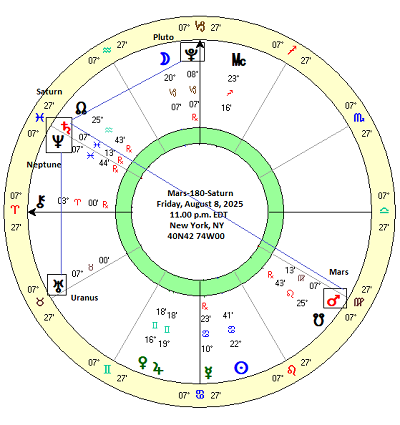

This bullet-proof rally may be seen as confirmation of the bullish nature of the August 8th Mars-Saturn opposition, in addition to alignments to Neptune, Uranus and Pluto. While I thought there were other reasons to be cautious last week, my study from two weeks ago clearly showed evidence of a bullish influence both before and after the exact 180-degree alignment between Mars and Saturn. This likely outweighed any market setback related to the Fed or Trump’s relationship with Fed Chair Jerome Powell that I had speculated about last week. In retrospect, the impact of the Mars-Saturn opposition may have only reflected the weak jobs report. This report and subsequent decline in bond yields has placed Powell in a corner as he may now be forced to cut rates at the September FOMC meeting regardless of the inflationary impact of Trump’s tariff regime.

Previously, I had recognized the general bullish influence of the Mars-Saturn opposition but I didn’t fully appreciate the scale of this influence. That was because I did not conduct the standard tests needed to assess statistical significance. I have remedied that oversight here by including T-scores and P-values for all the intervals in the data as shown in the summary table below. The original raw data can be found in my post of July 27.

Statistical significance: a necessary but not sufficient basis for prediction

In addressing the question of statistical significance, I have used the standard p-value threshold of 0.05. This means that the null hypothesis (i.e. no effect) can be rejected if there is a 95% or better probability that the results are non-random, i.e, there is a real and observable effect in the dependent variable (stock prices) in the sample. We can see that there are several intervals in which the p-value is lower than the 0.05 threshold thus demonstrating significance.

The first column on the left is the longest 30-day window (“-15d 15d”) has a p-value of just 0.029 and thus is statistically significant. The results in the second column (“-15d 0d”) were also significant and suggests the bullish bias is more likely to manifest in the period leading up to the date of the exact conjunction rather than afterwards. The results of shorter intervals also reached statistical significance including the 24-day window (“-12d 12d”), the 18-day window (“-9d 9d”), and the 12-day window (“-6d 6d”). It is worth noting that the shortest 6-day window (“-3d 3d”) did not reach the threshold of significance and in fact missed it by a wide margin (p = 0.405). This suggests that any bullish effects are less likely to manifest in the 3 days preceding and 3 days following the exact opposition.

But since Mars opposed Saturn yesterday, we are only halfway through some of the bullish interval windows. That means that there is more bullish potential that may yet manifest from this alignment. This could translate into further market upside at least until the 15-day period is over on Aug 23. Of course, the shorter intervals would terminate sooner on Aug 21 (12d), Aug 17 (9d) or Aug 14 (6d).

But does this mean that the rally will necessarily extend into late August? No, it does not. While the Mars-Saturn influence appears significant and real, it is still only one of many influences. And as the raw data shows, there are still many previous cases where stocks declined during this opposition. So there are no guarantees that this bullish pairing will play out according to its probable bullish outcome. In that respect, statistical significance may only be a necessary but not sufficient condition for prediction.

Implications for this week

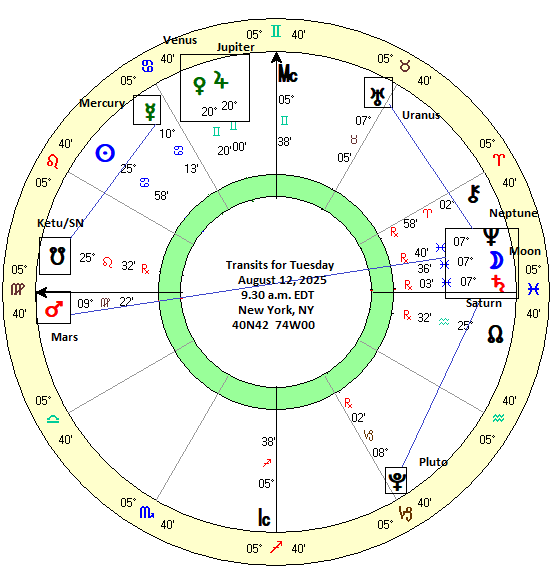

While the Mars-Saturn alignment is bullish this week, other alignments could offset that effect somewhat. The early week in particular has several alignments of note. Mercury ends its retrograde cycle on Monday and stations direct while in a close 45-degree alignment with Ketu, the South Lunar Node. The pairing of Mercury with the lunar nodes often has a modest bearish influence. The conjunction of Venus and Jupiter on Tuesday may hint at a positive start to the week, but there is an elevated risk of a bearish reversal once the conjunction begins to separate. This separation occurs in the early morning hours (EDT) on Tuesday, Aug 12.

Tuesday also leans bearish since the Moon will conjoin Saturn and Neptune and highlight the opposition with Mars. Even if Mars and Saturn are bullish together, the introduction of the Moon into the mix seems less positive. In a sense, this could be a replay of last Tuesday’s Mars-Moon-Saturn T-square which coincided with a modest down day. Same planets, albeit with different angles. Tuesday therefore has the potential to upend — or at least temporarily suspend — the bullish Mars-Saturn combination.