(24 August 2025) Stocks finished mostly higher last week after Fed Chair Jerome Powell signaled an interest rate cut was likely in September. Friday’s rally reversed a brief down trend for the indexes, although the Nasdaq still finished the week in the red. The current bull market looks as resilient as ever as dips continue to be bought aggressively

(24 August 2025) Stocks finished mostly higher last week after Fed Chair Jerome Powell signaled an interest rate cut was likely in September. Friday’s rally reversed a brief down trend for the indexes, although the Nasdaq still finished the week in the red. The current bull market looks as resilient as ever as dips continue to be bought aggressively

In planetary terms, the ongoing alignment of Saturn, Neptune, Uranus and Pluto may still close enough to support these elevated prices. And yet as Saturn (6 Pisces) gradually begins to separate from its conjunction with Neptune (7 Pisces) and thus weaken its alignment with Uranus (7 Taurus) and Pluto (7 Capricorn), there will soon come a time when optimism will be in shorter supply and markets will become more prone to a correction. But when?

Last week’s investigation into the NYSE tertiary progressed Mercury retrograde station on August 27 proposed a possible catalyst, although one that had a wide time window of effectiveness. While this retrograde Mercury influence is bearish, its impact need not be felt immediately as it may take several weeks or even months after the August 27 station date.

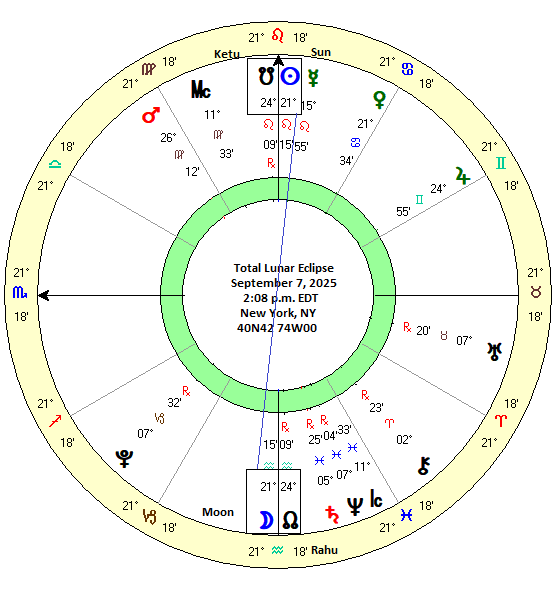

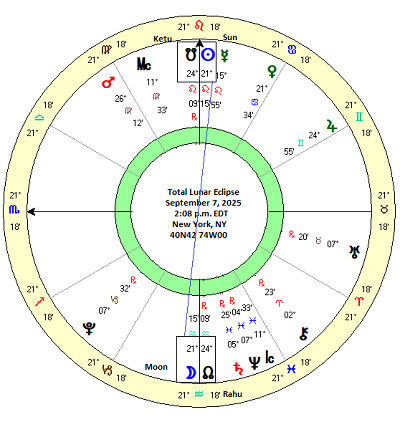

With that in mind, we turn this week to the upcoming eclipse period. On September 7, there will be a Total Lunar Eclipse which will be followed by a Partial Solar Eclipse 14 days later on September 21. Eclipse periods occur every six months and consist of two, or occasionally three eclipses that are separated by about 14-15 days. Each eclipse period consists of one solar and one lunar eclipse as the Sun and Moon conjoin the Lunar Nodes, Rahu and Ketu. Eclipses can be further divided into types thus solar eclipses can either be total, partial or annular while lunar eclipses can either be total, partial or appulse. The immediate eclipse period is about 15 days in duration and marks the time between eclipses. A longer eclipse period of 45 days may also be specified and includes the 15 days prior to the first eclipse and 15 days after the second eclipse. This may be extended to a 60-day period for triple eclipse sequences.

Eclipses are generally considered bearish in financial astrology, although they are often seen as wild card influences that can reverse prevailing trends — either up or down. The periods surrounding eclipses are believed to bring higher volatility and a greater likelihood of declines. But to what extent this is actually true is unknown. Eclipses may be blamed for declines when they happen, but then conveniently forgotten when declines do not materialize. In order to get a better understanding of its market effects, I decided to undertake a small statistical study of eclipses for the period of 2000 to 2025. The resulting sample of 116 eclipses and 54 eclipse periods is admittedly quite small but still large enough to derive statistical significance if the effects are strong enough.

Method

Since eclipses always occur in a sequence of two or three, I retained this pattern when analyzing the market effects of the eclipse period. I created a sample of 54 eclipse periods consisting of 46 two-eclipse periods and 8 three-eclipse periods. For each period, I recorded the closing prices of the S&P 500 on the days of both eclipses (Time zone = UTC). Then I recorded the prices at 5-day intervals before and after both eclipses in each series. The resulting row of prices therefore begins 15 days before the first eclipse and ends 15 days after the second (or third) eclipse.

To discover if there were any consistent effects, I calculated the percentage change across various time intervals. The left hand column is the short 14-15-day eclipse period between the first and second eclipse and labeled “0dE1 0dE2”. The second column represents the long 45-day eclipse period — including the 15-day buffer periods before and after — and is labeled “-15dE1 15dE2”. The third and fourth columns measure the percentage change from 15 days before the first eclipse (“-15dE1 0dE1”) until the eclipse and then the 15 days following the second eclipse (“0dE2 15dE2”). The rest of the columns measure shorter 5-day and 10-day time intervals immediately prior to an eclipse.

Results: All Eclipses

The table below displays the percentage changes across these various time intervals. The results are uninspiring to say the least. Summary statistics like average, median and standard deviation are shown on page 3 of the table. The average in the left hand column was 0.33% — more or less what chance would predict given the expected value of 0.23% for any random 15-day period. The expected value was calculated based on a 5.6% average annual return for the period of 2000-2025. Most other intervals were similarly close to their expected values although some were actually above their expected values, such as the extended 45-day eclipse period shown in the second column (“-15dE1 15dE2”). This elongated eclipse period had an average gain of 1.32% and median gain of 1.72% compared with an expected gain of 0.69%. So instead of being bearish, this was evidence that the eclipse period might actually be a bit bullish. However, we should note that this result was not statistically significant, as the p-value was well above the 0.05 threshold at 0.347. In fact, none of the intervals provided significant results.

This relatively uninteresting result is shown in the chart below. The average and median lines generally follow the expected line higher to the right over time reflecting the modestly bullish character of the aggregated eclipse periods. Do these findings refute the bearish view of eclipses? Yes and no. In so far as the commonly used simple shorthand of eclipses = volatility, then yes, this data does suggest that eclipses on the whole aren’t particularly bearish at all.

Disaggregation: Lunar Eclipses

But the key phrase there is “on the whole”. Eclipses are not all equal. Given there are six different types, it is worth knowing whether lunar eclipses are more bearish than solar eclipses, or if total eclipses (lunar or solar) more disruptive than partial eclipses. And we haven’t even considered the role of any third planet with eclipses. Eclipses that are aligned with malefics may yield different results than eclipses that are aligned with benefic planets.

But first things first. Let’s now take a look at lunar eclipses. After all, the September 7 eclipse will be a total lunar eclipse. If we analyze a sub-sample of other total lunar eclipses, we will have a better idea of the likely effects of this upcoming eclipse. The results are seen in the table below. While the sample is tiny (n=11), we can see that lunar eclipses do seem more bearish. In order to more closely recreate the current eclipse set up, I have created this sample of total lunar eclipses which occur first in the eclipse sequence rather than second.

There are some negative intervals in the 5 days before and after the lunar eclipse. And yet we shouldn’t get too excited since none of the intervals reached statistical significance, as all p-values are above 0.05. The pattern of price changes may be better understood from the chart below. The dip below zero near the day of the lunar eclipse is clear, as is the rebound afterwards. In fact, both the average and median end up higher than the long-term expected value thus suggesting that eclipses may even be bullish in their longer term effects.

But while the first position total lunar eclipse is somewhat bearish, other lunar eclipses are less so. If a total lunar eclipse occurs in the second position in any given eclipse period, there are a couple of dips below the expected line but it seems less focused on a particular point in the sequence. Ironically, the most bearish point occurs at the time of the first (solar) eclipse (E1 15d) and not at the time of the total lunar eclipse at E2 30d. As with the first position total lunar eclipse, the end of the period (45d) looks quite bullish compared to the expected value. It is possible that the first eclipse — whether lunar or solar — may be more negative in its effects than the second eclipse.

The appulse and partial lunar eclipses are actually quite bullish. The lunar appulse eclipse in the first position (LAE1) generally coincides with positive returns as it is well above the expected line. The partial lunar eclipse diverges widely from the expected line but it also seems somewhat bullish compared with the long term averages. Of course, none of these other lunar eclipses have large enough sample sizes to make a confident assessment of their market effects. But they broadly suggest that some eclipse types are less bearish than most astrologers believe.

Solar Eclipses

Finally, let’s take a look at solar eclipses. Since the upcoming Sep 7 lunar eclipse is total eclipse, then the Sep 21 eclipse will be a partial solar eclipse. Whenever there is a total lunar eclipse, we will always see a partial solar eclipse whether or not the lunar eclipse occurs in the first position or the second position. But that means that the effects of the partial solar eclipse can already be found in the chart of the two different total lunar eclipses. For the first position lunar eclipse (TLE1), the partial solar eclipse occurs on day 30 (E2 30d) in the eclipse period. As the chart shows, it is generally bullish at the time of the eclipse and for the 15 days afterwards. Conversely, if the total lunar eclipse occurs in the second position (TLE2), then the partial solar eclipse is slightly bearish as the average dips a bit below zero on day 15 (E1 15d). Again, this may be a hint that the first eclipse tends to be more bearish than the second.

For its part, the market effects of the total solar eclipse are similarly disappointing given its approximate tracking of the expected value line. The small sample size no doubt is working against us here but there is nothing that jumps out and says “bearish” at all. Needless to say, none of these intervals are statistically significant either.

For curiosity’s sake, we should make mention of the effects of the triple eclipse pattern. This only happens occasionally as there were only 8 eclipse periods that featured triple eclipses during the 25-year period under study. One might think that having an extra eclipse might produce different or perhaps worse results assuming that eclipses are somehow bearish. But that isn’t the case. In fact, triple eclipse periods are the most bullish of all the eclipse types. Both the average and median lines are well above the expected line throughout the 60-day period.

Conclusion

Are eclipses bearish? Well, not as much as is commonly believed. While most eclipse periods will have some negative average returns at some point, overall they are not bearish as measured across the entire 45- or 60-day period. But of all the eclipse types, we can say there is some evidence that total lunar eclipses are indeed bearish, especially in the 10 day window that straddles the eclipse. And since a total lunar eclipse will mark the start of the upcoming eclipse period on September 7, we should take note.

That said, it is possible to introduce further levels of analysis. While eclipses may not be as bearish as we thought, it may matter more which planets are aligned with the eclipse point. Rather than signaling periods of volatility, eclipses may also be seen as amplifiers for other aligned planets. Depending on the natural qualities of the planets involved, eclipses could prove be either bearish or bullish. I hope to discuss this more neutral amplifier approach to eclipses in my next post. Spoiler alert: I note that the partial solar eclipse on Sep 21 will be exactly opposite Saturn, a bearish planet.

Implications for this week

If we transpose the TLE1 chart to our current calendar, the average high point may occur as late as September 2, which is 5 days before the eclipse. This corresponds to the “10d” mark in the cumulative eclipse period chart. If the averages of that chart hold this time around, then stocks would be more likely to fall after September 2 and remain weak until September 17, which is marked “25d” in the chart. However, I wouldn’t put much faith in those dates given the tiny sample size we are working with and the absence of any statistical significance. But it does give a clue perhaps that dips are more likely to occur near the actual eclipse day.

If these previous patterns are repeated this week, it is possible that stocks could remain fairly strong since the bearish eclipse effects would not yet appear. That doesn’t preclude some downside this week; it only means that this evidence doesn’t make a strong case for major downside at this time. When evidence is this weak, it should only inform our decisions rather than dictate them.

To receive these weekly research posts as newsletters, please subscribe to my Empirical Astrology substack.