(7 September 2025) Stocks finished higher last week despite weak jobs data that has once again raised the specter of looming recession. While stocks fell after Friday’s jobs report, the glass half-full interpretation is that the Fed will be more willing to deliver multiple rate cuts this year which may eventually spur more economic activity. The Fed is widely expected to cut its key overnight lending rate at its next meeting on September 17.

(7 September 2025) Stocks finished higher last week despite weak jobs data that has once again raised the specter of looming recession. While stocks fell after Friday’s jobs report, the glass half-full interpretation is that the Fed will be more willing to deliver multiple rate cuts this year which may eventually spur more economic activity. The Fed is widely expected to cut its key overnight lending rate at its next meeting on September 17.

The US stock market continues to trade at or near its highs as we enter the semi-annual eclipse period which kicks off with this Sunday’s total lunar eclipse. The September 7 lunar eclipse will be followed by a partial solar eclipse on September 21. Evidence suggests that stocks tend to do less well in the days following a total lunar eclipse. My recent study of eclipses indicated that this period of underperformance may last for a week or perhaps two, and is likely to revert to a more bullish bias following the second eclipse.

While the study showed some bearish effects, the overall effect was not that strong. Moreover, the results did not reach the standard threshold of statistical significance at p < 0.05. In future, I hope to expand the study’s sample size in order to see if any of these eclipse effects reach statistical significance.

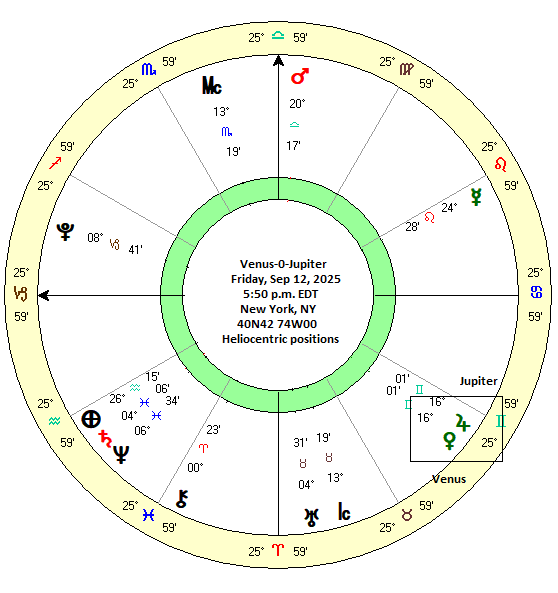

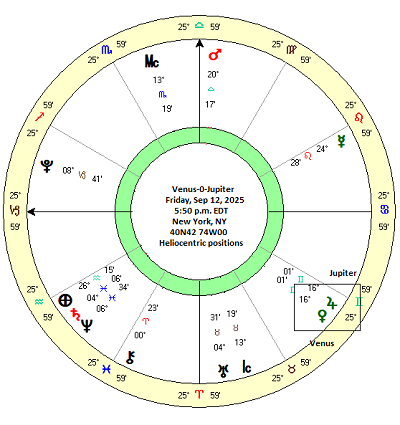

So while there is some reason to think markets may be more vulnerable to declines over the next week or two, eclipses are only one part of the puzzle. We should also note the presence of other potentially important planetary alignments. One that caught my eye is this week”s heliocentric conjunction of Venus and Jupiter on Friday, September 12.

The heliocentric Venus-Jupiter conjunction

In addition to the more commonly-used geocentric coordinate system, heliocentric planetary positions can also provide clues about possible influences on collective sentiment that may manifest in financial markets. For example, before the historic October 1929 crash, the Dow Jones hit its all time high of 381.17 on September 3 — just two days after a heliocentric Venus-Jupiter conjunction. Since both planets are considered benefic, hitting a high on such a conjunction was an apt reflection of their supposed bullish influence.

But it seems unlikely that Venus-Jupiter conjunction played a critical role in the whole 1929 crash scenario since Venus conjoins Jupiter every 238 days or so. Since it happens more than once a year, it may only exert a modest and fleeting effect on sentiment. And yet the question remains: what can we expect from this Friday’s Venus-Jupiter conjunction?

Method

To answer this question, I compiled a dataset of all the heliocentric Venus-Jupiter conjunctions from 1990 to 2025. The resulting sample yielded 55 cases, a sample size large enough to generate statistical significance if the data trended in a consistent direction. Closing prices of the S&P 500 were recorded at 3-day intervals starting at 15 days before the conjunction and ending 15 days after the conjunction. The conventional astrological view of conjunctions is that they are more likely to show their effect in the time leading up to the conjunction and dissipate afterwards as the conjunction separates. My hypothesis was therefore that this conjunction should be somewhat bullish during the 15 days before conjunction, with a greater effect in the 3 or 6 days immediately prior to the conjunction. The closing prices are shown in the table below.

Results

The resulting are underwhelming. As the summary statistics table below shows, this conjunction has very little effect across any interval pairs. The averages across most intervals are below the expected value while the median outcomes are somewhat above the expected value. The expected values were calculated based on a 8.4% average annual return during the period of 1990-2025. Needless to say, none of the intervals were statistically significant.

The main reason why the averages diverged somewhat from the medians is because two of the cases occurred during periods of extreme volatility: in September 2001 at the time of the 9/11 terror attacks, and in October 2008 at the depths of the global financial crisis. For this reason, it is reasonable to assume that the median may provide a better snapshot of the effects of the Venus-Jupiter conjunction. Nonetheless, any bullish effects are very muted. Moreover, if the Venus-Jupiter conjunction was truly bullish, why did it occur during those two periods of historic market turbulence?

Viewing it from a incremental perspective, the chart below shows just how close both the average and median tracks the expected line over time. If there was a positive effect from the conjunction, we would expect to see both lines significantly above the expected line. Even if we ignore the average line for the aforementioned anomalies, the median line is only 0.60% higher than the long term expected line at 9 days (“9d”) after the conjunction, its point of maximum divergence . And without statistical significance, we cannot reasonably predict any that this upcoming Venus-Jupiter conjunction will coincide with a bullish market outcome.

Implications for this week

The takeaway here is that the heliocentric conjunction of Venus and Jupiter may not be very bullish in its effects. With the conjunction due on Friday, there isn’t a compelling case to be made for gains this week. That said, we would be remiss if we didn’t take note of the fact that this week’s conjunction occurs very close to the north node of Jupiter at 16 Gemini/10 Cancer. This arguably puts the conjunction in a more bullish context. Even so, it isn’t sufficient reason to have a narrowly bullish bias this week.

That means that we should be paying close attention to the possible bearish effects of the total lunar eclipse on Sunday, September 7. While bearish in its average effects, it similarly lacks the statistical significance which would elevate it into a higher confidence prediction. And so we are left in an uncomfortable position which recalls Voltaire’s observation: “Doubt is not a pleasant condition, but certainty is absurd.”

If you would like to receive my weekly updates as an email newsletter, please subscribe to my Empirical Astrology Substack.