(14 September 2025) US stocks climbed higher last week as investors priced in a Fed rate cut following a muted inflation report and a large downward revision in recent job growth. The rise came despite the current eclipse period which can sometimes introduce a measure of volatility. Weak statistical evidence notwithstanding, the gains did coincide with the heliocentric Venus-Jupiter conjunction which was exact on Friday, September 12. This also happened to coincide with a close geocentric alignment of bullish Jupiter with Mercury and the Sun.

(14 September 2025) US stocks climbed higher last week as investors priced in a Fed rate cut following a muted inflation report and a large downward revision in recent job growth. The rise came despite the current eclipse period which can sometimes introduce a measure of volatility. Weak statistical evidence notwithstanding, the gains did coincide with the heliocentric Venus-Jupiter conjunction which was exact on Friday, September 12. This also happened to coincide with a close geocentric alignment of bullish Jupiter with Mercury and the Sun.

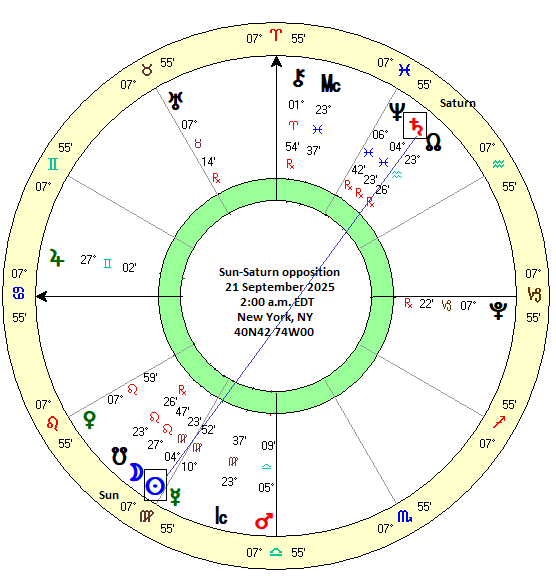

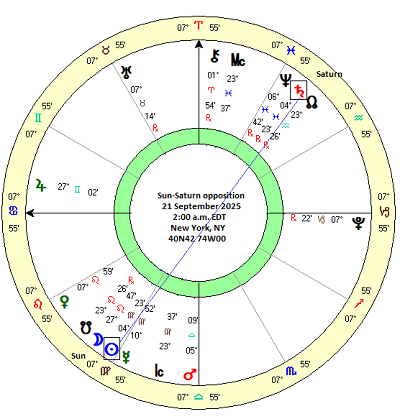

Whether or not this rally continue into Wednesday’s Fed meeting and beyond remains to be seen, however. Besides the ongoing eclipse period, this week will bring Sun and Mercury into opposition aspect with bearish Saturn. These oppositions are generally seen to have a negative influence on markets, although if they are part of larger alignments, it is possible that the inherent tension intrinsic to the opposition can be transformed into a more constructive influence.

For example, Saturn and Neptune are still just two degrees apart, while Uranus and Pluto are also less than three degrees from an exact alignment with Saturn. The presence of these other slow-moving outer planets at the time of this week’s Sun-Saturn and Mercury-Saturn oppositions may well alter any hypothetical impact. Before tackling the question of these larger alignments, it is worth examining the typical effects of these Sun-Saturn and Mercury-Saturn aspects.

Gold and the Sun-Saturn opposition

In this week’s post, I wanted to assess the average effects of the Sun-Saturn opposition. Unlike previous studies which focused on stock prices as the dependent variable, I thought I would change it up a bit this week and look at gold prices. Gold has significantly outperformed US stocks for the past two years given the decline in the US dollar, endless trade uncertainty and worries over of a possible global debt crisis. Gold is already up almost 40% in 2025 after rising 30% in 2024.

Gold is symbolically associated with the Sun and Venus as the precious metal that acts a store of value. In my experience, I have observed that aspects of the Sun and Venus with Saturn are generally bearish for gold while aspects involving Jupiter are more positive. But are my subjective impressions correct?

I decided to put this question to the test by systematically analyzing gold prices around the time of the Sun-Saturn opposition. I chose this aspect because the Sun is due to oppose Saturn on September 21, just four days after the FOMC meeting. Since Saturn is a bearish planet and the Sun has traditional associations with gold, I would hypothesize that gold price would be more likely to decline around the time of the Sun-Saturn opposition.

Method

To test this hypothesis, I recorded gold futures prices at 3-day intervals across a 30-day window around the annual Sun-Saturn opposition. Thus, prices 15 days before the opposition were recorded, then 12 days before, 9 days before and so on until 15 days after the opposition. The choice of a 30-day window was somewhat arbitrary but roughly coincided with a 15-degree orb which is more generous than most astrologers normally use. I included all Sun-Saturn oppositions since the start of futures trading in 1974. The resulting sample of 48 cases from 1976 to 2024 is fairly small in size but perhaps big enough to generate some significant results if the effects are large enough. The prices are shown in the table below.

Then I compared the price changes across various intervals to see where the effects, if any, were greatest. The first left-hand column (“-15d 15d”) is the longest interval which covered the entire 30-day window. The second column (“-15d 0d”) is the 15-day interval that culminates on the day of the exact opposition. Where this fell on a holiday, the next closest trading day was used. As a measure of possible effects, a benchmark expected value was calculated using the 6.4% average annual return for gold during the 1976-2024 period. This figure was calculated on a pro-rated basis for each interval. These price changes are shown in the table below.

Results

As the summary statistics table shows (below), there is very little effect of the Sun-Saturn opposition on gold prices. There was a discernible negative effect, however, which was seen in the longer and shorter intervals. The 30-day window shown in the left hand column (“-15d 15d”) produced an average negative result (-0.15%) which was below the expected value of 0.52%. However, this was not statistically significant given the p-value of 0.362 — well above the usual 0.05 threshold for significance. This was due to a high standard deviation (5.04%) which reflected a large variation in the results. While some Sun-Saturn oppositions coincided with negative outcomes, many were quite positive. Consequently, despite the negative bias, the results were not significant.

If we look at the data from a perspective of a sequence, the negative bias is more apparent. If we record the change in prices between the intervals during the 30-day window, we can see if there is any particular pattern. Are gold prices weaker around the day of the exact opposition? Are gold prices weaker during the run-up to the opposition as would be assumed by astrological theory?

Both the average and the median lines are mostly lower than the expected line which follows a gradual rise. This suggests that the Sun-Saturn opposition is a somewhat bearish influence on the price of gold. However, the negative influence is quite modest with a less than -1% outcome over the course of the 30-day period. Surprisingly, the median briefly moves above the expected line at the “0d” mark when the Sun-Saturn opposition is supposedly at its most intense effect. That is an anomalous result to say the least.

While the negative bias is evident, the results did not reach statistical significance as the table below shows. Well, except for one case: the first data point that measured the average change from 15 days before the opposition to 12 days before. I suspect this may be a statistical artifact created by the arbitrary starting point of 15 days prior to the opposition. It seems more likely that gold prices had a negative bias well before this “-15d” mark but they didn’t show up until this first recorded price change. As a result the expected value is artificially low (0.05%) which boosted the T-score and lessened the p-value so that it fell below the standard threshold of significance at 0.05.

3rd planet effects

The wide variation in outcomes from this opposition may be explained by simultaneous alignments with other planets. In that respect, not all Sun-Saturn oppositions are created equal. If an opposition occurs when it is also aligned with a third or fourth planet, that may change the outcome as the Saturn influence may be offset or even inverted. To analyze the potential effect of third planet, I grouped together cases in which there was a significant move up or down around the time of the Sun-Saturn opposition. Using a 12-day window (-6d 6d), I counted the number of cases in which the price of gold moved more than 3% up or down (<-3%, >3%). I repeated this process for a shorter 6-day window (-3d 3d) assembling a batch of cases in which price moved more than 2% up or down (<-2%, >2%). For each case, I recorded any third, fourth or fifth planet alignments and compiled the table below. A total of 17 bullish cases (>2%, >3%) and 12 bearish cases (<-2%, <3%) were recorded.

The results show a fairly random distribution of planets across both the bullish and bearish cases. Is there a pattern here? Maybe not since all the planets appear in both bullish and bearish columns. This would suggest that whatever the intrinsic effect of the Sun-Saturn opposition, the addition of other planets doesn’t have an obvious impact on outcomes. Or does it? The only things that stand out (in bold type) are: 1) Jupiter alignments occur more frequently in bullish outcomes (5 vs 2) and, 2) bearish outcomes.occur more frequently when no 3rd planet aligns with the Sun-Saturn opposition (4 vs 1).

Jupiter is a bullish planet, of course, so it is not hugely surprising that its presence here might boost outcomes. The absence of any third planet would also dovetail with the general expectation that the Sun-Saturn opposition is bearish. Without any additional alignments, its intrinsic bearishness can more readily manifest. While there are exceptions for both of these observations, the pattern is nonetheless there. Obviously, we can’t make too much of this is a tiny sample but it is worthy of further study.

For its part, the upcoming Sun-Saturn opposition on September 21 will indeed have alignments with other planets. Neptune is within 2 degrees of a conjunction with Saturn and Uranus and Pluto are within 3 degrees of their respective 60-degree alignments with Saturn. Mars will be exactly 120 degrees (a trine aspect) away from Saturn. The absence of any Jupiter alignments may reduce the probability of further gains in gold during its narrow 12-day opposition period, say from Sep 15 to Sep 27. But the presence of additional planets like Mars and Neptune should be seen in slightly positive terms. Perhaps these two factors may cancel each other out thus leaving only the average effects of the Sun-Saturn opposition as a better barometer of what we can expect. In other words, its average bearish bias may be a bit more likely to occur.

Conclusion

This study suggests that the Sun-Saturn opposition may coincide with a weakness in gold prices. The data showed a small but consistent underperformance of gold relative to the long term expected average return. While the evidence is intriguing, the failure of any tested interval to reach statistical significance is a reminder that these results should be taken with more than a pinch of salt. The upcoming Sun-Saturn opposition therefore is not a sufficient reason to think that gold prices will fall this week or next week. Nonetheless, the results are interesting and are worth taking into consideration.

Implications for this week

The Sun-Saturn opposition is only one of several alignments that will form this week. Mercury also opposes Saturn on Wednesday, September 17, while Mercury, Mars and Venus will all align with Chiron on Tuesday. The Mercury-Saturn opposition carries a slightly bearish overtone, although it can be very short-lived in its effects. The early week Chiron alignment may be more benign, however, as multiple planet alignments can be bullish regardless of the presence of malefics like Mars or Saturn.

The Sun-Saturn opposition won’t be exact until Sunday Sep 21 so that may delay any possible effects until later in the week or perhaps next week. With Wednesday’s Fed meeting on tap, it is tempting to think that the Sun-Saturn opposition could coincide with a negative reaction in gold prices and/or stocks. We shall see.

I would also note that the upcoming conjunction of Mars with its own South Node occurs on Sep 23. This may well be a more reliably bearish influence. In my next post, I hope to generate some relevant statistics on this double Mars influence in order to ascertain its market probabilities.

If you would like to receive my weekly updates as an email, please consider subscribing to a free newsletter at my Empirical Astrology Substack.