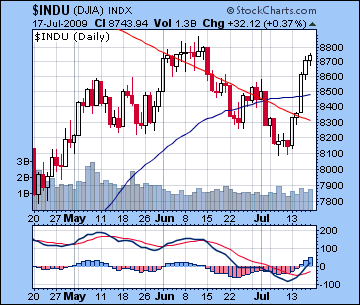

- Solar Eclipse may move stocks lower early; markets to move higher into August

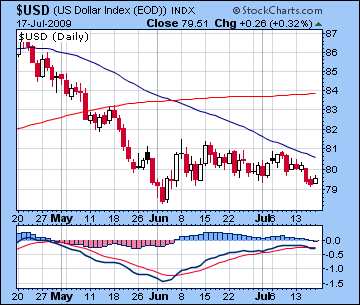

- Dollar strengthening with weakness by Friday

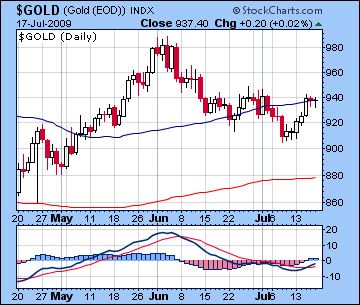

- Gold vulnerable to large declines on eclipse

- Crude to pullback before moving higher into August

- Solar Eclipse may move stocks lower early; markets to move higher into August

- Dollar strengthening with weakness by Friday

- Gold vulnerable to large declines on eclipse

- Crude to pullback before moving higher into August

This week features a total Solar Eclipse on Wednesday July 22 (GMT) which will follow a path of totality across central India and China. Since the areas where the eclipse is visible often figure in the news in the days and weeks following the eclipse, we can look for some noteworthy events, usually disruptive in nature, coming out of that part of the world. With Venus is a tense square aspect with Saturn on the exact day of the eclipse, markets are more likely to correct this week and move lower. Given the run up last week, this is perhaps to be expected. Monday’s applying Mercury-Mars sextile is the first opportunity for a correction, although it may wait until later in the day. On Tuesday the Moon enters Cancer to join the Sun and Ketu in advance of the eclipse and that could correspond with a major down day. Wednesday may also be hit with the eclipse fallout as Venus (money) is influenced by Saturn (pessimism and caution). On the whole, it seems that the earlier part of the week is more bearish, and we could see a significant fall on any of these three days. A possible sign of an upturn occurs on the Moon-Mercury conjunction on Wednesday at midday. This could conceivably set the stage for an afternoon rally. Thursday looks favourable also as the Moon opposes Jupiter. Friday could begin positive, but there is a chance for afternoon weakness which may push the markets into the red by the close. But generally speaking, the end of the week should see some recovery which may mitigate any losses that accompany the eclipse. Since this eclipse is quite powerful and contains the added bearish factor of the Venus-Saturn square, I would not be surprised by a large downside move as the market looks volatile this week. However, I don’t really see enough bearishness to knock out last week’s lows of 8100/870. Probably we will retrace part way before moving higher into August.

This week features a total Solar Eclipse on Wednesday July 22 (GMT) which will follow a path of totality across central India and China. Since the areas where the eclipse is visible often figure in the news in the days and weeks following the eclipse, we can look for some noteworthy events, usually disruptive in nature, coming out of that part of the world. With Venus is a tense square aspect with Saturn on the exact day of the eclipse, markets are more likely to correct this week and move lower. Given the run up last week, this is perhaps to be expected. Monday’s applying Mercury-Mars sextile is the first opportunity for a correction, although it may wait until later in the day. On Tuesday the Moon enters Cancer to join the Sun and Ketu in advance of the eclipse and that could correspond with a major down day. Wednesday may also be hit with the eclipse fallout as Venus (money) is influenced by Saturn (pessimism and caution). On the whole, it seems that the earlier part of the week is more bearish, and we could see a significant fall on any of these three days. A possible sign of an upturn occurs on the Moon-Mercury conjunction on Wednesday at midday. This could conceivably set the stage for an afternoon rally. Thursday looks favourable also as the Moon opposes Jupiter. Friday could begin positive, but there is a chance for afternoon weakness which may push the markets into the red by the close. But generally speaking, the end of the week should see some recovery which may mitigate any losses that accompany the eclipse. Since this eclipse is quite powerful and contains the added bearish factor of the Venus-Saturn square, I would not be surprised by a large downside move as the market looks volatile this week. However, I don’t really see enough bearishness to knock out last week’s lows of 8100/870. Probably we will retrace part way before moving higher into August.

Next week (July 27-31) looks mostly bullish although Monday has the potential for a very negative open as Mercury will be in aspect with Saturn. At the same time, Venus will be in a nice aspect with Jupiter, so there ought to be enough positive energy for the markets to close higher. More gains are likely as Mercury will oppose Jupiter midweek although some pullback is possible by Friday once this favourable influence has passed. The following week (Aug 3-7) also looks fairly bullish on the Mercury-Venus aspect but the market could be vulnerable to profit taking earlier in the week on the Mercury-Pluto-Rahu alignment. A potential turning point for the market is the approach of a Mars-Saturn square on Tuesday Aug 11. Market declines may be more likely during the week of Aug 10-14, especially after this aspect has reached exactitude. In fact, mid-August and the Mars-Saturn aspect may be a possible top for the market. In all likelihood, this peak will exceed the June/January highs of 9000/950, with the November 2008 highs of 9600/1000 a definite possibility.

As we head into the second half of August, I think the stock rally will lose some steam. With Jupiter entering sidereal Capricorn July 31, stocks will lose a significant bullish influence since Jupiter is debilitated in Capricorn. As a clue about how long this impending fall decline may extend, Jupiter will stay in Capricorn until December 2009 before it once again enters Aquarius. In addition, Saturn will again oppose Uranus on September 15 so that is another major negative for the market to contend with. While not a precise timing indicator, aspects from such slow moving planets often correspond with major moves. The last Saturn-Uranus opposition occurred on November 4 in the midst of the 2008 lows made in October and November. So while there are positive signals in the short term, the longer term view is more distinctly negative and investors should consider their best strategy for exiting long positions soon and contemplate establishing a short position here as the market tops out. I don’t have any firm opinions on what kind of levels we will see in October and November, but the March lows (6500/666) could very well be in play. In terms of risk/reward, the November downside far outweighs the August upside.

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish

The bulls took control again on Dalal Street last week as stocks rallied 8% on improved prospects for an Asian economic recovery. After Monday’s probing down towards 3900, the Nifty ended the week at 4375 while the Sensex finished at 14,744. I had been more bearish in my outlook, although I did allow for some kind of up move given the favourable aspects. Monday’s decline fit nicely with the Mars-Rahu aspect and Tuesday’s gain was also in keeping with expectations of the bullish Sun-Mercury conjunction which did produce a sizable gain. Wednesday continued in rally mode as the positive influence spread out over both days. Thursday was largely flat which somewhat in line with the forecast given the possible offsetting quality to the dominant aspects. Friday’s gain came on the Sun-Jupiter aspect and in retrospect I should have been more emphatic in my call. I realized a large move was possible but could not ascertain the direction given the possibility that the Mercury-Ketu conjunction could negate the bullishness of Sun-Jupiter. In any event, the market did not quite make the 38% retracement back to Nifty 3850 but given the current planetary situation, this seems unlikely in the short term, even with the prospect of an eclipse this week. The strength of the bounce off 3900 indicates that the market may have found some short term support from which is can launch a new rally. We can see a bullish MACD crossover forming with the late week gains as the histograms have moved into the positive. As another potentially bullish indicator, the Nifty and Sensex both ended the week above their 50-day moving averages thus making last week’s modest breach possibly temporary in nature.

With the total Solar Eclipse on Wednesday morning, the market is likely to be quite volatile this week with a distinctly bearish bias, especially in the early going. It is noteworthy that the "shadow of totality" will pass over central India beginning near Mumbai and travelling east across the subcontinent into Bangladesh and then into China, passing over Shanghai and finally over the Pacific Ocean. According to astrological theory, eclipses often foretell significant events in the days and weeks following the eclipse near the shadow of totality. These events usually have a sudden or disruptive nature to the status quo and could correspond with a natural event such as an earthquake or some kind of social unrest. Monday could open higher but the presence of a tightening Mercury-Mars aspect through the day is not a positive influence. The Moon will join this aspect towards the close and points to a possible decline. Tuesday also looks fairly negative as Venus applies to square with Saturn in advance of the eclipse. The Moon is moving towards an aspect with Jupiter near the close so that might preclude further weakness but it’s unlikely to spur much buying. With the eclipse occurring Wednesday just before the start of trading, it will be interesting to see how trading is affected. With Saturn rising just before the open at 9.50, caution and fear may be the predominant emotions, even if the market manages to avoid a large decline. The Moon conjoins Mercury on Thursday so that may bring more buyers into the market, although the open could be down. Friday may be the most positive day of the week as the Moon enters Leo and forms a parivartana yoga with the Sun in Cancer. The downside influences seem stronger this week so even if the late week is positive, the market will probably finish down. The eclipse is something of a ‘wild card’, however, since it can increase the size of the moves, especially in areas where the eclipse is visible such as India. Therefore, nothing would surprise me this week although I think the recent lows of 4000/13,400 are likely going to hold here.

With the total Solar Eclipse on Wednesday morning, the market is likely to be quite volatile this week with a distinctly bearish bias, especially in the early going. It is noteworthy that the "shadow of totality" will pass over central India beginning near Mumbai and travelling east across the subcontinent into Bangladesh and then into China, passing over Shanghai and finally over the Pacific Ocean. According to astrological theory, eclipses often foretell significant events in the days and weeks following the eclipse near the shadow of totality. These events usually have a sudden or disruptive nature to the status quo and could correspond with a natural event such as an earthquake or some kind of social unrest. Monday could open higher but the presence of a tightening Mercury-Mars aspect through the day is not a positive influence. The Moon will join this aspect towards the close and points to a possible decline. Tuesday also looks fairly negative as Venus applies to square with Saturn in advance of the eclipse. The Moon is moving towards an aspect with Jupiter near the close so that might preclude further weakness but it’s unlikely to spur much buying. With the eclipse occurring Wednesday just before the start of trading, it will be interesting to see how trading is affected. With Saturn rising just before the open at 9.50, caution and fear may be the predominant emotions, even if the market manages to avoid a large decline. The Moon conjoins Mercury on Thursday so that may bring more buyers into the market, although the open could be down. Friday may be the most positive day of the week as the Moon enters Leo and forms a parivartana yoga with the Sun in Cancer. The downside influences seem stronger this week so even if the late week is positive, the market will probably finish down. The eclipse is something of a ‘wild card’, however, since it can increase the size of the moves, especially in areas where the eclipse is visible such as India. Therefore, nothing would surprise me this week although I think the recent lows of 4000/13,400 are likely going to hold here.

Next week (July 27-31) looks mostly bullish although Monday could conceivably go either way as a bullish Venus-Jupiter aspect is apparently offset by a bearish Mercury-Saturn aspect. Given the added geometric resonance of Neptune and Uranus to Venus, I believe that the bulls will carry the day and take the market higher once again. Midweek also looks quite positive as Mercury will move into an opposition aspect with Jupiter. Since this will occur in close aspect to the ascendant of the NSE chart, we should be able to count on a sizable gain Wednesday or Thursday. The following week (Aug 3-7) looks more mixed with some early week profit taking possible on the Mercury-Pluto-Rahu alignment. Late week looks more bullish as Mercury (trading) applies to an aspect with Venus (money). After that, Mars squares Saturn on 11 August and could well mark a turning point for the market. The end of the week looks more negative and it is entirely possible that could see the top either in that week or the following week. Assuming there is no catastrophic sell off on the eclipse and we bottom this week around 4100-4200, I believe the market will move back up to its June highs of 4700/15,500 by mid-August. At this point, I would say there is a 50-50 chance that those highs can be exceeded. But the extent of any correction this week will help to define how high we might go in August. If the pullback is fairly small, then we could climb up to 5000. If, however, the eclipse hits the market hard and we go down to 4000-4100, then we may only manage to match the June highs.

From a longer term perspective, this rally is perhaps best used as an opportunity for investors to close any outstanding long positions and build a more comprehensive short position in anticipation for the declines that will likely begin in mid to late August. Since I am expecting a substantial decline over the next three to four months, it is important to recognize that this market has much more downside risk than upside potential. Jupiter enters sidereal Capricorn on 31 July and will stay there in its debilitated state until December 2009. This is a weakening effect on Jupiter, traditionally a planet associated with gains. Moreover, Saturn will again oppose Uranus on 15 September and this is another strong indication that we are about to move much lower. The last Saturn-Uranus opposition on 4 November 2008 closely coincided with the 2008 low in late October.

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish-neutral

As expected, the dollar moved below 80 last week, although the size of the move was bigger than anticipated. Monday was bearish as forecast while Tuesday reversed the trend on schedule. Wednesday was surprisingly negative however, as the Venus transit to the natal Jupiter was just past exact and that apparently was enough to trigger the selloff. Thursday was negative as we thought it might be due to the injurious position of the Moon, while Friday’s recovery arrived on cue with Venus coming in line with the natal ascendant, although the gain was fairly modest. Technically, the dollar index seems quite weak here as it remains below its falling 50 DMA while a bearish MACD crossover occurred last week. While the dollar may be vulnerable here, there should be a fair amount of support around the June lows of 78 and any move down to that level would signal a potentially bullish double bottom. The dollar looks like it could bounce higher here, especially early in the week as Venus aspects Uranus in the index chart. The strength may continue all the way into Wednesday and the Moon-Mercury conjunction opposite the natal Jupiter. After that, it should weaken again. Since this eclipse looks quite powerful, we could see some big moves here — presumably to the upside — so the dollar is more likely to finish higher, perhaps above 80 by Friday. This boost could inoculate it from falling too far in the coming two to three weeks. The dollar is likely to strengthen significantly into the fall season with a possible interim high occurring in mid to late November on the chaos created around the Saturn-Pluto square. Its March highs around 90 are very possible at that time, and I would not rule out it moving higher. Summer 2010 is looking like a potentially more bullish period and perhaps "final" top for the dollar as the Jupiter-Uranus-Saturn-Pluto alignment will positively activate the natal Sun-Saturn conjunction.

As expected, the dollar moved below 80 last week, although the size of the move was bigger than anticipated. Monday was bearish as forecast while Tuesday reversed the trend on schedule. Wednesday was surprisingly negative however, as the Venus transit to the natal Jupiter was just past exact and that apparently was enough to trigger the selloff. Thursday was negative as we thought it might be due to the injurious position of the Moon, while Friday’s recovery arrived on cue with Venus coming in line with the natal ascendant, although the gain was fairly modest. Technically, the dollar index seems quite weak here as it remains below its falling 50 DMA while a bearish MACD crossover occurred last week. While the dollar may be vulnerable here, there should be a fair amount of support around the June lows of 78 and any move down to that level would signal a potentially bullish double bottom. The dollar looks like it could bounce higher here, especially early in the week as Venus aspects Uranus in the index chart. The strength may continue all the way into Wednesday and the Moon-Mercury conjunction opposite the natal Jupiter. After that, it should weaken again. Since this eclipse looks quite powerful, we could see some big moves here — presumably to the upside — so the dollar is more likely to finish higher, perhaps above 80 by Friday. This boost could inoculate it from falling too far in the coming two to three weeks. The dollar is likely to strengthen significantly into the fall season with a possible interim high occurring in mid to late November on the chaos created around the Saturn-Pluto square. Its March highs around 90 are very possible at that time, and I would not rule out it moving higher. Summer 2010 is looking like a potentially more bullish period and perhaps "final" top for the dollar as the Jupiter-Uranus-Saturn-Pluto alignment will positively activate the natal Sun-Saturn conjunction.

The Euro closed higher last week as it ended trading near 1.41. While I expected gains for the Euro last week, the extent of the move was a little unexpected. The Sun-Mercury conjunction produced the anticipated gains and Mercury near Ketu on the 11th house cusp of the natal chart correlated with a decline Friday. The early week is likely to produce declines as the Sun conjoins Ketu for the eclipse on the 11th cusp. This could be translated as "an eclipsing of gains" since the 11th house is most closely associated with gains and income. Thursday and Friday look quite positive for the Euro as Venus will aspect the natal Mercury while the Moon picks up the natal Jupiter. There’s a good chance the Euro will close lower for the week, although discerning the relative impact of the down move early and the up move late is somewhat tricky. Overall, 1.40 is a reasonable guess here keeping in mind that the eclipse could produce a bigger than expected decline. As we move into August, we should see the Euro move back towards 1.43 and possibly a little higher. The Indian Rupee recovered last week as it closed around 48.5 With the eclipse energy focused on India, there may be sentiments and events that produce uncertainty that would bode poorly for the currency. A move towards 49 is therefore more likely. The early August period will likely see the Rupee strengthen towards 47-47.5 before easing off again in September. Watch for greater weakness in the fall period when its 2008 lows may be duplicated.

Dollar

5-day outlook — neutral-bullish

30-day outlook — bearish

90-day outlook — bullish

1-year outlook — bullish

After some early week lassitude, crude bounced back strongly last week and closed above $64. While I had been more bearish in last week’s newsletter, I recognized that some kind of rally towards $65 was likely, although I thought it would be confined to the early and middle parts of the week. Wednesday’s gain correlated nicely with transiting Venus’ aspect to the natal Jupiter in the Futures chart. I had expected the Mercury-Ketu conjunction on Friday to produce more selling but this negative influence was negated by the bullish entry of the Moon into Taurus, thus joining Mars and Venus in their alignment with natal Jupiter. Despite last week’s gains, crude remains below its 50-day moving average and MACD has yet to turn positive.

After some early week lassitude, crude bounced back strongly last week and closed above $64. While I had been more bearish in last week’s newsletter, I recognized that some kind of rally towards $65 was likely, although I thought it would be confined to the early and middle parts of the week. Wednesday’s gain correlated nicely with transiting Venus’ aspect to the natal Jupiter in the Futures chart. I had expected the Mercury-Ketu conjunction on Friday to produce more selling but this negative influence was negated by the bullish entry of the Moon into Taurus, thus joining Mars and Venus in their alignment with natal Jupiter. Despite last week’s gains, crude remains below its 50-day moving average and MACD has yet to turn positive.

This week crude seems headed back down, perhaps sharply as the Venus-Saturn aspect sets up very close to the Futures ascendant. I would think $60-62 is quite possible here, although since the eclipse looks so powerful, I would not rule out a larger pullback in the coming days. This is most likely to take place early and midweek with some recovery later on. After July 27 (a possible low), crude may well rally back to its recent highs above $70 by mid-August. Prices will begin to fall after that and continue to decline through September into the fall. We could see crude back below $40 by November.

5-day outlook — bearish

30-day outlook — bullish

90-day outlook — bearish

1-year outlook — bearish-neutral

Gold rallied more than 2% last week to close at $937. My forecast was more bearish, although I did allow for some strength back to $930 on the Venus-Jupiter aspect midweek. Happily this aspect did arrive on cue and Wednesday produced the largest gain of the week. Monday’s gain emerged despite the absence of any clear aspects and set the positive tone for the week. The late week forecast for declines did not come to fruition, although gold was largely flat Thursday and Friday. With these gains, gold has again climbed to its 50 DMA and we can see a bullish MACD crossover that might give gold bugs some cause for optimism here.

Gold rallied more than 2% last week to close at $937. My forecast was more bearish, although I did allow for some strength back to $930 on the Venus-Jupiter aspect midweek. Happily this aspect did arrive on cue and Wednesday produced the largest gain of the week. Monday’s gain emerged despite the absence of any clear aspects and set the positive tone for the week. The late week forecast for declines did not come to fruition, although gold was largely flat Thursday and Friday. With these gains, gold has again climbed to its 50 DMA and we can see a bullish MACD crossover that might give gold bugs some cause for optimism here.

Gold seems ripe for a selloff here as the eclipse of its significator, the Sun, occurs during a malefic Venus-Saturn square. This eclipse (5 Cancer) has the capability to move prices rapidly, and given the proximity of the natal Saturn (3 Cancer) in the ETF chart, it seems that the most likely direction this week is down. It is conceivable may see a large move toward $910 here. Some recovery is likely starting on Wednesday as the Moon-Mercury conjunction occurs in aspect with Jupiter. More upside is possible July 27 with the Venus-Jupiter aspect and as Venus approaches the aspect with Pluto towards the end of that week. Gold is likely to trade above $900 until late August when the Mars-Pluto opposition will aspect its ascendant and force prices down sharply. The Mars-Ketu conjuction in early October will probably coincide with a major decline in gold that will take it down to the $700-800 range.

5-day outlook — bearish

30-day outlook — neutral-bullish

90-day outlook — bearish

1-year outlook — bearish-neutral